Payroll Cost Reduction: 12 Tips for Businesses and Benefits

Robbin Schuchmann

Co-founder, Employ Borderless

Payroll costs are the total workforce compensation expenses for employers and include gross wages, bonuses, and employer-paid taxes, such as employer FICA (Federal Insurance Contributions Act) matching contributions. These expenses also involve benefits, such as health insurance and 401(k) contributions, and compliance costs, like payroll processing fees.

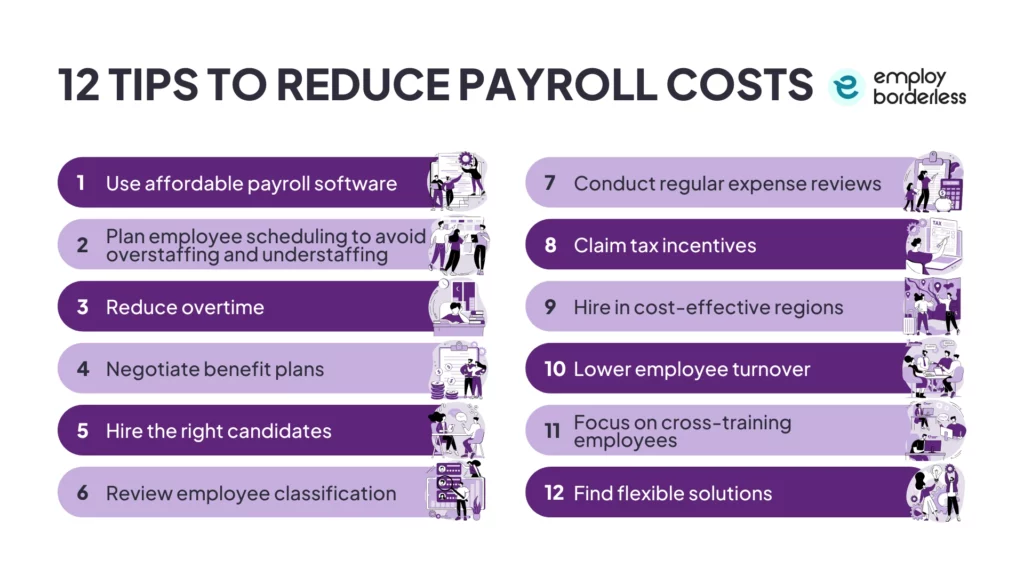

The tips for reducing payroll costs include using affordable payroll software, planning employee schedules to prevent overstaffing or understaffing, reducing overtime, negotiating benefit plans, hiring the right candidates, reviewing employee classifications, and conducting regular expense reviews. The benefits of reducing payroll costs are adjustment to economic changes, lower overall costs, increased profitability, staying competitive in the market, and better compliance and accuracy.

The 12 tips to reduce payroll costs for businesses are listed below.

- Use affordable payroll software: Investing in payroll software automates calculations, taxes, and recordkeeping, reduces manual errors, offers direct deposit, and provides downloadable pay stubs, which saves time and administrative costs.

- Plan employee scheduling to avoid overstaffing and understaffing: Match staffing with actual demand, use part-time or temporary workers for fluctuations, and strategically assign duties to improve productivity while reducing unnecessary labor expenses.

- Reduce overtime: Monitor and control overtime hours through policies and scheduling to prevent excessive pay, improve productivity, and manage payroll costs effectively.

- Negotiate benefit plans: Compare providers, gather employee feedback, and regularly review benefits to deliver cost-effective coverage that matches budget and employee priorities.

- Hire the right candidates: Maintain accurate headcount plans, select skilled employees, and use an ATS (Applicant Tracking System) to improve retention and productivity while reducing costs related to turnover.

- Review employee classification: Make sure workers are correctly classified as employees or contractors, and as salaried or hourly, to avoid back taxes, penalties, and unexpected payroll costs.

- Conduct regular expense reviews: Analyze payroll data with clear goals to identify errors, unnecessary spending, and opportunities to lower labor costs.

- Claim tax incentives: Utilize government programs like WOTC (Work Opportunity Tax Credit) and check state-specific incentives to reduce payroll taxes and maximize available savings.

- Hire in cost-effective regions: Build remote teams in locations with lower living costs and strong skill availability by offering competitive local pay to reduce payroll expenses without compromising talent.

- Lower employee turnover: Retain employees by reducing workplace stress, offering flexible schedules, PTO (Paid Time Off), and incentives, while lowering recruitment, training, and replacement costs.

- Focus on cross-training employees: Train staff in multiple roles to maintain productivity if employees leave, prevent knowledge gaps, and reduce reliance on additional hires or overtime.

- Find flexible solutions: Implement creative solutions like adjusting benefits, flexible work arrangements, performance-based pay, or remote work to improve employee satisfaction without disrupting business operations.

Use affordable payroll software

Using affordable payroll software helps reduce payroll costs by automating tasks that require extra staff, time, and manual effort. Investing in the right software removes particular roles and responsibilities by handling calculations, tax processing, and recordkeeping automatically. Issuing paper checks is costly and time-consuming due to printing, handling, and distribution, whereas ACH (Automated Clearing House) processing is inexpensive, fast, and convenient for both employers and employees. Direct deposit options are also available in payroll software with automated systems or downloadable pay stubs to simplify payroll processing and reduce administrative time and costs.

Plan employee scheduling to avoid overstaffing and understaffing

Carefully planning employee schedules by re-evaluating workforce needs helps businesses make strategic hires or reshuffle duties to improve overall productivity. Matching staffing levels with actual demand reduces unnecessary labor costs while making sure operations run smoothly. Hiring part-time or temporary staff during seasonal peaks or fluctuating workloads is a cost-effective way to meet demand without committing to high long-term payroll expenses. This temporary staffing also helps organizations control costs without affecting service quality.

Reduce overtime

Reducing overtime lowers payroll costs by making sure employees work mostly within their regular hours, and that extra pay for overtime is only used when necessary. Implementing clear policies and systems to monitor and control overtime hours helps managers track work patterns, identify when employees are approaching overtime limits, and step in before too many hours are worked. This active monitoring keeps labor costs in check and avoids unplanned overtime pay. Consistent monitoring through time-tracking tools or scheduling software also supports compliance with work-hour limits, improves productivity, and prevents unnecessary overtime from increasing your payroll budget.

Negotiate benefit plans

Negotiating benefit plans is an effective way to reduce payroll-related costs while still supporting employee satisfaction. Businesses secure more affordable coverage by comparing rates between multiple benefit providers and actively negotiating for better pricing. Gathering employee feedback helps identify the benefits that matter most, which allows employers to prioritize high-value options for the upcoming year rather than paying for underused incentives. Regularly reviewing and adjusting benefit plans makes sure they remain cost-effective, match your budget, and are responsive to changing employee needs.

Hire the right candidates

Hiring the right candidates starts with maintaining accurate headcount plans so you recruit talent that matches your operational needs and long-term goals. Productivity improves, and employee turnover decreases when the right people are hired from the start, which helps lower recruitment, training, and replacement costs related to payroll. Using an ATS (Applicant Tracking System) that integrates with your existing technology stack also simplifies recruitment, supports data-driven decisions, and helps with more strategic hiring that matches both budget and workforce planning.

Review employee classification

Reviewing employee classification is important because misclassifying workers leads to serious issues, such as back taxes, penalties, unpaid overtime, legal fees, fines, and even the loss of government contracts. Businesses have to make sure workers are correctly classified as employees or independent contractors to avoid these risks and unnecessary payroll costs. They also have to properly categorize them as salaried or hourly. Accurate classification supports compliance, prevents costly disputes, and helps maintain a predictable and well-managed payroll structure.

Conduct regular expense reviews

Conducting regular expense reviews helps organizations manage complex payroll data, as having too much information makes decision-making more difficult. Businesses more effectively identify trends, errors, and cost-reduction opportunities by reviewing payroll data against predefined objectives such as budget fluctuation, overtime usage, tax compliance, and benefit cost savings. Scheduling focused meetings to analyze payroll spending allows teams to detect unnecessary expenses, make informed adjustments, and maintain better control over overall payroll costs.

Claim tax incentives

Claiming tax incentives helps organizations lower overall payroll costs by utilizing government programs such as the WOTC (Work Opportunity Tax Credit). Such programs reward employers for hiring individuals from eligible groups. Regularly reviewing state-specific incentive programs helps employers identify additional payroll tax credits, exemptions, or reductions available. Staying informed about available incentives and applying them strategically allows businesses to maximize savings while remaining compliant with tax regulations.

Hire in cost-effective regions

Building remote teams in cost-effective regions allows businesses to reduce payroll costs without compromising on talent quality. Companies offer competitive local pay while benefiting from savings by hiring in locations where skills are strong and the cost of living is lower. This strategy provides access to a capable workforce, supports operational productivity, and reduces payroll expenses across the organization.

Lower employee turnover

Reducing employee turnover means lowering payroll costs, as replacing staff involves expenses for recruiting, hiring, and training new employees. Encouraging employees to take time off, such as vacations or long weekends, helps avoid stress, which is a major cause of employee turnover. Offering options like unpaid time off, flexible schedules, or other incentives improves retention, keeps experienced staff engaged, and maintains productivity. These options also reduce the financial impact of high turnover on payroll.

Focus on cross-training employees

Focusing on cross-training employees helps reduce payroll costs by preparing staff to handle multiple roles. The organization avoids knowledge gaps and reduces the need for costly replacements or overtime when staff are trained in multiple functions. Cross-training improves employee engagement and helps maintain business processes, best practices, and company culture. It also supports operational performance and reduces disruptions that increase payroll expenses.

Find flexible solutions

Finding flexible solutions helps reduce payroll costs without affecting operations. Businesses adjust voluntary benefits, such as health insurance, retirement, or flex spending plans, to more cost-effective options. Alternative work arrangements, like a four-day workweek, rotating schedules, or remote work, lower labor expenses while maintaining productivity. Offering performance-based pay, such as commissions, also motivates employees and matches compensation with results. Companies manage payroll accurately while keeping staff engaged and meeting operational needs through creative strategies.

What payroll costs do employers have?

The payroll costs that employers have include employee pay, employer payroll taxes, workers’ compensation insurance, employee benefits, and payroll administration.

Employee pay

Employee pay is usually the largest component of payroll costs for employers, as it includes salaries or hourly wages, bonuses, commissions, and overtime pay. Bonuses and commissions quickly increase total costs, while regular salaries and wages make up the majority of payroll expenses. Overtime pay, usually calculated at time and a half, is required for nonexempt employees who work over 40 hours per week and further raises payroll expenses if not carefully managed.

Employer payroll taxes

Employers are responsible not only for withholding taxes from employees’ paychecks but also for paying their share of payroll taxes. These include the employer portion of FICA (Social Security and Medicare), FUTA (Federal Unemployment Tax Act), SUTA (State Unemployment Tax Act), and other state-specific taxes such as paid family and medical leave premiums. For example, if an employee earns $50,000 per year, the employer pays around $3,825 in FICA, $450 in FUTA, and $250 in SUTA annually, which adds to total payroll costs.

Workers’ compensation insurance

Workers’ compensation insurance provides coverage for employees who become sick or injured on the job, and most states require businesses to include this insurance. Employers usually have coverage through a private provider or a state-operated fund, though states like North Dakota, Ohio, Washington, and Wyoming require enrollment through the state fund. Rates differ by state and industry, but the average cost is approximately $1.05 per $100 of employee wages, which makes it an important component in overall payroll expenses.

Employee benefits

Employee benefits are a part of payroll costs and play an important role in attracting and retaining talent. Common benefits include health insurance, retirement plans, EAPs (Employee Assistance Programs), life insurance, paid time off, and educational assistance. Employers spend thousands of dollars per employee each year on these offerings. For instance, small businesses pay around $6,500 annually for single health coverage and approximately $14,200 for family coverage per employee, which makes benefits another contributor to payroll expenses.

Payroll administration

Payroll administration adds to overall payroll costs and includes the expenses of managing and processing employee pay. Some businesses handle this in-house using payroll software, while others outsource it to a PEO (Professional Employer Organization) or payroll service provider. Costs include software subscriptions, service fees, and staff time spent managing payroll tasks. Tracking these expenses is important for understanding the full scope of payroll costs and providing accurate budgeting for the organization.

What are the benefits of payroll cost reduction?

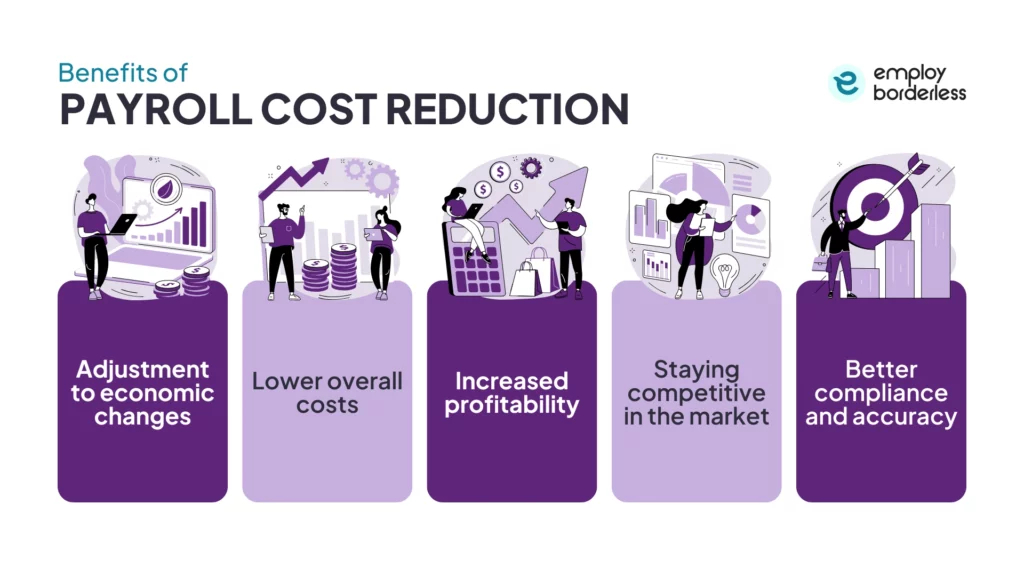

The benefits of payroll cost reduction are adjustment to economic changes, lower overall costs, increased profitability, staying competitive in the market, and better compliance and accuracy.

The benefits of payroll cost reduction are listed below.

- Adjustment to economic changes: Reducing payroll costs helps businesses stay financially stable during economic difficulties or unexpected challenges that reduce revenue. Companies adjust their cost structure with lower income and manage labor expenses to reduce costs without resorting to layoffs. This active approach allows organizations to maintain workforce stability, improve employee morale, and remain operationally and financially stable.

- Lower overall costs: Lowering payroll costs directly leads to reducing a company’s overall operating expenses, which makes the business financially stable. Organizations avoid unnecessary labor and administrative overhead by outsourcing particular functions or using payroll technology. These cost savings allow companies to budget for strategic initiatives, improve profit margins, and help make sure they stay competitive and profitable in the long term.

- Increased profitability: Reducing payroll costs lowers operating expenses without reducing revenue. A company that spends less on salaries, benefits, taxes, and overtime but earns the same sales, retains more revenue as profit rather than costs. This method effectively increases profit margins even if revenue does not grow.

- Staying competitive in the market: Decreasing payroll costs allows companies to offer products or services at competitive prices without reducing quality. This approach helps businesses attract and retain customers, earn market share, and remain strong in price-sensitive markets while maintaining operational performance.

- Better compliance and accuracy: Managing payroll costs carefully improves compliance and accuracy while making sure employees are paid correctly. This management also involves properly withholding taxes and consistently meeting legal requirements, which reduces the risk of fines and audits.

How to choose the right software for payroll cost reduction?

To choose the right software for payroll cost reduction, consider business size and setup, check your budget, confirm whether you require internal payroll expertise, decide between keeping full control or outsourcing payroll, and consider the total cost of ownership.

Choose software that matches your company’s size and structure. Small businesses mostly need simple systems, while large organizations require advanced features to handle complex payroll and multiple locations. Matching the software to your current setup means it is able to manage your specific payroll requirements.

Compare pricing models, which involve upfront fees, subscription costs, and any hidden charges. Make sure the software is within your budget while still providing the important features you need to manage payroll cost‑effectively.

Assess whether your team has the expertise to manage payroll internally. A system with extensive support and automated compliance updates is more suitable if you lack dedicated payroll knowledge or staff.

Determine if you want full control over payroll or prefer to outsource to a provider. Keeping payroll internal with software gives you direct control, while outsourcing reduces administrative burden and ensures expert handling of compliance. Choose the model that matches your company’s priorities and resources.

Evaluate more than the initial price and consider the long‑term costs of using the software, like training, updates, maintenance, and support. Evaluating the total cost helps you choose a solution that remains cost‑effective over time.

How much does payroll cost?

Payroll cost for small businesses with hourly employees usually ranges from 1.25 to 1.4 times the wages paid, which means every $100 in wages cost $125 to $140. This cost includes taxes, benefits, and fees. Most small businesses overall spend 15% to 30% of revenue on payroll, though this differs by industry, with retail around 8% and construction closer to 20%.

How much does it cost to outsource payroll?

Outsourcing payroll usually costs about $200 to $250 per employee per year, calculated as base fees plus per-employee charges depending on pay frequency. Some providers charge around $1.50 to $5 per employee per payroll run or offer a monthly per‑employee fee plus a base charge. Outsourced payroll services make it an affordable option for many businesses.

How to calculate the total payroll costs?

To calculate the total payroll costs, sum gross wages (base pay, overtime, and bonuses), employer payroll taxes (FICA, FUTA, and SUTA), benefits (health insurance, 401(k) matches), workers’ compensation, and PTO (Paid Time Off) for all employees. The formula for calculating payroll costs is adding gross pay, employer taxes, benefits, insurance, retirement, and other expenses. Using payroll software helps provide accuracy.

What are payroll costs for employees?

Payroll costs for employees include more than just their wages or salaries, overtime, and bonuses. They also involve employer payroll taxes (FICA 7.65%, unemployment 6%), benefits like health insurance (30% of total compensation), retirement matches, and other related costs like workers’ compensation and paid leave.

When should I use an EOR for global payroll?

You should use an EOR for global payroll when entering new markets without a local entity, testing expansion quickly, or handling short-term hires. It is ideal for quick onboarding and full compliance with local laws, taxes, and benefits while avoiding entity setup costs and delays.

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Ready to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations