17 smart tips to build an effective global payroll strategy

Robbin Schuchmann

Co-founder, Employ Borderless

A global payroll strategy is a structured plan for managing payroll operations across multiple countries and regions. The main goal is to maintain compliant and effective payment processes for a global workforce. A global payroll strategy is important for businesses because it simplifies regulatory compliance, handles currency and tax complexities, and organizes cross-border payroll functions.

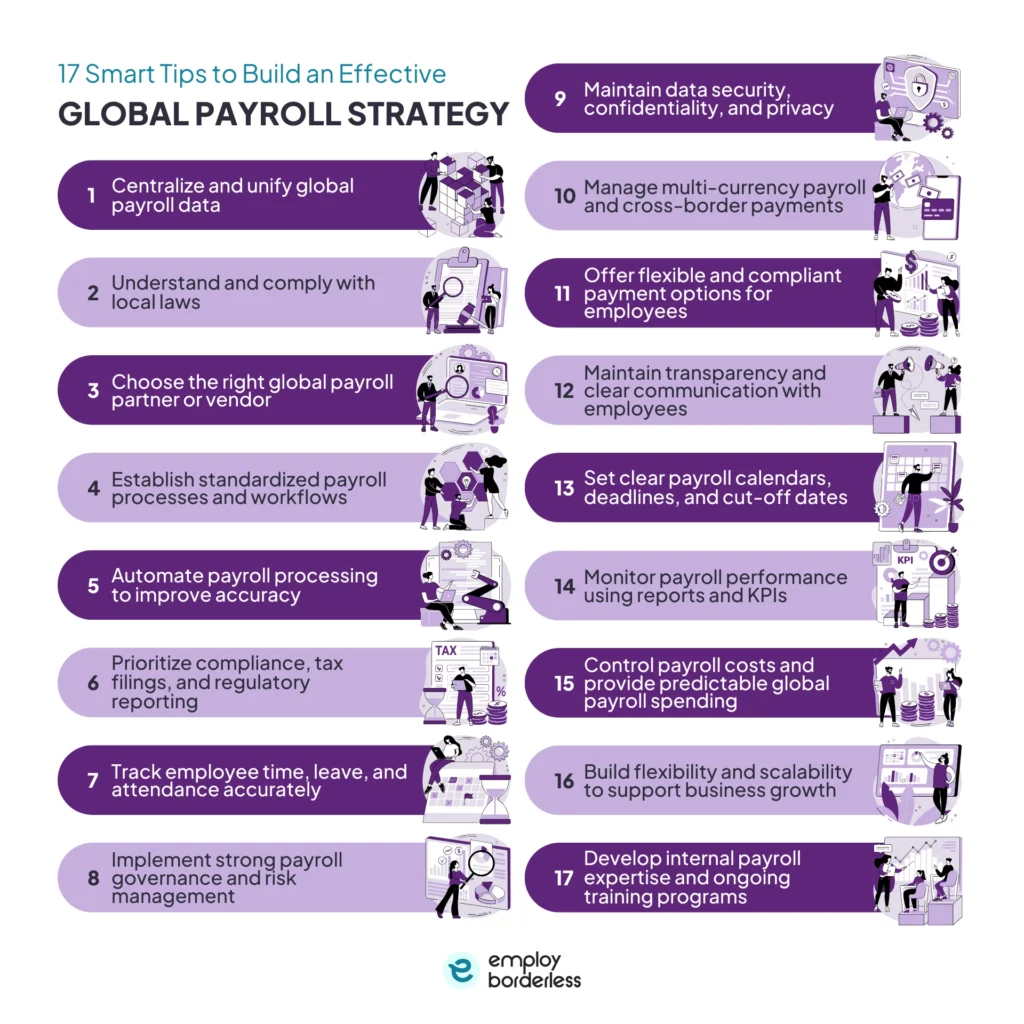

The benefits of a global payroll strategy are lower operational costs, reduced payroll errors, advanced insights for decision-making, improved employee experience, and operational accuracy. The tips for an effective global payroll strategy are to centralize and unify global payroll data, understand and comply with local laws, choose the right global payroll partner or vendor, establish standardized payroll processes and workflows, and automate payroll processing to improve accuracy.

The 17 smart tips for building an effective global payroll strategy are listed below.

- Centralize and unify global payroll data: Centralizing global payroll data mitigates issues from separate, region-specific systems, which improves communication among HR, finance, and payroll teams.

- Understand and comply with local laws: Understanding and complying with local payroll laws is important, as each jurisdiction has specific requirements for tax withholdings, social security, benefits, reporting deadlines, and employment standards.

- Choose the right global payroll partner or vendor: A reliable provider ensures compliance with local laws and manages tasks like tax filings and multi-currency payroll.

- Establish standardized payroll processes and workflows: Establish standardized payroll processes and workflows, as they provide the ability to scale operations as your business grows.

- Automate payroll processing to improve accuracy: A global payroll system integrates with time-tracking systems and automates payroll functions such as tax calculations, statutory deductions, and payslip generation.

- Prioritize compliance, tax filings, and regulatory reporting: Organizations must prioritize compliance with local tax laws, employee benefits, and statutory deductions to avoid penalties and reputational damage.

- Track employee time, leave, and attendance accurately: Tracking employee time, leave, and attendance accurately means providing correct payroll calculations and preventing overpayments or underpayments according to local labor laws.

- Implement strong payroll governance and risk management: Implementing strong payroll governance and risk management means establishing clear policies, roles, and responsibilities to ensure compliance with regulations and prevent fraud.

- Maintain data security, confidentiality, and privacy: Maintaining data security, confidentiality, and privacy means making sure that sensitive employee information, such as salaries, tax records, and personal details, is protected. This data protection reduces the risk of breaches and supports regulatory compliance across global payroll operations.

- Manage multi-currency payroll and cross-border payments: Managing multi-currency payroll and cross-border payments involves accurate employee compensation in the local currency, handling exchange rate fluctuations, and complying with international regulations.

- Offer flexible and compliant payment options for employees: Offer flexible and compliant payment options to make sure employees receive salaries through methods relevant to their location, such as direct deposit, e-wallets, or prepaid cards.

- Maintain transparency and clear communication with employees: Make sure employees understand payroll processes, payment schedules, and any deductions, which builds trust, reduces disputes, and supports compliance across global payroll operations.

- Set clear payroll calendars, deadlines, and cut-off dates: Set clear payroll calendars, deadlines, and cut-off dates to offer timely and accurate salary processing across all global payroll operations.

- Monitor payroll performance using reports and KPIs: Monitoring payroll performance using reports and KPIs (Key Performance Indicators) allows organizations to track accuracy and compliance, identify issues quickly, and make informed decisions to improve global payroll operations.

- Control payroll costs and provide predictable global payroll spending: Controlling payroll costs and providing predictable global payroll spending helps organizations manage budgets effectively, reduce unexpected expenses, and maintain financial stability.

- Build flexibility and scalability to support business growth: Building flexibility and scalability in global payroll allows organizations to adjust to workforce changes, expand into new markets, and support business growth without disrupting payroll accuracy or compliance.

- Develop internal payroll expertise and ongoing training programs: Developing internal payroll expertise and ongoing training programs helps improve the payroll team’s skills, keeps them updated on regulations and best practices, and supports global payroll operations.

Centralize and unify global payroll data

Centralizing and unifying global payroll data helps prevent issues caused by separate, region-specific systems. This centralization helps multinational businesses improve communication between HR, finance, and payroll teams. It simplifies compliance and reporting processes across multiple jurisdictions by organizing employee, tax, and payroll information into a single, integrated platform.

Centralized payroll data provides accuracy and transparency, which gives executives a unified view of payroll liabilities and workforce costs in real time. Choosing an integrated payroll system that consolidates all global payroll data into one location increases processing speed and lowers payroll errors.

Understand and comply with local laws

Understanding and complying with local laws is important because payroll regulations, tax rules, and employee benefits differ from one country to another. Each jurisdiction has its own set of payroll requirements, like income tax withholdings, social security and statutory benefits, reporting deadlines, and employment standards, that companies need to understand and apply correctly.

International companies that fail to comply with local payroll laws face audits, fines, and regulatory action from tax and labor authorities, which affects operational continuity. Organizations need to actively research and integrate local payroll regulations, such as taxes, social contributions, and mandatory benefits, into their global payroll processes. These integrated processes help maintain legal compliance, protect your business operations, and improve your organizational reputation across markets.

Choose the right global payroll partner or vendor

Choosing the right global payroll partner or vendor helps maintain smooth payroll operations across all countries where your business operates. A reliable payroll provider expertly processes pay and manages compliance with local labor laws, tax filings, and multi-currency payroll requirements. This payroll partner acts as an extension of your internal team by simplifying complex regulations and automating processes like calculations, reporting, or cross-border payments.

Companies that provide accurate and timely salary payments in local currencies through the right vendor experience increased employee satisfaction and protect their reputation and financial stability. It is important to evaluate global payroll providers based on their country-specific expertise, compliance flexibility, and support quality. Choosing a provider with proven multi-country experience helps confirm that your global payroll runs correctly, compliantly, and with no risk as your business grows internationally.

Establish standardized payroll processes and workflows

Establishing standardized payroll processes and workflows improves uniformity and operational productivity across all countries where your organization operates. Global teams work more productively when core payroll procedures, from data collection and wage calculations to tax filings and payment runs, follow a unified structure. This structure helps reduce payroll errors and supports smooth, more predictable payroll cycles across regions.

Standardization also improves your ability to scale global payroll operations as your business grows. A uniform arrangement makes it easy to add new countries or employees to your global payroll system without creating processes for every new market, which reduces administrative overhead and complexity.

Multinational businesses need to create a global payroll policy that defines standardized procedures for payroll functions such as tax filings, payment schedules, payroll runs, and reporting. This policy ensures all teams comply with the same central system while adjusting to country-specific requirements where necessary. Businesses should regularly audit their payroll processes to make sure they match their global payroll strategy and continue to perform effectively.

Automate payroll processing to improve accuracy

Automate payroll processing, as it helps organizations reduce manual errors, save administrative time, and confirm that employees are paid accurately and on schedule each pay cycle. Automated global payroll systems provide accuracy by applying predefined rules for wage, tax, and deduction calculations, which allow teams to shift their focus from transactional tasks to strategic business priorities.

International companies should implement a global payroll solution that automates core functions like tax calculations, statutory deductions, and payslip generation, while integrating smoothly with HR and time-tracking systems. Scheduling regular automated payroll runs also guarantees that all employees receive timely payments in the countries where they work. Automating tax filings and updates helps maintain compliance with local and international regulations, which reduces the risk of costly fines.

Prioritize compliance, tax filings, and regulatory reporting

Prioritize compliance with local tax laws, employee benefits, and statutory deductions to avoid costly penalties and reputational damage. Payroll tax laws and reporting requirements differ across countries and change frequently, which makes it necessary for organizations to stay updated. Non-compliance results in fines, back taxes, audits, and legal issues, while timely and accurate tax filings help maintain regulatory compliance and build trust with both employees and tax authorities.

Using global payroll systems that integrate with local tax authorities helps with real-time updates, accurate calculations, and automated filings. Maintaining detailed records of all tax submissions and statutory contributions promotes transparency and compliance. Reliable global payroll services also reduce risk by managing taxes, fees, and contributions for international employees, while offering accurate processing across jurisdictions.

Track employee time, leave, and attendance accurately

Accurately tracking employee time, leave, and attendance is important for ensuring global payroll accuracy and compliance. Proper time-off monitoring helps confirm that employees are paid correctly for absences, which reduces errors such as underpayments and overpayments. Integrating HR software with global payroll systems allows for automatic leave tracking, which saves time and lowers manual mistakes. Setting up alerts whenever employees take leave helps support timely adjustments across regions. Regular audits of leave records verify that all absences are correctly shown in employee pay to support transparency and compliance in your global payroll strategy.

Implement strong payroll governance and risk management

Strong payroll governance is important for managing risks in multi-country payroll operations. Clearly defining global, regional, or local processes and owners provides accountability and smooth coordination across all operational levels. Roles and responsibilities should be distributed at global, regional, and in-country levels, which helps with transparency and avoids confusion in duties. Following best practices for payroll standards, processes, and policies helps maintain unity and compliance across jurisdictions.

A good global payroll strategy outlines risk management measures, like regular payroll audits or dual authorization of payments for all payroll operations. Maintaining proper documentation and conducting regular self-assessments at different organizational levels also improves governance, reduces errors, and ensures compliance.

Maintain data security, confidentiality, and privacy

Global payroll systems handle sensitive employee information, which includes salaries, tax records, and personal details. Strong data protection measures like data encryption and MFA (Multi-Factor Authentication) offer employee privacy while reducing the risk of financial loss and reputational damage from data breaches. Regular security audits help identify risks and correct system issues quickly. Ongoing training makes sure global payroll teams follow best practices and comply with data protection regulations such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) for payroll security and regulatory conformity.

Manage multi-currency payroll and cross-border payments

Accurate currency management is important in global payroll to confirm employees are paid securely across different countries. It helps organizations manage exchange rate fluctuations, process salaries in local currencies, and avoid payment errors or delays that affect employee trust and compliance. Choose a global payroll system that supports multi-currency processing and allows automatic currency conversions based on real-time exchange rates. Integrating global payroll systems with reliable payment providers guarantees that cross-border payments are processed in the right currency.

Offer flexible and compliant payment options for employees

Providing employees with multiple payment options means they receive their pay conveniently. Flexible payment methods, such as direct deposit, e-wallets, and prepaid cards customized to local requirements, help offer timely and convenient salary payments across regions. These options improve employee satisfaction and retention while reducing the limitations of one-size-fits-all payroll systems.

Employees select their preferred payment method during onboarding, and organizations should make sure that payroll software integrates smoothly with all available options for accurate and timely processing. Organizations simplify global payroll operations while keeping employees engaged by offering multiple, compliant payment choices.

Maintain transparency and clear communication with employees

Clear communication about pay, deductions, and benefits confirms employees fully understand their compensation, which reduces confusion and legal disputes. Transparency builds trust, security, and long-term engagement, which makes employees stay committed. Providing detailed payslips that clearly explain earnings, deductions, commissions, and bonuses helps employees see exactly how their compensation is calculated.

Self-service portals also allow employees to access pay history, update personal information, and stay informed in real time. Integrated payroll platforms with these features not only create transparency but also improve employee satisfaction and trust, which makes a global payroll strategy more effective.

Set clear payroll calendars, deadlines, and cut-off dates

Payroll delays directly affect employee morale and disrupt daily operations, which makes timely payments an important component of global payroll. Organizations operating globally set expectations for both employees and payroll teams by establishing clear payroll deadlines that offer consistency and reliability.

Consistent payroll schedules help maintain positive relationships with employees, while global payroll software with automated scheduling guarantees that deadlines are achieved without manual involvement. Sending reminders to payroll teams and managers shows timely processing and reduces the risk of delays. Clearly communicating payroll calendars and cut-off dates provides transparency and improves operational productivity across the organization.

Monitor payroll performance using reports and KPIs

Regularly monitoring payroll performance helps identify areas for improvement and keeps global payroll processes operating smoothly and effectively. Organizations detect challenges early, increase accuracy, and improve the overall employee experience. Setting up KPIs (Key Performance Indicators), such as payroll accuracy, on-time payments, and employee satisfaction, provides measurable insights into operational performance.

Utilizing payroll reporting tools allows businesses to assess trends, simplify processes, and maintain compliance across regions. Gathering feedback from employees and payroll staff supports continuous improvement, which helps create a more reliable and transparent global payroll strategy.

Control payroll costs and provide predictable global payroll spending

Managing payroll in-house becomes expensive due to high setup costs, ongoing IT support, compliance management, and system maintenance. Switching to a cloud-based global payroll solution provides a subscription-based model, which makes costs predictable, scalable, and easy to budget. Outsourcing payroll also reduces spending by lowering the need for on-site hardware and server maintenance.

Automation lowers operational costs by reducing manual payroll tasks, while simplified payroll processes save time and reduce the overall operational burden. Subscription-based pricing offers transparent, predictable global payroll spending, which allows organizations to plan and control payroll costs effectively.

Build flexibility and scalability to support business growth

Global payroll requirements change as your business grows and expands into new regions. A flexible payroll strategy helps you scale operations smoothly without disruptions or compliance issues. Companies should select a global payroll system that easily adjusts to new employees, more countries, and complex workflows. Regularly reviewing and updating your global payroll processes means that your system continues to meet the changing demands of a growing global workforce, which supports long-term business success.

Develop internal payroll expertise and ongoing training programs

Companies that invest in ongoing training help their teams stay current on complex payroll processes, changing local compliance requirements, and the latest payroll technologies and tools. This training is provided through workshops, certifications, or course‑based learning. This focused training not only increases understanding of multi‑jurisdictional payroll regulations and system workflows but also builds strong internal expertise that reduces errors and compliance risks. Well‑trained payroll professionals improve payroll accuracy, increase operational productivity, and maintain the overall effectiveness of your global payroll operations.

What is a global payroll strategy?

A global payroll strategy is a comprehensive plan for managing payroll across multiple countries that includes workforce, processes, systems, and providers. It is a detailed plan for organizing, simplifying, and centralizing payroll operations to develop full global authority. The main goal of a global payroll strategy is to create a uniform structure for managing payroll operations across different countries, which increases payroll’s strategic value while improving accuracy and compliance.

Why is a global payroll strategy important for businesses?

A global payroll strategy is important for businesses, as it simplifies payroll processes and ensures compliance across different countries. Global payroll is complex due to multiple currencies, local tax laws, and language differences, which result in errors when managed in-house. Most businesses lack the resources to handle these complexities and benefit from partnering with a global payroll provider.

Professional providers consolidate payroll management into a single interface that includes correct pay rates, benefits, and tax deductions for all employees. Using global payroll solutions improves accuracy and compliance by providing cost-effective benefits and in-country expertise, which helps businesses simplify global operations and reduce legal risk.

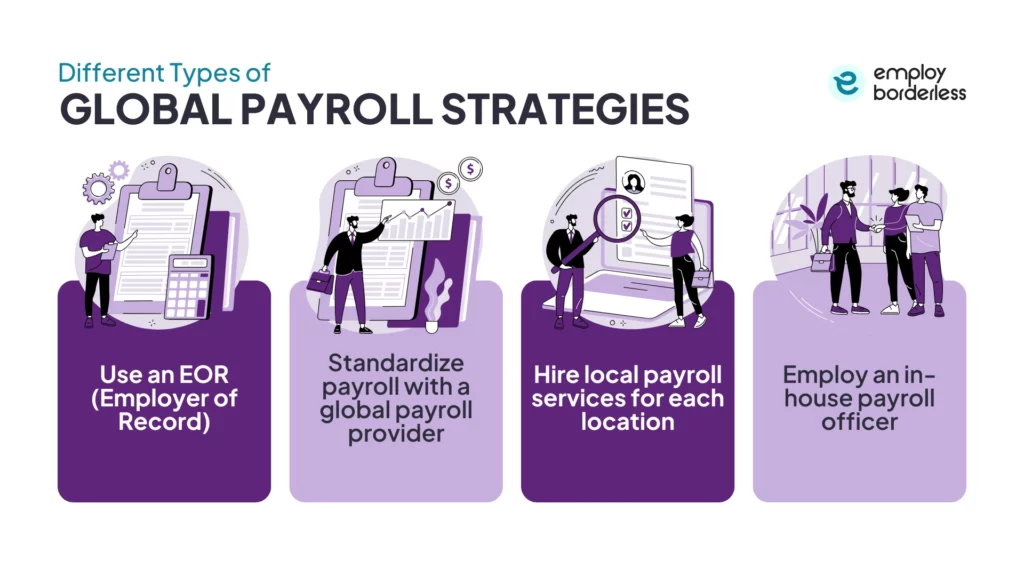

What are the different types of global payroll strategies?

The different types of global payroll strategies involve using an EOR (Employer of Record), standardizing payroll with a global payroll provider, hiring local payroll services for each location, and employing an in-house payroll officer.

The different types of global payroll strategies are listed below.

- Use an EOR (Employer of Record): Using a local EOR (Employer of Record) is an effective solution for companies that have not set up a legal entity in a specific country. EORs handle all payroll tasks, like banking, insurance, taxes, HR, and employment contracts. This model is ideal for businesses exploring a new market, reducing upfront investment, or quickly onboarding employees while waiting to establish their own legal entity.

- Standardize payroll with a global payroll provider: A centralized global payroll operation unifies all payroll processes and provides executives with real-time data. It simplifies workforce management, KPI monitoring, and fraud detection. Outsourcing payroll also reduces the burden on internal teams while offering reliable payroll processing.

- Hire local payroll services for each location: Working with a local payroll specialist helps reduce errors, improve accuracy, and ensure compliance if your business already has an entity in a location. These local payroll services are especially useful if you operate in a country with complex payroll laws, have issues about data security, or need to manage a large local workforce without investing in costly international systems.

- Employ an in-house payroll officer: Managing payroll in-house is an effective way to maintain full control when suitable internal resources are available. It, however, requires expertise in the payroll regulations of each country and is difficult to scale. This strategy makes it difficult to manage small numbers of employees located across multiple international locations.

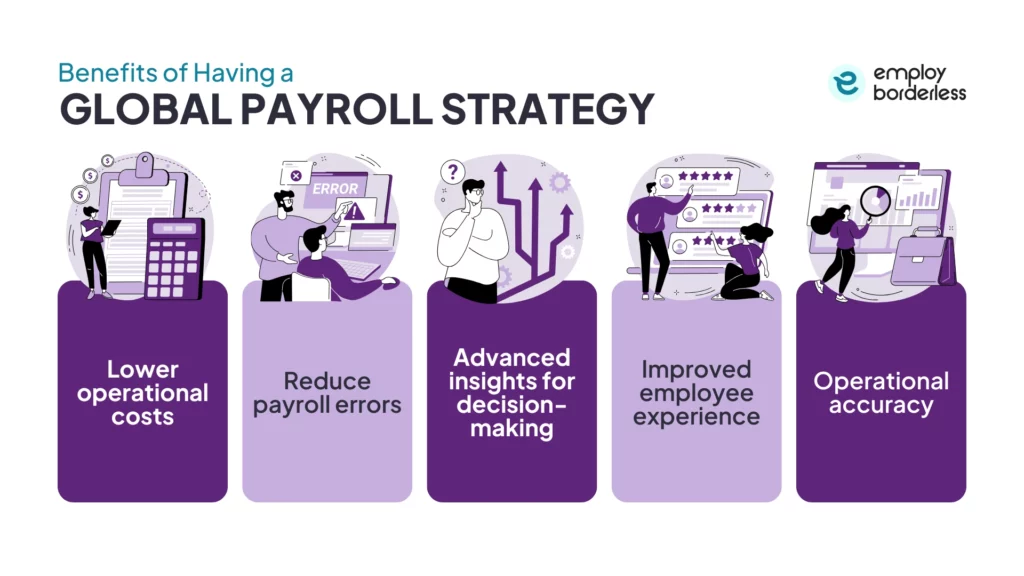

What are the benefits of having a global payroll strategy?

The benefits of having a global payroll strategy include lower operational costs, reduced payroll errors, advanced insights for decision-making, improved employee experience, and operational accuracy.

Lower operational costs

Centralizing and automating payroll processes across countries reduces administrative burdens, decreases manual work, and lowers overhead costs related to managing multiple local systems or vendors. It also reduces system and staffing expenses that are usually required for in-house payroll management across regions.

Reduce payroll errors

Global payroll solutions integrate payroll data and automate complex calculations, which reduces the risk of human error. Automated systems provide accurate tax withholdings, benefit deductions, and compliance with local regulations, which helps organizations avoid costly mistakes and legal penalties.

Advanced insights for decision-making

An effective global payroll strategy consolidates payroll data into unified dashboards and reporting tools while offering real-time analytics. These insights help executives predict labor costs, identify trends, and make informed strategic decisions according to their business goals.

Improved employee experience

Accurate and timely payroll increases employee satisfaction and trust when working across multiple regions. Global payroll systems mostly include user-friendly features such as digital payslips, self-service portals, and local language support, which increase transparency and engagement across international teams.

Operational accuracy

A global payroll strategy provides consistency and accuracy by standardizing payroll processes and integrating compliance updates across jurisdictions. This strategy helps organizations stay current with local labor laws and tax requirements while reducing compliance risks.

Which solutions work best for global payroll and workforce management?

The solutions that work best for global payroll and workforce management include EOR (Employer of Record), PEO (Professional Employer Organization), global payroll support, and global expansion support.

An EOR (Employer of Record) is a third-party service that legally employs workers on behalf of the client company in countries where it does not have a registered entity. The EOR handles payroll processing, tax withholdings, benefits administration, and compliance with local labor laws, while your business retains daily control of employee performance and work assignments.

A PEO (Professional Employer Organization) works through a co-employment arrangement to manage HR and payroll functions for businesses, especially in markets where the company already has an established entity. PEOs offer a flexible and productive way to manage international payroll processing, compliance, and HR functions, which allows businesses to focus on growth.

Global payroll support means centralized payroll services that manage payroll processing, tax compliance, multi-currency payments, and reporting across multiple countries. These solutions integrate payroll operations into a single platform to offer accurate and timely payments while maintaining compliance with local labor laws and tax codes.

Global expansion support includes services designed to help companies enter new international markets smoothly and compliantly. Expansion support services mostly combine expertise from EOR or global PEO offerings with strategic market insights, which help businesses scale operations cost-effectively while reducing risk and administrative overhead.

Can global payroll systems manage multiple currencies?

Yes, global payroll systems can manage multiple currencies, as they help businesses process and pay international employees in their specific local currencies. These systems handle currency conversion and exchange rates to simplify cross-border payroll processing and reduce manual work and errors.

How often should a global payroll strategy be reviewed?

A global payroll strategy should be reviewed annually or when there are major changes, such as entering new countries, regulatory updates, workforce growth, or system upgrades. Regular reviews help ensure ongoing compliance, payroll accuracy, cost savings, and conformity with changing business and labor law requirements across regions.

How do outsourced payroll services support a global payroll strategy?

Outsourced payroll services support a global payroll strategy by ensuring compliance with different local tax and labor laws and allowing internal teams to focus on strategic growth. These outsourced payroll services also provide centralized reporting, multi-currency management, and scalability to handle payroll across multiple countries.

Why is risk management in payroll important to a global payroll strategy?

Risk management in payroll is important to a global payroll strategy because it helps prevent costly errors, fraud, and non-compliance with international tax and labor laws. Multinational businesses protect financial credibility, maintain legal compliance across jurisdictions, and retain their reputation and employee trust by actively implementing payroll risk management.

How do payroll trends affect a global payroll strategy?

Payroll trends affect a global payroll strategy through AI-based automation, cloud-based systems, real-time processing, and improved compliance tools. These payroll trends reduce errors and support real-time decision-making, which helps global payroll strategies stay compliant, scalable, and consistent with a distributed workforce.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations