Payroll Tax Withholding: Definition, Working, Types, Steps, and How to Calculate

Robbin Schuchmann

Co-founder, Employ Borderless

Payroll tax withholding is the portion of an employee’s gross wages that an employer deducts and remits directly to tax agencies, such as the IRS, on the employee’s behalf. This process includes mandatory taxes like federal and state income tax, Social Security, and Medicare, and ensures the employee’s compliance with tax regulations throughout the year.

The types of payroll tax withholding are U.S. resident withholding tax and nonresident withholding tax. The steps for payroll tax withholding involve making sure new employees complete a W-4 on their first day of work, determining an employee’s gross pay, calculating federal withholding based on gross pay, calculating FICA contributions, calculating state and local taxes, and timely depositing federal, state, and local payroll taxes.

The information required to calculate payroll tax withholding includes the employee’s filing status, income sources, additional expected income, the end date of the most recent pay period, wages for the current pay period and year-to-date totals, and federal income tax withheld for the current pay period and year-to-date.

What is payroll tax withholding?

Payroll tax withholding is the process by which employers deduct federal, state, and local taxes from employees’ gross wages and submit them to the relevant government authorities. Payroll tax withholding is mandatory, and the amount employers withhold depends on the employee’s income. Under-withholding causes IRS penalties and audits, while over-withholding affects employees and makes tax returns more complex. Employers need to comply with the IRS-mandated obligations and avoid costly penalties.

What is the purpose of payroll tax withholding?

The purpose of payroll tax withholding is to collect income tax from employees’ wages throughout the year, rather than collecting it all at once at the end of the year. This system allows taxpayers to meet their tax obligations while making sure that there are no overpayments or underpayments at the end of the fiscal year. Withholding tax also helps the government manage its revenue flow by allocating the tax liability across each pay period. This management allows for more consistent funding of public services and programs.

How does payroll tax withholding work?

Payroll tax withholding works by maintaining accurate withholding rates to keep the business compliant and the payroll team confident. Federal income tax withholding differs based on the employee’s marital status, number of dependents, and the information provided on Form W-4. The federal income taxes withheld from employees’ salaries are paid directly to the federal government to fund public services, infrastructure, defense, and other programs.

FICA (Federal Insurance Contributions Act) taxes, which include Social Security (6.2%) and Medicare taxes (1.45%), are withheld at fixed rates from the employee’s wages. FICA taxes are shared by both the employee and the employer. The employer must match the amount withheld from the employee’s paycheck for Social Security and Medicare and pay an equal contribution on the employee’s behalf. This equal contribution means that the total rate for Social Security is 12.4%, and the Medicare tax is 2.9%. Employers also need to withhold state and local taxes, but the actual requirements differ by location. Business owners must check their state or local tax agency to apply the correct rates.

What are the main types of payroll tax withholding?

The main types of payroll tax withholding include the U.S. resident and nonresident withholding tax. The IRS uses these taxes to make sure that the right amount is withheld in different situations.

U.S. resident withholding tax

Federal income tax withholding involves U.S. residents’ wages, which every U.S. employer must deduct from employees’ paychecks and remit to the IRS. Employees reconcile any balance or overpayment when filing their annual Form 1040 tax return, usually due April 15. Employees receive refunds for excess withholding or pay the difference if too little is withheld, while possibly facing underpayment penalties.

Withholding amounts are set through Form W-4 to approximate actual tax liability. Employees are able to avoid underpayment penalties by adjusting their W‑4 so that withholding, along with any estimated tax payments, covers at least 90% of the current year’s tax. The total must equal 100% to 110% of the prior year’s tax under safe harbor rules.

Nonresident withholding tax

Withholding tax on nonresident aliens permits proper taxation of income earned from U.S. sources. Nonresident individuals are those who are not U.S. citizens or nationals and do not meet the green card test or essential presence test. These individuals who work in a trade or business in the U.S. during the year must file Form 1040NR only if they have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, and more. The IRS provides standard deduction and exemption tables to determine tax obligations and allowable deductions. Tax treaties between the U.S. and the individual’s home country may also affect withholding amounts.

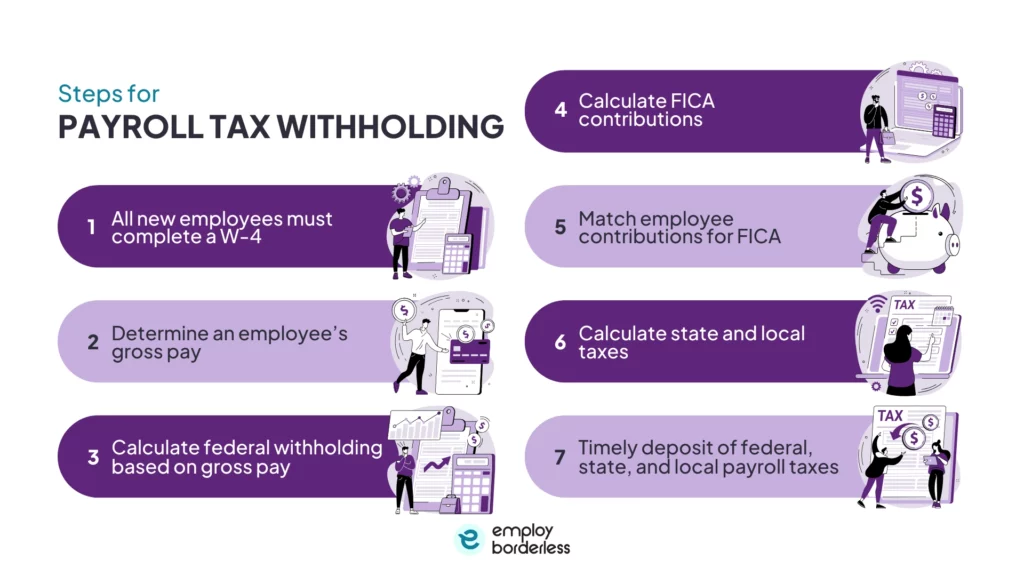

What are the steps for payroll tax withholding?

The steps for payroll tax withholding involve all new employees completing a W-4 on their first day of work, determining an employee’s gross pay, calculating federal withholding based on gross pay, calculating FICA contributions, calculating state and local taxes, and timely depositing federal, state, and local payroll taxes.

All new employees must complete a W-4

All new employees are required to fill out Form W-4 on their first day of work. Employers must receive a completed W-4 before processing payroll to guarantee that the correct federal income tax is withheld. The form includes instructions and guidance for employees with multiple jobs or a working spouse. Employees should also update their W-4 whenever their financial or life situation changes, such as a second job, marriage, having a child, or divorce.

Determine an employee’s gross pay

Calculate the employee’s gross wages before withholding any taxes. The calculation for hourly employees involves multiplying the number of hours worked by the hourly rate. For example, 90 hours at $12.00 per hour equals $1,080.00. Overtime is usually paid at time and a half, so six hours of overtime at $12.00 per hour and a half times the rate results in $108.00. The total gross pay for 90 hours plus six overtime hours comes to $1,188.00.

Salaried employees receive a fixed amount each pay period. For example, an employee earning $50,000 annually with a twice-monthly pay schedule would have gross wages of $50,000 divided by 24 pay periods, which equals $2,083.33 per pay period.

Calculate federal withholding based on gross pay

Determine federal income tax withholding after calculating an employee’s gross pay. This step requires the use of the W-4 form, through which the employee shows their withholding choices and specifies any extra amounts to deduct. Refer to the IRS tax tables for 2026, or use reliable payroll software or an online payroll calculator to perform the calculations for determining the withholding accurately.

Calculate FICA contributions

FICA combines Social Security and Medicare taxes, with contributions required from both the employer and the employee. The total FICA withholding is 7.65 percent, which includes 6.2 percent for Social Security and 1.45 percent for Medicare. Employers must withhold Social Security taxes until the employee earns at least $184,500 in 2026. Medicare taxes have no income limit.

For example, to calculate FICA for an employee with gross pay of $875.00, calculate Social Security tax by taking $875.00 multiplied by 6.2 percent, which equals $54.25. Take $875.00 multiplied by 1.45 percent, which equals $12.69 for Medicare tax. The total FICA to withhold for this pay period is $54.25, added to $12.69, which equals $66.94. Employees who earn more than $200,000 annually are also liable to a Medicare surtax of 0.9 percent. This surtax is withheld in addition to the regular FICA taxes.

Match employee contributions for FICA

Employers are also responsible for matching the amount of FICA taxes withheld and deducting FICA taxes from employee wages. For example, if $76.94 is deducted from an employee, the employer must match that amount and deposit the funds on time.

Calculate state and local taxes

Employers must also calculate state and local payroll taxes depending on their business location. They must submit these taxes to the relevant state or local agency on time and ensure compliance with tax laws and regulations.

Timely deposit of federal, state, and local payroll taxes

Tax deposit schedules differ by state, with many states requiring quarterly deposits. It is important to check with local agencies to determine the correct schedule for your business. There are currently two deposit schedules for federal taxes, which include monthly and semiweekly. Business owners are notified at the start of the year about the schedule they must follow. It is the business’s responsibility to calculate taxes accurately and submit them by the due dates, whether payroll is processed in-house or through a payroll service provider. Failure to make timely deposits results in penalties ranging from 2% to 15%, which depends on how late the deposit is made.

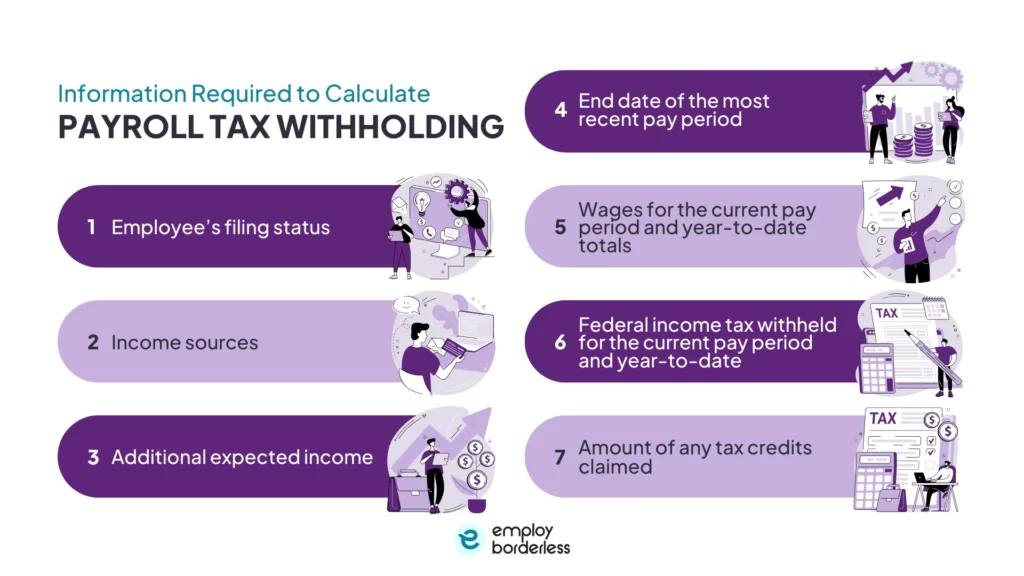

How is payroll tax withholding calculated?

Payroll tax withholding is calculated using information like the employee’s filing status, income sources, additional expected income, the end date of the most recent pay period, wages for the current pay period and year-to-date totals, and federal income tax withheld for the current pay period and year-to-date.

The information required to calculate payroll tax withholding is listed below.

- Employee’s filing status: Filing status, such as single or married, affects how withholding is calculated. W‑4 adjustments, which include information about dependents, other income, deductions, or extra withholding amounts elected by the employee, are used to adjust taxable wages and credits.

- Income sources: Sources of income, which involve base salary, hourly earnings, commissions, performance bonuses, and tips reported to employers, are considered taxable income. These components are included in withholding calculations for income tax, Social Security, and Medicare.

- Additional expected income: Additional expected income means income that the employee expects during the year not paid by the employer as wages, such as interest, dividends, retirement distributions, or other taxable amounts. Employees report this on Form W-4 to have additional federal income tax withheld. Form W‑4 allows employees to report extra expected income other than standard wages. This report helps determine the correct amount of tax to withhold from each paycheck.

- End date of the most recent pay period: Employers use the pay period end date to determine the exact payroll period the wages cover. This payroll period makes sure the correct IRS withholding tables from Publication 15-T are applied, even if the employee did not work the entire period.

- Wages for the current pay period and year-to-date totals: Employers use current and year-to-date wages to calculate accurate withholding for each paycheck. Business owners use this calculation to confirm proper tracking and reporting of taxable earnings, in compliance with IRS payroll rules.

- Federal income tax withheld for the current pay period and year-to-date: Federal income tax withheld for the current pay period and year to date shows the amount of tax already deducted. This information helps employers maintain accurate withholding and correct year-end reporting under IRS guidelines.

- Amount of any tax credits claimed: Tax credits entered on Form W-4, such as credits for dependents, reduce the amount of federal income tax withheld from each paycheck.

What are the tools and resources to simplify payroll tax withholding?

The tools and resources to simplify payroll tax withholding are the IRS tax withholding estimator, payroll software solutions, and IRS Publication 15 (Employer’s Tax Guide).

The IRS Tax Withholding Estimator is a free, easy-to-use tool that helps quickly verify withholding accuracy. This calculator is useful for handling challenging W-4 situations or double-checking the figures.

Payroll software solutions simplify payroll management for businesses. These solutions automate payroll calculations, manage employee deductions, file taxes, and support compliance, which helps save time and reduce errors each pay period. Many businesses find that using payroll software lowers overall administrative costs and provides an all-in-one system for payroll, scheduling, and team management.

IRS Publication 15 is an important reference for employers, as it provides clear guidance on federal withholding tables, payroll tax rules, and compliance requirements.

Why is it important to withhold the accurate amount of payroll tax?

It is important to withhold the accurate amount of payroll tax because it allows businesses to avoid penalties, fines, and IRS audits while maintaining accurate financial records. It also makes sure that employees pay their taxes accurately throughout the year and prevents unexpected bills or missed refunds. Proper withholding protects the business and builds employee trust and confidence at tax time.

What factors affect your payroll withholding tax rate?

The factors that affect your payroll withholding tax rate include changes in your income level, marital status, or the number of allowances you claim on your W-4. These factors have a direct impact on the amount of tax withheld from your paycheck, as do changes in tax laws or tax brackets.

What happens when an employer withholds the wrong amount of tax?

When an employer withholds the wrong amount of tax, it affects the employee’s annual income tax return. The employee owes additional tax and faces underpayment penalties if too little tax is withheld. The employee gives the government an interest-free loan and receives the excess amount back as a refund if too much tax is withheld.

How do I submit a change in my withholding tax amount?

You can submit a change in your withholding tax amount by completing a new W-4 and submitting it to your employer. This form allows you to adjust your withholding options, such as your filing status, number of allowances, and any additional amount you want withheld. Employers adjust the federal income tax deducted from your future paychecks to better match your actual tax liability once they receive the updated W-4.

Who qualifies for exemption from payroll tax withholding?

Individuals who qualify for exemption from payroll tax withholding include holders of J or Q visas (non-immigrant visas) and those with no expected tax liability. Nonresident aliens file Form 8233, while others show it on their W-4 to claim exemption. Eligibility must be reviewed and updated annually.

How often should payroll taxes be remitted to the IRS?

Payroll taxes should be remitted to the IRS on either a monthly or semi‑weekly schedule, which depends on the total tax liability during a lookback period. Monthly depositors pay by the 15th of the following month, while larger employers under a semi‑weekly schedule must deposit within a few business days after each payday.

What percentage of a paycheck is usually withheld?

The percentage of a paycheck usually withheld from a standard full-time employee’s federal income tax ranges from 10% to 22%. This percentage is based on IRS tables (Publication 15-T), filing status, Form W-4 inputs, and pay period. Social Security is 6.2%, and Medicare is 1.45%, which your employer matches. State income tax differs by state, from 0% to over 10%.

Can employers do payroll withholding manually?

Yes, employers can do payroll withholding manually, but it is complex. You need to calculate federal income tax, Social Security, Medicare, and any state or local taxes. It is possible, but time-consuming and subject to errors, so most businesses use calculators for payroll accuracy.

What are common payroll tax withholding mistakes?

The common payroll tax withholding mistakes are deducting the wrong amount of tax, using outdated tax rates or tables, missing payroll tax deposit deadlines, filing incorrect tax forms or reporting errors, and failing to update employee or payroll data.

How do I know if my payroll tax withholding is correct?

To know if your payroll tax withholding is correct, compare amounts on pay stubs and W‑2 forms to the expected tax liability. The IRS Tax Withholding Estimator, or an IRS-provided tool, Paycheck Checkup, also helps confirm if your withholding amount is accurate. Review your withholding annually or after major life or income changes, and update it using Form W‑4 when necessary to avoid payroll fraud.

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Ready to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations