Global payroll compliance: definition, challenges, and best practices

Robbin Schuchmann

Co-founder, Employ Borderless

Global payroll compliance means making sure organizations meet all legal, tax, and regulatory standards when paying employees across multiple countries. Global payroll compliance is complex due to the unique statutory, tax, and regulatory requirements across countries, unexpected changes in regulations, and the need for specialized knowledge to manage these requirements effectively.

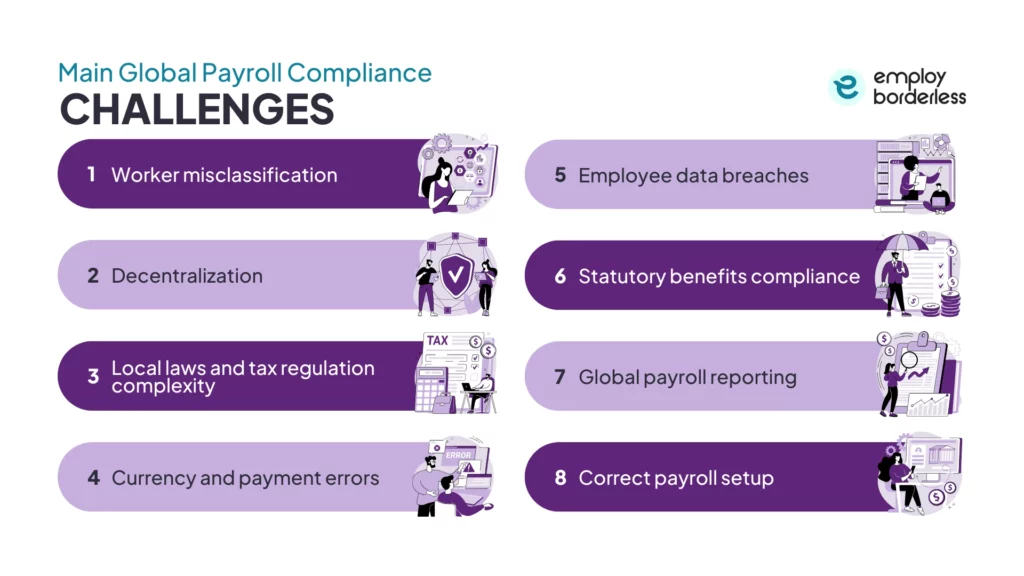

The challenges of global payroll compliance include worker misclassification, decentralization, currency and payment errors, employee data breaches, statutory benefits compliance, global payroll reporting, and correct payroll setup.

The best practices for improving global payroll compliance are establishing a global payroll strategy, continuous regulatory monitoring, strong payroll security standards, regular compliance audits, a global benefits strategy, clear payroll policies and communication, and implementing centralized HCM (Human Capital Management) software.

What is global payroll compliance?

Global payroll compliance is the practice of making sure that multinational companies follow all payroll-related laws, such as employment laws, tax regulations, reporting obligations, and statutory requirements when compensating employees across different countries. This compliance includes accurate wage calculation, correct tax deductions, timely social contributions, and proper recordkeeping for local authorities. Global payroll compliance also involves benefits management, employee terminations, and meeting local data protection standards, along with salary payments.

Why is global payroll compliance complex?

Global payroll compliance is complex because each country applies its own legal laws for employee compensation, taxation, and worker protection. These regulations are updated frequently and mostly with limited advance notice, which requires organizations to stay informed at all times. The complexity increases when internal teams lack resources or specialized expertise to manage payroll requirements across multiple jurisdictions.

Remote work also makes it difficult to determine which country’s employment and tax laws the company needs to apply. Cross-border contracts also introduce questions about tax residency and social security duties that require careful review. Employee expectations for transparent payroll processes, timely salary payments, and correct deductions continue to increase, which places pressure on organizations to maintain accuracy and consistency in payroll operations.

What are the main global payroll compliance challenges?

The main global payroll compliance challenges include worker misclassification, decentralization, local laws and tax regulations, and currency and payment errors. These challenges also involve employee data breaches, statutory benefits compliance, global payroll reporting, and correct payroll setup.

Worker misclassification

Worker misclassification means incorrectly classifying employees as independent contractors, which exposes organizations to serious legal and financial risk. Tax authorities in many jurisdictions actively review worker classification practices and require payment of unpaid taxes, social contributions, and financial penalties when identifying non-compliance. Organizations also face liabilities that continue over multiple years when a worker is categorized as a freelancer but performs the duties of an employee.

Decentralization

Operating payroll through separate regional systems leads to disconnected data and inconsistent processes across the organization. Local teams mostly follow different procedures, which reduces the reliability of consolidated payroll reporting. Compliance gaps develop when central teams have no clear visibility over the usage of regulations in each location. These inconsistencies are frequently identified only during audits or through formal employee inquiries, which increases both operational risk and administrative effort.

Local laws and tax regulation complexity

Each jurisdiction maintains its own labor codes, tax rates, withholding requirements, and reporting deadlines, which makes global payroll compliance complex. These rules are detailed and change frequently, so organizations have to regularly track updates to avoid errors. Even small differences in the implementation of income tax, employer contributions, or filing deadlines result in penalties, audits, and increased compliance risk. These differences in regulations across jurisdictions make it difficult to maintain a consistent, accurate global payroll without specialised local knowledge and ongoing monitoring.

Currency and payment errors

Exchange rate fluctuations impact payroll calculations, which create differences between estimated costs and actual payments. Timing mismatches occur when conversion rates change between the time of payroll calculation and the time of payment. Employees paid in local currency experience differences in their net pay from month to month, which affects their confidence in the accuracy and reliability of the organization’s payroll.

Employee data breaches

Employee data breaches occur as payroll systems hold sensitive personal information, such as bank details, tax identifiers, and salary data. Transferring this information across borders introduces the possibility of cybersecurity threats and changes in data protection laws. Data breaches result in regulatory penalties under statutes such as GDPR (General Data Protection Regulation) while damaging employee confidence and the organization’s reputation.

Statutory benefits compliance

Statutory benefits compliance means countries mandate different pension contributions, health insurance schemes, and social security payments. Calculating these accurately requires understanding local standards, employer-employee split ratios, and reporting schedules. Errors such as miscalculating contribution amounts, applying incorrect employer-employee allocations, missing reporting deadlines, or using outdated rates result in underpayments, fines, or overpayments that affect labor costs.

Global payroll reporting

Consolidating payroll data from multiple countries into unified reports becomes a challenge for organizations using separate systems. Differences in currencies, pay cycles, and reporting formats make it difficult to combine information accurately for audits, financial planning, and regulatory submissions. Inconsistent or incomplete data also affects decision-making and increases the risk of errors during audits.

Correct payroll setup

Setting up payroll systems correctly from the start is important to avoid future compliance issues. Each country has specific requirements for tax codes, pay schedules, deduction sequences, and reporting formats. Mistakes made during the initial setup increase over time, which leads to higher costs and difficulties during audits or system migrations.

What are the best practices for improving global payroll compliance?

The best practices for improving global payroll compliance include establishing a global compensation strategy, continuous regulatory monitoring, strong payroll security standards, and regular compliance audits. Some other best practices are a global benefits strategy, clear payroll policies and communication, and implementing centralized HCM (Human Capital Management) software.

Establishing a global compensation strategy

A unified compensation strategy provides consistency while considering local market conditions. Standardizing pay structures, grade levels, and bonus policies across regions promotes equity while adjusting to cost-of-living differences and legal minimum requirements. This strategy simplifies administration and reduces the risk of compliance or discrimination issues arising during audits.

Continuous regulatory monitoring

Labor laws, tax rates, and reporting requirements change frequently across jurisdictions. Organizations must have systems in place to monitor these legislative updates and implement operational adjustments quickly. Using automated alerts from regulatory databases or collaborating with local experts helps make sure that payroll teams receive updates in time to meet all compliance deadlines.

Strong payroll security standards

Protecting employee data requires strong encryption, strict access controls, and regular security assessments. Compliance with data protection regulations, such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), requires specific security measures when transferring information across borders. Implementing effective security measures lowers the risk of data breaches and shows that the organization meets regulatory and employee expectations for data privacy.

Regular compliance audits

Regular internal and external audits help identify errors before they result in regulatory penalties. Examining tax filings, benefits calculations, and employee classification decisions shows errors that go unnoticed and increase over time. Conducting active audits also produces documentation that supports compliance during official inspections.

Global benefits strategy

A structured benefits strategy ensures compliance with statutory requirements while providing competitive incentives to attract and retain talent. Tracking mandatory contributions in each jurisdiction helps prevent compliance gaps, and applying additional benefits consistently improves the organization’s employer brand worldwide.

Clear payroll policies and communication

Documented policies that clearly explain pay dates, deduction procedures, and reporting procedures help reduce salary confusion and errors. Clear communication with employees about the calculation of compensation standards builds trust and reduces workplace disputes. Consistent messaging across regions supports uniform standards while respecting local requirements.

Engage local experts

In-country specialists have practical knowledge of local tax rules, labor laws, and regulatory requirements that internal teams sometimes do not have. Working with local payroll providers or legal advisors helps ensure compliance stays current with actual regulatory practices rather than relying on outdated rules.

Implement centralized HCM software

A unified HCM (Human Capital Management) platform brings payroll data from multiple countries into a single system. Centralized systems improve visibility, standardize processes, and simplify reporting. Connecting with local tax and benefits providers reduces manual work while ensuring accurate compliance.

How to choose an outsourced global payroll compliance partner?

To choose an outsourced global payroll compliance partner, consider proven global experience, compliance expertise, technology and integration capabilities, service scope, data security standards, transparent pricing, and local support.

Choose a provider with a proven global experience that operates successfully in the countries where you employ workers and understands regional standards rather than relying on generic processes.

Prioritize a provider that shows global compliance expertise and thorough knowledge of local tax codes, labor laws, and reporting obligations. This expertise also requires support by certified professionals and a documented record of successful compliance.

Select a provider that offers technology and integration capabilities for global payroll compliance. Determine whether the provider’s platform connects smoothly with your existing HR and finance systems, which reduces manual data transfers and related errors.

Choose a globally compliant payroll provider whose service scope matches your needs and includes everything from basic payroll processing to equity compensation, benefits administration, and regulatory filings.

Select a provider that provides data security standards such as GDPR (General Data Protection Regulation), encryption protocols, access controls, and breach notification procedures.

Make sure the provider offers transparent pricing to prevent unexpected costs by clearly defining fees for standard processing, additional countries, and special requests. Choose a provider that offers local support and timely assistance from specialists familiar with each country’s requirements, which helps reduce delays when urgent issues occur.

What is global payroll?

Global payroll is the process of compensating employees across multiple countries while complying with each jurisdiction’s tax, labor, and reporting requirements. It involves calculating gross-to-net pay, withholding income taxes, remitting employer and employee social contributions, and disbursing funds in local currencies by mandated deadlines.

Global payroll involves more than basic processing for multinational companies and includes data consolidation for financial reporting, workforce cost analysis, and strategic planning. Effective global payroll operations combine centralized management with local execution. They maintain consistent control while providing the flexibility needed to manage regional differences in pay cycles, statutory deductions, and benefits administration.

What tools or systems help improve global payroll compliance?

The tools or systems that help improve global payroll compliance are HCM (Human Capital Management) systems, cloud-based payroll software, and automation tools. These solutions centralize employee data, reduce duplication, and make sure updates transfer across all compliance-related workflows.

What is global HR compliance?

Global HR compliance is a comprehensive set of employment obligations organizations must meet across jurisdictions, which include hiring practices, workplace safety, anti-discrimination policies, and termination procedures.

How is global payroll different from regular payroll?

Global payroll is different from regular payroll in that global payroll includes multiple jurisdictions with different regulations, while regular payroll operates within a single legal and tax system. Global payroll complexity increases when organizations have to handle different currencies, different pay schedules, and country-specific statutory deductions at the same time.

How do currency changes impact global payroll processing?

Currency changes impact global payroll processing when converting from a reporting currency to local currencies. Fluctuations also create budget differences and impact employee net pay or the payroll process if contracts are in a foreign currency. Fixing exchange rates at set intervals helps keep costs stable and predictable.

What are the risks of non-compliance in global payroll?

The risks of non-compliance in global payroll are legal risks, financial liabilities, and reputational damage. Legal risks include fines, back taxes, and possible criminal liability for responsible officers. Financial liabilities involve interest, penalties, and compensation claims from employees. Reputational damage makes it difficult to attract and retain talent and draw attention from regulators and investors.

How often should companies review their global payroll compliance policies?

Companies should review their global payroll compliance policies regularly and conduct formal internal audits quarterly. Quarterly assessments track frequent statutory changes in multiple jurisdictions. Annual audits review overall policy effectiveness and provide consistency with business growth. Immediate reviews should be conducted after major events, such as entering new markets, taking over companies, or responding to regulatory actions.

What should businesses know about global payroll taxation?

Businesses should know about global payroll taxation that each country has its own withholding rates, tax classifications, and filing deadlines, which they need to follow carefully. Cross-border taxation includes complexities, like considerations of tax treaties, permanent establishment risks, and social security totality agreements. Accurate payroll taxation requires a clear understanding of both employer obligations and employee benefits in each relevant jurisdiction.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations