7 Common Payroll Audit Mistakes Employers Must Know and How to Avoid Them

Robbin Schuchmann

Co-founder, Employ Borderless

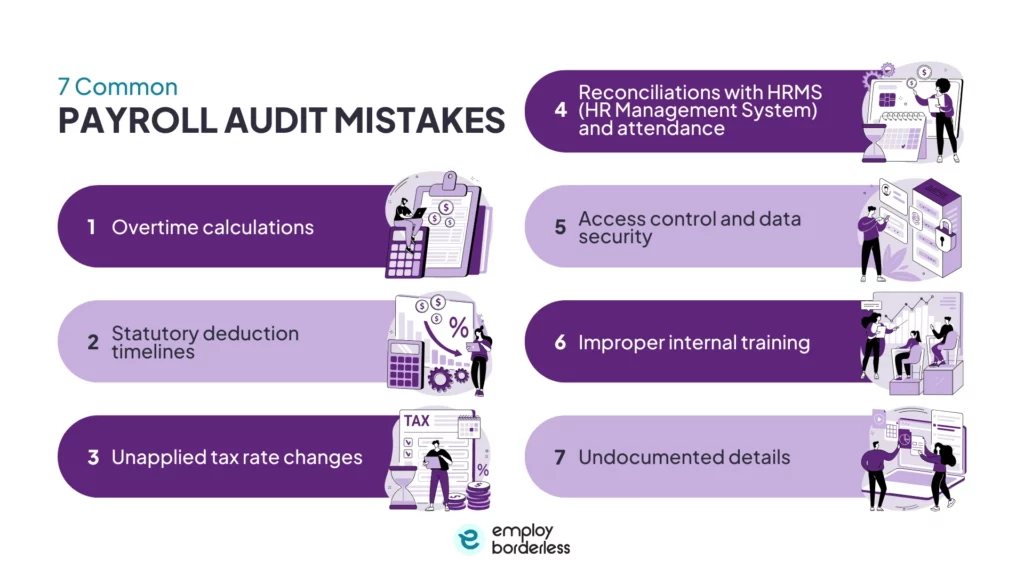

A payroll audit is a systematic review of a company’s payroll records, processes, and systems to check that employees are paid correctly, deductions and taxes are accurate, and payroll practices comply with relevant laws, regulations, and internal policies. Common payroll audit mistakes involve overtime calculations, statutory deduction timelines, unapplied tax rate changes, reconciliations with HRMS (HR Management System) and attendance, access control and data security, improper internal training, and undocumented details.

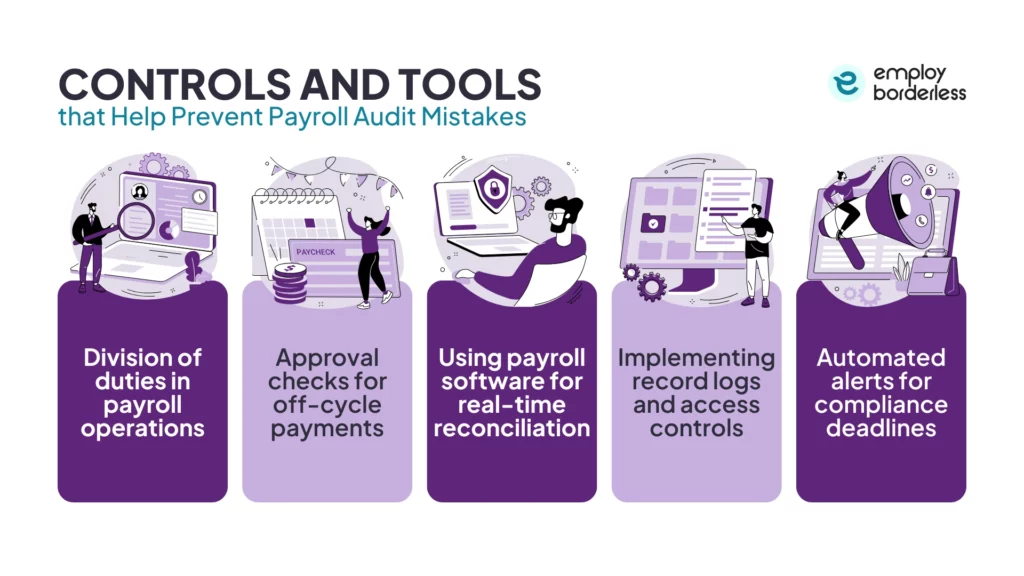

The controls and tools that help prevent payroll audit mistakes include division of duties in payroll operations, approval checks for off-cycle payments, using payroll software for real-time reconciliation, implementing record logs and access controls, and automated alerts for compliance deadlines.

7 common payroll audit mistakes employers must know are listed below.

- Overtime calculations: Incorrectly computing overtime pay due to wrong hours or rates leads to under‑ or overpayment and violates wage laws, which causes compliance and audit issues.

- Statutory deduction timelines: Missing deadlines for tax and statutory deposits result in penalties, interest, and audit alerts for noncompliance with required remittance schedules.

- Unapplied tax rate changes: Failing to update or apply new tax rates causes incorrect withholdings and filings, which leads to errors, penalties, and audit risks.

- Reconciliations with HRMS (HR Management System) and attendance: Mismatches between HR, attendance, and payroll data cause inaccurate pay and compliance gaps.

- Access control and data security: Weak access permissions and a lack of secure controls allow unauthorized changes, which increases error and fraud risk while affecting audit records.

- Improper internal training: Poor training and expertise in payroll procedures prevent the detection of errors and compliance issues, which reduces audit effectiveness.

- Undocumented details: Missing or poorly organized payroll records make it difficult to verify transactions or support audit findings, which increases penalties and delays.

- Overtime calculations

Overtime calculations are a common payroll audit mistake, as errors occur when hours worked on weekend shifts, night work, or public holidays are misclassified or not properly included in the pay rules and formulas regulating premium rates. For example, some systems or manual processes apply a flat overtime rate without differentiating between standard overtime, weekend differentials, and holiday premiums, which leads to underpayment or overpayment.

Accurate tracking and classification of hours worked are important because overtime rules usually require specific multipliers (1.5x or higher). These multipliers depend on the labor law or company policy, so neglecting these details affects the payroll calculation and results in noncompliance. Even a single incorrect overtime calculation causes compliance violations, wage claims, and legal exposure during an audit. Auditing teams and payroll professionals must examine how weekend and public holiday hours are calculated and paid.

- Statutory deduction timelines

Missing statutory deduction timelines for federally and state-mandated payroll taxes are a frequent payroll audit mistake. Employers have to deposit federal income tax withholding, Social Security, and Medicare (FICA) taxes according to IRS-assigned deposit schedules, while state income tax and unemployment tax deadlines differ by jurisdiction.

Failing to remit these deductions within the required timeframes quickly leads to IRS penalties, interest charges, and state enforcement actions. These issues are commonly detected during payroll or tax audits. Even short delays result in increasing fines and compliance risks, which make accurate tax deposits an important area of focus for payroll teams.

- Unapplied tax rate changes

Companies fail to apply updated tax rates and codes in payroll systems after changes in federal, state, or local tax laws. Many companies continue using outdated tax tables or incorrect tax codes, such as failing to update withholding tables after IRS revisions or state rate adjustments. Failure to apply updated tax rates causes under- or over-withholding of federally and state-mandated payroll taxes, such as income tax, Social Security, Medicare, and relevant state taxes.

Employers and employees both share responsibility in cases of incorrect tax obligations. Both parties face penalties, interest charges, and compliance issues that are identified during payroll or IRS audits when new tax rates are not applied. Keeping payroll systems current with the latest tax rate changes and verifying that updates are properly applied helps prevent costly withholding errors and audit issues.

- Reconciliations with HRMs and attendance

A frequent payroll audit issue occurs when HR, timekeeping, and payroll systems are disconnected. This lack of integration between HR, timekeeping, and payroll systems leads to inaccurate payouts and compliance gaps because attendance, leave, shift records, and payroll data do not match. Errors such as unapproved hours, incorrect overtime, or missed leave adjustments go undetected when attendance data is not integrated with the HRMS (HR Management System) and payroll platform.

Auditors usually look for consistent audit records that match attendance and leave data with final payroll results. Reconciliation of time worked, approved absences, and shift schedules with actual payments supports accuracy and compliance. Making sure these systems are coordinated and regularly reconciled lowers mismatches, reduces manual corrections, and improves internal controls. Strong internal controls help avoid penalties and negative audit results.

- Access controls and data security

Poor access controls and data security around core payroll records, such as employee personal details, salary structures, allowances, deductions, and tax information, directly affect the accuracy of employee compensation and payroll calculations. Payroll and HR systems must restrict edit permissions so that only authorized personnel make changes to sensitive payroll master files. Broad or weakly managed access rights increase the risk of unnoticed or unauthorized edits that lead to incorrect pay, fraudulent activity, or compliance gaps.

Auditors frequently notice situations in which access privileges are not strictly controlled, changes to pay rates or withholding elections are not properly authorized, or audit logs do not show who changed what and when. Strong role-based access controls, regular review of user permissions, and secure authentication measures help confirm that only designated staff are allowed to modify payroll masters. These security methods reduce the chance of data breaches, payroll errors, and audit findings.

- Improper internal training

Lack of internal training and poorly executed internal audits result in ongoing payroll processing errors. Errors go undetected when audits are performed by staff who lack training or a clear audit checklist, and corrective actions are not implemented effectively. Organizations have to conduct regular internal audits of payroll procedures to verify that data entry, calculations, statutory withholdings, and system configurations are functioning correctly.

Staff performing internal audits need to have a comprehensive audit checklist and a clear understanding of how the payroll system works. This understanding includes tax rules, system controls, and reconciliation procedures to accurately identify risks and recommend improvements that strengthen payroll accuracy and compliance.

- Undocumented details

Organizations sometimes fail to maintain complete documentation of payroll records. This failure creates challenges because a thorough payroll audit requires detailed questions about payroll processes, employee compensation, and explanations for those payments. Auditors are unable to verify compliance, identify errors, or assess payroll calculations without properly documented records, such as timesheets, pay registers, tax forms, and explanations for adjustments.

Gathering all relevant payroll records and supporting documentation upfront helps auditors trace transactions, confirm working hours and payment distribution, and resolve gaps accurately. Incomplete or missing information slows the audit process and increases the risk of penalties, questions from regulators, and costly corrections. These risks make thorough documentation an important component of effective payroll audit readiness.

What is a payroll audit?

A payroll audit is a comprehensive review of a business’s payroll processes, records, and data. The purpose of payroll audits is to identify errors while making sure that all payroll processes are accurate, compliant, and up to date. Conducting a payroll audit also provides an opportunity to confirm that former employees are no longer on the payroll and that all payroll records are complete and well-organized. Additional areas to review during a payroll audit include employee pay rates, payroll tax withholdings, payroll costs, overtime, hours worked, off-cycle payments, tax forms, and bonuses or commissions.

What are the two types of payroll audits?

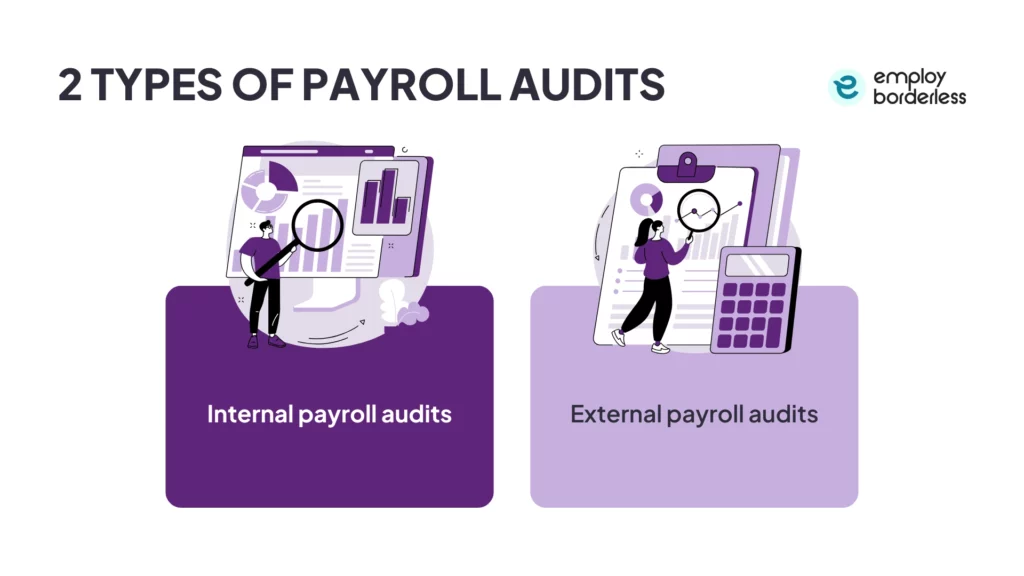

The two types of payroll audits are internal payroll audits and external payroll audits. Payroll audits are important for ensuring payroll compliance and avoiding issues with tax authorities and other statutory entities.

The types of payroll audits are listed below.

- Internal payroll audits: Organizations usually form an internal team of payroll and HR experts to conduct internal payroll audits. The purpose is to evaluate the performance of current payroll processes and identify opportunities for improvement to ensure compliance.

- External payroll audits: An external payroll audit is a review of a company’s payroll processes and records conducted by an independent third party, such as a CPA (Certified Public Accountant) or an external audit firm. These auditors objectively examine payroll data to assess accuracy and compliance with wage and tax laws. They also assess the effectiveness of internal controls, which helps identify issues that internal teams sometimes miss.

What controls and tools help prevent payroll audit mistakes?

The controls and tools that help prevent payroll audit mistakes are the division of duties in payroll operations, approval checks for off-cycle payments, using payroll software for real-time reconciliation, implementing record logs and access controls, and automated alerts for compliance deadlines.

Division of duties in payroll operations

Division of duties in payroll operations reduces the risk of errors and fraud by making sure that no single person has control over all important steps of the payroll process. Organizations create checks and balances by dividing tasks among different individuals or teams. Tasks such as employee data setup, payroll calculation, approval of payments, and reconciliation are separated to make mistakes and unauthorized actions easy to detect and difficult to execute. For example, separating the roles of entering payroll data, approving payroll runs, and distributing funds prevents issues such as incorrect pay rates, nonexistent employees, or fraudulent adjustments from going unnoticed.

Approval checks for off-cycle payments

Approval checks for off-cycle payments are an important control that requires managers or authorized personnel to review and approve every off-cycle payroll transaction before processing. These transactions include corrections, bonuses, or one‑time payments outside the regular payroll cycle. This review routes the request through a defined approval workflow. A manager, HR, or finance lead confirms the need and accuracy of the payment, which reduces the risk of unauthorized or false payouts.

Using payroll software for real-time reconciliation

Using payroll software for real‑time reconciliation allows organizations to automatically compare payroll data, like employee details, hours worked, deductions, and payments, across integrated HR, timekeeping, and accounting platforms as transactions occur. Real-time reconciliation regularly validates and updates payroll information, unlike traditional month-end checks. This reconciliation allows teams to identify and correct errors instantly to keep records accurate throughout the pay period and maintain compliance.

Implementing record logs and access controls

Implementing record logs and access controls helps prevent payroll audit mistakes by making sure that systems track and protect all actions on payroll data and that only authorized users access or modify sensitive information. Payroll systems with audit logs track the user, the change made, and the time of the change. These audit logs create a clear and secure record that supports error detection and audit verification.

Strong access controls, such as role‑based permissions and multi‑factor authentication, limit payroll data editing to appropriate personnel and help stop unauthorized access or modifications. Audit logs and access controls improve accountability, data security, and compliance, which makes it easy to identify issues and show reliable internal controls during payroll audits.

Automated alerts for compliance deadlines

Automated alerts for compliance deadlines help payroll teams stay on track by having payroll software send reminders for important filing and payment due dates, such as tax deposits, returns, and statutory contributions. Modern systems include built‑in calendars and notification features that alert users in advance of upcoming deadlines. Such features reduce the risk of missed or late submissions that result in penalties, interest, or audit issues. Automated alerts allow timely action, improve accuracy, and support overall payroll compliance by actively notifying HR and finance staff of compliance obligations.

How to transform payroll audits from a challenge to a business opportunity?

To transform payroll audits from a challenge to a business opportunity, consider engaging expert payroll support, implementing proper payroll management, and simplifying audits.

Engaging expert payroll support, whether through external consultants or specialized payroll service providers, helps make sure that payroll processes remain accurate, compliant, and up to date with changing tax and labor laws. Experts offer specialized knowledge that reduces the burden on internal teams, lowers compliance risks, and provides reliable documentation and best practices. These resources simplify audits and improve overall payroll performance.

Strong payroll management practices, like standardized workflows, up‑to‑date employee data, and integrated systems, provide accuracy and consistency in payroll calculations, deductions, and reporting. Well‑managed payroll processes reduce errors, protect sensitive information, and improve compliance with legal requirements, which builds confidence in audit results and operational performance.

Simplifying the audit process by using tools such as modern payroll software, automated reporting, and organized records helps businesses conduct audits more smoothly and detect issues early. Automation provides clear, accurate data and audit trails, while systematic documentation and regular reviews allow companies to identify risks, implement improvements, and maintain audit readiness with less effort.

How often should I conduct a payroll audit?

You should conduct a payroll audit at least once a year to ensure accuracy and compliance with tax and wage laws. Many companies, however, choose to audit semiannually or quarterly, especially if payroll is complex, frequently changing, or if there are higher risks of errors or noncompliance.

What options or services can help with payroll audits?

The options or services that can help with payroll audits are professional payroll audit firms offering expert review and compliance support, and outsourced payroll services that manage processing and statutory filings. Payroll software with built‑in compliance, reporting, and audit trail features also helps simplify review and error detection.

What happens if employees are misclassified in payroll audits?

If employees are misclassified in payroll audits, the employer faces serious financial and legal issues. These issues include back taxes, unpaid payroll tax liabilities, interest, and penalties from the IRS and state authorities, as well as wage claims, back pay for unpaid overtime or benefits, and potential lawsuits.

How can businesses prevent payroll fraud?

Businesses can prevent payroll fraud by dividing payroll duties, implementing strong access controls, and using automated payroll systems that track changes and generate audit records. Regular internal and external audits, timely reconciliation of payroll records, and thorough employee verification processes also reduce the risk of nonexistent employees, unauthorized payments, and other fraudulent activities.

How can payroll software improve the audit process?

Payroll software can improve the audit process through payroll integration, which centralizes and standardizes payroll data across HR, timekeeping, and accounting systems. It automates calculations and creates complete audit records and change logs that are easy to access. Payroll software integrates compliance checks and real‑time reporting, which reduces errors and makes audit preparation fast, simple, and reliable.

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Ready to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations