What is the ROI of PEO?

Robbin Schuchmann

Co-founder, Employ Borderless

A PEO (Professional Employer Organization) is a third-party company that provides HR services to companies under the co-employment model. These HR services include payroll administration, employee benefits enrollment, compliance support, and risk management.

A PEO works by establishing a co-employment agreement with the client company and acting as the employer of record for payroll, taxes, and employee benefits. The client company maintains control over daily operations, such as employee and performance management.

Partnering with a PEO provides businesses with an average return on investment of around 27.2%, which comes from reducing costs related to payroll, benefits, and insurance coverage. The ROI of PEO is calculated by taking the total savings from using a PEO, subtracting the total PEO’s fees, dividing the result by the total PEO’s fees, and then multiplying by 100 to get the percentage.

What is the ROI of using a PEO?

The ROI (Return on Investment) of using a PEO is 27.2%, which measures how profitable the investment is by comparing the business gains to the costs. This ROI figure is cited in a white paper published by NAPEO (National Association of Professional Employer Organizations) in collaboration with McBassi & Company. The ROI is calculated on an annual basis, as it shows the return businesses expect per year, not over a multi-year duration.

How to calculate the ROI of PEO?

To calculate the ROI of a PEO, find your annual PEO cost, as businesses usually spend about $1,395 per employee annually on PEO services. Then, compare this cost to the savings a PEO generates for your business, which includes reduced HR expenses, better health benefit rates, and lower workers’ compensation costs.

Businesses calculate the ROI by subtracting the PEO fees from the total savings the PEO generates, then dividing the result by the PEO’s fees, and multiplying by 100 to show the ROI as a percentage. For example, if the annual savings per employee are about $1,775 and the cost is $1,395, the ROI comes out to 27.2%. This calculation is done on an annual basis to provide a clear, accurate comparison of yearly costs versus benefits.

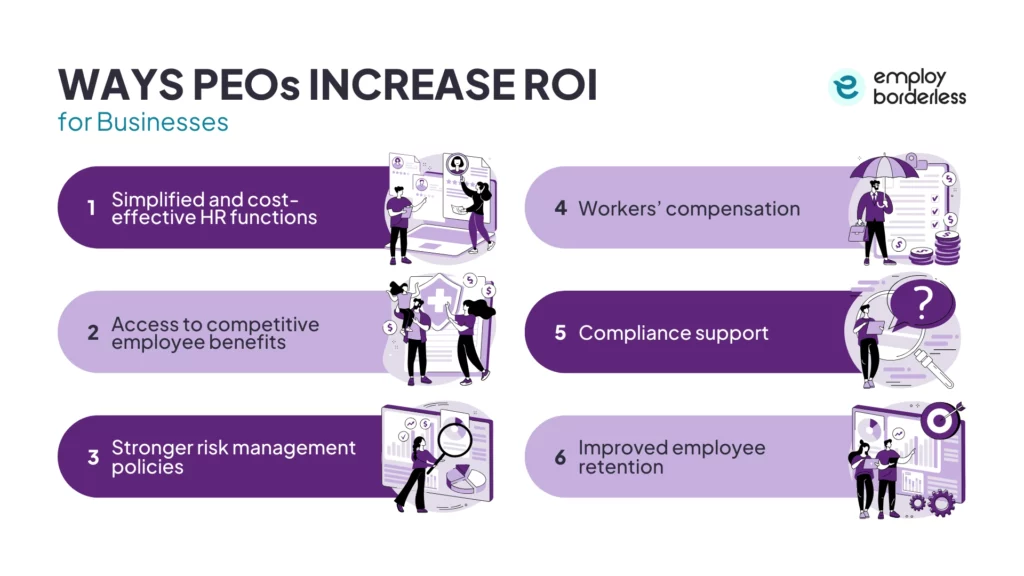

How do PEOs increase ROI for businesses?

PEOs increase ROI for businesses by providing simplified and cost-effective HR functions, access to competitive employee benefits, stronger risk management policies, workers’ compensation, compliance support, and improved employee retention.

Simplified and cost-effective HR functions

Simplified and cost-effective HR functions mean PEOs use advanced and automated systems to process payroll, file taxes, and manage benefits administration. This automation reduces time spent on manual tasks, lowers costly errors, and helps avoid legal penalties, which also improves ROI.

A PEO increases ROI by lowering HR overhead because it takes full responsibility for tasks such as payroll, benefits, compliance, and risk management. This responsibility eliminates the need for a business to maintain a full in-house HR team and reduces costs related to hiring, training, and managing HR staff.

Access to competitive employee benefits

Access to competitive employee benefits means that a PEO pools employees from multiple client businesses to negotiate better rates with insurers and benefit providers. This group buying power allows businesses to obtain benefits at lower costs, which helps them reduce overall company expenses.

PEOs secure high-quality health, retirement, and disability insurance plans that small businesses are unable to afford on their own. PEOs help companies save on benefit costs while improving employee satisfaction and retention by providing access to these Fortune 500–level benefits at lower rates. This competitive package reduces turnover expenses and improves overall business profitability.

Stronger risk management policies

Stronger risk management policies mean that PEOs help businesses implement risk mitigation practices to prevent costly workplace issues and reduce financial liabilities. They guide on labor law compliance, develop workplace safety programs, and offer training to lower accidents and injuries. PEOs also help businesses lower costs and increase ROI by identifying risks, creating policies that meet current employment laws, and improving workplace safety.

Workers’ compensation

Workers’ compensation means the PEO helps businesses manage claims expertly by providing timely reporting and compliance with regulatory requirements. This comprehensive approach not only helps in controlling costs but also mitigates legal liabilities related to workplace injuries.

This third-party service provider increases ROI by reducing workers’ compensation costs and grouping employees from several clients to negotiate lower premiums and better coverage terms. This collective bargaining power allows businesses to access more affordable workers’ compensation insurance than individual companies are able to secure on their own, which results in cost savings. The PEO also creates active risk management strategies, such as safety training programs and workplace safety audits, to minimize workplace injuries because fewer injuries result in fewer compensation claims, directly leading to cost reduction.

Compliance support

Compliance support means PEOs make sure businesses comply with complex employment laws and regulations, like FLSA (Fair Labor Standards Act) and FMLA (Family and Medical Leave Act), to reduce costly legal penalties and fines.

PEOs contribute to a business’s return on investment by offering specialized knowledge on federal, state, and local employment laws to ensure businesses remain compliant with changing regulations. They expertly manage employment aspects like wage and hour laws, employee classification, and workplace safety standards. This third-party service provider also offers training programs for management and staff to promote a culture of compliance within the organization. PEOs help businesses prepare documentation for compliance audits, which helps reduce the risk of legal liabilities and lower related costs.

Improved employee retention

Improved employee retention means that PEOs help businesses retain employees by offering quality benefits, like retirement plans and health insurance, and training and development programs, which support both employee and overall company growth.

Businesses that partner with a PEO experience lower employee turnover rates, which range from 10% to 14%. This reduction in turnover not only minimizes the direct costs related to recruiting and training new employees but also promotes a more experienced and engaged workforce, which results in increased productivity and reduced operational disruptions.

How to choose the right PEO for your business to maximize ROI?

To choose the right PEO for your business to maximize ROI, consider the range of HR services offered, make sure the PEO scales with your business growth, check for industry-specific expertise, and confirm that it provides compliance support for legal matters.

Consider the range of HR services that the PEO offers, such as payroll processing, benefits administration, and employee training. These services help businesses simplify workplace operations and reduce administrative burdens, which result in cost savings and improved workforce productivity.

Make sure the PEO scales as your business expands and your HR needs become more complex. The right PEO offers scalable solutions, like onboarding new employees, benefits enrollment, and tax filings for new hires, that adjust to your growing workforce and changing requirements. It provides continuous support without the need for frequent service provider transitions, which also leads to cost savings.

Choose the PEO with experience in your industry, as it understands the unique challenges and regulatory requirements, which help your business avoid employment violations and costly legal fines. An industry-specific PEO provides businesses with customized solutions according to their operational needs.

Confirm that the PEO provides support for complex labor laws and regulations, such as managing tax filings and ACA (Affordable Care Act) reporting. This compliance expertise reduces the risk of penalties and also ensures your business stays compliant, which increases ROI (return on investment).

How does a PEO help businesses grow?

A PEO helps businesses grow by simplifying HR administration, providing flexibility and scalability, and allowing companies to focus on their core activities. It also supports business growth by offering access to better employee benefits and ensuring compliance and risk mitigation.

How many companies use a PEO?

The number of companies that use a PEO is 208,000 in the United States, and these companies collectively employ more than 4.5 million employees. Companies using a PEO have access to comprehensive HR services, which include payroll, benefits, compliance support, and risk management.

Is PEO worth the cost?

Yes, a PEO is generally worth the cost as businesses see an average ROI of about 27.2% or more through cost savings when partnering with a third-party company. The PEO cost depends on factors like the number of employees, the scope of services required, industry-specific risks, and geographic location.

Can small businesses use PEOs and achieve ROI?

Yes, small businesses can use PEOs and achieve ROI as they offer small businesses high cost savings, improved compliance, access to better employee benefits, and operational accuracy that result in an average ROI of about 27.2%. A PEO for small businesses also helps them grow faster, have lower turnover, and reduce HR-related risks.

What is the downside of using a PEO?

The downside of using a PEO is that businesses lose control over HR processes, like payroll processing, benefits administration, compliance management, and decision-making, as they have to follow the PEO’s established policies and systems.

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Ready to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations