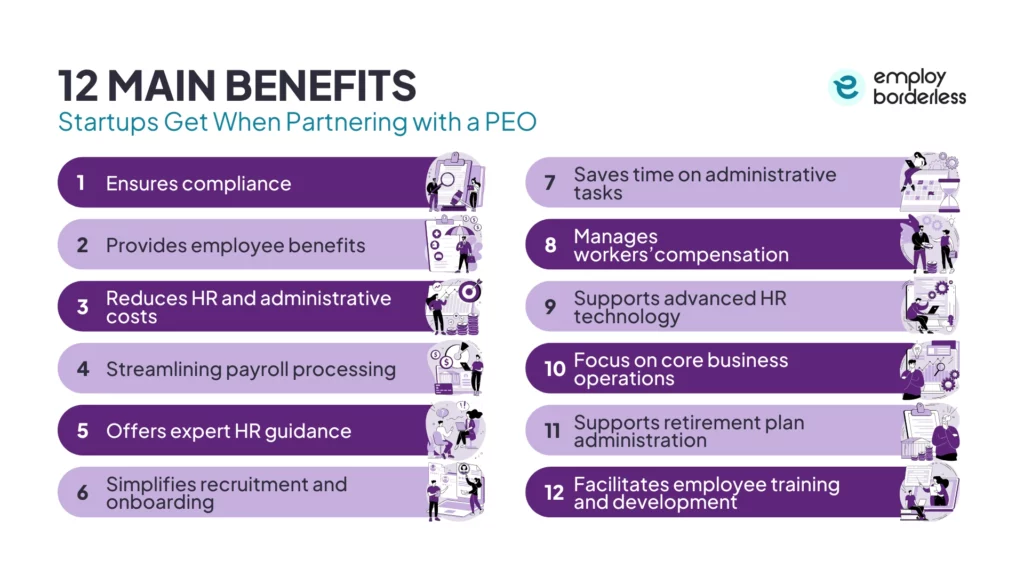

12 main benefits startups get when partnering with a PEO

Robbin Schuchmann

Co-founder, Employ Borderless

A PEO (Professional Employer Organization), also known as an outsourcing model, is a third-party organization that offers complete HR services to businesses under a co-employment agreement. A PEO helps startups grow more quickly while reducing legal and administrative risks by managing HR, payroll, benefits, and compliance.

The main benefits startups get when partnering with a PEO are ensuring compliance, providing employee benefits, reducing HR and administrative costs, streamlining payroll processing, offering expert HR guidance, simplifying recruitment and onboarding, saving time on administrative tasks, managing workers compensation programmes, supporting advanced HR technology, focusing on core business operations, supporting retirement plan administration, and facilitating employee training and development.

The 12 main benefits startups get when partnering with a PEO are listed below.

- Ensures compliance: A PEO manages HR compliance, payroll, tax filings, and labor law compliance accurately and ensures startups comply with employment laws and regulations, which reduces legal risks.

- Provides employee benefits: This third-party service provider allows startups access to high-quality employee benefit packages. These include healthcare, dental, vision, life insurance, disability coverage, wellness programs, and employer-sponsored programs.

- Reduces HR and administrative costs: PEOs use a shared services model and manage payroll, benefits, recruitment, onboarding, recordkeeping, and compliance in a centralized HR system, which reduces administrative costs for startups.

- Streamlining payroll processing: A PEO uses advanced technology to automate tasks like direct deposits, tax withholdings, deductions, wage calculations, and year-end tax returns, to make accurate filings that comply with tax laws.

- Offers expert HR guidance: This outsourcing model helps startups develop strategic HR policies that promote a culture that focuses on growth through professional advice and best practices.

- Simplifies recruitment and onboarding: PEOs simplify startup hiring and onboarding by creating job descriptions, posting openings, conducting interviews, managing background checks, and using ATS (Applicant Tracking Systems) to attract top talent.

- Saves time on administrative tasks: The PEO provides an integrated HR platform for startups that offers portals and self-service tools for employees to manage reports, update personal information, and examine pay cheques, which saves time for in-house HR staff.

- Manages workers’compensation: This third-party service provider conducts safety audits, creates safety programs, and offers training to comply with OSHA (Occupational Safety and Health Administration) and industry regulations.

- Supports advanced HR technology: PEOs use cloud-based HR systems to simplify workforce management, payroll, benefits administration, compliance, and onboarding, which allows faster operations and improved employee experience through data-driven HR decisions.

- Focus on core business operations: The PEO handles daily administrative tasks, such as employee documentation, recruitment, and onboarding, which saves resources for employers to focus on core business activities like customer engagement and financial management.

- Supports retirement plan administration: This outsourcing solution manages setup, compliance, and maintenance of 401(k) and other plans, to make sure startups meet legal requirements while offering competitive employee retirement benefits.

- Facilitates employee training and development: PEOs provide employee training programs on anti-discrimination, pay, and labor laws to promote a responsible workplace culture. They also provide continuous training on payroll tax duties and local labor laws.

1. Ensures compliance

Ensuring compliance means a PEO guarantees that companies follow all relevant labor laws, regulations, and standards.

PEOs have expert compliance teams that monitor changing labor laws, tax laws, and industry standards for accurate employee classification under FLSA (Fair Labor Standards Act) and IRS (Internal Revenue Service) regulations. They monitor HR regulations, perform risk analyses, and conduct compliance audits to protect startups from fines or lawsuits. The PEO also manages payroll processing, tax withholding, and benefits administration for industry-specific startups, which include employees working remotely or internationally.

This outsourcing model creates updated workplace HR policies and actively alerts startups to employment law and regulatory changes, which involve wage and hour laws, tax codes, and classification of contractors. Startups face regular issues related to timely tax filings, accurate employee classification, and payroll management, so a PEO handles these issues for the client to ensure compliance and reduce the risk of costly penalties and legal actions.

2. Provides employee benefits

Providing employee benefits means PEOs offer employees different non-wage compensations with their regular salary, such as health insurance and disability insurance.

PEOs combine employees from different client companies and allow startups (small and medium-sized businesses) to get access to premium employee benefit packages. These include healthcare, dental, vision, life insurance, disability coverage, wellness programs, and employer-sponsored programs.

These packages are similar to Fortune 500-level companies, and the PEO offers these benefits at an affordable insurance rate that startups are unable to negotiate on their own. This third-party service provider also gives startup employees access to retirement options, such as 401(k) plans, and handles the full benefits management lifecycle, from enrollment, claims processing, and employee enquiries to COBRA (Consolidated Omnibus Budget Reconciliation Act) administration.

3. Reduces HR and administrative costs

Reducing HR and administrative costs means spending less money on tasks like hiring, benefits administration, payroll, and compliance by partnering with a PEO.

PEOs work under a shared services model and manage payroll processing, benefits administration, recruitment and onboarding, recordkeeping, and compliance, all integrated into a single centralized HR system. This greatly reduces administrative costs as startups no longer need an internal HR staff to handle these functions.

PEO charges a fee per employee or a percentage of payroll, ranging approximately from 2 to 12%, so startups save money on operational costs, office space, software licenses, and salaries. This outsourcing model allows employers to focus on strategic company operations, such as customer needs, product development, technological advantage, and more, rather than handling time-consuming and costly administrative duties.

4. Streamlines payroll processing

Streamlined payroll processing is the process of automating wage compensation, reducing manual labor, and making sure that employees receive accurate and timely payments.

The PEO handles direct deposits, tax withholdings, deductions, and wage calculations automatically by using advanced technology that reduces delays and manual data entry. These systems also produce year-end tax returns, such as W-2s and 1099s, without requiring manual labor. PEOs guarantee accurate federal, state, and local filings, withholding, and payments, and make sure that payroll systems are always in compliance with tax laws and regulations.

These automated payroll systems also identify and fix payroll errors before they occur by regularly conducting system audits, pre-processing reviews, such as account numbers and country codes, and verifying the accuracy of transactions. This guarantees correct pay runs and reduces costly mistakes like underpayments, overpayments, or tax misfilings.

5. Offers expert HR guidance

Offering expert HR guidance means PEO gives professional advice and guidance on issues related to human resources, such as attracting and retaining top talent, employee engagement, and ensuring compliance with labor laws.

PEOs help startups create strategic HR policies according to their needs, which include creating employee handbooks, discipline policies, employee health and safety, and promoting a culture that encourages growth and unity. PEOs help startups manage hiring, leave policies, workplace safety, and anti-discrimination laws through professional advice and best practice procedures.

The PEO also offers continuous compliance support with important employment standards, which involve the EEOC (Equal Employment Opportunity Commission), FMLA (Family and Medical Leave Act), and OSHA (Occupational Safety and Health Administration). They resolve workplace issues through expert HR mediation, which includes carefully assessing employee claims, providing dispute resolution, and guaranteeing legally fair results.

6. Simplifies recruitment and onboarding

Simplifying recruitment and onboarding means PEO simplifies the process of hiring and onboarding employees for startups by using technological processes, such as ATS (Applicant Tracking System) and digital onboarding platforms.

PEOs make hiring and onboarding easier for startups by creating job descriptions, posting job openings, conducting interviews, and managing background checks. They also use ATS (Applicant Tracking Systems) to accurately filter applicants and help startups attract top talent. This reduces the workload for small teams or startups who do not have access to specialized recruiting services.

This outsourcing model uses digital systems that automate important administrative tasks to simplify the onboarding process, which includes e-signatures, document collection, benefits enrollment, 1-9 verification, and tax withholding forms. They also manage compliance training and make sure that new workers receive the important information on issues like data security, workplace harassment prevention, and health and safety laws. This helps improve the applicant experience and employer branding through PEOs’ professionally developed onboarding and recruitment processes that positively impact a startup’s reputation and employee retention.

7. Saves time on administrative tasks

Startups partner with a PEO as they handle daily administrative tasks, which saves them time to focus on core business activities, such as sales, marketing, and finance.

The PEO offers a single, integrated HR platform that gives managers and staff at startups access to portals and self-service tools. These systems allow employees to receive reports, update personal information, and examine pay cheques, which reduces the need for manual and separate systems to handle different administrative tasks.

This third-party service provider smoothly integrates time data into payroll for accurate recordkeeping and replaces spreadsheets and paper timesheets with automated timekeeping solutions, such as biometric or mobile clock-ins. The administrative burden is greatly reduced by these systems, which also monitor overtime, identify irregularities, and implement compliance guidelines.

PEOs reduce the need for standard HR documentation and handle payroll filings, workers’ compensation audits, tax returns, I-9s, benefits contracts, and compliance documentation under their own EIN (Employer Identification Number). This saves the amount of time in-house workers spend on paperwork and shifts legal liability from the company to the PEO.

8. Manages workers’ compensation programs

Managed workers’ compensation programs means a PEO takes responsibility for handling all aspects of a company’s workers’ compensation coverage, such as medical expense coverage, wage replacement, and rehabilitation services.

The employees of a startup only need to report injuries using HR software, while the PEO takes care of the paperwork, insurer communications, and early intervention plans. This guarantees accurate, compliant claim handling while reducing administrative costs. PEOs conduct safety audits, create safety programs, like emergency response planning, and offer training as part of their risk consulting and loss prevention services. These programs help startups comply with OSHA and industry-specific safety regulations.

9. Supports advanced HR technology

PEO gives startups and small businesses access to advanced, integrated software platforms that automate and simplify complex HR tasks, such as cloud-based HR systems and data analytics.

PEOs implement fully integrated, cloud-based HR systems that simplify workforce management, payroll, benefits administration, compliance, and onboarding into a single platform

for faster operations and a uniform employee experience. These tools help startups make data-driven HR decisions by offering live visibility into employee performance, engagement, retention, and compliance measures through complete analytics and reporting platforms.

PEO systems offer mobile apps and cloud-based portals to give startup managers and employees access to invoices, benefits, time-off requests, compliance documentation, and performance reviews. This improves flexibility, reduces administrative delays, and makes it easy to manage teams and startup processes productively.

10. Focus on core business operations

Focus on core business operations means the startups focus on scalability and growth by partnering with a PEO, as it manages time-consuming HR and administrative tasks, such as employee documentation, recruiting, and onboarding.

A PEO helps startups reduce internal challenges such as rising administrative costs, slow approval cycles, and compliance delays when they manage these HR functions in-house. The startup business avoids investing in costly HR teams or other staffing by outsourcing these time-consuming HR processes and paperwork. The PEO automates these functions and simplifies tax filing, compliance administration, and workers’ compensation. This allows startup employers to focus on core business activities, which include customer engagement, product development, and financial management, which is important for growth and market reach.

11. Supports retirement plan administration

A PEO offers startups access to MEPs (Multiple Employer Plans) and ARPs (Association Retirement Plans), which are forms of retirement savings plans similar to 401(k)s. This makes it possible for startups to offer retirement benefits without creating separate plans for employees as they partner with this third-party service provider. The PEO is the sponsor of these plans, so it manages continuing administration, such as nondiscrimination tests and Form 5500 filings, to ensure compliance with employment regulations.

PEOs also give startups fiduciary support, such as ERISA (Employee Retirement Income Security Act) 3(16) plan administrator, 3(21) advisor, and 3(38) investment manager. This helps startups from performing complex fiduciary responsibilities, and also avoids costly fines and legal penalties. The majority of retirement plans that PEO manages include engagement services and learning resources such as online tools, one-on-one consultations, and seminars on retirement planning. These are created to help employees understand the value of benefits, so they select suitable contributions and better investment options.

12. Facilitates employee training and development

Facilitates employee training and development means a PEO provides the tools, programs, and support to help employees learn new skills, improve performance, and grow professionally within the company.

PEOs create and conduct compliance training programs that focus on topics such as anti-discrimination, pay and hour regulations, I-9 documentation, harassment prevention, and changes to labor laws. They help companies follow legal regulations and promote a responsible workplace culture by offering informed and updated content.

This outsourcing model provides continuous training on payroll tax duties, which include withholding rates, multi-state tax laws, filings, and Form 8973 procedures to guarantee that management and employees understand and follow the most recent tax rules. This helps reduce the chances of errors and IRS fines.

PEOs provide regular training sessions or workshops related to local labor laws, such as the FMLA, FLSA, and OSHA safety standards, to make sure both the startup employer and employees follow these laws. This active strategy helps startups maintain compliance with changing regulations without the need for internal legal teams.

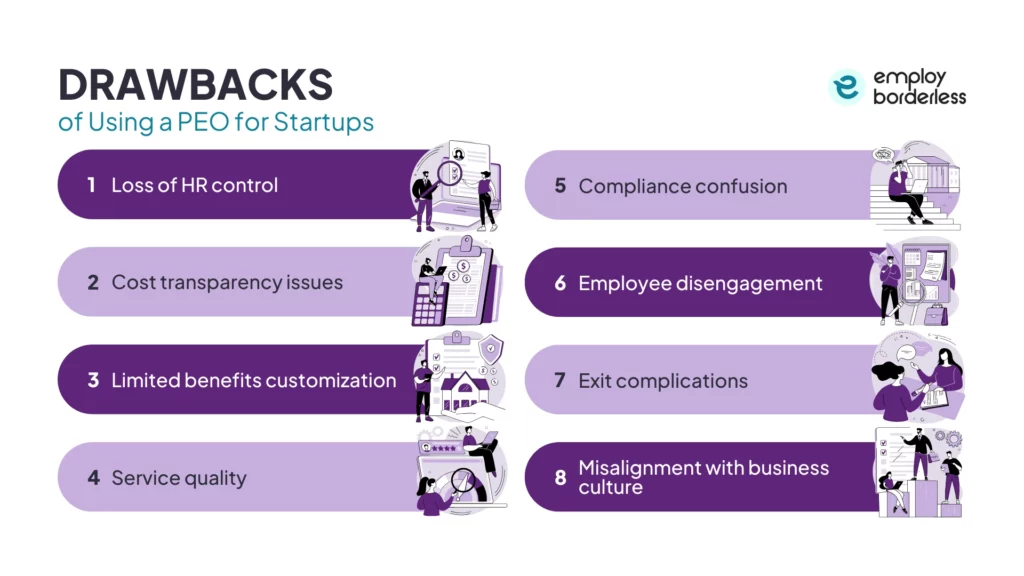

What are the drawbacks of using a PEO for startups?

The drawbacks of using a PEO for startups are loss of HR control, cost transparency issues, limited benefits customization, service quality, compliance confusion, employee disengagement, exit complications, and misalignment with business culture.

The drawbacks of using a PEO for startups are listed below.

- Loss of HR control: Loss of HR control occurs when startups enter into a co-employment agreement with a PEO to outsource important HR functions like compliance monitoring, payroll, and benefits administration. PEOs’ standardized policies sometimes do not match the startup’s HR choices and culture, which limit personalized talent strategies, reduce employee engagement, and limit the startup’s ability to adjust quickly.

- Cost transparency issues: Cost transparency issues happen when a PEO does not clearly explain the costs of each HR service. PEOs charge a fixed price per employee or a percentage of payroll, so their contracts sometimes do not make it clear which services are included in the contract. It is challenging to understand what the business is paying for or to compare with other options when extra fees like setup services, taxes, or benefits are not explained in detail.

- Limited benefits customization: Limited benefits customization means that when working with a PEO, startups have limited control over health insurance plans, retirement plans, and other benefits for their employees. PEOs already provide established benefit packages because they manage employee benefits for different businesses at the same time. This limits a startup’s ability to change these plans according to the needs of its employees. This also limits their ability to recruit talent competitively and change ideas as the business expands.

- Service quality: Service quality refers to how reliable and responsive a PEO is in delivering HR services, like payroll processing, benefits enrollment, and compliance support. Startups face challenges when partnering with a PEO, such as slow response times, difficulty contacting support teams, and failure to consider unique business requirements. PEOs do not focus on one business at a time, which sometimes causes errors in areas like payroll processing or regulatory compliance.

- Compliance confusion: Compliance confusion occurs as both the startup and PEO are co-employers, so employees are unclear about who is responsible for legal and regulatory HR needs, like labor laws, tax filings, or workplace policies. The PEO is responsible for specific legal areas, such as payroll taxes or benefits requirements, but the startups sometimes believe the PEO is handling all compliance problems. This unclear division of duties results in inaccurate filings or missed deadlines, violating industry regulations or labor laws, and penalties and fines.

- Employee disengagement: Employee disengagement means employees feel disconnected from their company because the PEO is responsible for onboarding, performance management, and policy administration. This third-party service provider manages benefits enrollment and payroll processing, so employees feel unsupported, unvalued, and less engaged with the startup’s operations. Their relationship with their employer and the business becomes less strong, which results in low morale and an increase in employee turnover rates.

- Exit complications: Exit complications mean startups sometimes face challenges when terminating their agreement with the PEO. Exiting the agreement with the outsource model is difficult due to complex contract terms, notice periods for termination, fees, and legal requirements. The startups also have to shift the operations out of a PEO arrangement, which involves replacing HR systems for payroll, benefits, compliance tasks, and securely collecting employee records. The costs of leaving the agreement also include duplicate W-2 forms, setting up new tax accounts, restarting workers’ compensation coverage, and losing access to affordable group benefits.

- Misalignment with business culture: Misalignment with business culture means PEO’s standard HR processes do not match the startup’s values and working culture. PEOs use standard procedures for workplace policies, performance reviews, and onboarding, so these one-size-fits-all systems do not accurately match the goal of the startup. Employees feel disconnected from the company’s culture, and managers also find it difficult to create a unified brand identity.

How to know if your startup is ready for a PEO partnership?

To know if your startup is ready for a PEO partnership, consider team size and growth rate, time spent on HR and administrative tasks, complexity of payroll and compliance, access to competitive employee benefits, and plans for quick scaling or recent funding.

Startups qualify for a PEO as they hire about five to ten employees and continue to expand quickly. Manual procedures take a lot of time, and HR complexity also increases at this starting phase, so a PEO helps offer scalable HR systems. This facilitates startups as they no longer need to hire a team of in-house HR staff and only focus on growth strategies.

PEOs save time and resources for employers and team members who are burdened with payroll, onboarding, benefits, and other HR administrative tasks. This third-party service provider handles these routine tasks and allows startups to spend their time on product development or market strategy.

The startup faces challenges when handling payroll, tax returns, workers’ compensation, and labor law compliance, particularly when they are working in different jurisdictions. A PEO helps offer an expert compliance team to handle these legal responsibilities and reduces legal risk and penalties.

PEOs help startups access large company-level benefits by grouping different client businesses, as they cannot independently negotiate group-rate health insurance or retirement programs. This allows startups to provide competitive benefits, such as healthcare, vision, dental, life insurance, retirement, and wellness programs, and recruit and maintain top personnel.

A PEO helps simplify onboarding, compliance setup, and benefits administration immediately as a startup receives funding or expects an increase in recruiting or market growth. It also offers HR technological platforms and professional support that allow startups to scale more quickly without the delays and costs related to establishing an internal HR team.

What types of services do PEOs offer?

The types of services that PEOs offer are payroll and tax processing, HR management, benefits administration, risk management, and compliance support. PEO services also include employee training and development, technology solutions, time and attendance tracking, and compensation.

Is a PEO worth the cost?

Yes, a PEO is worth the cost for startups and small and medium-sized businesses, depending on the business’s unique needs. A PEO client saves around $1,775 per employee annually on HR and benefits costs, and it also provides an average return on investment of around 27% per year, according to an article titled “The ROI of Using a PEO” published by the NAPEO (National Association of Professional Employer Organizations).

How is PEO support different for nonprofits compared to small businesses?

A PEO support is different for nonprofits compared to small businesses in terms of shared benefits, fundraising and donor documentation, grant and compliance, and volunteer management. PEO for nonprofits offers compliance support related to donor reporting requirements, 501(c)(3) rules, employee classification, and funding rules.

Is a PEO the right solution for small businesses?

Yes, a PEO is the right solution for small businesses that need help in managing HR functions like payroll processing, benefits administration, and compliance and risk management. PEO for small businesses allows employers to focus on growth while it handles administrative and legal responsibilities.

What is the purpose of the PEO?

The purpose of the PEO is to offer complete HR services to businesses under a co-employment model. The PEO becomes the employer of record for tax and benefit purposes while the client business maintains control over employee management and daily operations, like product development and sales, and marketing.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 9 articles

PEO fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations