Global payroll reporting: definition, importance, types, and best practices

Robbin Schuchmann

Co-founder, Employ Borderless

Global payroll reporting is the process of collecting and analyzing payroll data across multiple countries to provide accurate, timely, and actionable insights. It is important for businesses with international operations, as it ensures compliance with local tax and labor laws, supports informed decision-making, and provides a clear overview of workforce costs and trends across all regions.

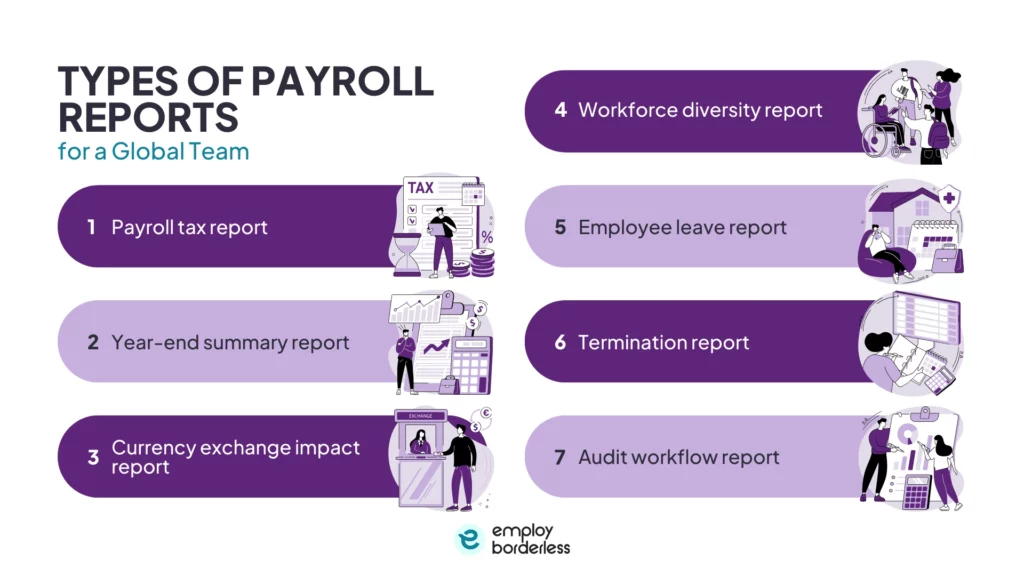

There are types of payroll reports for a global team, which include the payroll tax report, the year-end summary report, the currency exchange impact report, the workforce diversity report, the employee leave report, the termination report, and the audit workflow report.

The best practices for generating global payroll reports include integrating payroll with HR and finance tools, using automated alerts and notifications, training teams on payroll reporting tools, centralizing data and reporting, and utilizing a cloud-based payroll platform.

What is global payroll reporting?

Global payroll reporting includes both internal payroll reports used for financial analysis, workforce planning, and operational insights, and mandatory payroll reports submitted to tax and social security authorities to meet statutory reporting requirements. Managing both internal and government payroll reporting becomes complex when payroll is run across multiple countries. Different jurisdictions require different types of payroll reports, which increases complexity and makes it difficult for businesses to stay compliant and avoid missing timely filings.

Why is global payroll reporting important?

Global payroll reporting is important because it converts raw payroll data into actionable insights for workforce planning, business strategy decisions, and new target markets. It also provides cost analyses that show how much money is spent in each location, which helps with cash flow management. Consolidated global payroll reports help prepare for audits and ensure compliance with local regulations. Global payroll reporting also allows businesses to assess the quality and performance of their payroll providers. It offers a clear view of payroll operations across all locations, which helps with effective business management.

What are the types of payroll reports for a global team?

The types of payroll reports for a global team are the payroll tax report, the year-end summary report, the currency exchange impact report, the workforce diversity report, the employee leave report, the termination report, and the audit workflow report.

The types of payroll reports for a global team are discussed below.

- Payroll tax report: A payroll tax report details the taxes withheld from employee wages and the employer’s tax obligations across different countries. It is used to provide accurate tax calculations, timely filings, and compliance with local tax and social security regulations. Payroll tax reports within a global payroll solution help reduce non-compliance risks by automating tax calculations, consolidating real-time data, and providing a clear view of tax responsibilities across all locations.

- Year-end summary report: A year-end summary report provides an overview of annual payroll data, like total employee wages, deductions, taxes, and detailed earnings across all regions. It supports compliance with HR and regulatory requirements while offering a clear record of payroll activity for the entire year. This report also helps identify patterns, such as increases in overtime or sick leave, that inform workforce planning and strategic decisions for the next year.

- Currency exchange impact report: A currency exchange impact report shows how exchange rate fluctuations affect payroll costs when paying employees in different countries. It helps organizations understand the impact of currency movements on salary payments, budgeting, and overall payroll spending. Currency exchange impact reports within global payroll platforms track real-time rate changes, which allow companies to manage payroll costs accurately and ensure timely, compliant payments in local currencies.

- Workforce diversity report: A workforce diversity report is an important payroll and HR document that tracks diversity metrics, such as age, ethnicity, gender, and other demographic factors across the workforce. It helps organizations analyze staff distribution, identify pay gaps, and promote fair and equal pay practices.

- Employee leave report: An employee leave report tracks all types of employee absences, such as paid leave, sick leave, parental leave, and unpaid time off across the workforce. It provides a clear record of leave balances, usage, and entitlements according to local labor laws and company policies. Employee leave reports help provide correct salary calculations and prevent overpayments or underpayments for global teams.

- Termination report: A termination report summarizes all payroll and compliance details related to an employee’s exit, like final wages, severance, unused leave payouts, bonuses, benefits, and tax adjustments. It makes sure that offboarding is handled accurately and according to local labor laws. It also simplifies updates to benefits, pensions, insurance, and tax records to avoid errors.

- Audit workflow report: An audit workflow report tracks and documents the review and approval processes for payroll transactions. It makes sure that all payroll activities are properly verified and compliant with internal policies and external regulations. Managing payroll across multiple countries involves complex workflows with multiple reviewers and approvals for global teams. An audit workflow report provides a clear record of who approved what and when, which helps prevent errors, find differences, and maintain accountability.

Who requires global payroll reporting?

Global payroll reporting is required by global payroll managers, finance teams, and human resources managers. Both internal business teams and external regulatory entities require global payroll reporting to ensure compliance, transparency, and informed decision-making.

Global payroll managers

Global payroll managers require global payroll reporting because they must maintain control of payroll activities across all countries where their organization operates. Detailed global payroll reporting shows which local vendor is handling payroll in each country, who is responsible for payroll processing locally, and global payroll costs by country for a month, quarter, or year.

Finance teams

Finance teams under the CFO (Chief Financial Officer) must process and deliver financial accounting figures each month, and this usually includes payroll‑related costs. Finance department has a legal obligation to show and update specific payroll costs as part of regular financial reporting and compliance requirements. Finance teams need quick access to finalized general ledger reports after payroll is processed, as these reports enter directly into the organization’s monthly accounting close and statutory reporting.

Human resources managers

HR managers face challenges when global HR and payroll systems are not integrated, which leads to multiple disparate systems. This lack of integration makes consolidated multi-country reporting difficult and reconciliation of data a challenge. The HR manager requires global payroll reporting because compliance departments must meet legal and regulatory responsibilities for multi-country compliance.

Compliance relies on the quality of technology that payroll and HR departments use to provide transparency and proof. The compliance manager needs digital tools and transparent reporting to show country-by-country compliance and data protection during audits.

What are the challenges of global payroll reporting?

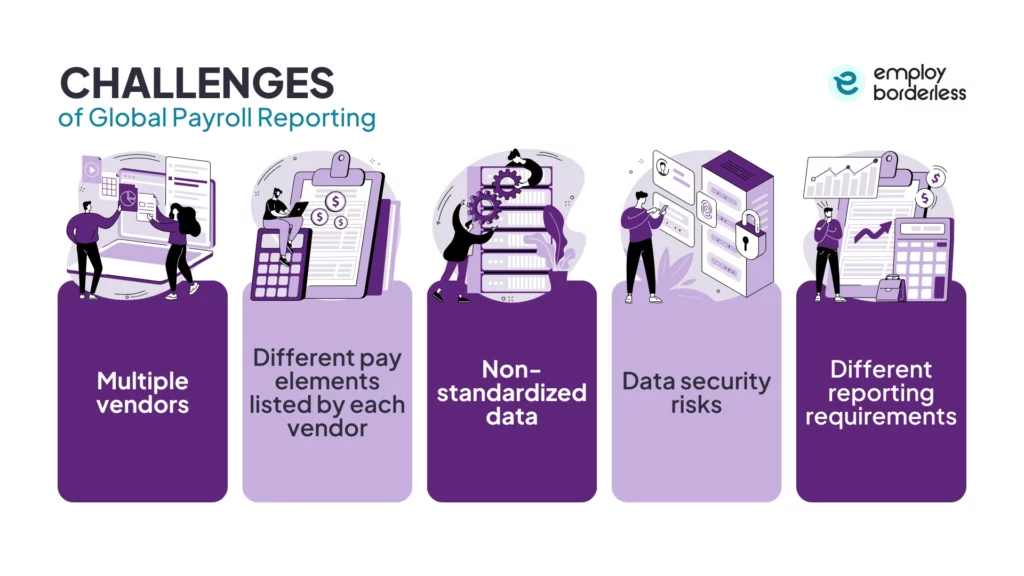

The challenges of global payroll reporting are multiple vendors, different pay elements listed by each vendor, non-standardized data, data security risks, and different reporting requirements.

The challenges of global payroll reporting are discussed below.

- Multiple vendors: Foreign businesses that work with multiple in‑country payroll providers make reporting difficult. Each vendor uses a different system and format, which makes it hard to combine data into a unified global report.

- Different pay elements listed by each vendor: Payroll data from different vendors mostly includes different pay components and structures. For example, in one country, a payroll vendor possibly reports overtime pay separately from regular wages, while in another country, overtime is included in the total salary. These differences make it challenging to combine, compare, and analyze payroll data across multiple countries. Finance and payroll teams also have to reconcile the differences for accurate global payroll reports.

- Non-standardized data: Finance and payroll teams spend a lot of time reconciling differences and manually adjusting data, which increases the risk of errors and affects the reliability of global payroll reporting without standardized data.

- Data security risks: Global payroll reporting also faces data security risks because sensitive payroll information is transferred between multiple systems and vendors. Businesses are exposed to breaches or loss of confidential employee data, especially under strict data protection laws, when data is stored in many places without centralized controls.

- Different reporting requirements: Different reporting requirements across countries add complexity because each jurisdiction has its own compliance rules, formats, and timelines. This difference means global payroll has to adjust reporting outputs to meet local standards, which makes creating accurate global reports difficult.

How can businesses manage their global payroll reporting?

Businesses can manage their global payroll reporting by using global payroll reporting software or a unified global payroll platform and in-country payroll partners. Global payroll reporting software, or a unified payroll platform, automates data collection and combines payroll information from all countries into a central system. Automation and consolidation reduce manual work, lower errors, and provide fast, more accurate reporting across jurisdictions. Cloud‑based solutions simplify calculations, tax compliance, and multi‑country reporting, which helps teams produce consistent, audit‑ready reports with less manual involvement.

Many foreign organizations continue to work with in-country payroll partners to make sure local statutory reporting requirements are completed accurately and on time. Maintaining a global payroll and compliance calendar with all local filing deadlines is important to avoid compliance issues. This calendar also provides timely reporting for companies that choose to manage payroll in‑house.

What are the best practices for generating global payroll reports?

The best practices for generating global payroll reports are to integrate payroll with HR and finance tools, use automated alerts and notifications, train teams on payroll reporting tools, centralize data and reporting, and utilize a cloud-based payroll platform.

Integrate payroll with HR and finance tools

Integrating payroll with HR and finance tools improves data flow across systems and reduces duplicate data entry and errors. Accounting, time‑tracking software, and employee changes, like promotions, salary updates, or benefits adjustments, automatically import into payroll calculations when payroll connects with HRIS (Human Resources Information System). This unified data helps with more accurate and consistent payroll reporting, fast compliance tracking, and better financial planning.

Use automated alerts and notifications

Setting up automated alerts and notifications within global payroll systems helps teams stay updated on deadlines, differences, or data updates. Global payroll automation identifies issues like missing timesheets, pending approvals, or compliance events, so teams act before they affect reporting accuracy. Automated reminders improve the timeliness and quality of global payroll reporting by reducing manual follow‑ups and missed actions.

Train teams on payroll reporting tools

Ongoing training makes sure payroll, HR, and finance teams understand how to use reporting tools effectively. Employees need up‑to‑date knowledge about features, compliance requirements, and how to analyze data outputs as global payroll systems change. Well‑trained teams make fewer errors, respond quickly to issues, and produce detailed, audit‑ready payroll reports that support strategic decision‑making.

Centralize data and reporting

Centralizing payroll data into a single system or database collects information from all countries and vendors into one place. This centralization makes it easy to standardize reporting formats, compare costs across regions, and generate consolidated global insights. A centralized approach reduces errors and simplifies compliance reporting, which gives businesses a reliable, unified record of payroll data.

Utilize a cloud-based payroll platform

Cloud‑based payroll platforms provide real‑time access to payroll data from anywhere and support global operations with scalable, automated reporting capabilities. These platforms help reduce manual processes, increase data security, and offer centralized dashboards for monitoring payroll trends and performance. They also improve accuracy and reduce the risk of costly reporting errors because cloud solutions update automatically and mostly include multi‑country compliance support.

How does global payroll reporting support informed financial decision-making?

Global payroll reporting supports informed financial decision-making by tracking global workforce headcount, monitoring pay and taxes, identifying pay-run differences, and acting on actionable insights.

Tracking global workforce headcount involves having accurate counts of all employees across countries, which include those who are active, inactive, newly joined, or recently left the company. Centralized headcount data allows companies to reconcile HR and global payroll systems and understand true workforce costs, which is important when preparing overall financial statements or planning budgets.

Monitoring pay and taxes means gathering detailed payroll expenses and employer tax obligations across jurisdictions in a unified format. Consolidated payroll reporting combines gross pay, deductions, and tax liabilities across multiple countries. This data helps finance teams assess labor costs accurately and ensure compliance with local tax and social contribution requirements.

Identifying pay-run differences means comparing global payroll runs to detect issues in pay elements, allowances, or tax withholdings between periods. This identification helps find errors early so that differences do not affect financial reports or budgeting estimations.

Acting on actionable insights turns global payroll data into meaningful trends and intelligence for decision-making. Organizations are able to analyze labor costs across regions, make informed staffing and compensation choices, and improve compliance and operational performance.

How does global payroll reporting help with compliance?

Global payroll reporting helps with compliance by making sure payroll data meets local tax, labor, and regulatory requirements across all countries. It consolidates information for accurate statutory filings, reduces errors through automation, and updates calculations as local laws change, while maintaining global payroll regulations and compliance.

What metrics are commonly included in global payroll reports?

The metrics commonly included in global payroll reports are total payroll cost, error resolution cycle time, compliance rate, and overtime cost. Other global payroll KPIs (Key Performance Indicators) include accuracy rate, payroll processing time, and payroll leakage.

What does an ideal global payroll report look like?

An ideal global payroll looks like a consolidated and accurate overview of payroll processes across all countries, which provides both micro- and macro-level insights. It standardizes cost factors and pay details, includes all payroll-related aspects other than wages, and allows customization of metrics. It also offers real-time access to data and supports comparisons across regions for informed decision-making.

How often should global payroll reports be generated?

Global payroll reports should be generated every pay cycle, which includes weekly, biweekly, or monthly for financial analysis, quarterly for taxes, and annually for year-end filings. Customize the report frequency to meet compliance needs and scale the business for the best monitoring.

What tools are used for global payroll reporting?

The tools used for global payroll reporting are built‑in reporting engines in payroll or HRMS (Human Resource Management System) and business intelligence and reporting platforms. Companies also use AI in payroll reporting for performing operations across countries by automating data validation and anticipating future compliance requirements.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations