7 factors behind global payroll complexity and how to manage it

Robbin Schuchmann

Co-founder, Employ Borderless

Global payroll involves managing and processing employee payments for those working across different countries. This process requires the coordination of local tax laws, labor rules, currency exchanges, and compliance requirements to make sure employees receive accurate and lawful compensation globally.

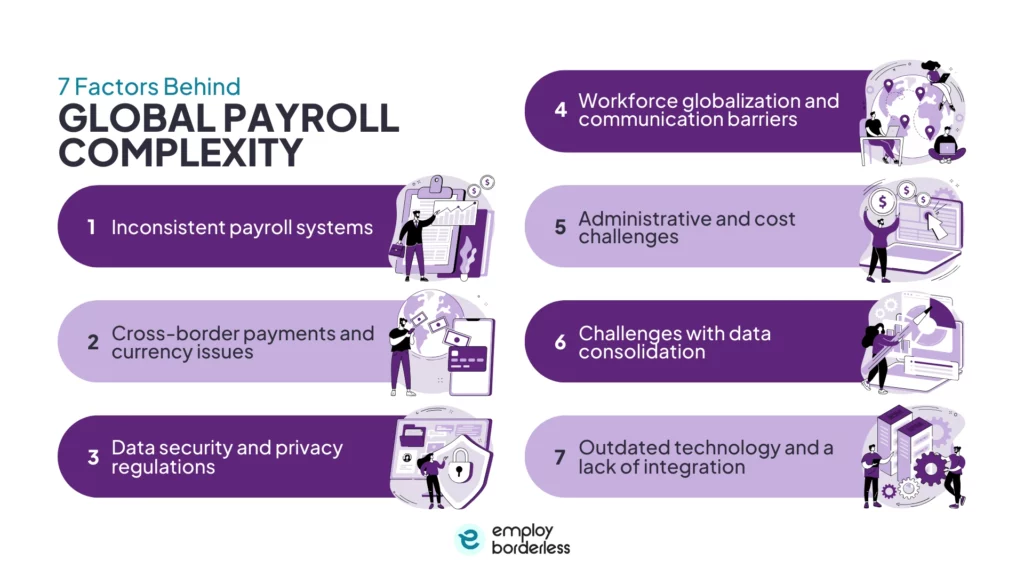

The factors behind global payroll complexity include inconsistent payroll systems, cross-border payments and currency issues, data security and privacy regulations, workforce globalization and communication barriers, administrative and cost challenges, and outdated technology and a lack of integration.

Global payroll complexity is managed by unified platforms, automation, and HR-finance integration, which help simplify calculations and payments while maintaining compliance. A unified system also automates repetitive tasks such as currency conversions and compliance checks, which lowers the administrative burden and improves overall operational performance.

The 7 factors behind global payroll complexity are listed below.

- Inconsistent payroll systems: Inconsistent payroll systems make global payroll complex due to reliance on different local providers, which leads to disorganized employee data across platforms.

- Cross-border payments and currency issues: Cross-border payments and currency issues increase complexity in global payroll management because fluctuating exchange rates affect payroll budgets and employee salaries.

- Data security and privacy regulations: Data security and privacy regulations in global payroll are complex due to the sensitivity of payroll data. Local laws establish the storage, retention, access, and management of payroll data, which increases the risk of non-compliance.

- Workforce globalization and communication barriers: Workforce globalization makes global payroll complex due to changing local labor laws, tax regulations, social contributions, and benefits.

- Administrative and cost challenges: Administrative and cost challenges increase the complexity of global payroll because of manual processing and the need for multiple country-specific vendors.

- Challenges with data consolidation: Data consolidation is complex, as storing payroll information in separate systems creates the risk of missed entries, outdated employee data, and calculation errors.

- Outdated technology and a lack of integration: Many organizations use independent on-site payroll systems that do not connect with modern HR, finance, and time-tracking tools.

Inconsistent payroll systems

Inconsistent payroll systems increase global payroll complexity because the use of different local payroll providers means employee data is maintained across multiple, disconnected platforms. This lack of consolidation makes it difficult to understand total workforce costs, benefits, and payroll trends at an organizational level. Different vendor approaches, timelines, reporting formats, and tax rules also create inconsistent payroll processes, which affect wage calculations, bonuses, deductions, and statutory filings.

Payroll teams spend more time on administrative tasks rather than on process improvement without standardized systems. Manual data entry and regular corrections also lead to training requirements, slow response times, increased operational costs, and more compliance risks, like delayed legal updates and poor data security controls.

Cross-border payments and currency issues

Cross-border payments and currency issues add to global payroll complexity, as fluctuating exchange rates impact payroll budgets and employee salaries. Local laws mostly determine the method and currency in which payments are made. Manual or delayed currency conversions result in FX (Foreign Exchange) errors, extra fees, and poor margins.

Global payroll processing is also challenging because of differences in banks, time zones, local holidays, and business hours, which result in irregular payment timings. Additional costs include unexpected or hidden fees when payments pass through multiple banks. Some regions have limited payment options and require supporting alternatives such as mobile wallets, digital platforms, or even cryptocurrency.

Data security and privacy regulations

Data security and privacy regulations are a growing complexity in global payroll, as payroll data is highly sensitive and liable to strict legal requirements, like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act). Local laws regulate the storage, retention, access, and management of payroll information to ensure compliance.

Businesses operating globally fail to meet these mandatory responsibilities, which leads to costly fines, lawsuits, and reputational damage. Global payroll management requires more than secure storage, as it includes proper handling of issues and conformity to reporting demands, like notifying authorities and affected employees quickly in case of a data breach.

Workforce globalization and communication barriers

Workforce globalization and communication barriers also make global payroll complex, as organizations have to comply with local labor laws, tax regulations, social contributions, and benefits for every country where employees work. Multinational companies need to provide payslips and payroll reports in the correct language, currency, and format to maintain compliance and transparency.

Specific legal rules for different worker types make proper classification important to avoid penalties. Global payroll systems also have to accurately differentiate between employees and contractors to perform correct calculations, taxes, and filings automatically.

Administrative and cost challenges

Administrative and cost challenges add more complexity to global payroll as manual processing and managing multiple country-specific vendors increase operational burden and require internal resources. Setting up legal entities and compliance systems in foreign countries includes legal, financial, and administrative overhead. Integrating separate payroll systems with HR and finance platforms mostly causes data transfer issues, security risks, and extra administrative effort.

Decentralized payroll data makes reporting and reconciliation more time-consuming, which slows strategic decision-making. Managing multiple vendors adds complexity, with unreliable processes and performance tracking increasing expenses. Unorganized payroll approaches also result in hidden expenses, which include intermediary banking fees, compliance penalties, and additional audit preparation, all increasing overall budgets and resource demands.

Challenges with data consolidation

Data consolidation also involves complexities, as storing payroll information across different systems and formats increases the risk of missing entries, outdated employee data, and incorrect calculations. Reconciling these differences takes time and introduces errors, which lead to late or inaccurate payments and tax filings. Compiling reports from multiple sources mostly produces outdated information, which reduces the reliability of financial predictions and decision-making.

Outdated technology and a lack of integration

Outdated technology and a lack of integration are also causes of global payroll complexity because many organizations rely on on-site payroll systems that operate independently from other business platforms. These on-site payroll systems lack integration with modern HR, finance, and time-tracking tools. This disconnect leads to duplicated work, inaccuracies, and manual data entry, which increases errors and slows payroll processing.

Limited automation in outdated systems causes slow payroll runs, complex updates, and delayed reporting. It also makes it difficult to keep up with changing tax laws, reporting requirements, and data privacy regulations, such as GDPR (General Data Protection Regulation).

How to manage global payroll complexity with a unified system?

To manage global payroll complexity with a unified system, organizations centralize payroll data across all subsidiaries by integrating HR, finance, and payroll platforms into a single solution. Companies automate repetitive tasks such as tax calculations, currency conversions, and compliance reporting, which helps provide correct and timely payments in multiple countries. A unified system also helps maintain local compliance by automatically updating regulations, statutory contributions, and reporting requirements, while supporting multi-currency payroll and smooth cross-border payments.

Integration with existing HR and financial systems offers employees secure self-service portals to improve transparency and reduce administrative burden. A unified global payroll system simplifies complex operations, mitigates risk, and allows organizations to scale effectively while maintaining compliant and timely payroll across the globe.

How do unified platforms help reduce global payroll complexity?

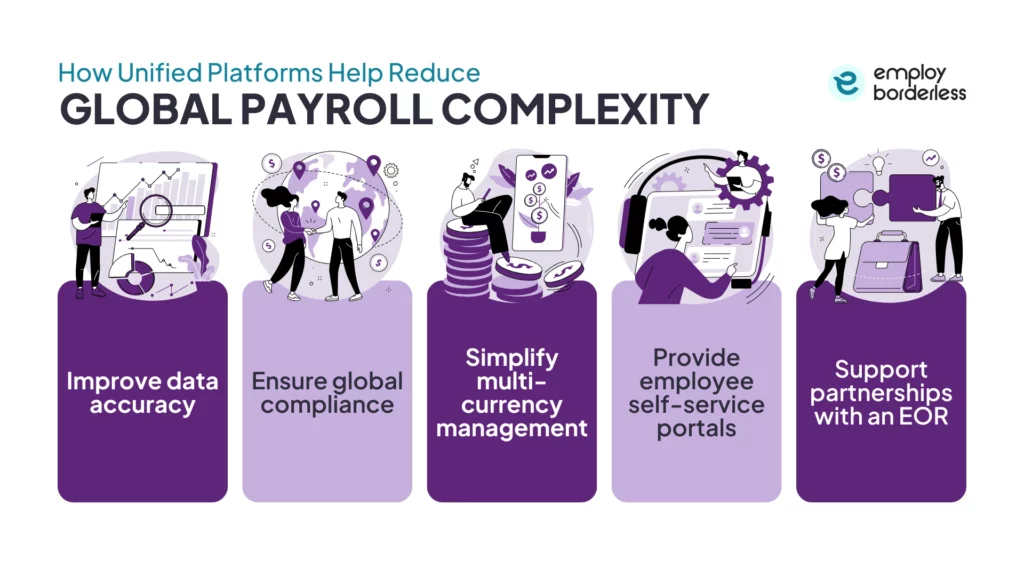

Unified platforms help reduce global payroll complexity by improving data accuracy, ensuring global compliance, simplifying multi-currency management, providing employee self-service portals, and supporting partnerships with an EOR (Employer of Record).

Improve data accuracy

Unified payroll platforms lower manual data entry and disparate spreadsheets by centralizing payroll information into one system. This centralization reduces human errors and inconsistencies in calculations, reporting, and pay data across countries. Payroll irregularities are detected early and corrected before payroll runs with automated validations and real‑time data processing. This automation improves overall data reliability and reduces costly legal disputes or rework.

Ensure global compliance

Global payroll compliance is difficult for international businesses due to changing tax, labor, and reporting regulations in each jurisdiction. Unified platforms include built‑in regulatory intelligence, frequently updating legal requirements, and making sure statutory filings and tax calculations follow local laws. Such regulatory intelligence avoids legal risks and costly penalties from non‑compliance while standardizing compliance processes globally.

Simplify multi-currency management

Managing payroll across different currencies and fluctuating exchange rates places an administrative burden on companies. Unified payroll systems integrate multi-currency processing and FX (Foreign Exchange) management, which allows companies to process payroll in each local currency reliably from one interface. This currency management not only simplifies conversions but also improves the transparency of international payroll costs.

Provide employee self-service portals

Modern unified payroll systems mostly include employee self‑service tools that allow staff to access pay slips, tax documents, and personal payroll data on demand. These systems offer transparency to employees, reduce HR support queries, increase employee satisfaction, and allow workers to manage their own information.

Support partnerships with an EOR

Partnering with an EOR (Employer of Record) through a unified platform allows companies to hire and pay employees in countries where they do not have a legal entity. The EOR handles employment contracts, statutory contributions, local taxes, and compliance requirements on the company’s behalf. This model helps with quick market entry, reduces payroll overhead, and ensures compliance even in unfamiliar jurisdictions.

What is global payroll?

Global payroll is the process by which multinational organizations calculate wages, deduct taxes and benefits, process payments, and ensure compliance for employees located in different countries. It integrates payroll functions, such as salary calculation, statutory deductions, currency conversion, filing requirements, and reporting, across all the countries where a company operates.

Global payroll also manages tax withholding differences, benefit contributions, and wage laws that change frequently across borders, while local payroll focuses on one tax system and one currency. Effective global payroll ensures multi-country compliance, reduces legal and financial risks, and consolidates payroll operations into a unified system for better accuracy.

Why is global payroll compliance more difficult than local payroll compliance?

Global payroll compliance is more difficult than local payroll compliance because multinational organizations must regularly track and apply unique tax laws, labor regulations, reporting requirements, data privacy standards, and statutory filings in each country. These global payroll regulations and compliance differ widely and change frequently, which increases the risk of errors and penalties across jurisdictions.

How do local labor laws increase global payroll complexity?

Local labor laws increase global payroll complexity, as each country implements different employment rules, wage requirements, tax withholdings, benefits, and reporting obligations that employers have to follow accurately. These differing payroll labor laws demand ongoing monitoring, frequent legal updates, and accurate adjustments to payroll processes to remain compliant across jurisdictions.

How does global payroll complexity impact staffing and talent management?

Global payroll complexity impacts staffing and talent management by increasing administrative burden and operational errors, which requires HR teams to spend more time on compliance and payroll issues rather than strategic recruiting and retention. Errors, delays, or a lack of transparency in pay reduce employee satisfaction, damage the employer’s brand, and lead to higher turnover and difficulty retaining top talent.

What role do visa and work permit regulations play in global payroll complexity?

The role visa and work permit regulations play in global payroll complexity is that each country has unique immigration requirements and legal authorizations that employees have to meet before they start work. Employers also have to manage visa and work permit documentation, approval timelines, and compliance with these rules as part of payroll and employment processing.

How do in-house payroll systems contribute to global payroll complexity?

In-house payroll systems contribute to global payroll complexity by relying on manual processes, limited expertise, and technology built for single‑country operations. These in-house payroll systems make it difficult to keep up with specific tax laws, changing regulations, multi‑currency payments, and compliance requirements across jurisdictions.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations