Global payroll trends in 2026: how leading companies are adapting

Robbin Schuchmann

Co-founder, Employ Borderless

Global payroll is the process used to manage and process employee compensation across multiple countries, which includes wages, tax withholdings, benefits, and regulatory reporting to meet each location’s unique legal and tax requirements.

Global payroll is important for international businesses because it ensures compliance, centralizes and simplifies payroll operations, mitigates legal and financial risk, improves employee experience, and supports strategic decision-making.

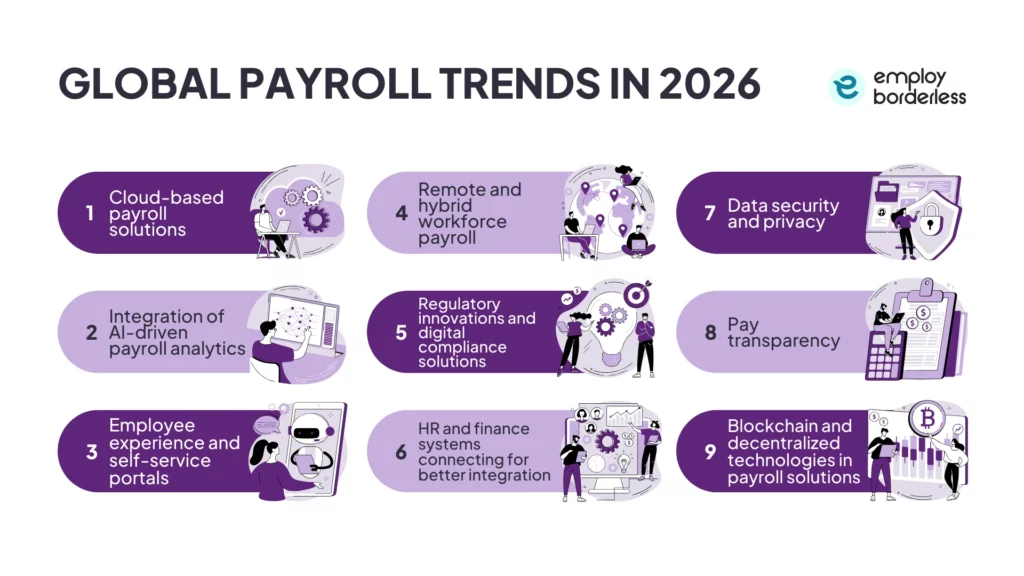

Global payroll trends that businesses should know include cloud-based payroll solutions, integration of AI-driven payroll analytics, employee experience and self-service portals, remote and hybrid workforce payroll, data security and privacy, pay transparency, and blockchain and decentralized technologies in payroll solutions.

The global payroll trends that businesses should know are listed below.

- Cloud-based payroll solutions: Cloud-based payroll solutions are influencing global payroll processes by automating salary calculations, deductions, tax filings, and payments to offer timely and accurate employee payments globally.

- Integration of AI-driven payroll analytics: AI-driven payroll analytics utilizes artificial intelligence to collect insights from payroll data, which helps with predictions of future costs, detection of issues, and strategic workforce decision-making.

- Employee experience and self-service portals: Employee self-service portals are increasingly popular, particularly among remote and international workers, as they allow employees to manage payroll and benefits smoothly.

- Remote and hybrid workforce payroll: The transition to remote and hybrid workforces demands flexible payroll solutions to manage multiple locations and time zones.

- Regulatory innovations and digital compliance solutions: Modern payroll systems feature compliance and regulatory monitoring tools that automatically adjust to changing tax laws and labor regulations, which reduces the risk of fines.

- HR and finance systems connecting for better integration: Global payroll platforms are integrating HR, payroll, and finance systems to improve data flow and information sharing.

- Data security and privacy: Global payroll systems manage sensitive employee data, which requires advanced security measures like SSL encryption, multi-factor authentication, and access controls.

- Pay transparency: Multinational organizations are focusing on pay transparency to establish clear expectations, attract skilled candidates, and retain talent.

- Blockchain and decentralized technologies in payroll solutions: Blockchain and decentralized technologies allow secure payroll transactions through distributed ledgers for faster global payments by reducing reliance on intermediaries.

Cloud-based payroll solutions

Cloud-based payroll solutions are changing the global payroll trends by simplifying the process of employee payments around the world. Cloud-based systems reduce manual work by automating salary calculations, deductions, tax filings, and payments across different countries. They also make sure that employees are paid correctly and on time, no matter the location, which improves global payroll administration.

These cloud‑based platforms offer accessibility, which allows HR teams, finance professionals, and authorized employees to access payroll data and perform core tasks from anywhere. These systems provide security with up-to-date protections, improve accuracy in calculations and reporting, and offer scalable user management as businesses grow. Cloud-based payroll also reduces costs and supports more productive global payroll operations by reducing the need for internal software and hardware maintenance.

Integration of AI-driven payroll analytics

AI‑driven payroll analytics means using artificial intelligence to gather useful insights from payroll data for predicting future payroll costs, identifying issues, and helping executives make more strategic workforce decisions. AI tools also improve important payroll functions like tax compliance, benefits management, and financial reporting or budgeting by automating complex rules and reducing manual management.

Technologies such as machine learning, NLP (Natural Language Processing), and RPA (Robotic Process Automation) also increase operational productivity by improving data analysis, automating repetitive tasks, and allowing better interaction with payroll systems.

Employee experience and self-service portals

Employee self-service portals are increasingly popular, especially among remote and international workers, as they allow employees to control payroll and simplify benefits management. These portals allow staff to update personal information, view payroll data, track attendance, submit expenses, add notes for time blocks, monitor regular and overtime hours, and request time off.

These self-service portals reduce payroll confusion and administrative tasks for HR while providing access to self-evaluations and performance data to support productivity and professional development. Mobile-friendly features also help manage independent contractors or freelancers with non-standard hours, while allowing access to payslips, expense submission, and PTO (Paid Time Off) requests from anywhere.

Remote and hybrid workforce payroll

The shift to a remote and hybrid workforce payroll requires flexible payroll solutions that adjust to different locations and time zones. Mobile access is important for employees, as global mobility and relocations are changing payroll structures. Global mobility and employee relocation are also influencing payroll structures, as organizations face challenges like unique tax regulations, employee classifications, and multi-state or multi-country payments.

Standard time tracking is difficult for distributed teams, which makes advanced payroll systems necessary. Partnering with experienced global payroll providers ensures compliance and simplifies international payroll management.

Regulatory innovations and digital compliance solutions

Modern payroll systems now include built‑in compliance and regulatory monitoring tools that automatically adjust to changing tax laws and labor regulations. Automated updates help businesses stay current with local and international statutory changes, which reduces the risk of fines and legal penalties. Digital compliance solutions provide a unified workflow and clear audit records by integrating payroll, HR, and attendance data. These solutions also automate tax calculations, statutory deductions, and filings to make sure payroll remains legally compliant across all locations.

HR and finance systems connecting for better integration

Modern payroll platforms increasingly integrate HR, payroll, and finance systems to provide smooth data flow and information sharing. This integration lowers manual data entry and errors by coordinating employee, payroll, and financial information across departments. It simplifies workflows, improves payroll accuracy, and supports collaboration between HR and finance teams. Integrated systems also improve compliance and audit preparation with reliable, up-to-date records, while teams focus on strategic, high-value work, rather than administrative tasks.

Data security and privacy

Global payroll systems handle sensitive employee information, such as salaries, bank details, and tax data, which makes security a top priority. Advanced solutions use SSL encryption, multi‑factor authentication, and access controls to prevent breaches and unauthorized access. Strong data security helps organizations comply with regulations like GDPR (General Data Protection Regulation) and other global laws while preventing costly breaches, legal penalties, and reputational damage. Selecting reputable payroll providers with recognized security certifications, such as SOC 2 or ISO 27001, also provides data protection and builds employee trust.

Pay transparency

Multinational organizations are focusing on pay transparency to set clear expectations, attract qualified candidates, and retain top talent. Transparent pay practices also help reduce inequity in salary setting and help lower gender and racial pay gaps. Sharing pay ranges in job postings reduces hiring cycles, improves candidate engagement, and builds employer brand and trust. These practices help organizations maintain competitiveness in the global talent market.

Blockchain and decentralized technologies in payroll solutions

Blockchain and decentralized technologies utilize distributed ledgers to record and store payroll transactions securely. Decentralized payroll systems allow faster and more effective global payments by reducing reliance on intermediaries such as banks or central processors. Smart contracts automate payroll actions like salary disbursements and tax withholdings based on predefined rules, while blockchain’s stable records help with security and fraud prevention. These technologies also simplify cross-border transactions to support global and remote teams without traditional banking delays.

What is global payroll?

Global payroll is the comprehensive process of managing wages, taxes, payments, and benefits for employees in multiple countries. It makes sure every payment complies with labor, tax, and reporting laws, which depend on the employee’s or contractor’s host country. Global payroll also handles tasks such as calculating wages, withholding taxes, and distributing payslips.

Why is global payroll important for international businesses?

Global payroll is important for international businesses because it ensures compliance (with different international payroll laws and regulations), centralizes and simplifies payroll operations (across multiple countries), and improves productivity and reduces costs (by automating processes). It is also important as it mitigates legal and financial risk, improves employee experience, and supports strategic decision-making.

Ensures compliance

Ensuring compliance means global payroll helps businesses follow local tax laws, labor regulations, and statutory requirements in every country of operation. A structured global payroll approach provides timely updates, accurate filings, and uniform documentation, which reduces the risk of fines, audits, back payments, and legal disputes. Global payroll allows organizations to operate securely across multiple regions.

Centralizes and simplifies payroll operations

Centralizing and simplifying payroll operations across multiple countries gives organizations a single platform to manage employee payments, tax reporting, and compliance requirements rather than handling separate systems for each location. This unified approach improves performance by lowering duplicate tasks, reducing manual work, and maintaining uniform processes and accurate data across regions. Centralized global payroll makes it easy to generate reliable reports, reduce administrative complexity, and monitor global payroll operations as the business grows.

Improves productivity and reduces costs

Automating payroll calculations, reporting, and payments globally reduces hours spent on data entry, tax calculations, and error correction. This automation leads to lower operational costs by preventing payroll errors and avoiding costly compliance penalties, as it requires no additional staff dedicated to these tasks. HR and finance teams are allowed to focus more on strategic work like planning, analysis, and employee engagement.

Mitigates legal and financial risk

Accurate payroll processing with global payroll systems helps prevent costly errors in wages, taxes, and benefits. These systems also help avoid mistakes that result in audits, financial penalties, and legal disputes with authorities or employees. Automated compliance with local and international tax laws and filing deadlines lowers the risk of underpayments or misreporting that lead to fines, back payments, and complex internal processes. Proper recordkeeping supports audit preparation and accountability across jurisdictions.

Improves employee experience

Transparent payroll practices improve employee experience by providing clear access to pay stubs, deductions, and compensation explanations to reduce employee confusion and lower payroll-related inquiries. These factors improve overall employee satisfaction and engagement, which helps organizations retain talent and create a more positive workplace culture.

Supports strategic decision-making

Centralized global payroll data gives leaders detailed insights into labor costs, workforce trends, overtime and termination patterns, and budget predictions. These insights help them plan where to hire, how to allocate resources, and how payroll expenses impact financial goals, which supports smarter workforce planning and business growth decisions.

What are the challenges of managing global payroll across multiple countries?

The challenges of managing global payroll across multiple countries include currency fluctuations, time zone differences, language barriers, finding qualified local partners, and managing costs and budgets.

The challenges of managing global payroll across multiple countries are listed below.

- Currency fluctuations: Compensating employees in different currencies means dealing with frequently changing exchange rates. These changes affect payroll accuracy, budgeting, and the actual value employees receive, which makes financial planning more complex.

- Time zone differences: Coordinating payroll processing and communication across multiple time zones sometimes causes delays and miscommunication. These differences make scheduling, approvals, and timely execution of payroll tasks difficult.

- Language barriers: Working with employees, authorities, or local partners in different languages leads to misunderstandings and errors in documentation or reporting. These barriers slow issue resolution if payroll information is not clearly communicated or translated.

- Finding qualified local partners: Identifying and managing reputable local payroll providers or experts who understand specific country regulations and practices is difficult. Inconsistent standards or communication also increase administrative burden and risk.

- Managing costs and budgets: Global payroll involves unpredictable expenses, such as currency conversion fees, differing wage structures, tax duties, and local service provider fees. These differences make it more difficult to accurately arrange expenses and estimate budgets.

How are global payroll service providers transforming international payroll?

Global payroll service providers are transforming international payroll by ensuring compliance across borders, providing scalable solutions for growth, faster market entry and competitive advantage, and better data security and confidentiality.

Global payroll providers stay up‑to‑date with frequently changing tax laws, labor regulations, and statutory requirements in each country. Their expertise helps businesses avoid non‑compliance risks, fines, and legal penalties when processing payroll internationally.

These providers offer payroll platforms that easily expand as companies enter new markets or add employees and adjust to local payroll requirements without major system changes, which supports smooth growth and operational stability.

Global payroll services help businesses hire and pay employees quickly in new regions. Businesses do not have to establish a legal entity, as these services handle local payroll setup, compliance, and payments for faster market entry, while giving a competitive advantage.

Leading global payroll solutions implement strong protections such as SSL encryption, secure access controls, and compliance with data privacy regulations, like GDPR (General Data Protection Regulation). These solutions make sure that sensitive payroll and employee data remain secure and protected from breaches or unauthorized access.

How is AI transforming global payroll operations?

AI is transforming global payroll operations through predictive compliance, intelligent workforce planning, and automated payroll. AI in payroll also integrates HR and finance systems, provides accurate insights for planning and estimation, and routinely updates regulatory requirements to help maintain compliance across borders.

What regulatory changes are affecting global payroll practices?

The regulatory changes affecting global payroll practices include shifting cross‑border tax and wage laws, pay transparency and labor regulations, and data privacy or classification rules. Other changes are employment tax, benefits, social insurance requirements, and adjustments to payroll regulations and compliance around the world.

How are EOR models simplifying global expansion?

EOR models are simplifying global expansion by allowing companies to hire internationally without setting up a legal entity. EORs also handle payroll, taxes, benefits, and compliance with local labor laws on the company’s behalf, which reduces administrative and legal burdens and lowers costs related to entity setup.

How is global payroll adjusting to the gig economy?

Global payroll is adjusting to the gig economy by integrating gig payroll systems that handle contractor and freelancer payments across borders, offering flexible payout options like same‑day or digital wallet transfers to meet gig worker expectations.

Why is preventing payroll fraud important in global payroll solutions?

Preventing payroll fraud is important in global payroll solutions because it protects organizations from financial losses and the impact on cash flow caused by unauthorized or fraudulent payments. Preventing payroll fraud helps maintain compliance with regulations, protect the company’s reputation, and improve employee confidence in payroll accuracy and security.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations