Payroll Tax vs Income Tax: Definitions, Differences, Similarities, Challenges, and Best Practices

Robbin Schuchmann

Co-founder, Employ Borderless

Payroll tax is a tax on wages and salaries that employers and employees pay as a percentage of earnings. It mainly funds social insurance programs such as Social Security and Medicare and is usually withheld from paychecks. Income tax is a tax levied on an individual’s or entity’s earned and other taxable income based on established rates and brackets. Individuals with high income levels are generally taxed at higher rates.

The differences between payroll and income tax include tax responsibility (who pays), funding purposes, tax structure, withholding process, filing timeline, taxed income or earnings, tax rates, and usage. Both payroll and income tax share similarities, such as mandatory withholding, employer responsibility, compliance requirements, relevance to year-end tax documentation, impact on total employment cost, wage-based taxation, and paycheck-based collection mechanisms.

There are also payroll and income tax challenges for businesses, which include compliance with tax laws, accurate record-keeping, managing payroll for remote workers, timely deposits and filings, cash-flow management, and calculation errors and inaccurate withholding.

The best practices for processing payroll and income taxes involve categorizing employees and independent contractors, considering voluntary deductions, completing payroll forms, establishing a consistent schedule, and securing payroll and tax data properly.

What is payroll tax?

Payroll tax is a type of federal and state tax shared between employers and employees to fund particular government programs, such as Social Security and Medicare, for retired or disabled individuals. Employers are responsible for accurately calculating the amounts, usually a percentage of an employee’s taxable wages, withholding money from employees’ paychecks, and making scheduled payments to federal and state tax authorities.

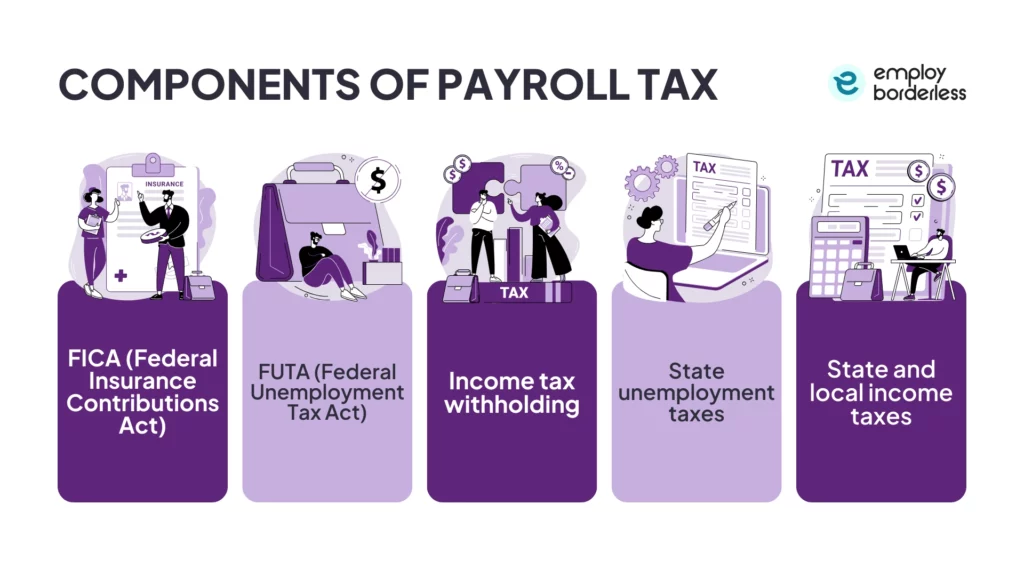

What are the components of payroll tax?

The components of payroll tax are FICA (Federal Insurance Contributions Act), FUTA (Federal Unemployment Tax Act), income tax withholding, state unemployment taxes, and state and local income taxes.

The components of payroll tax are listed below.

- FICA (Federal Insurance Contributions Act): FICA taxes support Social Security and Medicare, with employees and employers each paying 6.2% for Social Security and 1.45% for Medicare. Social Security benefits retirees and those with disabilities, while Medicare mainly funds healthcare for individuals aged 65 and older.

- FUTA (Federal Unemployment Tax Act): FUTA requires employers to pay a 6% federal tax on the first $7,000 of wages paid to each employee to help fund the national unemployment insurance program. FUTA is paid entirely by employers, not employees, unlike some payroll taxes.

- Income tax withholding: Income tax withholding requires employers to deduct federal income taxes from employees’ salaries and bonuses. The amount withheld is calculated by the employer based on the employee’s Form W-4, which provides details such as filing status, dependents, and other adjustments, along with the employee’s earnings. Employees pay this tax entirely, with employers acting solely as withholding and remitting agents to the IRS.

- State unemployment taxes: SUTA (State Unemployment Tax Act) funds state unemployment insurance benefits. Employers mostly pay these taxes, although some states also require employee contributions toward state unemployment taxes. SUTA tax rates and wage bases differ by state and are set under state law.

- State and local income taxes: Most states and some cities require employers to withhold state and, in some cases, local income taxes from employee wages to fund state and local government programs. Tax rates, wage bases, and withholding requirements differ by jurisdiction, and some states do not charge an income tax at all. Some states and localities levy employer-paid payroll taxes to support specific initiatives such as workforce training and public transportation, in addition to income tax withholding.

What is income tax?

Income tax is implemented by the federal government and most states on the income or profits of individuals, businesses, and other entities. Income tax applies to wages, salaries, interest, dividends, rental income, and other earnings. Employees are responsible for the tax, but employers calculate and withhold it based on information provided on Form W-4. State and local governments also require withholding, though a few states have no income tax. Revenue from income taxes funds public programs and services at the federal, state, and local levels.

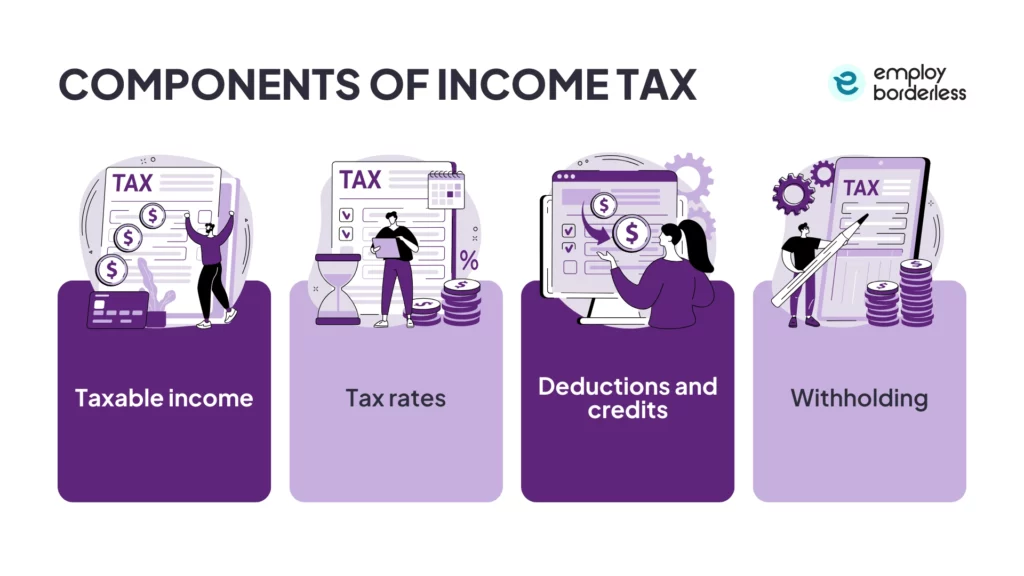

What are the components of income tax?

The components of income tax are taxable income, tax rates, deductions and credits, and withholding.

The components of income tax are mentioned below.

- Taxable income: Taxable income is the portion of an employee’s or entity’s income that is liable to taxation and includes wages and salaries, interest, dividends, and rental income.

- Tax rates: Tax rates for income tax are usually progressive, which means higher income levels are taxed at higher rates. Federal tax rates range from 10% for lower incomes to 37% for high earners, while state tax rates differ by state. This system makes sure that individuals with higher earnings contribute a larger share of their income to taxes.

- Deductions and credits: Deductions and credits allow individuals and businesses to reduce their taxable income or overall tax liability. Common deductions include charitable contributions and business expenses. Credits apply for qualifying children, education, or other eligible activities and directly lower the amount of tax due.

- Withholding: Withholding requires employers to deduct a portion of employees’ wages for income taxes based on the information provided on Form W-4. Self-employed individuals and businesses usually pay estimated taxes quarterly rather than having taxes withheld.

What are the differences between payroll tax and income tax?

The differences between payroll tax and income tax are tax responsibility (who pays), funding purposes, tax structure, withholding process, filing timeline, taxed income or earnings, tax rates, and usage.

| Features | Payroll tax | Income tax |

| Tax responsibility (who pays) | Employer and employee | Employees |

| Funding purposes | Social Security, Medicare, federal unemployment insurance, and state programs (if relevant) | Different public programs and spending priorities, such as education and agricultural subsidies. |

| Tax structure | A flat rate applied to earnings up to a set limit | A progressive rate that increases with income |

| Withholding process | Withholding follows fixed rates | Withholding differs based on W-4 elections |

| Filing timeline | Reported by employers on periodic tax returns | Reported quarterly and reconciled annually |

| Taxed income or earnings | Applies only to wages and salaries earned through employment | All taxable income |

| Tax rates | The payroll tax rate is 15.3% | Federal income tax brackets range from 10% to 37% |

| Usage | Used for specific social programs | Used for general public funding, like defense, education, and transportation |

Tax responsibility (who pays)

Employers share responsibility with employees for FICA taxes, which fund Social Security and Medicare, while some taxes, such as FUTA and SUTA, are paid entirely by employers. This shared liability directly affects labor costs.

Employees pay income tax solely based on their individual tax situation, filing status, and income. Employers act only as withholding agents, as they collect and remit taxes on the employee’s behalf.

Funding purposes

The purpose of payroll taxes is to fund specific programs with dedicated revenue channels, such as Social Security retirement and disability benefits, Medicare, and unemployment insurance. This targeted purpose means that employees and employers are pre-paying for benefits that are claimed later.

Income tax funds general government operations and services, which include defense, education, infrastructure, and other federal, state, and local programs not supported by specific revenue channels.

Tax structure

Payroll taxes are specific taxes that both employers and employees pay, mainly to support Social Security and Medicare. These rates are fixed percentages of wages, and Social Security applies only up to a set limit. Payroll taxes are withheld from each paycheck, and employers contribute a matching share.

Income taxes are levied on total income from all sources, which include wages, investments, and business profits. Individuals and some businesses with higher income levels pay higher tax rates. Income tax is deducted from paychecks, but employees sometimes pay more or get a refund when filing, based on their deductions, credits, and exemptions.

Withholding process

FICA withholding uses fixed percentages with almost no exceptions. Most employees pay these taxes no matter their income, filing status, or personal circumstances, with limited exemptions for some students or religious workers.

The income tax withholding process differs based on employees’ W-4 elections, filing status, dependents, and income level. Employees adjust their withholding and qualify for exemptions in particular situations.

Filing timeline

Employers report these payroll taxes quarterly (Form 941 for FICA, Form 940 annually for FUTA), but there is no annual filing requirement for employees. These payments are final, and employees do not reconcile them on their personal returns.

Employers withhold and report income tax quarterly on Form 941, but the final tax liability is reconciled annually when employees file their personal tax returns. Employees owe additional taxes or receive refunds based on their total income, deductions, and credits.

Taxed income or earnings

Payroll taxes are levied only on wages and salaries earned from employment and are used to fund specific programs like Social Security and Medicare. Income taxes apply to an individual’s total taxable income from many sources, like wages, investments, business profits, and interest, which makes the income tax base more extensive than the payroll tax base.

Tax rates

The current federal payroll tax rate is 15.3%, which includes both the employer’s and employee’s contributions. This rate consists of 12.4% for Social Security and 2.9% for Medicare. The federal income tax system is progressive, which means that the tax rate increases as an individual’s taxable income increases. The rates currently range from 10% to 37%, which depends on income level and filing status, such as single, married filing jointly, or head of household.

Usage

Payroll taxes are used to fund three specific programs, which are Social Security, Medicare, and unemployment benefits. Income taxes support a wide range of public services and government programs, such as national defense, healthcare, and infrastructure.

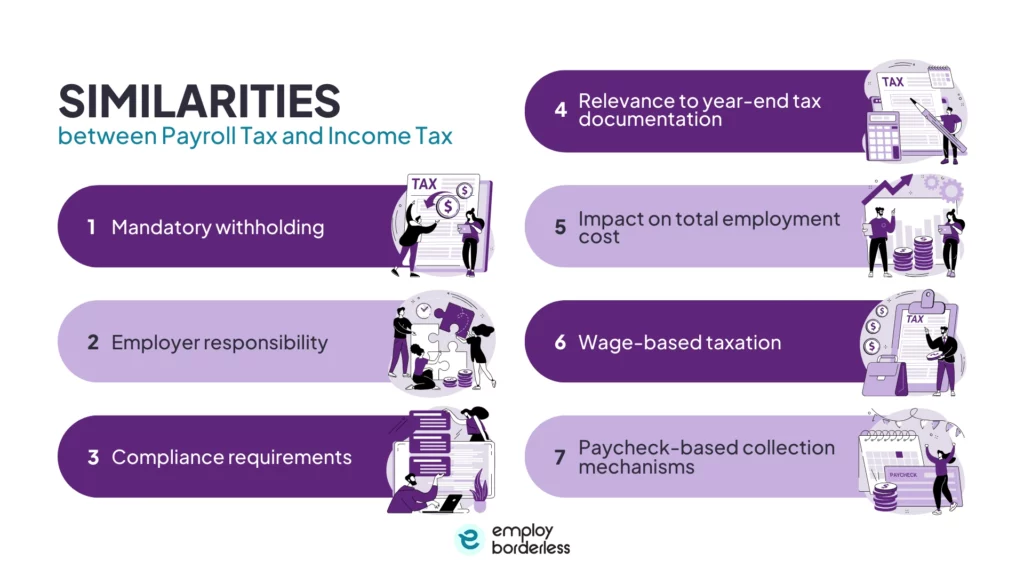

What are the similarities between payroll tax and income tax?

The similarities between payroll tax and income tax include mandatory withholding, employer responsibility, compliance requirements, relevance to year-end tax documentation, impact on total employment cost, wage-based taxation, and paycheck-based collection mechanism.

Mandatory withholding

Both payroll taxes and income taxes are deducted from employees’ paychecks according to the law. This mandatory withholding reduces employees’ take‑home pay and makes sure taxes are collected throughout the year rather than all at once.

Employer responsibility

Employers must calculate the correct amounts and withhold federal income tax and payroll taxes from employee wages using Form W‑4 and IRS withholding tables. They deposit and report those taxes to the IRS and state agencies on the proper schedule.

Compliance requirements

Employers must follow strict schedules and rules to remain compliant with withholding and remitting payroll and income tax obligations. Failure to comply with these requirements, such as not withholding the correct amount or not making timely deposits and filings, results in penalties, interest, and possible regulatory action from the IRS.

Relevance to year-end tax documentation

Both payroll tax and income tax withholding require employers to prepare and issue year-end documentation, such as Form W-2, to report wages and taxes withheld for the year. Employees use these forms when filing their individual tax returns. Employers must file these forms with the SSA (Social Security Administration) and provide copies to employees by the required deadline each year.

Impact on total employment cost

The withholding process for both payroll and income taxes affects the total cost of employing someone. Employers are responsible for withholding income tax and the employer’s share of payroll taxes when budgeting labor costs, which makes actual employment expenses higher than just gross wages.

Wage-based taxation

Both payroll and income taxes are based, at least in part, on wages earned. Payroll taxes are levied directly on wages and salaries from employment, while income taxes include wages as a major part of the taxable income base, along with other income sources.

Paycheck-based collection mechanisms

Employers withhold federal income tax from employee paychecks based on Form W-4 details and remit it to the IRS. Payroll taxes, like Social Security, Medicare, and withheld income taxes, are deducted from wages and sent to tax authorities through Forms 941 and 944 as part of the pay-as-you-go system. Employers also pay matching FICA and other taxes separately.

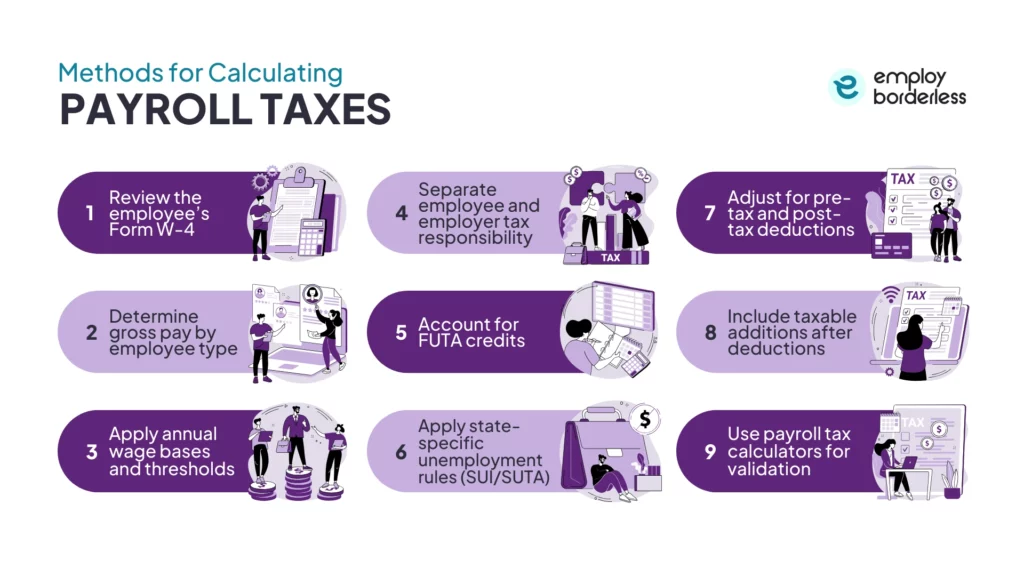

How to calculate payroll tax?

To calculate payroll taxes, review the employee’s Form W-4, determine gross pay by employee type, apply annual wage bases and thresholds, separate employee and employer tax responsibility, account for FUTA credits, and apply state-specific unemployment rules (SUI/SUTA).

The methods for calculating payroll taxes are listed below.

- Review the employee’s Form W-4: Use filing status, dependents, and additional withholding instructions to determine accurate federal tax withholding before calculating payroll taxes.

- Determine gross pay by employee type: Multiply the number of hours worked by the employee’s hourly pay rate. Divide the employee’s annual salary by the total number of pay periods in the year.

- Apply annual wage bases and thresholds: Calculate Social Security tax only up to the annual wage base, and apply the additional Medicare tax once an employee’s wages exceed the required threshold.

- Separate employee and employer tax responsibility: Identify which taxes are shared (Social Security, Medicare) and which are employer-only (FUTA, SUI/SUTA).

- Account for FUTA credits: Reduce the FUTA rate by applying the maximum state unemployment tax credit to determine the net federal unemployment tax due.

- Apply state-specific unemployment rules (SUI/SUTA): Use state-specific rates, wage bases, and new-employer flat rates rather than relying on a single federal standard.

- Adjust for pre-tax and post-tax deductions: Subtract benefits like health insurance or retirement contributions before or after taxes, which depends on their tax treatment.

- Include taxable additions after deductions: Add back reimbursements and taxable benefits that increase taxable wages at the end of the calculation.

- Use payroll tax calculators for validation: Cross-check manual calculations using payroll tax tools to estimate total liability accurately.

What is an example of a payroll tax calculation?

An example of a payroll tax calculation is that an employee earns $52,000 per year and is paid biweekly, which results in $2,000 per paycheck. Social Security tax is calculated at 6.2 percent, which equals $124, and Medicare tax is calculated at 1.45 percent, which equals $29, for a total employee FICA withholding of $153 per pay period.

The employer matches these amounts and also pays unemployment taxes, which include FUTA at 0.6 percent and state unemployment tax at 3 percent, until the employee’s wages reach the $7,000 wage base. These tax amounts stay consistent throughout the year because the employee’s earnings stay below the Social Security and additional Medicare thresholds.

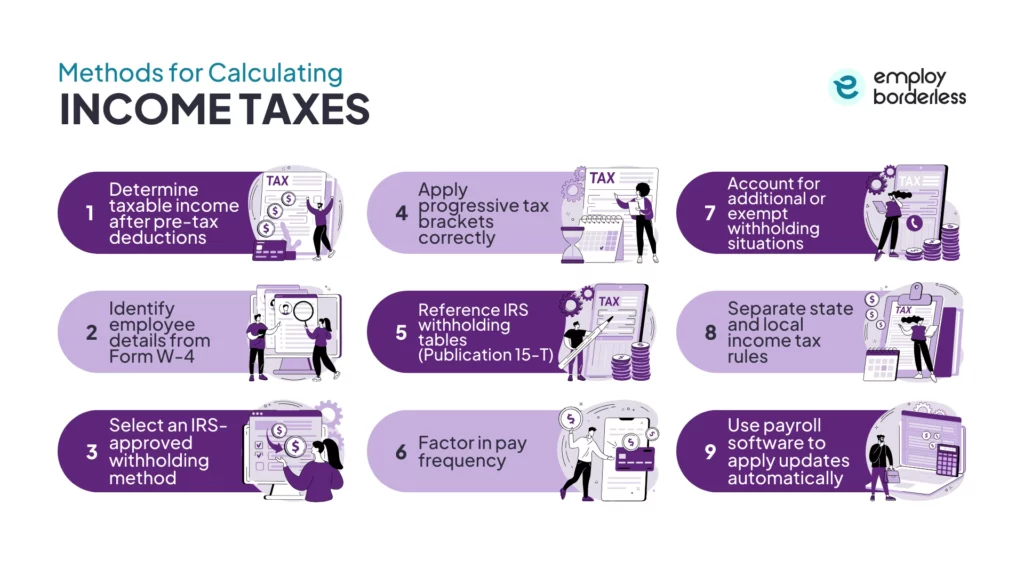

How to calculate income tax?

To calculate income taxes, determine taxable income after pre-tax deductions, identify employee details from Form W-4, select an IRS-approved withholding method, apply progressive tax brackets, reference IRS withholding tables (Publication 15-T), factor in pay frequency, and separate state and local income tax rules.

The methods to calculate income taxes are listed below.

- Determine taxable income after pre-tax deductions: Reduce gross pay by eligible pre-tax deductions such as retirement contributions and health insurance to find income subject to tax.

- Identify employee details from Form W-4: Use filing status, dependents, and any extra withholding requests provided on the employee’s Form W-4.

- Select an IRS-approved withholding method: Choose either the wage bracket method or the percentage method, which depends on payroll size and IRS guidance.

- Apply progressive tax brackets correctly: Calculate tax so that each portion of income is taxed only at its applicable bracket rate, not as a flat percentage.

- Reference IRS withholding tables (Publication 15-T): Use official IRS tables based on pay frequency, wage level, and filing status to determine withholding amounts.

- Factor in pay frequency: Adjust calculations based on whether payroll is run weekly, biweekly, semimonthly, or monthly.

- Account for additional or exempt withholding situations: Adjust calculations for employees who request extra withholding or qualify for exemption from federal income tax.

- Separate state and local income tax rules: Apply state and local income tax rates or flat amounts, which change by jurisdiction and differ from federal rules.

- Use payroll software to apply updates automatically: Rely on payroll systems to keep up with annual tax table changes and reduce manual calculation errors.

What is an example of an income tax calculation?

An example of an income tax calculation is that an employee earns $48,000 annually as a marketing associate at his company. The company pays employees monthly and uses the percentage method to calculate federal income tax withholding. The employee’s filing status is single. The employer first divides the annual salary by 12, which results in a gross monthly income of $4,000 to determine monthly withholding. The employer subtracts the monthly standard deduction allowance of approximately $1,342 (the 2026 standard deduction of $16,100 divided by 12), which results in adjusted wages of $2,658, using the IRS percentage method.

The first $1,033 of this adjusted amount (showing the monthly equivalent of the $12,400 annual threshold for the 10 percent bracket) is taxed at 10 percent, which equals approximately $103, and the remaining $1,625 is taxed at 12 percent, which results in approximately $195. Combining these amounts, the employee’s total federal income tax withheld per paycheck is approximately $298. The employer deducts this amount and remits it to the IRS.

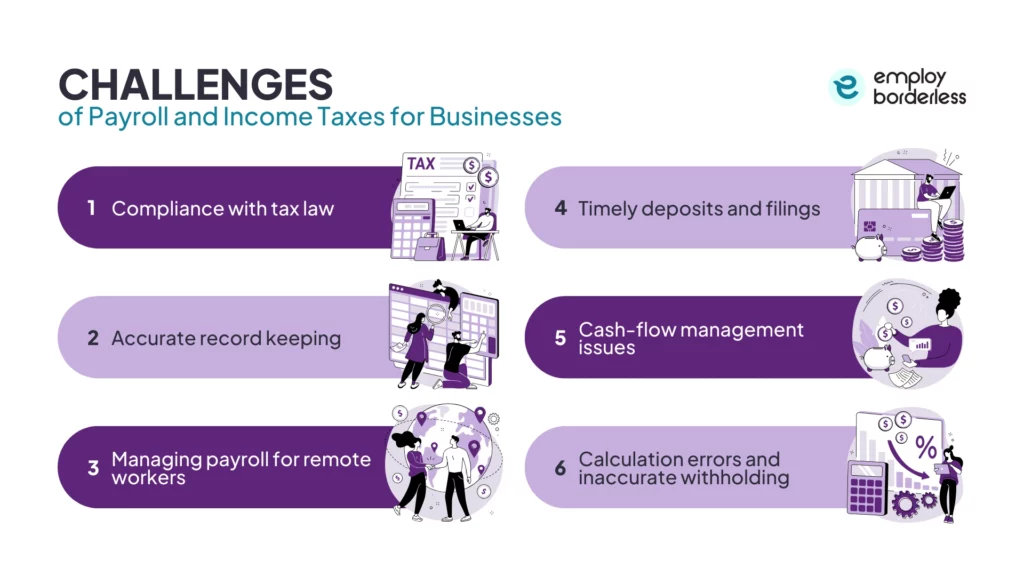

What are the challenges of payroll and income taxes for businesses?

The challenges of payroll and income taxes for businesses are compliance with tax laws, accurate record keeping, managing payroll for remote workers, timely deposits and filings, cash-flow management issues, and calculation errors and inaccurate withholding.

The challenges of payroll and income taxes for businesses are listed below.

- Compliance with tax law: Federal and state tax authorities mandate companies to file or submit payroll taxes on different schedules. New York, California, and Oregon require employers to pay particular payroll taxes every quarter, while the IRS mandates employers to pay monthly or semi-weekly.

- Accurate record keeping: Payroll taxes involve complex paperwork. Managing all the documents, like required forms, pay stubs, and internal reports, becomes difficult for businesses, as they have to accurately pay and file taxes.

- Managing payroll for remote workers: Tax rules for remote workers are mostly inconsistent. Remote workers generally owe state income tax based on where they physically perform the work, not just where the company is headquartered. Someone living and working remotely in Texas usually does not owe Massachusetts income tax unless they occasionally work on-site in MA.

- Timely deposits and filings: Failing to submit payroll tax payments and required filings by the IRS deadlines leads to penalties, interest, and increased compliance burden. Businesses need strong tracking systems to avoid late payments.

- Cash-flow management issues: Businesses face difficulty keeping funds for payroll taxes, especially when payments are due, so they require careful financial planning.

- Calculation errors and inaccurate withholding: Mistakes in calculating withholdings for federal and state taxes (under‑withholding or over‑withholding) result in fines, back taxes, employee dissatisfaction, and extra administrative work to correct errors.

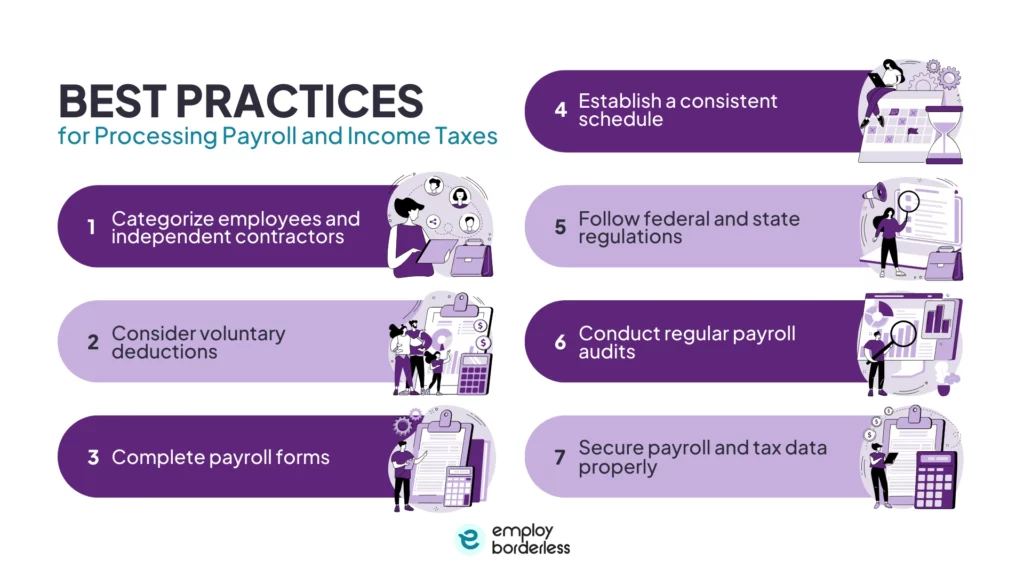

What are the best practices for processing payroll and income taxes?

The best practices for processing payroll and income taxes are to categorize employees and independent contractors, consider voluntary deductions, complete payroll forms, establish a consistent schedule, and secure payroll and tax data properly.

Categorize employees and independent contractors

A worker’s classification determines the management of their taxes. Employees generate payroll expenses for the company, while independent contractors are responsible for their own tax withholdings, and the business only pays the agreed-upon amount for services. Correct classification is important to provide accurate payroll processing and compliance. Misclassifying a worker results in withholding payroll taxes from an independent contractor or failing to issue a Form W-2 for an employee.

Consider voluntary deductions

Businesses need to consider voluntary deductions, like health, dental, vision, and life insurance premiums, loan payments, retirement plans, and union dues, along with FICA, FUTA, and income taxes. For example, employees enrolled in company-administered health or life insurance plans have their monthly premiums deducted from their paychecks. Proper tracking of these deductions confirms correct payroll and benefits administration.

Complete payroll forms

Companies have to make sure all required payroll and tax forms are filled out correctly before submission. Detailed and error‑free records of wages, withholdings, and deductions help support compliance with tax authorities and reduce mistakes.

Establish a consistent schedule

Set and follow a regular payroll schedule with clear deadlines for time submissions, calculations, and tax deposits. A predictable routine decreases unexpected errors and offers timely payments and filings.

Follow federal and state regulations

Compliance with federal and state payroll regulations helps prevent penalties and fines. The IRS provides a schedule of employment tax due dates that businesses use to set reminders or automate payments through their payroll systems. State revenue agencies also publish important deadlines online, which support accurate and timely filing.

Conduct regular payroll audits

Perform periodic reviews of payroll records and processes to detect mistakes, incorrect tax withholdings, or classification issues before they become costly errors. Regular audits support accuracy and compliance.

Secure payroll and tax data properly

Protect sensitive payroll information with strong security measures, such as restricted access, SSL encryption, and regular backups. These measures prevent unauthorized access and protect employee and business data while complying with data protection laws, like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act).

How do payroll and income tax affect employers and employees?

Payroll and income tax affect employers and employees by determining wages and net income, cash flow and budgeting considerations, and possible disincentives or behavioral effects.

Taxes reduce the amount employees take home because income tax and payroll tax withholdings are deducted from gross wages before pay is received. Payroll taxes increase the overall cost of labor, which has an impact on wage offers and negotiations when employers are trying to balance compensation with tax expenses.

Poor management of payroll and income tax obligations has an impact on the cash flow of the company. Employers have to separate funds regularly to cover tax deposits and filings, while employees must budget based on net pay after taxes.

Increased payroll or income taxes reduce the financial rewards of working for some individuals. This reduction lowers incentives to work more hours, and individuals also ask for better pay, which affects employers’ hiring and wage decisions.

Who pays payroll taxes?

Both employees and employers pay payroll taxes under U.S. law. Employers withhold income, Social Security, and Medicare taxes from employee wages and remit them, and they also pay their own share of Social Security and Medicare. There are some taxes that only employers pay, such as FUTA (Federal Unemployment Tax Act), according to payroll regulations and compliance.

Who is exempt from payroll tax?

Independent contractors and freelancers are the most common exemptions from payroll taxes. Employers do not withhold federal income taxes or FICA (Social Security and Medicare) from their payments. These workers handle their own tax obligations directly with the relevant government agencies.

Who is exempt from federal income tax?

Individuals whose gross income remains below IRS filing thresholds for their filing status are usually not required to pay federal income tax because they do not have enough income to owe tax.

Do employees pay more payroll or income taxes?

Lower-income workers mostly pay a large share of their earnings in payroll taxes due to flat rates without deductions, while higher earners pay more in progressive income taxes. Employees usually pay both payroll taxes (like Social Security and Medicare withholdings) and income taxes through paycheck deductions, but which one the employees pay more depends on income level.

Is income tax paid the same as income tax withheld?

No, income tax paid is not the same as income tax withheld. Income tax withheld is the amount your employer deducts from your paycheck and sends to the government as a prepayment toward your total tax bill. Your actual tax owed is calculated when you file your return. You pay the difference if withholding is less than the tax due, and if it is more, you receive a refund.

Are income and payroll taxes paid the same way?

No, income and payroll taxes are not paid the same way. Payroll taxes involve matching contributions from employers (like Social Security), while income taxes are solely the employee’s responsibility and are reconciled annually. Both are usually withheld from employee paychecks by employers and remitted to the government.

Do all states require payroll tax and income tax withholding?

No, not all states require payroll tax and income tax withholding. Nine states, which include Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming, lack state income taxes, so no state income tax withholding applies. Federal payroll taxes apply in all states, but SUTA (State Unemployment Tax Act) and other state-level payroll levies differ by state, and some states impose none.

Can payroll taxes be deducted from income tax?

No, payroll taxes cannot be deducted from income tax, as both are separate withholdings from wages. Payroll taxes, like FICA for Social Security and Medicare, fund specific programs and are not creditable against federal or state income taxes. Employees report withheld amounts on tax returns, but payroll taxes remain separate obligations.

How do you prepare for a payroll tax audit?

To prepare for a payroll tax audit, establish a timeline, assign team roles, and gather records like timesheets, payroll registers, tax filings, and employee contracts. Verify classifications, wages, withholdings, and reconciliations with ledgers. The role of audits in payroll is to ensure compliance, accuracy, and error prevention.

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Ready to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations