Understanding Payroll Costs: Definition, Factors, Calculation, and Strategies

Robbin Schuchmann

Co-founder, Employ Borderless

Payroll costs are the total expenses a business spends to compensate its employees, which include direct wages and salaries, employer payroll taxes, benefits, and other employment-related expenses. These costs show the full financial responsibility of having employees, not just the gross pay.

The cost of payroll processing depends on the method, such as in-house, payroll software, outsourcing payroll services, and online payroll providers. The factors that affect payroll cost involve payroll frequency, total number of employees, industry, types of services required, employee benefits, frequency of payee onboarding and offboarding, and operations across multiple states or jurisdictions.

The total expenses included in calculating payroll cost are employee gross wages, employer payroll taxes, unemployment insurance, optional costs, payroll service provider fees, and the final formula. Some strategies help manage payroll costs, like reducing employee turnover, outsourcing payroll functions, classifying workers accurately, introducing flexible shift scheduling, investing in time tracking, auditing benefits, and complying with relevant business laws.

What are payroll costs?

Payroll costs are the total expenses related to compensating employees for their work at the company. These expenses are regular salaries, bonuses and commissions, paid time off, and other employee leave. Payroll costs also include the employer-paid portion of payroll taxes, FICA (Federal Insurance Contributions Act) taxes, employee benefit contributions, and unemployment insurance contributions. Most businesses manage labor costs when administering payroll.

What are the types of payroll costs?

The types of payroll costs are direct payroll costs and indirect payroll costs.

Direct payroll costs

Direct payroll costs are the basic, non-negotiable payments that make up most of the payroll budget and increase directly as the workforce grows. They are usually the first employee-related costs businesses account for, like gross wages, salaries, and bonuses, overtime pay and commissions, and compensation for hours worked in each pay period.

Indirect payroll costs

Indirect payroll costs are the employer’s share of payroll taxes, such as FICA in the U.S. or similar social security, pension, and statutory health contributions in other countries. Indirect payroll costs also involve employee benefits, like health insurance, retirement or pension plans, and PTO (Paid Time Off), such as vacation leave, sick leave, and parental or family leave.

Indirect payroll costs are mostly missed, especially by founders and small businesses, because they are not seen in offer letters or base salary figures. These expenses sometimes match or even exceed direct wages over time. They grow more complex as operations expand across regions for enterprises, which makes them some of the most difficult payroll costs to predict and manage.

How much does payroll processing cost?

Payroll processing cost depends on the method, whether it is processed in-house or the company outsources payroll. Payroll processing methods also involve utilizing payroll software and online payroll providers.

In-house payroll

Some business owners choose to manage payroll internally, either handling it themselves or assigning the responsibility to dedicated staff. This approach offers full control over payroll operations and keeps costs relatively low at first. Expenses generally include payroll systems or software, time-tracking tools, check printing, and fees for direct deposit processing.

Running payroll in-house requires a thorough understanding of payroll rules and ongoing attention to changing tax laws and labor regulations to avoid penalties. It is possible to manage payroll independently, but the process is time-consuming and demanding. Hiring an in-house payroll specialist adds salary, benefits, and training costs, while engaging a CPA (Certified Public Accountant) for tax planning or compliance introduces extra ongoing expenses. These factors increase the actual cost of keeping payroll in-house.

Outsourcing payroll

Outsourcing payroll is a cost-effective alternative to managing payroll internally, especially for small businesses. Working with a payroll service provider helps businesses save money on indirect costs like payroll software, staff time, training, and the risk of penalties for errors or missed filings. Third-party payroll providers handle calculations, tax filings, and compliance requirements while processing payroll accurately according to current regulations.

Most payroll providers charge a base platform fee plus a PEPM (Per-Employee Per Month) charge. Industry guides report base fees ranging from $20 to $180 per month, with per-employee costs between $2 and $20 PEPM. This range depends on features such as time tracking, benefits administration, or HR support.

The difference between in-house payroll and outsourcing payroll

| Features | In-house payroll | Outsourcing payroll |

| Costs of initial setup | High (software and employee training) | Low (contract-based or flat fees) |

| Time investment | Considerable (requires ongoing staff time) | Minimal (automated and managed by a third-party provider) |

| Risk of inaccurate compliance | High (manual, risk of errors, constantly changing laws) | Low (automated and professionally managed) |

| Flexibility for expanding businesses | Limited (requires manual scaling) | High (scales easily as business grows) |

Payroll software

Payroll software helps simplify and automate payroll tasks, which reduces the time and effort required to pay employees accurately and on schedule. Costs for small businesses include the software subscription itself and, in some cases, setup or implementation fees, which depend on the provider and pricing model. Software usually costs around $40 per month or $500 per year, but it differs based on selected features and the size of the workforce.

Many accounting platforms include basic payroll capabilities, while dedicated payroll systems offer more advanced tools such as automated tax calculations, filings, and compliance support. Choosing software that integrates or exports payroll data directly into the company’s accounting system improves accuracy, makes sure payroll and financial records match, and supports proper documentation for payroll and business tax reporting.

Online payroll providers

Online payroll services help businesses save time, reduce errors, and simplify payroll management. These platforms are particularly useful for growing businesses, as they scale to match increasing workforce needs. Online payroll providers simplify operations, such as processing payroll and generating payroll reports, filing taxes at the federal, state, and local levels, and reporting new hires. They also help with calculating withholding taxes and deductions, preparing paychecks and direct deposits, and automating contributions for retirement plans or insurance premiums.

Costs differ depending on the provider, number of employees, payroll frequency, and additional services such as benefits setup or custom reporting. Online payroll services charge a monthly base fee along with a per-employee fee. Base fees range from $20 up to over $200 per month for most leading providers, with per-employee charges between $4 and $15 per month. Look for clear, upfront pricing to avoid unexpected fees when choosing an online provider.

How much does payroll service cost?

Payroll service costs differ depending on the size of the business, such as small-sized businesses, medium-sized businesses, and large companies.

Small-sized businesses

Payroll service for small-sized businesses with up to 25 employees costs $175 to $300 per month. This estimate shows a common pricing model with a base fee of approximately $50 and an additional $5 per employee.

Medium-sized businesses

Monthly payroll expenses for medium-sized businesses with around 100 employees range from $550 to $1,100. Costs increase under the standard pricing structure, which combines a fixed base fee with per-employee charges. This structure means total payroll fees grow proportionally as the number of employees rises.

Large companies

Monthly payroll costs range from $2,500 to $3,000 or more for large companies with approximately 500 employees. Total expenses remain high due to the number of payroll transactions and administrative requirements, while some providers offer lower per-employee rates for high-volume accounts.

What are some common factors that affect payroll cost?

Some common factors that affect payroll cost include payroll frequency, total number of employees, industry, types of services required, employee benefits, frequency of payee onboarding and offboarding, and operations across multiple states or jurisdictions.

Payroll frequency

The frequency of payroll runs is weekly, biweekly, semimonthly, or monthly, which directly affects payroll costs and administrative workload. More frequent pay periods mean more payroll runs, which increase processing fees and the risk of errors. For example, a weekly payroll results in 52 runs per year, while a monthly schedule only requires 12 runs.

Payroll service pricing differs depending on how often you process payroll, as some providers charge per run, while others allow unlimited runs within a period. It is also important to consider different pay schedules for different employee types, such as salaried versus hourly workers. Balancing employee expectations with cost management is essential when choosing a payroll frequency.

Total number of employees

Workforce size plays a major role in determining payroll costs, as most payroll providers use a pricing model that combines a fixed base fee with a per-employee charge. These per-employee fees add up as headcount increases, which increases overall payroll expenses. Seasonal or temporary hiring also adds complexity, since fluctuating employee numbers require frequent updates, and additional payroll processing raises costs.

Industry

Some industries, such as construction, healthcare, or manufacturing, face more complex payroll requirements due to specialized labor laws, union rules, and strict compliance standards. These added complexities increase payroll processing costs, as providers have to spend extra time and resources to ensure regulatory compliance. Businesses anticipate related expenses and choose payroll solutions that are prepared to manage these requirements effectively by understanding the specific payroll obligations of the industry in advance.

Types of services required

Payroll costs increase when businesses require additional services and features such as time tracking, benefits administration, or multi-state tax support. These capabilities are mostly priced separately or included only in higher-tier plans, which makes it important to select features that match the company’s actual needs. Basic payroll plans are the most cost-effective, while advanced tools, such as HR integrations, compliance management, or expanded reporting, raise overall payroll expenses.

Employee benefits

Employee benefits influence total payroll expenses, with health insurance as the highest benefit-related cost, commonly adding 10% to 20% to payroll depending on employer contributions. Retirement plans, such as employer 401(k) matching, introduce predictable long-term costs but support retention. Bonuses and incentive pay cause payroll costs to fluctuate based on performance, while innovative benefits, such as flexible work arrangements, wellness programs, and mental health support, offer high employee value with relatively lower direct payroll impact.

Frequency of payee onboarding and offboarding

A business that frequently adds or removes employees experiences increases in payroll-related administrative work and costs. Setting up new hires correctly in payroll systems requires collecting and entering personal and tax information, configuring pay rates, and ensuring compliance, all of which take time and increase the risk of errors in payroll processing.

Offboarding requires accurate final pay calculations, benefit adjustments, and system updates. Mistakes in the offboarding process lead to compliance issues or overpayment. Frequent changes in staffing also contribute to increased turnover and incur additional costs in recruitment or training. Such changes indirectly raise overall payroll expenses.

Operations across multiple states or jurisdictions

Payroll becomes more complex when a business employs workers across multiple states or local jurisdictions. Each state and often each locality has its own payroll tax rates, filing requirements, and labor regulations. Managing these differences internally increases administrative workload and raises the risk of errors, penalties, and compliance issues. Many small businesses outsource to third-party payroll providers, as they help manage multi-state payroll accurately and cost-effectively.

Technology and payroll systems

The cost of payroll software or outsourced payroll services affects total payroll expenses. Modern technology reduces errors, saves administrative time, and lowers long-term costs, while payroll systems require upfront investment. Many providers offer tiered pricing models or volume discounts for larger teams, and businesses often negotiate more reasonable rates as their workforce grows.

What additional fees are associated with payroll services?

The additional fees associated with payroll services are paycheck printing and distribution, payroll tax filing and submissions, direct deposit processing, automated check authorization and signing, year-end payroll reporting and compliance (Forms W-2 and 1099), and new hire reporting.

The additional fees associated with payroll services are discussed below.

- Paycheck printing and distribution: Some providers charge for printing and mailing paychecks to employees instead of or in addition to direct deposit. This service includes checking stock, printing labor, and postal fees.

- Payroll tax filing and submissions: Payroll services generally handle federal, state, and local tax filings on the company’s behalf. Providers charge extra for calculating, submitting, and remitting these taxes if this is not included in the base package.

- Direct deposit processing: Some providers charge a transaction fee for each direct deposit made, especially if packaged separately from the base fee, while many plans include direct deposit.

- Automated check authorization and signing: Some services offer automated tools that authorize, sign, and issue payroll checks electronically. This service is convenient, but sometimes it is an add-on or premium feature.

- Year-end payroll reporting and compliance (Forms W-2 and 1099): Employers must provide W-2s and 1099s to employees and tax authorities at the end of the year. Providers charge additional fees for generating, printing, filing, and mailing these forms.

- New hire reporting: Employers are required to report new hires to government agencies within a set period. Some payroll services include this in the base price, while others charge extra to prepare and submit these reports on the company’s behalf.

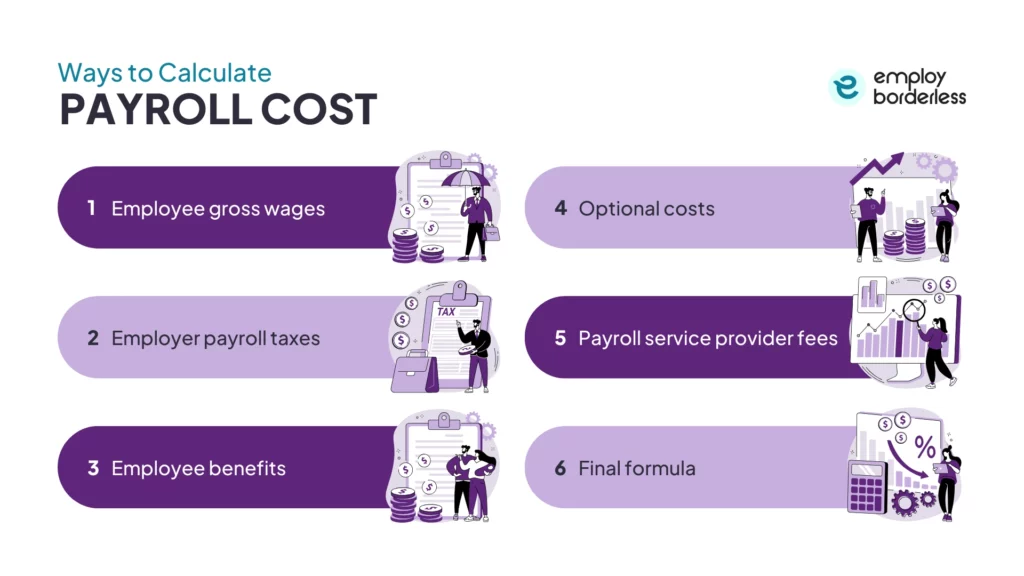

How to calculate payroll cost?

To calculate payroll cost, determine employee gross wages, employer payroll taxes, employee benefits, optional costs, payroll service provider fees, and the final formula.

The ways to calculate payroll cost are listed below.

- Employee gross wages: Add up the total wages for all workers, which include salaries, hourly pay multiplied by hours worked, overtime, bonuses, commissions, and tips. For example, if a company employs 15 employees, each earning $3,000 per month, the total gross monthly payroll comes to $45,000.

- Employer payroll taxes: Calculate the employer’s share of payroll taxes. This share includes Social Security at 6.2% of wages (up to the annual wage limit), Medicare at 1.45% of all wages, FUTA (Federal Unemployment Tax Act) at 0.6% to 6% on the first $7,000 of each employee’s wages, and SUTA (State Unemployment Tax Act), which differs by state. For example, if the gross payroll is $45,000 and employer payroll taxes are estimated at 9% of gross wages, the calculation is $45,000 multiplied by 9%, resulting in $4,050 in employer payroll taxes.

- Employee benefits: Employee benefits, such as health, dental, and vision insurance, retirement contributions, 401(k) match, life or disability coverage, and wellness incentives, add to total payroll expenses. For example, if benefits cost $300 per employee per month and there are 15 employees, the total monthly benefits expense is $300 multiplied by 15, which equals $4,500 per month.

- Optional costs: Other optional but common employer costs include PTO (Paid Time Off) accrual costs, workers’ compensation insurance, training, onboarding, HR compliance support, and taxes for fringe benefits, like company cars and bonuses.

- Payroll service provider fees: Add the monthly cost of your payroll provider, which includes a base fee plus a per-employee fee. For example, a base fee of $40 plus $4 per employee for 15 equals a total of $100 per month.

- Final formula: Total payroll cost equals gross wages plus employer payroll taxes, employee benefits, payroll provider fees, and any other optional costs (employer-related costs).

Example

The gross total is $45,000, employer taxes are $4,050, benefits are $4,500, and the payroll provider fee is $100, so adding them all equals $53,650 per month.

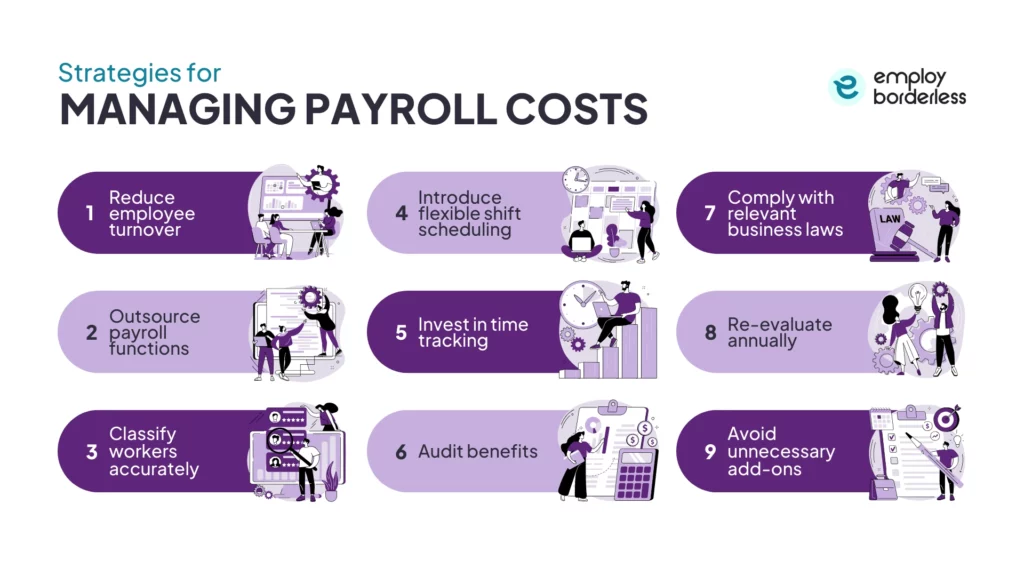

What are the strategies for managing payroll costs?

The strategies for managing payroll costs are to reduce employee turnover, outsource payroll functions, classify workers accurately, introduce flexible shift scheduling, invest in time tracking, audit benefits, and comply with relevant business laws.

Reduce employee turnover

High employee turnover increases payroll‑related costs because replacing staff involves recruiting, onboarding, and training new hires, all of which require time and money. Frequent turnover also disrupts productivity and requires temporary coverage or overtime pay to fill gaps. Businesses reduce hiring and training costs by improving retention through better employee engagement, clear career development opportunities, effective onboarding, and competitive compensation.

Outsource payroll functions

Outsourcing payroll functions means hiring a third-party provider to handle payroll processing rather than managing it in-house. This strategy helps businesses reduce costs and administrative burdens. Companies avoid expenses related to hiring, training, and retaining full-time payroll staff by outsourcing while purchasing and maintaining payroll software and technology.

Classify workers accurately

Accurate worker classification, like differentiating between employees and independent contractors, is an important strategy for managing payroll costs and avoiding costly penalties and liabilities. Employers pay payroll taxes, unemployment insurance, benefits, and other employment-related costs for workers classified as employees, while independent contractors are responsible for their own taxes and benefits. Misclassifying an employee as a contractor to reduce costs results in back taxes, penalties, interest, fines, and legal liabilities if regulators determine the classification was incorrect.

Introduce flexible shift scheduling

Flexible shift scheduling allows employers to adjust staffing based on real-time demand rather than following strict schedules. Companies avoid overstaffing and costly overtime by matching labor with actual business needs, which helps control labor and payroll costs. Flexible scheduling tools also improve employee satisfaction and retention. It also reduces turnover and the expenses related to recruiting and training new staff. This approach improves operational accuracy and lowers payroll‑related expenses while maintaining workforce engagement.

Invest in time tracking

Investing in a reliable time-tracking system helps control payroll expenses. Automated time tracking removes manual entry mistakes, verifies hours worked, and reduces costly payroll miscalculations. This automation helps prevent paying for hours not actually worked. Digital clock-in and clock-out systems, such as GPS or biometric tracking, reduce buddy punching and false time entries, which help prevent wage inflation and unnecessary labor costs. Time data that integrates directly into payroll systems lowers duplicate data entry, simplifies payroll processing, and decreases administrative workload while reducing operational costs.

Audit benefits

Conducting regular audits of payroll and employee benefits helps ensure accuracy, compliance, and cost control. A payroll or benefits audit reviews payroll records, deductions, benefit enrollments, and related filings to detect errors, overpayments, or compliance gaps before they become costly problems. Businesses correct these errors quickly, avoid penalties, and improve spending by identifying incorrect benefit enrollments, duplicate payments, or misclassified benefits.

Comply with relevant business laws

Making sure payroll complies with all relevant labor laws, tax requirements, and reporting regulations helps avoid costly penalties and legal problems and also reduces overall payroll costs. Using automation and reliable payroll software simplifies tax calculations, deductions, and filings, which reduces manual errors that lead to fines or corrections.

Re-evaluate annually

Reviewing payroll expenses on a yearly basis helps detect opportunities to manage and reduce costs more effectively. An annual review shows unused features or services the company is paying for. It also helps identify ways to simplify processes or use more useful technologies, and makes sure the payroll plan still matches the business size and needs.

Regular audits also help identify errors or compliance issues early and find cost savings through bundled services, automation, or switching to a plan with better value. Companies also adjust staffing, update benefit plans, and negotiate better rates by reassessing payroll setup each year. This assessment keeps payroll costs in compliance with business growth and goals.

Avoid unnecessary add-ons

Payroll service providers often bundle extra features, such as advanced reporting, HR tools, benefits administration, or integrations, that are not required by every business. Auditing the current payroll plan and identifying features the business does not actually use helps select a more suitable tier or remove optional extras. This strategy lowers monthly fees without compromising essential functionality. Regularly reviewing and comparing plans also helps make sure the company does not pay for duplicative services or unused add-ons, which increase costs over time.

What are the future trends in payroll costs?

The future trends in payroll costs include quick access to earned wages, increased pay frequency and amounts, timely payments for gig and contract workers, and new solutions for more accurate payroll processing.

The future trends in payroll costs are listed below.

- Quick access to earned wages: Instant or on-demand pay allows eligible employees access to a portion of their earned wages before the regular payday, usually for a flat per-transaction fee. Offering pay-on-demand requires additional time and resources for setup and ongoing administration for employers. This option also adds complexity to payroll processing, especially for businesses handling payroll in-house.

- Increased pay frequency and amounts: Employees mostly expect competitive and fair compensation, which raises payroll costs. Meeting these demands while managing rising operational expenses affects cash flow and reduces profits for employers. Businesses need to monitor financial metrics closely and have strategies in place to meet payroll obligations. Some payroll providers offer services, such as payroll protection, which help manage the timing of fund collection from your bank account to reduce risk.

- Timely payments for gig and contract workers: Freelance and gig workers often have to wait weeks for compensation, unlike traditional employees who are paid weekly or biweekly. Delaying payments risks losing skilled contractors to competitors. Using modern payroll technology or outsourcing payroll allows businesses to pay contract-based, freelance, and gig workers quickly while making sure they receive the timely compensation they rely on and expect.

- New solutions for more accurate payroll processing: Businesses are increasingly implementing front-end payroll reviews to reduce errors and save time. Allowing employees to review their pay information before payroll is processed provides accuracy and gives them a chance to adjust withholdings or pre-tax contributions.

How do payroll costs impact business cash flow?

Payroll costs impact business cash flow through payroll timing effects, cash reserves strategy, direct deposit benefits, and supplier negotiation.

Payroll timing, like weekly, biweekly, or monthly, is important, as funds must be available to pay employee wages on schedule. Weekly payroll increases cash outflow frequency compared to biweekly or monthly, which affects liquidity and creates short-term shortages if reserves are low. Businesses must allocate funds accurately to avoid delays in meeting payroll obligations.

Insufficient cash reserves create short-term liquidity problems, which make it difficult to meet payroll responsibilities. Establishing separate reserves from revenue (mostly 3 to 6 months of expenses, which include two payrolls) provides coverage during slow periods. This strategy prevents liquidity problems related to payroll timing.

Using alternative payroll methods, such as direct deposit or electronic payments, simplifies processing and reduces administrative delays. Negotiating payment terms with suppliers also saves cash to meet payroll needs, which helps businesses maintain financial stability while paying employees on time.

What are the most cost-effective payroll pricing models?

The most cost-effective payroll pricing models are PEPM (Per-Employee-Per-Month), which costs $2 to $20 per payroll frequency, fixed rate, and percentage, which ranges from 1% to 3%.

What are the pricing ranges for payroll services?

The pricing ranges for payroll services are a base fee plus per-employee costs, which range from $2 to $20. Some providers charge a per-pay-cycle fee ranging from $20 to $60, plus an additional $1 to $3 per employee. Other pricing models include an annual fee, ranging from $1,000 to $6,000 per year, which sometimes also adds per-employee costs. A software-only option is available for around $40 per month or $500 per year.

How do you compare payroll vendors for the payroll process?

To compare payroll vendors for the payroll process, request a comprehensive pricing explanation, evaluate the quality of customer service, and ask about scalability if the company plans to expand.

Can I do payroll myself?

Yes, you can do payroll yourself if the size of your business is small. Handling payroll requires a considerable time commitment and a thorough understanding of payroll taxes and regulations. Many small business owners find that using professional payroll services is useful, as it saves time and reduces the risk of costly errors.

Why do payroll fees increase over time?

Payroll fees increase over time because businesses grow and require more services. They also require frequent payroll runs and support for larger or more complex workforces, all of which increase processing workload and costs. Adding features such as tax filing, compliance support, and advanced software tools makes fees more expensive as the needs expand.

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Ready to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations