9 ways nonprofit organizations can benefit from using a PEO (plus common disadvantages)

Robbin Schuchmann

Co-founder, Employ Borderless

A PEO (Professional Employer Organization), also known as an outsourcing model, is a third-party service provider that enters into a co-employment agreement. This outsourcing solution handles HR functions, such as payroll, benefits, tax filings, and compliance.

Nonprofit organizations partner with a PEO as they manage employee performance and development, simplify HR duties, and make sure payroll computations and tax withholdings comply with industry-specific regulations.

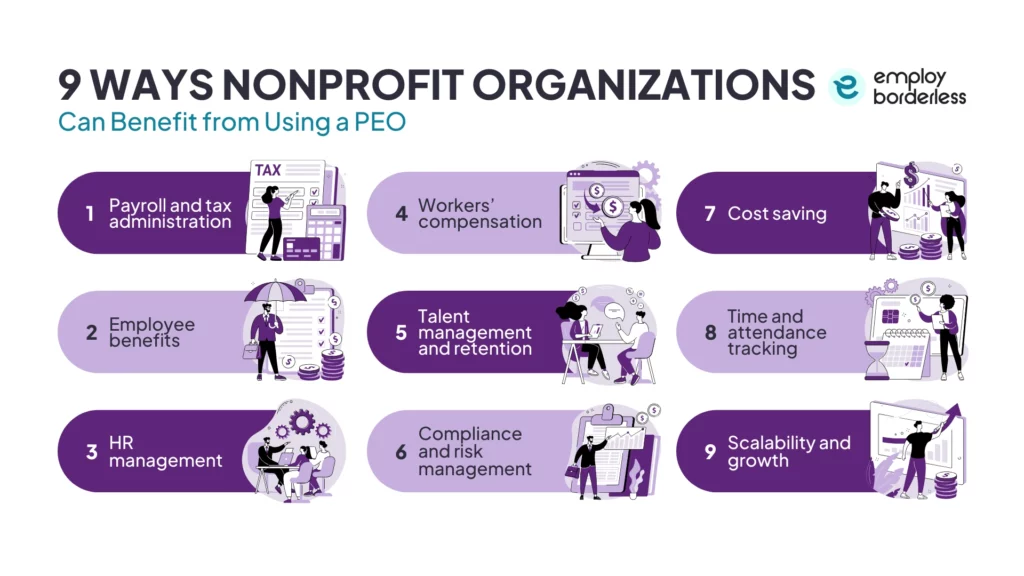

The 9 ways nonprofit organizations benefit from using a PEO are payroll and tax administration, employee benefits, HR management, workers’ compensation, talent management and retention, compliance and risk management, cost saving, time and attendance tracking, and scalability and growth.

The ways nonprofit organizations benefit from using a PEO are listed below.

- Payroll and tax administration: This outsourced solution works as a legal employer for payroll and taxation purposes in a co-employment arrangement. PEOs calculate and deduct federal income tax from employee pay cheques using Form W-4.

- Employee benefits: PEOs use their large workforce to provide charity organizations with competitive benefits, such as health insurance, vision coverage, life insurance, retirement plans, and other benefits at affordable rates.

- HR management: This third-party service provider offers nonprofits expert HR professionals who handle hiring qualified employees, onboarding, performance management, and policy creation without the need for internal hires.

- Workers’ compensation: The outsourcing model handles workers’ compensation administration, which includes proper job classification, real-time payroll tracking, and the implementation of safety and return-to-work programs.

- Talent management and retention: PEOs provide professional HR consultants to help charitable organizations with job descriptions, recruitment, and onboarding strategies to attract top talent and develop outstanding personnel to support their organization’s goals.

- Compliance and risk management: PEOs help nonprofits reduce risks as they maintain compliance with labor laws, tax laws, and 501(c)(3) standards through professional advice, employee classification, and accurate implementation of HR policies.

- Cost saving: This third-party service provider helps nonprofit staff with costly operations by managing payroll, HR compliance, and reporting. This reduces internal HR expenses and saves funds for the organization’s main activities.

- Time and attendance tracking: PEOs provide time and attendance tracking solutions that help with employee scheduling, work hour monitoring, payroll error prevention, and reporting and labor law compliance.

- Scalability and growth: PEOs facilitate scalability and growth, which allow nonprofits to manage staff in different sites, develop their operations, and stay compliant with HR solutions that adjust to organizational changes and goals.

1. Payroll and tax administration

Payroll and tax administration is the process of managing employee wages, which includes calculating gross wages, withholding and submitting taxes, reporting to authorities, and ensuring complete legal compliance.

Nonprofit organizations use PEOs’ up-to-date knowledge of complex federal, state, and local labor and tax laws. PEOs take complete responsibility and manage all aspects of payroll and tax administration, which include salary computation, direct deposit processing, and W-2 Form issuance. This reduces manual human errors and saves nonprofit organizations’ employees from handling difficult payroll and tax submission procedures.

This outsourced solution acts as the official employer under a co-employment model for payroll and tax purposes. PEOs compute and deduct federal income tax from employee pay cheques using Form W-4, and then submit these taxes to the IRS using their own EIN (Employer Identification Number).

PEOs withhold both the employee’s and employer’s portion of Social Security (6.2%), a total of 12.4%, and the Medicare portion of both (1.45%), a total of 2.9%, along with any additional Medicare tax (0.9%), according to a topic titled “Topic no. 751, Social Security and Medicare withholding rates” and “Topic no. 560, Additional Medicare tax”, published by the IRS (Internal Revenue Service).

The PEO monitors and timely submits all payroll taxes, such as unemployment and FICA (Federal Insurance Contributions Act). Nonprofit organizations partnering with a third-party service provider have reduced chances of fines or penalties for inaccurate or late tax submissions.

2. Employee benefits

Employee benefits are non-wage compensations provided to employees with their standard wages or salaries, such as health insurance and retirement plans.

PEOs use their large workforce to offer competitive benefits to charitable organizations, such as retirement plans, health insurance, dental and vision coverage, life insurance, and other benefits at low prices that are only available to big companies. Nonprofits benefit from PEO’s purchasing power, as they are unable to negotiate these insurance rates on their own.

Companies that use PEOs for employee benefits have an increased employee retention rate of 10 to 14%, according to an article titled “Professional Employer Organizations: Keeping Turnover Low and Survival High”, published by the NAPEO (National Association of Professional Employer Organizations).

Nonprofits have to be more competitive in the labor market when they offer employee benefits, so they partner with PEOs to get access to Fortune-500 level benefits at a low cost, and cut administrative fees, which also reduce employee turnover rates in their organization.

PEOs reduce legal risks for nonprofits by helping them maintain compliance with state benefit requirements, such as ERISA (Employee Retirement Income Security Act), ACA (Affordable Care Act), and COBRA (Consolidated Omnibus Budget Reconciliation Act).

3. HR management

HR (Human Resource) management means recruiting and onboarding workers, training them, compensating them, creating policies, and managing employees to improve their performance and company objectives.

Nonprofit organizations lack full-time HR staff, particularly small and medium-sized nonprofits, so PEOs provide them with expert HR professionals who manage hiring skilled candidates, onboarding, performance management, and policy development without requiring internal hires.

This third-party helps nonprofit organizations create more reliable teams by helping with job descriptions, recruitment strategies, facilitating interviews, and compliance with employment regulations and laws, which include wages and compensation, working conditions, and workplace safety.

PEOs offer centralized platforms and standardized procedures that simplify routine HR duties such as benefits enrollment, payroll, employee policy administration, time tracking, performance reviews, and compliance monitoring. This helps nonprofit employees focus on their main business objectives, such as community involvement, public benefit, fundraising events, and recruiting donors.

4. Workers’ compensation

Workers’ compensation is a form of insurance that provides wage replacement, benefits, or medical care to employees in case of work-related injuries and illnesses.

PEOs negotiate master workers’ compensation policies with affordable rates by grouping workers from different client companies, which nonprofits are unable to manage on their own. Small and medium-sized nonprofit organizations get access to lower workers’ compensation costs through this grouping, which allows them to provide legally required coverage to workers. The PEO makes sure that employees are fairly and accurately compensated in case of workplace injury.

This outsourcing model provides workers’ compensation premiums on a pay-as-you-go basis, directly connected to actual payroll, which also improves cash flow management by avoiding costly compensation payments. This third-party service provider manages every aspect of workers’ compensation administration, such as real-time payroll tracking, accurate job classification, and the implementation of safety and return-to-work programs. This also helps with the paperwork of workers’ claims, costly audit corrections, while reducing the regulatory burden for nonprofits.

The PEO improves workplace safety through active risk assessments, OSHA (Occupational Safety and Health Administration) training, and accident prevention monitoring. They handle claims to save nonprofit organizations from increasing expenses and complex legal issues. PEOs serve as the official co-employer and make sure that workers’ compensation forms and coverage comply with state regulations using their own EIN.

5. Talent management and retention

Talent management and retention mean promoting a high-performing workforce that establishes and maintains programs to attract, recruit, develop, and keep talented employees.

PEOs offer expert HR specialists to help nonprofit organizations create job descriptions, recruitment, and establish onboarding strategies, which allow them to attract and develop the skills of top talent to support their organization’s objectives. Nonprofits attract talent through PEOs’ benefit program that offers industry-specific compensation and premium benefits from their group purchasing power.

This third-party service provider increases employee engagement, loyalty, and morale because it provides career development opportunities and HR support that are only found in larger organizations. This maintains organizational expertise that is important to nonprofits while reducing turnover and the related expenses of hiring and training new employees.

6. Compliance and risk management

Compliance and risk management mean an organization complies with laws and regulations related to employment standards while identifying, assessing, and reducing any risks that affect an organization’s operational, financial, or reputational stability.

The PEO handles complex employment standards to help nonprofits with limited internal legal or HR departments or those operating in multiple countries with different compliance requirements. PEOs protect nonprofit organizations from penalties, lawsuits, and funding ineligibility by staying up to date on federal, state, and local requirements. These include wage and hour regulations, workplace safety, OSHA standards, EEOC (Equal Employment Opportunity Commission), and unemployment insurance rules to protect charitable organizations from unexpected legal actions.

PEOs manage 501(c)(3) compliance and reduce risk through proper worker classification and reliable HR practices. This outsourced solution facilitates EPLI (Employment Practices Liability Insurance), which covers legal expenses related to wrongful termination, discrimination, harassment, and other HR-related issues. PEOs become legitimate employers for compliance and payroll tax purposes by using their co-employment model. This reduces audit risk and regulatory exposure for nonprofits by managing registrations, filings, and legal duties.

This third-party service provider helps nonprofit organizations predict future problems rather than just responding to them after they occur. They regularly assess organizational and HR risks and implement policies, training courses, and responsive protocols for harassment or injury response.

7. Cost saving

Cost saving means reducing costs without affecting the products or level of service quality.

This outsourcing solution groups personnel from different nonprofit client organizations to offer affordable health insurance, retirement, and workers’ compensation rates that save these organizations money because they are unable to receive these benefits on their own. The PEO also manages insurance premiums, like workers’ compensation, in real time with payroll, which reduces the need for nonprofits to prepare initial payments. This improves budget planning and cash flow for nonprofit organizations.

This outsourcing model helps nonprofit employees with costly operations by handling payroll, HR compliance, benefits enrollment, and reporting. This reduces internal HR costs and saves resources for the organization’s core functions, such as fundraising, program delivery, and public benefit.

PEOs approximately charge a fee of 2 to 12% of payroll, but because they save money on insurance, HR, compliance, and administrative costs, this is more affordable to nonprofit organizations than maintaining dedicated human resource personnel or managing benefits independently.

8. Time and attendance tracking

Time and attendance tracking means monitoring and recording workers’ work schedules, which include start and end times, breaks, and any absences or time off, such as vacation or sick days.

PEOs provide electronic time and attendance systems to reduce errors in the recording of hours worked. These systems make sure that workers are paid on time and correctly by directly integrating with payroll processes, which saves charitable organizations from costly payroll errors and administrative difficulties.

Nonprofit organizations have to follow complex federal and state employment laws, such as those related to overtime, FMLA (Family Medical and Leave Act), and breaks. The time-tracking systems that PEOs use help keep thorough, legal records that reduce the chances of fines or audits.

Features like electronic timesheets, supervisor approvals, and employee self-service portals automate time tracking while reducing errors and the amount of time spent on handling attendance manually. Accurate attendance information helps nonprofit organizations manage absenteeism, which otherwise decreases resources and also affects the understanding of labor expenses. A PEO also offers flexible time and attendance systems that accurately record hours for volunteers, teams in different sites, and part-time employees.

Charitable organizations depend on grants and funding, so it is important to have transparent and auditable records of their hours worked. Systems for tracking time and attendance facilitate correct reporting to stakeholders and funders, which improves confidence, trust, and compliance with grant requirements.

9. Scalability and growth

Scalability means a company’s ability to grow or adjust to changing market demands or trends without requiring extra resources or reorganization. Growth means the process through which a company expands in terms of size, income, workforce, and market reach.

A PEO gives nonprofit organizations the chance to expand their operations without managing more complex administrative or human resources issues through the hiring of more employees, the launch of new programs, expanding into new sites, or managing remote employees.

The third-party service provider also provides scalable and up-to-date HR solutions that change with the nonprofit’s expansion, and allows them to focus on core objectives, such as marketing and communication, fundraising program management, and strategic planning. Nonprofits depend on PEOs’ expertise for volunteer management, payroll, compliance, employee benefits, and risk management rather than having to expand their internal HR staff or systems as the organization’s needs grow.

What are the common disadvantages of using a PEO for nonprofit organizations?

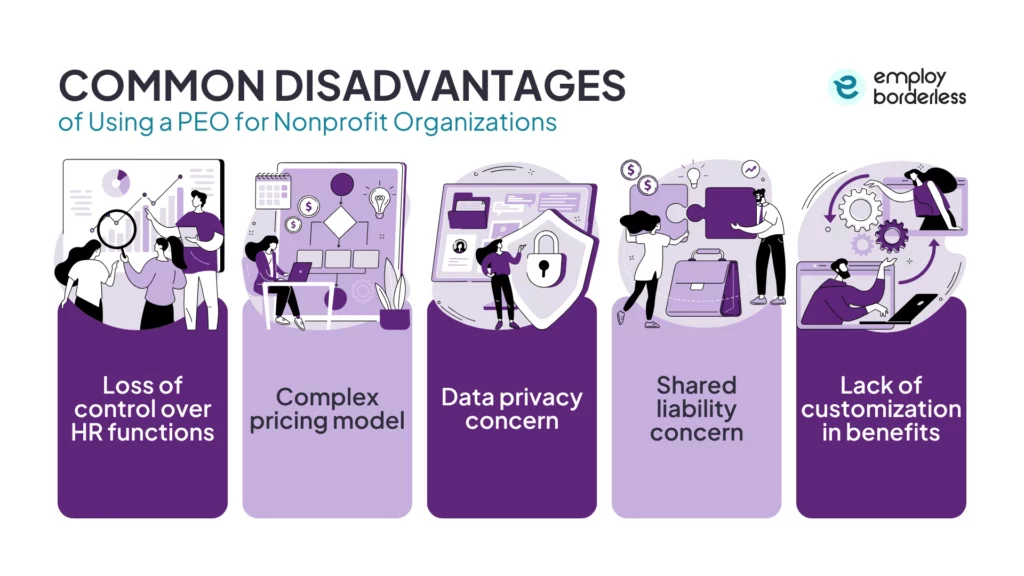

The common disadvantages of using a PEO for nonprofit organizations are loss of control over HR functions, complex pricing model, data privacy concerns, shared liability concerns, and lack of customization in benefits.

The common disadvantages of using a PEO for nonprofit organizations are listed below.

- Loss of control over HR functions: Loss of control over HR functions means an organization no longer has complete control over its human resources operations, which include hiring, managing employees, and creating policies. Nonprofits lose some control over benefit providers, HR regulations, and technological platforms when they partner with a PEO. Existing workflows are affected because small charity teams have to adjust to the PEO’s standardized HR systems and procedures, which can become challenging for organizations with limited resources.

- Complex pricing model: A complex pricing model means a structure with different pricing strategies, factors, or hidden fees that make it challenging for customers to understand the final cost. Nonprofit organizations have limited and restricted finances, so unclear or variable PEO fees, such as varying percentages of payroll or bundled service prices, sometimes cause overspending or misallocation of funds. This pricing complexity affects tight budget and financial management, which is important for grant compliance and donor trust.

- Data privacy concern: Data privacy concern means the possibility of sensitive personal or organizational data being improperly accessed, shared, stored, or misused by third parties. Data privacy regulations, such as the CCPA (California Consumer Privacy Act) and GDPR (General Data Protection Regulation), place strict requirements on nonprofits to handle and protect donor and employee data. This information includes Social Security numbers, payroll records, health information, and donor names, so the nonprofit is liable if a PEO handles data wrongly or breaches data protection law.

- Shared liability concern: Shared liability means two or more people share legal accountability for the risks, responsibilities, or financial damages. A PEO enters into a co-employment agreement with a nonprofit organization so both share legal responsibility for employment-related matters, such as payroll taxes, labor disputes, and HR compliance, when a nonprofit and a PEO enter into a co-employment arrangement. This outsourced model handles administrative and compliance duties, so the nonprofit still faces legal fines or penalties even if the PEO makes an error.

- Lack of customization in benefits: Lack of customization in benefits means the inability to customize benefit programs to match the unique requirements, budget, or values of an organization. Nonprofits that use PEOs have to select from pre-established, standardized benefit packages that the PEO has negotiated for its large labor workforce. The benefit packages sometimes do not meet the employees’ needs or the nonprofit’s goal and culture. This outsourced model also limits plan design, suppliers, and contribution techniques for nonprofit organizations.

How does the co-employment model work for nonprofits partnering with PEOs?

The co-employment model works for nonprofits partnering with PEOs in terms of employment relationship and responsibilities, control and decision making, risk and liability sharing, access to benefits, and administrative and compliance support.

The PEO and the nonprofit are co-employers for the employees. This outsourcing model becomes the employer of record for payroll, benefits, taxes, workers’ compensation, and compliance monitoring, while the nonprofit is still in charge of daily operations, such as hiring, firing, and organization culture.

Nonprofit organizations maintain direct control over core organizational activities, like social welfare and charity, team management, and strategic decisions, which involve organizational development. The PEO’s role is to provide administrative HR services, compliance assurance, and risk management support. This maintains organizational authority while reducing administrative burdens on internal employees.

The nonprofit shares liability with the third-party service provider, so if PEO makes an error or breaches legal regulations in payroll taxes or compliance, both parties are held accountable and are responsible for legal penalties and fines.

Charitable organizations get access to Fortune-500–level benefits at low costs because PEO groups nonprofit employees with its large labor workforce. The premium benefits include health insurance, retirement plans, and wellness programs.

PEOs help nonprofit organizations by handling administrative and compliance duties, such as HR, processing payroll, submitting taxes, and administering benefits, while nonprofit organizations focus on their goal. They also offer guidance on best practices, regulatory updates, and help with audits and compliance issues, which involve workplace disputes or data privacy breaches.

What factors should nonprofit organizations consider when choosing a PEO?

The factors that nonprofit organizations should consider when choosing a PEO are understanding the organization’s needs, quality of services, cost and fee transparency, technology and support, and accreditation and reputation.

Identify the organization’s needs when choosing a PEO, which include a nonprofit’s HR complexity, staff size, growth plans, and specific requirements according to the industry, like volunteer management and grant reporting. PEOs offer solutions related to these particular needs and provide compliance in multiple states, benefits negotiation, or volunteer HR support.

Review the PEO’s responsiveness and quality of service offering to assess whether they are an active and full-service partner. Check which services are included in their complete HR packages, which involve risk management, benefits, payroll, compliance, and hiring. Also, verify the quality of customer service by reviewing other clients’ feedback related to the nonprofit industry.

Carefully analyze the fee structure by understanding all expenses and confirming the final cost. PEOs usually charge a fee per employee or a percentage of payroll in addition to benefits and insurance costs. Make sure that all administrative and insurance costs are fully transparent, and examine the possible benefit savings through group purchasing.

Examine the PEO’s technological and standardized platforms for reporting, payroll processing, data management, ATS (Applicant Tracking Systems), and compliance support tools. It is important for nonprofit organizations to have access to these management reports, employee portals, and HR and benefits reporting. Make sure it provides strong data support for onboarding, volunteer, and staff reporting, and ensure compliance.

Check its accreditations like ESAC (Employer Services Assurance Corporation) accreditation, IRS-certified CPEO, and staff HR and payroll certifications. Verify its experience in the nonprofit industry and its membership in respectable organizations, like NAPEO (National Association of Professional Employer Organizations).

What are the services that PEOs provide?

The services that PEOs provide are HR consulting, recruitment, benefits administration, compliance, compensation, and time and attendance tracking. PEO services also include risk management, employee training and development, payroll management, and technology solutions.

Can nonprofits use a PEO?

Yes, nonprofits can use a PEO to outsource HR functions, compliance, payroll management, and benefits administration. PEOs use a co-employment model in which both the nonprofit organization and the outsourced model are the co-employers for the employees, but the nonprofit maintains control over daily management.

Can a PEO support volunteer and staff management in nonprofits?

Yes, a PEO supports volunteer and staff management in nonprofits, as it offers integrated systems that manage HR documents, onboarding, and policies for both paid workers and unpaid volunteers to help ensure proper classification and compliance.

Are PEO services cost-effective for nonprofits with limited budgets?

Yes, PEO services are cost-effective for nonprofits with limited budgets because PEOs group employees from multiple organizations to offer more reasonable benefits, such as health insurance and retirement plans. PEOs manage payroll, compliance, risk management, and reporting as part of a single service, so these savings reduce the need for full-time in-house HR teams.

How are PEO services different for nonprofits compared to small businesses?

PEO services are different for nonprofits compared to small businesses due to their unique financing sources, workforces, and regulatory structure. PEOs help nonprofits with 501(c)(3) requirements, grant compliance, and registration in multiple states related to their fundraising models. PEOs for small businesses focus on simplifying commercial regulations to facilitate company growth and competitiveness in the market.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 9 articles

PEO fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations