PEO vs. employee leasing: definition, differences, similarities, benefits, and drawbacks

Robbin Schuchmann

Co-founder, Employ Borderless

A PEO (Professional Employer Organization) is an outsourcing HR model that partners with businesses to provide HR services, such as payroll processing and tax filing, recruitment and onboarding, benefits administration, and compliance support. Employee leasing is a recruitment agency that provides new workers or contractors to a client company temporarily.

The main differences between a PEO and employee leasing are employer status, employment structure, cost model, compliance and benefits, and control and liability, while the similarities that PEO and employee leasing share include HR outsourcing, payroll and tax filings, reduced administrative burden, access to expertise, and cost savings.

The major benefits of the PEO are payroll, compliance support, recruitment and onboarding, benefits administration, risk management, training and development, and employee leasing benefits, which include quick staffing, short-term employment, saving time and reducing costs, attracting and retaining top talent, and reducing employer risk.

Despite these benefits, the drawbacks of PEO are loss of control, limited customization, cost considerations, legal liability, and communication issues. Employee leasing drawbacks involve control issues, leasing costs, lack of loyalty, increased dependency, and loss of tax incentives.

What is a PEO?

A PEO is a third-party organization that allows businesses to outsource their HR functions under a co-employment agreement. This third-party HR service provider handles payroll processing, benefits administration, compliance support, and risk management on behalf of the client businesses.

How does a PEO manage HR through co-employment?

A PEO manages HR through co-employment by becoming a co-employer with the client company, and sharing responsibilities under a formal agreement known as the CSA (Client Service Agreement). The PEO becomes the employer of record for tax and legal purposes and uses its own EIN (Employer Identification Number) to file payroll taxes. The client company remains the worksite employer, responsible for managing employees’ daily work and performance.

What is employee leasing?

Employee leasing, also known as staff leasing, is an arrangement where a staffing agency hires and provides workers to a client company for a specific project or a temporary period.

How does employee leasing work?

Employee leasing works through a formal agreement between a client company and a staffing or leasing agency, which outlines the duration, costs, and responsibilities. The agency handles sourcing, screening, hiring, and onboarding, and places the employees on its own payroll. The agency is the legal employer, while the client company manages the employees’ routine tasks and workflow.

What are the differences between a PEO and employee leasing?

The differences between a PEO and employee leasing are employer status, employment structure, cost model, compliance and benefits, and control and liability.

| Features | PEO | Employee Leasing |

| Employer status | PEO shares employer status | The staff leasing agency is the sole legal employer. |

| Employment structure | The client hires employees and enters a co-employment agreement. | The agency hires and provides leased staff to clients. |

| Cost model | A percentage of the total payroll or a flat fee per employee | Markup or flat fee over wages. |

| Compliance and benefits | Provides compliance support and access to premium benefits. | Compliance and benefits only for leased workers |

| Control and liability | Client controls daily work, and PEO shares legal and HR liability | The agency controls employment terms, and the client has limited control |

Employer status

A PEO relationship involves shared employer status through co-employment, in which the PEO becomes the administrative employer, responsible for payroll, tax filings, and HR compliance. The client is the operational employer and maintains control over hiring, firing, and daily management. This shared role divides responsibilities clearly between the PEO and the client, under the CSA (Client Service Agreement).

The leasing agency holds full employer status in an employee leasing arrangement. It is solely responsible for employment contracts, legal duties, payroll taxes, and benefits. The client company simply monitors the workers but does not share in the legal employer role. The leased employees remain on the agency’s records throughout their placement in the client company.

Employment structure

Employee leasing agencies provide pre-hired, temporary, or project-specific workers to client companies. These remain employees of the leasing agency, and the client does not take long-term employment responsibility or retain them after the project ends. This model offers flexibility but limits the client’s control over hiring and workforce continuity.

The client company hires and onboards employees, and they are part of the client’s internal team. The PEO only becomes involved post-hire to handle administrative employer responsibilities, such as payroll and compliance, through a co-employment relationship.

Cost model

The cost model of the PEO is that clients pay a service fee, commonly 2 to 12% of payroll, to cover HR administration and compliance support, along with employees’ legal labor costs. The PEPM (Per Employee Per Month) model costs the business a set monthly payment for each employee, usually between $100 and $200 per month.

Employee leasing agencies charge either a flat monthly (or yearly) fee per employee, usually ranging from $40 to $160 per month, or a percentage of total payroll, between 2% and 12%, which depends on the service package and workforce size.

Compliance and benefits

A PEO offers full compliance support, which includes risk management, regulatory guidance, workers’ compensation insurance, and access to large-group benefits that are unavailable to small businesses. Employee leasing agencies manage payroll, basic compliance, and sometimes benefits, but only for the leased employees they officially employ.

Control and liability

The client maintains full control over operational decisions, from hiring, firing, to performance evaluation, in a PEO relationship, while the PEO takes HR liability for payroll, taxes, benefits, and compliance. The leasing agency controls employment-related decisions, which include hiring practices, disciplinary actions, and the terms of employment under an employee leasing arrangement. The client has limited authority over these aspects, as the agency holds full legal responsibility for the leased employees.

What are the similarities between a PEO and employee leasing?

The similarities between a PEO and employee leasing are HR outsourcing, payroll and tax filings, reduced administrative burden, access to expertise, and cost savings.

HR outsourcing

HR outsourcing means both PEO and employee leasing models transfer core HR functions from the client company to an external provider. The client assigns tasks like onboarding, HR policy management, payroll administration, benefits coordination, and compliance monitoring to the provider in both setups, which allows the organization to focus on its strategic operations, such as product development and customer service.

Payroll and tax filing

Payroll and tax filing means the PEO and the employee leasing agency file payroll taxes under their own EIN (Employer Identification Number) on behalf of the client.

The PEO acts as the employer of record for tax and payroll purposes and files taxes using its own EIN, which shifts responsibility for withholding, remitting, and reporting taxes from the client to the PEO. The payroll services provided by PEOs are integrated into the client’s HR system, which includes wage reporting, time tracking, and employee self-service.

The employee leasing also handles payroll and tax filings under its own EIN, but the structure is related to a staffing model, where employees are not part of the client’s workforce. Clients also have little access to and control over payroll procedures in an employee leasing arrangement.

Reduced administrative burden

Reduced administrative burden means businesses are able to simplify internal operations and reduce overhead costs by outsourcing PEO and employee leasing. Both models make sure complex HR functions are managed professionally, such as employee and payroll management. This strategic shift allows organizations to focus more effectively on core business objectives while relying on external providers for administrative productivity and regulatory accuracy.

Access to expertise

Access to expertise means that both PEOs and employee leasing agencies provide clients with professional support, which includes HR specialists, compliance experts, and benefits advisors. Clients benefit from professional guidance on labor laws, risk management, employee benefits, and workplace policies that are complex or costly to maintain in-house.

Cost savings

Cost savings refers to how both PEOs and employee leasing agencies help businesses reduce expenses, particularly HR-related administrative overhead, employee benefits costs, and compliance risk.

Both service models offer cost savings, particularly for small and medium-sized businesses, by lowering the requirement for HR personnel and using provider-negotiated group benefits rates. They also help avoid fines and legal penalties for poorly handled compliance and employment regulations, such as the FLSA (Fair Labor Standards Act) and EEO (Equal Employment Opportunity). Both charge systems result in operational savings, even if they differ in markup or service fee.

What are the use cases of PEO?

The use cases of PEO are SMBs (Small and Medium-Sized Businesses) and startups, growing and scaling companies, multi-state or remote operations, and regulated industries with complex compliance needs.

The use cases of PEO are listed below.

- SMBs (Small and Medium-Sized Businesses) and startups: PEOs simplify important administrative functions, like payroll, benefits, and compliance, and deliver economies of scale in insurance and labor risk management for SMBs and startups that lack dedicated HR teams. This setup allows cost savings, $1,775 per employee annually, and employers to focus on strategic growth.

- Growing and scaling companies: Growing and scaling companies use PEO to scale HR processes smoothly, which include payroll processing, benefits administration, and talent acquisition. PEOs help with standardized hiring workflows, HR systems, and compliance across departments or locations, which saves time, reduces errors, and supports quick expansion.

- Multi-state and remote operations: Businesses with operations in multiple states experience complex challenges related to payroll taxation, employment laws, and benefits administration. PEOs provide specialized expertise and ensure full legal compliance across different state jurisdictions, which simplifies workforce management for companies with remote teams operating in different locations.

- Regulated industries with complex compliance demands: Industries like healthcare, manufacturing, or professional services have strict labor laws and safety regulations. These industries benefit from PEOs’ compliance management, risk mitigation, and safety training capabilities, as they reduce legal exposure and administrative burden.

What are the use cases of employee leasing?

The use cases of employee leasing are temporary or project-based staffing, seasonal workforce demands, resolving talent shortages or recruitment challenges, and supporting startups or small businesses with limited HR capabilities.

The use cases of employee leasing are listed below.

- Temporary or project-based staffing: Employee leasing is used to meet short-term or project-specific needs. It allows client companies to quickly access skilled workers for defined durations, particularly when internal staff are unable to handle the workload or match a skill requirement. The businesses use a leasing company as this strategy provides operational flexibility with no long-term commitments.

- Seasonal workforce demands: Businesses in seasonal industries, such as retail, hospitality, logistics, and agriculture, use employee leasing to quickly scale their workforce during peak periods. Leasing agencies provide carefully selected workers and manage hiring, onboarding, and compliance, which reduces the administrative burden on the client.

- Resolving talent shortages or recruitment challenges: Companies experiencing challenges in sourcing qualified candidates, particularly for specialized roles, use employee leasing as a quick way to get access to a larger talent pool. Leasing agencies maintain networks of pre-screened professionals and allow businesses to quickly fill important positions without complex recruitment processes.

- Support for startups and small businesses with limited HR capabilities: Employee leasing supports small businesses and startups as they lack HR capabilities or administrative capacity. The leasing agency manages important functions such as recruitment, onboarding, payroll, and compliance, which help these businesses operate productively without the need to build an internal HR department.

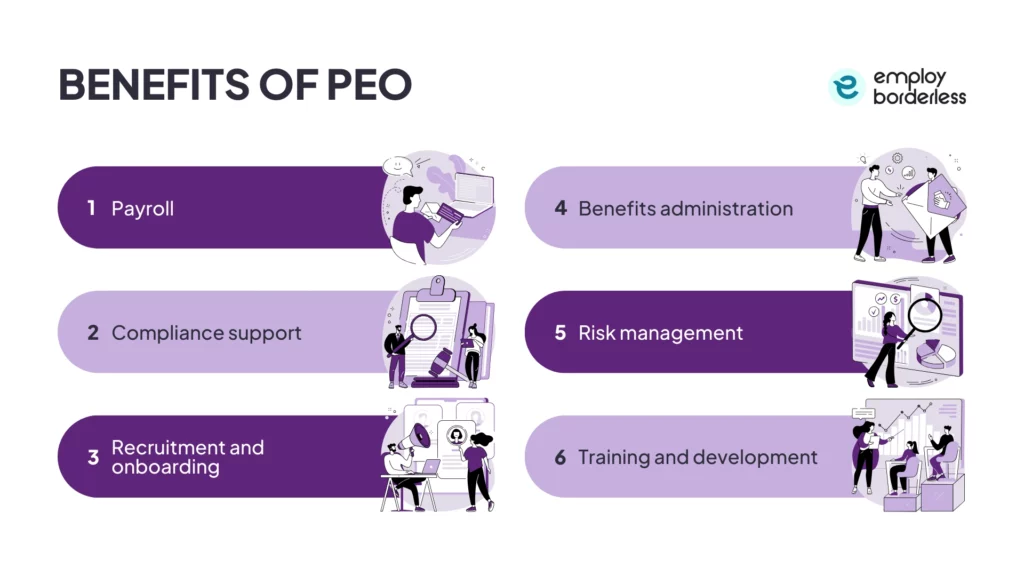

What are the benefits of PEO?

The benefits of PEO are payroll, compliance support, recruitment and onboarding, benefits administration, risk management, and training and development.

The benefits of PEO are listed below.

- Payroll: Payroll refers to the full range of payroll services provided by a PEO under a co-employment arrangement. The PEO manages the entire payroll process, which includes wage calculations (such as overtime and bonuses), tax and benefit deductions, payment distribution (direct deposit or check issuance), and detailed payroll reporting.

- Compliance support: Compliance support means PEO makes sure the businesses comply with employment laws and regulations. PEOs maintain expertise on federal, state, and local labor laws, such as the ADA (Americans with Disabilities Act), ACA (Affordable Care Act), FMLA (Family and Medical Leave Act), and FLSA (Fair Labor Standards Act). It also actively informs businesses about relevant labor law changes to reduce legal risks and penalties.

- Recruitment and onboarding: Recruitment and onboarding mean PEO helps businesses hire qualified candidates and familiarize the new employees with the client company’s policies. PEOs help craft job descriptions, post openings across platforms, screen candidates, and organize interviews. It also helps complete new hires’ paperwork, benefits enrollment, and tax forms through automated cloud-based systems like ATS (Applicant Tracking System) and CRM (Candidate Relationship Management). This reduces manual filing, errors, and improves data accuracy for the client’s business.

- Benefits administration: Benefits administration means PEOs offer client businesses access to Fortune 500-level benefit packages. This includes health and disability insurance, life, vision, and dental insurance. It also provides retirement plans like 401(k) and wellness programs to the employees of the client’s business.

- Risk management: Risk management refers to PEOs providing active strategies and support to mitigate legal, financial, workplace safety, and compliance risks under a co-employment model. PEOs manage claims related to workplace injuries, harassment, or wrongful termination, which reduces legal exposure and administrative burden.

- Training and development: PEOs support workplace learning and career growth through structured training and development programs, such as LMS (Learning Management Systems), to deliver a range of training modules, virtual sessions, workshops, and in-person seminars. These training sessions also include important compliance topics such as harassment prevention, OSHA (Occupational Safety and Health Administration), cybersecurity, and anti-discrimination. This helps employees grow into future leadership roles and feel motivated in long-term learning.

What are the benefits of employee leasing?

The benefits of employee leasing are quick staffing, short-term employment, saving time and reducing costs, attracting and retaining top talent, and reducing employer risk.

The benefits of employee leasing are listed below.

- Quick staffing: Employee leasing allows businesses to quickly fill open positions using the leasing agency’s pre-screened candidates. This reduces the need for lengthy recruitment and onboarding processes, as the agency handles sourcing, screening, and placement.

- Short-term employment: Short-term employment allows businesses with limited budgets or resources to hire workers without the need for full-time permanent employees. Employee leasing agencies provide temporary staff quickly, without long-term commitments. This allows employers to meet urgent project deadlines, handle unexpected staffing needs, and seasonal demand cost-effectively.

- Save time and reduce costs: Employee leasing agencies handle the recruiting and HR administration, so client companies save time, reduce costs, and avoid the complexities of in-house systems for payroll, tax, and benefits management. This makes employee leasing particularly beneficial for businesses requiring cost efficiency and operational flexibility.

- Attract and retain top talent: Attract and retain top talent means that employee leasing agencies provide their leased workers access to benefit packages, like health, dental, and vision insurance. This improves a small or medium-sized company’s ability to keep skilled leasing employees.

- Reduce employer risk: Leasing agencies serve as the legal employer of leased workers for payroll and tax purposes, and take responsibility for unemployment insurance and workers’ compensation. This arrangement transfers related legal and financial liabilities from the client’s business to the leasing agency in the event of claims or disputes involving those employees.

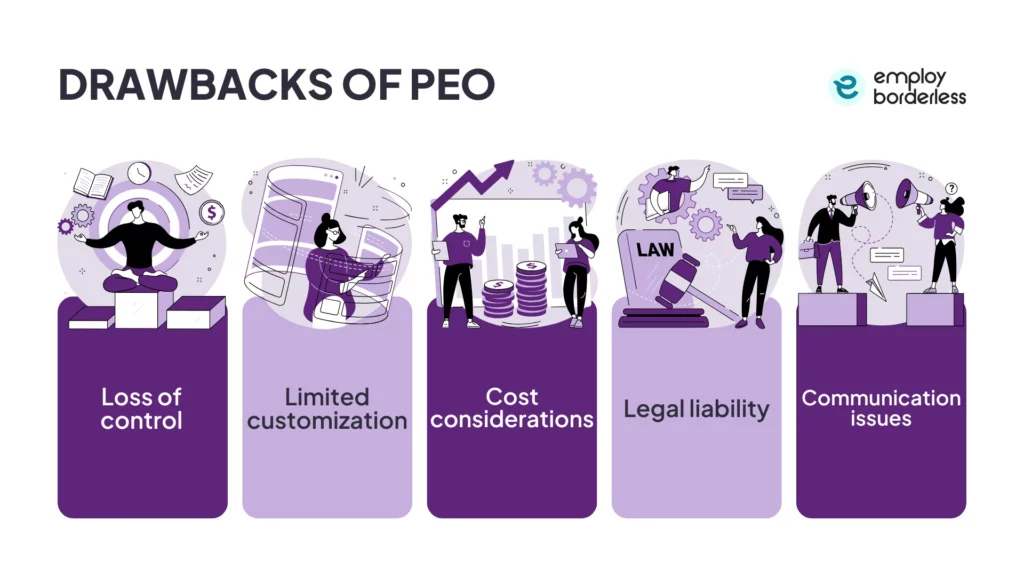

What are the drawbacks of PEO?

The drawbacks of PEO are loss of control, limited customization, cost considerations, legal liability, and communication issues.

The drawbacks of PEO are listed below.

- Loss of control: Loss of control occurs when client companies transfer HR responsibilities to a third-party provider like a PEO, which results in less influence and autonomy over HR decisions and performance management. Routine changes, such as updating payroll schedules or switching benefits providers, are processed through the PEO, which delays implementation and limits operational flexibility.

- Limited customization: Limited customization means PEOs use standardized systems and workflows, which limit the client business’s ability to customize HR procedures, benefits plans, and workplace policies. These policies do not perfectly reflect the company’s unique culture, which impacts employee morale and engagement.

- Cost considerations: Some client businesses find PEOs’ bundled services less cost-effective compared to separate, specialized HR solutions. This is because they already have in-house HR teams or existing systems in place. It is important to assess whether the bundled services match the company’s needs and if the pricing remains affordable as the business grows.

- Legal liability: Legal liability means both the PEO and the client business share legal liability under a co-employment model and are legally responsible for payroll, taxes, and workers’ compensation. The client’s business is held liable under IRS rules or employment regulations even if the PEO makes inaccurate filings, such as tax reporting or benefit administration.

- Communication issues: Communication issues occur when partnering with a PEO, as sharing benefits, policy updates, or performance matters through a third party causes confusion for both management and employees. Some PEOs work with multiple clients at the same time, which causes delays in responding to payroll inquiries, compliance questions, or HR issues.

What are the drawbacks of employee leasing?

The drawbacks of employee leasing are control issues, leasing costs, lack of loyalty, increased dependency, and loss of tax incentives.

The drawbacks of employee leasing are listed below.

- Control issues: Control issues occur when a business partners with an employee leasing agency, as the leased workers are legally employed by the agency, not the client company. Final authority over leased workers is held by the leasing agency, which prevents the client company from making independent decisions on hiring, termination, or disciplinary actions.

- Leasing costs: Leasing costs mean employee leasing providers charge fixed fees per employee per month or a percentage of payroll. These costs scale with workforce size and are applicable regardless of performance. The client is still responsible for related costs without a refund or adjustment, even if the leased employee underperforms.

- Lack of loyalty: Leased employees usually recognize their roles as temporary, without long-term integration or future commitments within the client company. They show less dedication and motivation compared to permanent staff, as they are not fully involved in the internal team.

- Increased dependency: Businesses outsource talent and HR functions to a leasing agency, which makes them highly dependent on that provider for staffing continuity and operational support. The company also depends on the leasing agency for important decisions, such as changing staffing requirements, updating benefits, or adjusting payroll. This dependency delays responses to changing business needs and restricts internal control.

- Loss of tax incentives: Loss of tax incentives means the client company loses eligibility for tax credits or benefits, such as those related to hiring, training, or payroll. These benefits are usually claimed by the agency rather than the client because the employees are legally employed by the leasing agency.

Which is the best HR solution for your business: PEO or employee leasing?

The best HR solution for your business depends on the nature of the workforce, scope of services, cost structure and budgeting, control and management, and scalability and flexibility.

PEO is best suited for businesses with permanent, long-term employees, where ongoing HR support, employee development, and complete workforce management are important. Employee leasing is the best arrangement for short-term, project-based, or seasonal staffing, particularly for businesses that need quick recruiting and temporary hires.

This third-party HR service provider is the best solution as it offers a complete HR package, which includes payroll, benefits, compliance, training, risk management, and employee development. Employee leasing focuses mainly on recruitment and staffing, and administrative HR tasks like payroll and basic compliance for leased workers are handled through the leasing agency.

A PEO charges either a percentage of the company’s total payroll, usually between 2% and 12%, or a fixed PEPM (Per-Employee-Per-Month) fee. This pricing model is scalable and includes services such as benefits administration. Employee leasing involves a higher per-employee markup, particularly for short-term placements. This becomes more expensive for businesses that require long-term staffing solutions.

The outsourcing model is the right HR solution for businesses that do not require full control over administrative functions such as payroll, benefits, and compliance. The employee leasing model is more suitable for businesses that prioritize quick access to talent and are comfortable with the leasing agency holding legal control over the leased workers.

PEOs are ideal for long-term business growth and provide HR support that scales with company expansion. They operate within a set framework of workplace policies and procedures, which limits a company’s flexibility to customize its HR practices. Employee leasing allows quick workforce adjustments, ideal for seasonal needs, and also offers flexibility in scaling staffing levels without the long-term commitments related to permanent hires.

What are the alternatives to PEO and employee leasing?

The alternatives to PEO and employee leasing are ASOs (Administrative Service Organizations), EOR (Employer of Record), HRO (Human Resources Outsourcing), and RPO (Recruitment Process Outsourcing).

ASOs (Administrative Service Organizations) provide outsourced support for administrative HR functions, such as payroll processing, benefits administration, and tax filings, while the client company remains the legal employer of record. The ASO does not enter into a co-employment relationship or share employment liability with the client business, as compared to PEO.

EOR (Employer of Record) acts as the legal employer for the client company’s workforce, handles payroll, taxes, benefits, and ensures compliance, particularly in regions where the company lacks a legal entity. The client company maintains authority over daily operations and employee management, but the EOR takes full employer-related liability.

HRO (Human Resources Outsourcing) is a customizable model where a business outsources specific HR functions, such as payroll, benefits, recruitment, or compliance, without entering a co-employment arrangement. The client has full employment liability and control, and only selects the tasks they want to outsource.

RPO (Recruitment Process Outsourcing) is a specialized service that takes responsibility for part or all of the recruitment lifecycle, which includes candidate sourcing, screening, interview coordination, offer management, and onboarding. RPO providers do not take any employer responsibilities or legal liability, and their role matches the client company’s in-house HR or hiring team.

Is a PEO the right HR solution for small businesses?

Yes, a PEO is the right solution for small businesses as they need complete support without developing a full in-house HR team. PEO for small businesses offers payroll, benefits, compliance, and risk management through a co-employment model, which allows the employer to focus on growth while making sure HR responsibilities are professionally managed and legally compliant.

Are employee leasing services legal?

Yes, employee leasing services are legal in many jurisdictions when they comply with local labor laws, hold necessary licenses or permits, and operate under proper contracts. The leasing agencies legally employ the workers and handle payroll, benefits, tax withholdings, and labor law compliance, which reduces legal risk for the businesses using these services.

How do I pay for PEO services?

To pay for PEO services, you usually receive two invoices, one for payroll (wages, taxes, benefits) issued bi-monthly, and another for PEO services fees, issued monthly. Payments are usually made through ACH (Automated Clearing House) direct debit for convenience and timely employee compensation. Check your PEO’s onboarding for specific payment setup details.

Who is the employer of a leased employee?

The employer of a leased employee is the employee leasing agency, not the client company. The leasing agency handles all HR responsibilities for payroll, tax, benefits, insurance, and legally employs and pays the leased workers.

How do I report leased employees on a tax return?

To report leased employees on a tax return, you do not file payroll taxes or issue W-2s, as they are legally employed by the leasing agency. You report payments made to the agency as a business expense, usually under contract labor or professional services on your business tax return, based on your entity type.

Are leased employees eligible for benefits?

Yes, leased employees are eligible for benefits, but only through the leasing agency that employs them, not the client company. The employee benefits include healthcare, retirement, and paid leave.

What is the difference between a PEO and traditional HR?

The difference between a PEO and traditional HR is that a PEO provides outsourced HR services, such as payroll, benefits, and compliance through a co-employment model with the client business, and shares legal responsibilities with the employer. Traditional HR is fully in-house, which means the business maintains complete control, responsibility, and liability for all HR functions.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 9 articles

PEO fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations