2026 Payroll Compliance Checklist: 17 Must-Follow Rules to Avoid Fines and Penalties

Robbin Schuchmann

Co-founder, Employ Borderless

Payroll compliance means making sure all aspects of payroll, like wage calculations, tax withholding, reporting, and recordkeeping, comply with federal, state, and local laws. Payroll compliance is important to prevent fines and audits, avoid legal liabilities, maintain employee trust through correct pay, and protect the organization’s reputation and operational stability.

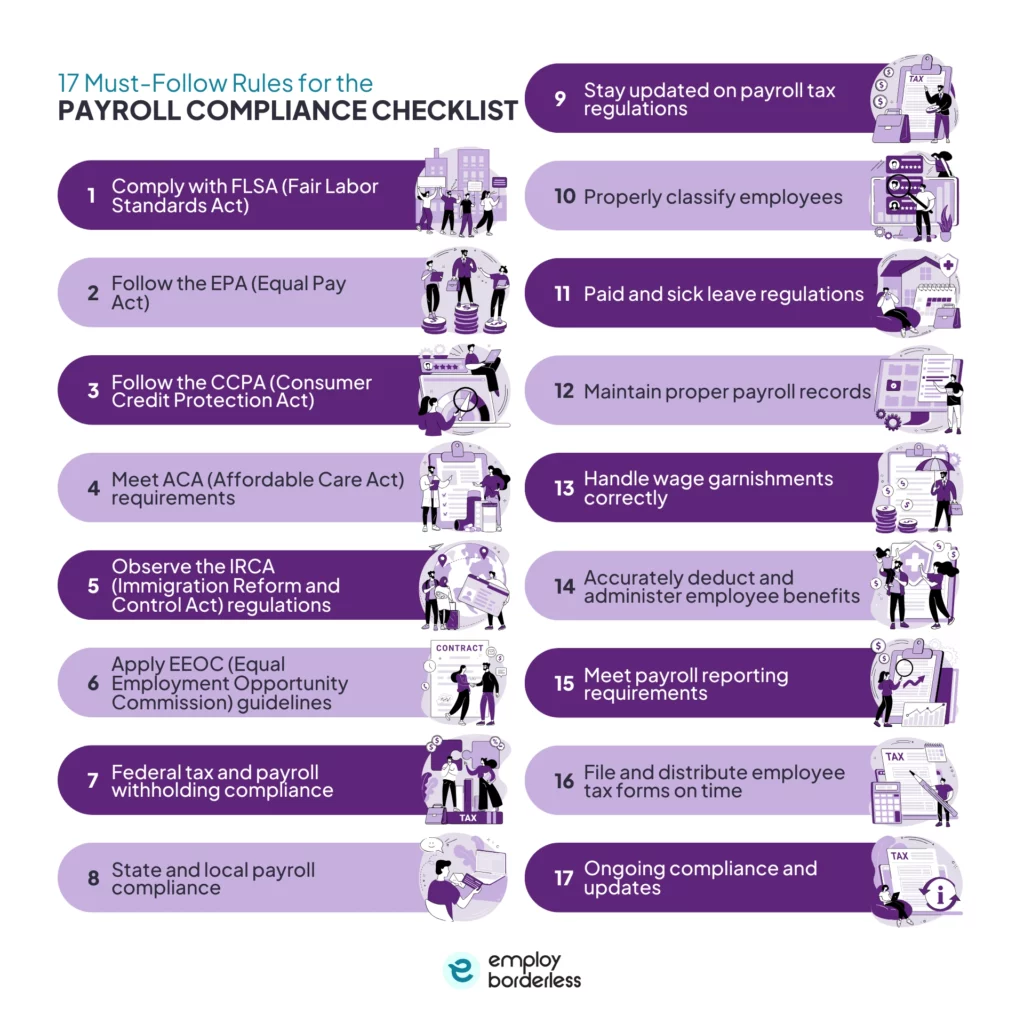

The payroll compliance checklist includes complying with the FLSA (Fair Labor Standards Act), following the EPA (Equal Pay Act), following the CCPA (Consumer Credit Protection Act), meeting ACA (Affordable Care Act) requirements, observing the IRCA (Immigration Reform and Control Act) regulations, and applying EEOC (Equal Employment Opportunity Commission) guidelines.

The 17 must-follow rules for the payroll compliance checklist are listed below.

- Comply with FLSA (Fair Labor Standards Act): Complying with FLSA means paying minimum wage, overtime for non‑exempt employees, recording hours accurately, and following federal wage and hour standards to avoid penalties.

- Follow the EPA (Equal Pay Act): Follow the EPA to make sure men and women receive equal pay for similar work to prevent discrimination claims and legal liability.

- Follow the CCPA (Consumer Credit Protection Act): Employers have to withhold wages for legally required garnishments and meet federal limits to avoid violations and employee disputes.

- Meet ACA (Affordable Care Act) requirements: Meeting ACA requirements means offering minimum essential coverage and accurately reporting health coverage to the IRS and employees.

- Observe the IRCA (Immigration Reform and Control Act) regulations: Verify the identity of new hires and work eligibility using Form I‑9 to comply with immigration law.

- Apply EEOC (Equal Employment Opportunity Commission) guidelines: Report workforce demographic data (EEO‑1) if eligible and track pay and hiring practices for equity and compliance.

- Federal tax and payroll withholding compliance: Employers must withhold, deposit, and report federal income, Social Security, Medicare, and unemployment taxes accurately and on time.

- State and local payroll compliance: Payroll teams need to follow local wage, hour, pay stub, and tax rules, as they sometimes differ from federal requirements.

- Stay updated on payroll tax regulations: Monitor federal, state, and local law changes to confirm accurate withholding and filings.

- Properly classify employees: Correctly classify employees, contractors, exempt, and non‑exempt to avoid tax and wage violations.

- Paid and sick leave regulations: Track and administer paid sick, family, and other leave according to relevant state and local laws.

- Maintain proper payroll records: Employers must keep detailed payroll, tax, and time records for audits and legal compliance.

- Handle wage garnishments correctly: Process garnishments lawfully by following limits and requirements for child support, taxes, and other orders.

- Accurately deduct and administer employee benefits: Apply correct pre- and post-tax benefit deductions and meet reporting obligations for benefit programs.

- Meet payroll reporting requirements: File payroll tax returns, such as W‑2, 941, and state or local reports, timely and accurately.

- File and distribute employee tax forms on time: Issue W‑2s and 1099s by deadlines to avoid IRS fines and reporting errors.

- Ongoing compliance and updates: Subscribe to agency updates and maintain a payroll calendar to follow changing laws and deadlines.

Comply with FLSA (Fair Labor Standards Act)

The U.S. Department of Labor implements the FLSA (Fair Labor Standards Act), a federal law, by establishing wage and hour regulations. This law provides requirements related to federal minimum wage, overtime eligibility and exemptions, work hours and breaks, child labor protections, and record-keeping for both exempt and non-exempt workers. The law applies to full-time and part-time workers in the private sector and federal, state, and local governments. Employers should carefully review exempt classifications to make sure workers meet both the salary and duty requirements under the FLSA.

Follow the EPA (Equal Pay Act)

Business owners must comply with the Equal Pay Act by making sure that men and women who perform similar work within the same establishment are paid the same wage. Recent state laws have amended equal pay obligations by requiring employers to conduct regular pay audits. These audits help confirm that pay practices are fair and consistent across all employee groups. The Lilly Ledbetter Fair Pay Act of 2009 extended the timeframe for filing equal pay claims. The 180-day filing period begins with the most recent paycheck, which increases employers’ ongoing responsibility to maintain pay equity under this law.

Follow the CCPA (Consumer Credit Protection Act)

The CCPA (Consumer Credit Protection Act) requires employers to garnish an employee’s wages when a debt is enforced through a court order or other legal process, which includes state tax collection or an IRS levy. The CCPA also limits the amount that can be withheld from an employee’s wages, which means garnishment does not create undue financial difficulty.

Meet ACA (Affordable Care Act) requirements

Employers with more than 50 full-time employees are required to offer minimum essential coverage or make an employer shared responsibility payment to the IRS. Employers also have ACA reporting obligations to both the IRS and employees. These requirements demand more accuracy, especially for electronic filings, as the standard for mandatory e-filing is lower. Employers have to complete and submit forms like 1095-C (employer-provided health insurance offer and coverage information) accurately and on time.

Observe the IRCA (Immigration Reform and Control Act) regulations

The IRCA (Immigration Reform and Control Act) requires employers to verify the identity and employment eligibility of all new hires. Employers need to confirm that each new hire is legally authorized to work in the United States. They complete this verification using Form I-9 (Employment Eligibility Verification).

The payroll teams have to make sure that employees complete and sign Section 1 no later than their first day of employment. They must also complete and sign Section 2 within three business days of the employee’s first day. The IRCA requires all employees, including remote workers, to complete Form I-9 with document verification. Employers enrolled in E-Verify and in good standing use a DHS-authorized alternative procedure to verify documents remotely through live video interaction, while employers not enrolled in E-Verify must arrange for in-person document inspection, even for remote hires.

Apply EEOC (Equal Employment Opportunity Commission) guidelines

The EEOC (Equal Employment Opportunity Commission) mandates private employers with 100 or more employees and federal contractors with 50 or more employees to submit workforce data through the EEO-1 Report (employee demographic and pay data reporting). This report includes employee counts by race and gender for a designated pay period. Compliance checks under the EEOC involve confirming whether the organization is required to file the EEO-1 Report.

These checks also include tracking employee earnings and hours worked to support accurate EEO-1 submissions. Organizations should maintain a single, integrated platform to access HR, payroll, and time data required for EEO-1 reporting. Employers must use an applicant tracking system to retain hiring and non-selection records in case of an EEOC audit.

Federal tax and payroll withholding compliance

Employers are required to withhold federal income tax from employee wages and remit it to the federal government. They must issue and file a Form W-2 for each employee. Employers must withhold Social Security and Medicare taxes from employee wages and also contribute the employer’s matching share under FICA (Federal Insurance Contributions Act). They have to make sure that tax withholding uses current IRS-published rates and complies with IRS rules.

Employers must pay federal unemployment tax to fund unemployment benefit programs. This FUTA tax (Federal Unemployment Tax Act) is paid entirely by the employer and is not deducted from employee wages. Most employers are also subject to state unemployment taxes.

State and local payroll compliance

The business owners must follow all state and local payroll laws, as many states implement wage and hour regulations that differ from federal rules. These state and local payroll laws include income tax withholding, unemployment insurance, and other mandated deductions. Employers must provide timely reporting and payments to the relevant state or local agencies.

For example, California and New York establish their own minimum wage rates and require detailed wage statements. States such as Massachusetts and Illinois regulate pay frequency, final pay deadlines, and direct deposit rules. Cities, like San Francisco and Seattle, enforce local minimum wages that exceed state and federal standards. Employers with operations in multiple states or cities must monitor and comply with payroll requirements in each jurisdiction.

Stay updated on payroll tax regulations

Employers must stay informed about changes to payroll tax laws to ensure ongoing compliance. They maintain compliance by monitoring updates to FICA, FUTA, and federal income tax withholding requirements. They also need to track state- and city-specific payroll tax rules, which sometimes differ from federal regulations. Business owners are also required to comply with quarterly and other required deposit schedules, as missed deadlines result in IRS penalties.

Properly classify employees

The employer must correctly classify workers as employees or independent contractors, and then employees are further classified as exempt or non-exempt for legal and financial compliance. Misclassification violates proper overtime and minimum wage regulations under the FLSA and also exposes employers to back pay liabilities, payroll tax penalties, and fines from the IRS and Department of Labor.

Employers also become liable for unpaid benefits, workers’ compensation, and unemployment insurance contributions, and they face audits or lawsuits from misclassified workers. Proper classification protects both the business and employees by ensuring compliance with accurate wages, taxes, and benefit obligations.

Paid and sick leave regulations

The business owner must comply with federal, state, and local paid leave laws, such as sick leave, PTO (Paid Time Off), and family leave. The employer must monitor regulations in every location where the company operates and accurately track employee leave accruals to maintain compliance.

Maintain proper payroll records

Employers must accurately track all hours worked, overtime, and time-off balances to comply with wage and hour laws. The FLSA requires employers to keep complete, accurate records of hours worked and payroll data and make them available for inspection. Accurate timekeeping helps ensure legal compliance, supports correct pay calculations, and protects the business in case of audits or disputes. Employers face back-pay claims, penalties, or liability without reliable records. Most business owners use digital timekeeping systems to reduce manual errors, centralize records, simplify reporting, and provide documented proof of hours worked.

Handle wage garnishments correctly

The business owner must withhold wages for mandated obligations, which include child support and alimony, student loans, tax debts, and consumer debts, like credit card judgments. The CCPA (Consumer Credit Protection Act) limits how much employers can withhold from an employee’s wages, while some states set more strict rules. Separate laws govern federal student loans and IRS garnishments.

Accurately deduct and administer employee benefits

Payroll teams must deduct and track employee benefits contributions accurately. These contributions involve pre-tax benefits, such as health insurance or 401(k), post-tax deductions like life insurance premiums or wage garnishments, and paid leave or state-mandated programs, such as family leave in New York or California.

Each benefit type has specific tax rules and reporting requirements. Misclassifying deductions or making errors result in compliance violations, creates tax liabilities, and negatively affects employees. Accurate administration means lawful payroll processing, proper employee benefits, and a smooth payroll operation.

Meet payroll reporting requirements

Employers have to file accurate payroll reports with the IRS, state tax authorities, and relevant local agencies. The important reports are Form W-2 (year-end wage and tax reporting for employees), Form 941 (quarterly federal payroll tax returns), state unemployment and income tax reports, and local wage and tax reports, if required. The IRS also mandates electronic filing of information returns like Forms W-2, 1099, 1099-MISC, and 1099-NEC when a business files 10 or more such returns in a calendar year. Timely and accurate reporting ensures compliance, avoids penalties, and maintains proper documentation for audits.

File and distribute employee tax forms on time

The employer must prepare, file, and distribute W-2 and 1099 forms to employees by January 31 each year. Late filing results in IRS fines of up to $680 for intentional disregard. Companies automate form generation by using payroll software, which helps ensure accuracy, save time, and prevent costly penalties.

Ongoing compliance and updates

Employers must stay current with state and federal payroll laws to maintain compliance. They must subscribe to IRS and state tax agency newsletters for regulatory updates. Employers must review Department of Labor announcements and guidance regularly. The payroll teams also need to implement a payroll compliance calendar to track important filing deadlines, tax deposits, and reporting requirements. Actively monitoring changes helps prevent missed deadlines, penalties, and compliance risks, while making sure the payroll operations remain accurate and up-to-date.

What is payroll compliance?

Payroll compliance means following all federal, state, and local laws and regulations that govern payroll processing, taxes, employee wages, and recordkeeping. Employers are responsible for correctly calculating wages according to relevant laws, like FLSA minimum wage and overtime rules, and timely tax withholdings for federal, state, and local income taxes. They also need to maintain proper records to meet compliance standards set by authorities like the DOL and the IRS. Businesses have to stay updated on changes in payroll legislation to ensure ongoing compliance.

Why is payroll compliance important?

Payroll compliance is important to maintain legal and financial integrity by consistently following all relevant payroll laws, tax regulations, and reporting requirements. It helps employers pay employees accurately and on time, which builds trust, increases satisfaction, and supports a positive workplace culture. Payroll compliance also protects a company’s reputation by reducing the risk of penalties, audits, legal disputes, and public credibility issues that result from noncompliant payroll practices.

What are the penalties for payroll non-compliance?

The penalties for payroll non-compliance are financial penalties, legal liability, audits and investigations, reputational damage, and loss of business licenses.

The penalties for payroll non-compliance are discussed below.

- Financial penalties: Financial penalties include fines, late-payment charges, and interest for failing to withhold, deposit, or report payroll taxes accurately.

- Legal liability: Payroll non-compliance leads to legal action, which includes lawsuits, liens, or personal liability for unpaid payroll taxes, especially for responsible parties.

- Audits and investigations: Payroll errors or missed filings result in IRS or state tax audits, which mean legal inspection, back taxes, and penalties.

- Reputational damage: Payroll non-compliance affects a company’s reputation among employees, regulators, investors, and business partners, while reducing trust and credibility.

- Loss of business licenses: Authorities sometimes suspend or revoke business licenses in serious or repeated cases, which limits or stops the employer’s ability to operate.

What are the latest payroll compliance changes employers need to know?

The latest payroll compliance changes employers need to know include wage threshold adjustments, remote work tax implications, health coverage mandates, and payroll technology integration.

Employers have to monitor updates to pay thresholds that affect payroll compliance. For example, changes to minimum wages at the federal, state, and local levels affect payroll calculations and withholdings. Staying current means providing accurate wage reporting, overtime eligibility, and compliance with wage-and-hour laws.

Remote and hybrid work create complex tax obligations for employers. Remote work across multiple states results in multi-jurisdictional tax withholding, backdated tax liabilities, fines, and additional reporting requirements without proper management. Employers must determine employees’ work locations and adjust payroll accordingly to avoid penalties.

Updated requirements for health coverage and reporting impact payroll compliance. Employers must accurately report ACA (Affordable Care Act) information, such as 1095-C forms, track employee participation in plans, and follow updated contribution limits and mandates to avoid compliance issues and penalties.

Modern payroll compliance increasingly depends on technology. Employers are utilizing automated payroll systems, e-filing mandates (lower thresholds for e-filing), and integration with tax reporting platforms. They also use AI tools to reduce errors, update wage bases, and stay in compliance with changing laws. These technologies help ensure real-time compliance, reduce manual risk, and meet expanding regulatory requirements.

Which payroll compliance violation occurs most commonly?

The payroll compliance violation that occurs most commonly is employee misclassification, which causes back taxes and legal penalties.

How frequently should employers audit their payroll system for compliance?

Employers should audit their payroll system for compliance at least once a year, with more frequent reviews, such as quarterly or semi-annual audits. The role of audits in payroll is to detect errors early and maintain accuracy.

What happens if a payroll tax payment is late?

If a payroll tax payment is late, the IRS charges 2% to 15% penalties, which depend on the number of days the payment is overdue.

What happens if employers do not follow payroll compliance rules?

If employers do not follow payroll compliance rules, they face penalties for late or incorrect filings, legal actions including lawsuits, back pay and interest obligations, audits and investigations, and reputational damage. These payroll challenges and solutions mostly require correcting errors, updating processes, and using compliant payroll systems to reduce risk and maintain employee trust.

How can I improve payroll accuracy and compliance?

You can improve payroll accuracy and compliance by regularly auditing payroll data, staying updated on tax law changes, using reliable payroll software, maintaining accurate employee records, and training payroll staff. Improve payroll accuracy by automating calculations and filings to reduce errors and ensure timely, compliant payroll processing.

Why is data security important in a payroll compliance checklist?

Data security is important in a payroll compliance checklist because payroll systems store sensitive employee information such as Social Security numbers, bank details, and wages. Payroll data security helps prevent breaches, fraud, and identity theft while ensuring compliance with data protection laws, like GDPR (General Data Protection Regulation), and maintaining employee trust.

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Ready to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations