Global payroll automation: definition, tasks, tools, benefits, and risks

Robbin Schuchmann

Co-founder, Employ Borderless

Global payroll automation is the use of software to automatically manage payroll processes for a company’s international workforce. The global payroll tasks to automate include payroll processing, compliance reporting, tax calculations, pay calculations, time and attendance tracking, benefit deduction, and year-end processing.

The tools and systems required to automate global payroll are compliant contractor onboarding and classification, integration with crypto payment systems, automatic tax form generation, secure wallet and banking integrations, and real-time analytics, tracking, and notifications.

The benefits of global payroll automation are less administrative burden, cost-effective payroll administration, accurate and compliant payroll records, simplified payroll reporting, tracking payments and invoices in real time, and scalable payroll data management. There are also risks of global payroll automation, which include data security and privacy risks, currency and payment issues, change management and adoption, and cost and implementation time.

What is global payroll automation?

Global payroll automation means using software and systems to automate routine and complex tasks while processing workers’ payroll across multiple countries. Such software helps automatically adjust salary calculations, tax deductions, currency conversions, and reporting to each country’s employment laws. These global payroll automation systems act as a central base to connect HR, finance, and compliance.

Why does global payroll automation matter for multinational businesses?

Global payroll automation matters for multinational businesses because it increases speed and productivity for any repeatable computer-based task that the employees are currently managing. Many business units rely on standardized processes, which makes automation relevant across multiple departments. Introducing automation across multiple departments leads to performance improvements, cost reductions, and increased productivity. Global payroll automation is considered a business-transformation technology that is able to change existing workflows.

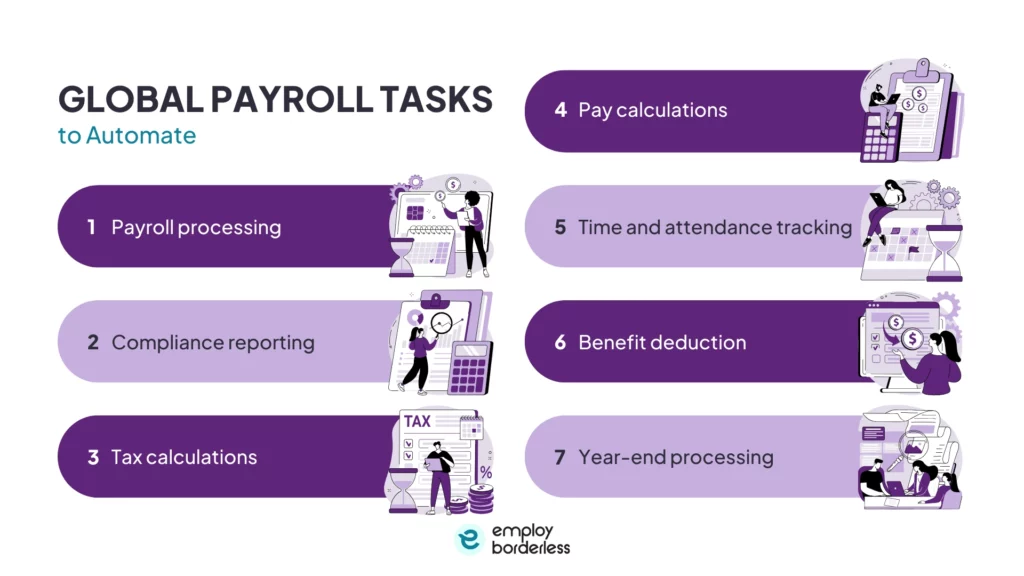

What are the global payroll tasks to automate?

The global payroll tasks to automate include payroll processing, compliance reporting, tax calculations, pay calculations, time and attendance tracking, benefit deduction, and year-end processing.

Payroll processing

Payroll processing means a global payroll automation platform calculates taxes and wages, generates paychecks automatically, and deposits funds directly into employees’ bank accounts. This automation makes sure that payments are disbursed on time and correctly while complying with local laws and regulations.

Compliance reporting

Compliance reporting is the process by which global payroll automation generates required documents, such as W-2s, 1099s, and country-specific tax forms, by using up-to-date regulatory rules to ensure compliance across jurisdictions.

Tax calculations

An automated global payroll solution calculates and withholds taxes from employees’ paychecks with lower manual input. These systems are built with country-specific tax rules, like income tax rates, social security contributions, and statutory deductions, to provide correct calculations for each location.

Pay calculations

Pay calculations mean global payroll automation software calculates employees’ salaries by applying local pay rules to hourly wages, overtime, bonuses, and attendance data. It handles country-specific labor laws, pay frequencies, and statutory requirements while making accurate and timely pay calculations for employees working globally.

Time and attendance tracking

Integrated global payroll systems automatically record employee attendance, working hours, overtime, breaks, and leave days by collecting data through digital clocks, biometric devices, or mobile apps. This automation reduces manual timesheets and data entry while reducing human errors and mistakes. The collected attendance data is updated in real time with the payroll system to make sure that hours worked, overtime, and paid time off are accurately shown in salary calculations.

Benefit deduction

A global payroll automation solution calculates deductions for employee benefits such as health insurance premiums, retirement plan contributions, and other voluntary or employer-provided benefit options. It applies each benefit’s specific rules and rates to the employee’s earnings.

The system handles both mandatory and voluntary benefit deductions, for example, automatically subtracting the correct health insurance amount or retirement contribution from each paycheck based on the employee’s selections and plan terms. This automation makes sure that benefit costs are deducted accurately and in compliance with company policies and local regulations.

Year-end processing

A global payroll automation system simplifies year-end processing by automatically generating country-specific tax forms and payroll reports. It summarizes employee earnings, taxes, benefits, and deductions, which helps companies close payroll accurately and keep their financial management up-to-date.

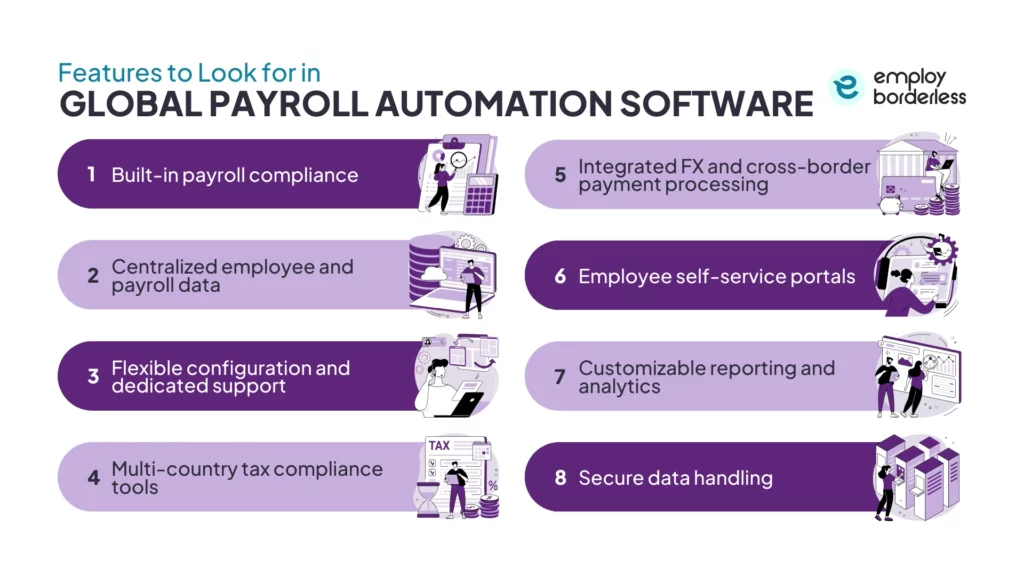

What are the features to look for in global payroll automation software?

The features to look for in global payroll automation software include built-in payroll compliance, centralized employee and payroll data, flexible configuration and dedicated support, and multi-country tax compliance tools. Some other features are integrated FX and cross-border payment processing, employee self-service portals, customizable reporting and analytics, and secure data handling.

The features to look for in global payroll automation software are listed below.

- Built-in payroll compliance: Built-in payroll compliance means the software automatically applies the correct local, regional, and international tax and labor laws. Companies do not have to manually track or understand regulations for every country they operate in.

- Centralized employee and payroll data: A global payroll automation solution provides a centralized database where all employee records, compensation details, tax information, and payroll history are stored in one secure system. This centralization reduces data and manual entry errors, as teams no longer have to manage separate systems or spreadsheets for each country.

- Flexible configuration and dedicated support: Global payroll automation software allows customized settings, workflows, and rules to match your organization’s unique payroll policies, pay structures, and multi‑country requirements. This software also offers expert support to help with setup, problem-solving, and updates, while providing smooth and effective use as your company grows.

- Multi-country tax compliance tools: Multi-country tax compliance tools calculate taxes correctly for every jurisdiction, keep up with changing local laws, and help generate compliant reports and filings, all from a single platform. These compliance tools reduce errors, help avoid penalties for non‑compliance, and make managing payroll across borders simple.

- Integrated FX and cross-border payment processing: Global payroll software automatically handles FX (Foreign Exchange) conversions and international money transfers as part of the global payroll workflow. The system pays employees in their local currency, using up‑to‑date exchange rates and compliant payment routes rather than manually converting funds and establishing separate bank transfers.

- Employee self-service portals: Employee self-service portals are secure online dashboards within global payroll systems that allow employees to access and manage their own payroll and HR information without contacting HR. Employees are able to view and download payslips, check pay history, update personal details, request time off, and see benefit or tax information, all in real time from any device.

- Customizable reporting and analytics: Global payroll automation software offers flexible reporting tools that allow you to create and customize payroll reports based on your specific needs, like labor costs, tax liabilities, overtime trends, or benefit deductions. These tools help analyze payroll data in real time, detect issues, and make informed decisions about budgeting, staffing, and compliance.

- Secure data handling: Secure data handling means that global payroll automation software protects sensitive employee and payroll information using strong security measures, like SSL encryption, role‑based access controls, and multi‑factor authentication. The system also performs regular audits and logging to track activity and helps businesses comply with data protection regulations, like the CCPA (California Consumer Privacy Act). This global payroll automation software reduces the risk of breaches, fraud, and legal penalties.

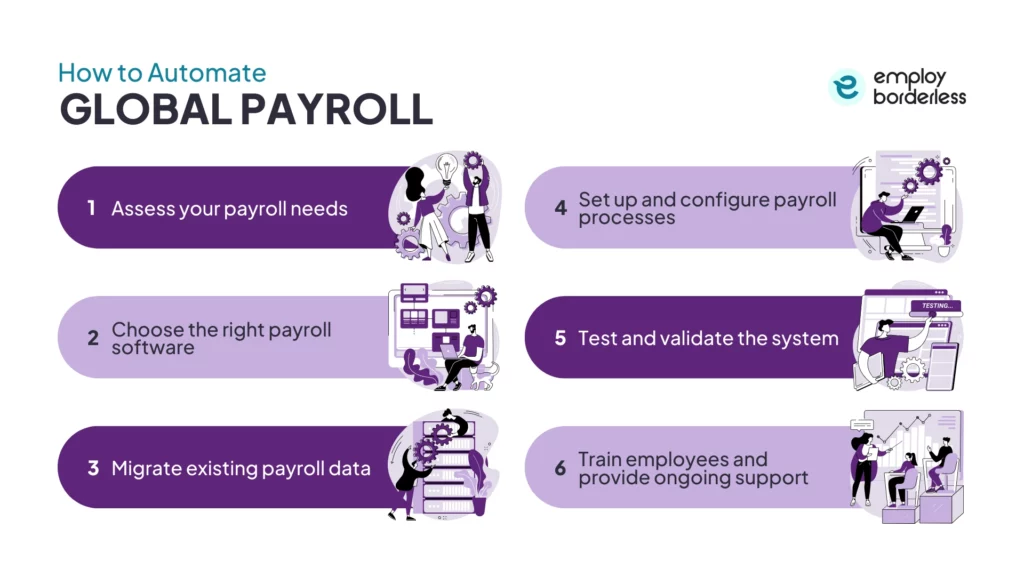

How to automate global payroll?

To automate global payroll, assess your payroll needs, choose the right payroll software, migrate existing payroll data, set up and configure payroll processes, test and validate the system, and train employees, while providing ongoing support.

The steps to automate global payroll are discussed below.

- Assess your payroll needs: Clearly understand your current payroll needs, workforce, and location, and define the goals for your future automated system before evaluating payroll tools or vendors. This step makes sure you select a global payroll solution that matches your business needs.

- Choose the right payroll software: Select a software solution that supports your workforce, complies with local regulations, and provides ongoing support. It is also helpful to review feedback from other users on trusted third-party sites to understand the software’s performance and reliability.

- Migrate existing payroll data: Accurate data migration is important when moving from one payroll system to another. Choose a platform that allows you to transfer all historical data, financial records, and employee information easily. Make sure the system prioritizes data security and protects sensitive employee information, as mishandling or breaches result in legal and financial penalties.

- Set up and configure payroll processes: Set up your payroll system to comply with all relevant legal and regulatory requirements in each country where you operate. This compliance includes tax laws, statutory deductions, benefits, labor regulations, minimum wage requirements, and reporting duties. Configure the system to handle accurate currency conversions and exchange rates according to regulatory standards if your operations involve multiple currencies. Lastly, establish the payroll frequency for each location according to local requirements, whether it is weekly, monthly, or quarterly.

- Test and validate the system: Conduct thorough testing to make sure all calculations and processes are correct after configuring your payroll system. Identify and resolve any errors before the system is fully set up to maintain accurate and reliable payroll operations.

- Train employees and provide ongoing support: Train your HR staff and employees on how to use the new platform after configuring, testing, and validating the payroll system. Employees mostly face difficulty adjusting to the new system, so explain the purpose of the change and how it saves time and simplifies processes during the transition. Provide a clear transition checklist and outline your training plan to offer a smooth integration.

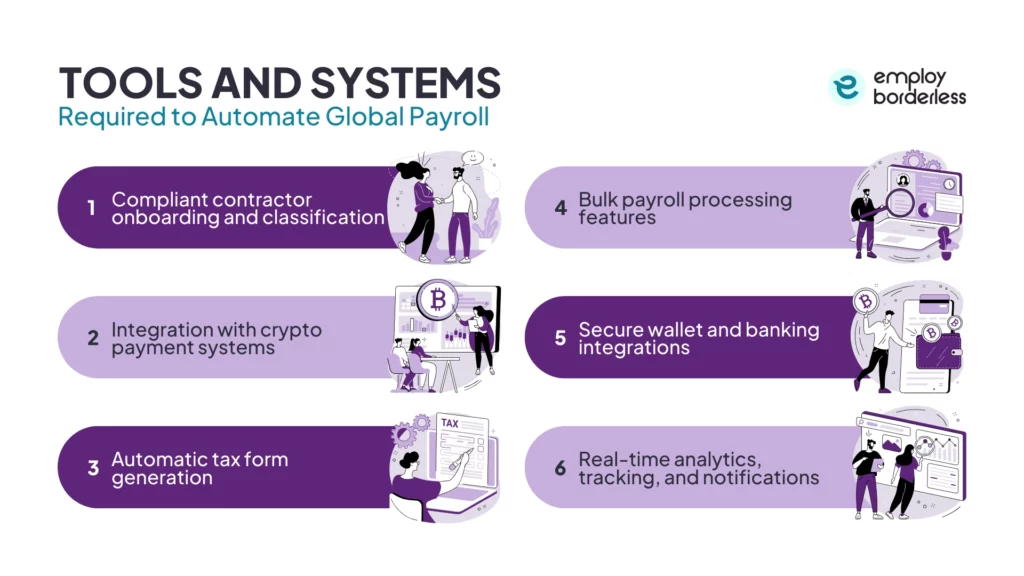

What tools and systems are required to automate global payroll?

The tools and systems required to automate global payroll are compliant contractor onboarding and classification, integration with crypto payment systems, and automatic tax form generation. Other tools and systems include bulk payroll processing features, secure wallet and banking integrations, and real-time analytics, tracking, and notifications.

The tools and systems required to automate global payroll are listed below.

- Compliant contractor onboarding and classification: Compliant contractor onboarding and classification refers to the systems and tools that help multinational businesses hire, register, and correctly categorize independent contractors according to local laws before payroll processing begins.

- Integration with crypto payment systems: Integration with crypto payment systems means connecting traditional payroll platforms with cryptocurrency payment networks. These systems allow businesses working globally to automate salary and contractor payments in digital assets, like Bitcoin and Ethereum, or support hybrid payouts combining fiat and crypto.

- Automatic tax form generation: Automatic tax form generation prepares the required tax documents as part of the payroll process. These systems calculate tax amounts based on employee earnings and legal tax rules and then generate forms, like annual employee tax statements or statutory reports with pre‑filled data, to save time and reduce errors.

- Bulk payroll processing features: Bulk payroll processing features are capabilities within payroll systems that allow organizations to process large volumes of payroll transactions quickly, rather than handling each employee individually. This functionality is especially important for global businesses with many employees across multiple countries, as it improves payment cycles and reduces manual work.

- Secure wallet and banking integrations: Secure wallet and banking integrations are systems that connect your global payroll platform directly with secure financial accounts, like digital wallets and bank networks. These integrations make sure that salary and contractor payments are sent automatically and safely. They also help reduce manual steps, like exporting and uploading payment files, and support both traditional bank transfers and modern digital wallet payouts.

- Real-time analytics, tracking, and notifications: These global payroll automation tools regularly monitor payroll data, provide up‑to‑date insights, and send alerts about important events throughout the payroll process. These systems collect and show payroll information, such as labor costs, attendance data, exceptions, and compliance issues, on dashboards. This data helps HR and finance teams see the current status of payroll operations without waiting for periodic reports.

What are the benefits of global payroll automation?

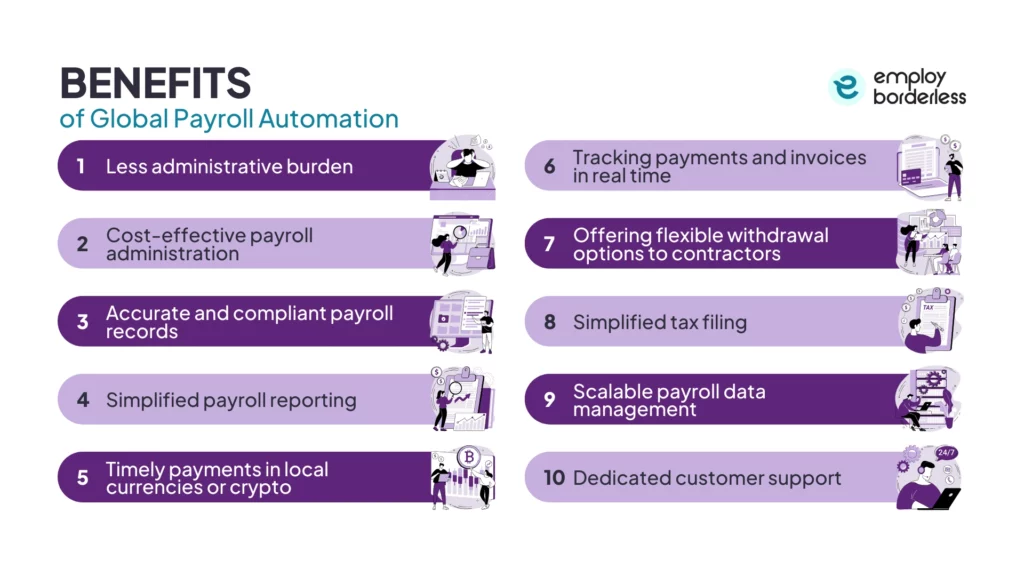

The benefits of global payroll automation are less administrative burden, cost-effective payroll administration, accurate and compliant payroll records, simplified payroll reporting, timely payments in local currencies or crypto, and tracking payments and invoices in real time. Some other benefits include offering flexible withdrawal options to contractors, simplified tax filing, scalable payroll data management, and dedicated customer support.

Less administrative burden

Automating global payroll removes repetitive manual tasks like entering timesheets, calculating wages, preparing payslips, and compiling reports. Global payroll teams run payroll faster and focus on strategic HR and finance work rather than spending hours on spreadsheets and data entry.

Cost-effective payroll administration

Global payroll systems reduce labor costs related to manual processing, corrective payroll adjustments, and hiring extra staff during peak periods, once automated. This automation leads to long‑term savings compared with manual payroll operations over time.

Accurate and compliant payroll records

The automated global payroll system calculates wages, taxes, deductions, and statutory contributions based on up‑to‑date rules. They automatically update for local tax law changes and maintain detailed audit records, which help businesses stay compliant in every country where they work.

Simplified payroll reporting

All payroll data, which includes employee information, currencies, and deductions, is stored in one central platform through global payroll automation. This automated system makes generating reports for internal analysis, audits, or government filings simple and less risky than manually consolidating spreadsheets from different countries.

Timely payments in local currencies or crypto

Automated global payroll systems handle multi‑currency payments while making sure employees and contractors around the world receive their pay on schedule in their local currency. Some modern platforms also support flexible payout options, such as digital wallets or crypto, to meet contractor needs and reduce transfer fees.

Tracking payments and invoices in real time

Automation platforms provide real‑time dashboards and analytics so HR and finance teams see the status of payroll runs, payment completions, and financial commitments across countries quickly. This accessibility improves payroll scheduling and helps identify issues before they affect employees.

Offering flexible withdrawal options to contractors

Global payroll systems built for distributed workforces support multiple payment methods and contractor requirements. For example, some platforms allow contractors to receive pay through bank transfer, digital wallets, or even crypto, which makes payments faster and more convenient in regions where traditional banking delays are a challenge.

Simplified tax filing

Automated payroll technology handles tax calculations according to local regulations and mostly generates or submits required tax reports directly. This technology reduces errors, helps meet filing deadlines, and avoids the risk of penalties for incorrect or late tax submissions.

Scalable payroll data management

An automated system scales with your business without increasing HR workload, such as when onboarding more employees, entering new markets, or changing work arrangements. Multinational companies expand to new locations and hire workers within the existing platform rather than building new manual processes for each region.

Dedicated customer support

Many global payroll vendors offer ongoing expert support, which helps with compliance questions, problem-solving, onboarding guidance, and updates on regulatory changes worldwide. This support is especially helpful for companies without in‑house tax or labor law expertise.

What are the risks of global payroll automation?

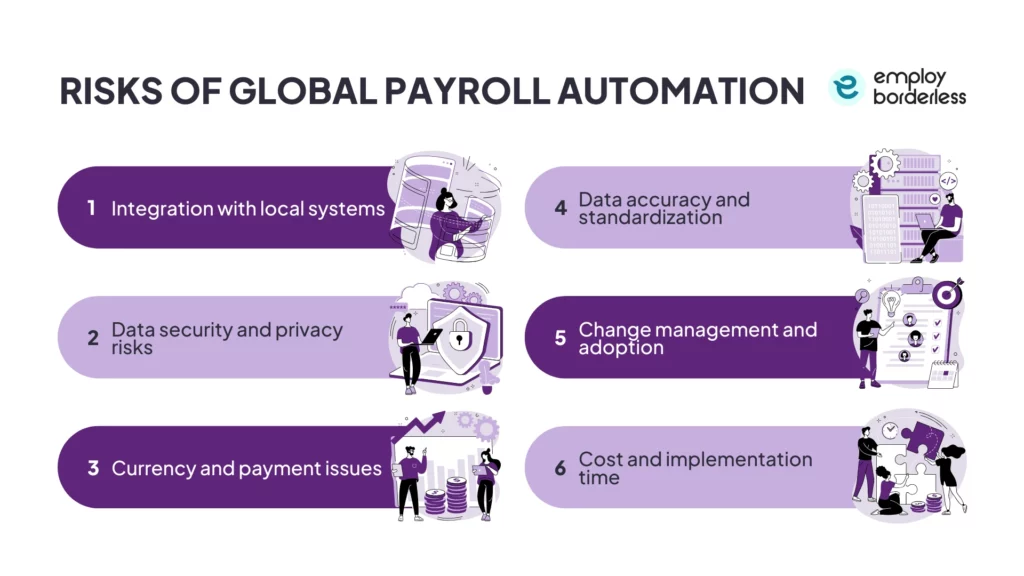

The risks of global payroll automation are integration with local systems, data security and privacy risks, currency and payment issues, data accuracy and standardization, change management and adoption, and cost and implementation time.

The risks of global payroll automation are listed below.

- Integration with local systems: Global payroll automation mostly needs to connect with local HR, timekeeping, and accounting systems. Integration becomes difficult if old or incompatible systems are used. These incompatible systems cause data errors, delays, and extra manual work to transfer or standardize information across platforms operating globally.

- Data security and privacy risks: Data security and privacy risks occur as global payroll systems store highly sensitive personal and financial data. Companies face risks of data breaches, insider threats, and non-compliance with regional privacy laws like GDPR (General Data Protection Regulation) without reliable security measures.

- Currency and payment issues: Paying global employees involves multiple currencies and cross-border transfers. Fluctuating exchange rates and international banking fees make it difficult to plan a budget and cause differences in payouts, which also affect employee trust or company expenses.

- Data accuracy and standardization: Global payroll automation creates inaccuracies in pay calculations, tax reporting, and auditing, especially if local requirements are not coordinated with the central payroll system.

- Change management and adoption: Introducing global payroll automation requires organizational change. Teams sometimes resist new processes, have difficulty learning new tools, or fail to adjust standardized practices across regions. Poor change management delays implementation and reduces system effectiveness.

- Cost and implementation time: Implementing a global automated payroll system is expensive and time-consuming. Costs include licensing, integration, training, and possibly customizing the platform for local laws. Long implementation timelines delay expected benefits and increase initial costs if not managed properly.

How to choose the right global payroll automation solution?

To choose the right global payroll automation solution, consider multi‑country payroll coverage, global compliance support, implementation and support services, integration capabilities, and payment flexibility.

Choose a global payroll automation platform that supports payroll processing in all the countries where you operate now and are planning to expand. The right global payroll solutions handle local tax laws, statutory benefits, and payroll requirements across multiple jurisdictions smoothly.

Select a solution that keeps up with changing labor laws, tax rules, reporting requirements, and statutory contributions in every country where you compensate employees. It must automatically update these rules and make sure payroll tax filings and deductions are accurate, which reduces the risk of fines or legal problems.

Evaluate the provider’s onboarding process, training, and ongoing support. Providers with strong implementation support and responsive customer service, especially across time zones, help with a smooth setup and quick issue resolution when employees face challenges.

Prioritize a global payroll solution that integrates easily with your existing HR, time-tracking, accounting, and ERP (Enterprise Resource Planning) systems. Smooth integration lowers manual data entry, reduces errors, and offers reliable data flow across platforms, which makes payroll fast and easy to report.

The right solution has to support multiple payment options and currencies to pay employees and contractors where they are located. These options include local-currency payments, support for multiple payout methods, and real-time exchange rate features. Flexible payment processing improves employee satisfaction and simplifies global financial operations.

Can global payroll automation support hybrid teams?

Yes, global payroll automation supports hybrid teams because automated, cloud-based payroll systems handle employees and contractors working from different locations. These systems also connect payroll with HR and time tools, while ensuring compliant pay no matter where hybrid workers are based.

Is global payroll automation secure and compliant with data privacy laws?

Yes, global payroll automation is secure and compliant with privacy laws when you choose a reputable provider. Modern global payroll systems use strong data protection measures such as encryption and audit records to protect sensitive payroll information. They also comply with international privacy regulations like GDPR (General Data Protection Regulation) and other regional laws to reduce legal risk and protect employee data.

How much does global payroll automation software cost?

Global payroll automation software costs $5 to $50 PEPM (Per-Employee-Per-Month), though the $5 cost is uncommon and usually related to basic or limited-feature plans. Full-featured global payroll services are priced between about $20 and $50 per employee per month, which depends on features, support, and compliance capabilities.

What compliance reporting is automated with global payroll systems?

The compliance reporting automated with global payroll systems includes statutory tax and labor reports and audit-ready documentation or logs with global payroll regulations and compliance requirements. Unified global payroll reporting combines data across regions for tax, labor law, and financial compliance reviews.

How does global payroll automation improve accuracy?

Global payroll automation improves payroll accuracy by reducing manual data entry and using built-in rules to perform accurate calculations for wages, taxes, and deductions across jurisdictions.

Are there cloud‑based global payroll automation options?

Yes, there are cloud-based global payroll automation options, such as dedicated global payroll platforms, all-in-one HR suites with payroll functionality, and specialized EOR (Employer of Record) services. Such cloud-based payroll software centralizes data, automates calculations, and ensures multi-country compliance.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations