How do you record wages when using a PEO

Robbin Schuchmann

Co-founder, Employ Borderless

A PEO (Professional Employer Organization), also known as a third-party service provider, is an outsourcing model that provides HR services to businesses, which include payroll processing, benefits administration, and compliance support.

A PEO records employee wages by classifying workers, such as exempt or non-exempt, part-time or full-time employees, calculating gross pay, withholding taxes, applying benefits deductions, and making sure employees are paid accurately and on time. It also keeps detailed payroll records and manages related reporting and compliance requirements.

Companies record wages by using a PEO to save time and cost, track accurately, reduce administrative burden, provide compliance support, reduce payroll liability, and time and attendance tracking.

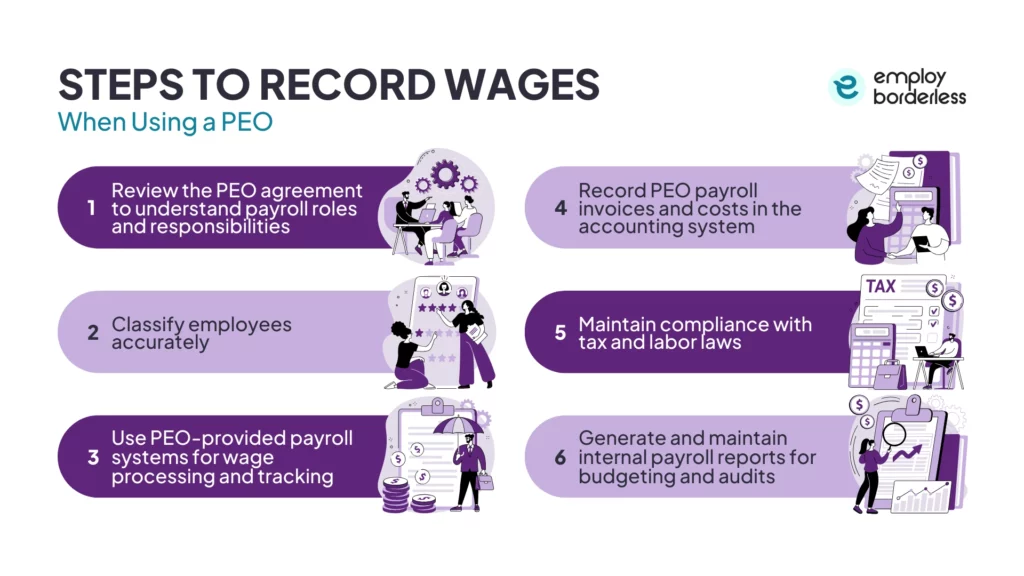

The steps to record wages when using a PEO are listed below.

- Review the PEO agreement to understand payroll roles and responsibilities: A PEO becomes the administrative employer for a client business in the PEO agreement, and handles payroll, tax filing, confidentiality, liability, and termination terms.

- Classify employees accurately: PEOs accurately classify employees for legal, tax, and benefits purposes, and guarantee correct tax withholding, overtime pay compliance, and secure workers’ compensation coverage.

- Use PEO-provided payroll systems for wage processing and tracking: Cloud-based payroll platforms like Gusto, Deel, and Onpa simplify payroll processes, ensure compliance, and simplify reporting, while reducing manual data entry and administrative tasks to improve employee engagement.

- Record PEO payroll invoices and costs in the accounting system: Businesses record payroll transactions, which include gross wages, administrative fees, tax liabilities, benefits premiums, and workers’ compensation costs, to provide accuracy and compliance with state regulations.

- Maintain compliance with tax and labor laws: The PEO helps companies comply with tax and labor regulations, such as the FLSA (Fair Labor Standards Act). It records wages accurately, handles payroll taxes, files forms, monitors labor regulations, and manages compliance alerts.

- Generate and maintain internal payroll reports for budgeting and audits: Businesses that partner with PEO benefit from detailed internal payroll reports for audits, budgeting, cash flow tracking, and administrative decision-making. Monthly, quarterly, and yearly reports help businesses with strategic planning, forecasting, and internal controls.

Review the PEO agreement to understand payroll roles and responsibilities

A PEO and the client business enter into a co-employment agreement or a client service agreement, where the PEO becomes the administrative employer and the client remains the worksite employer who manages daily operations and business strategy. The PEO agreement defines PEO’s responsibilities, which include payroll processing, benefits administration, tax filing, compliance, confidentiality, liability, and termination terms.

The PEO handles all payroll-related tasks, which include processing salaries, bonuses, commissions, deductions, and issuing pay stubs. It files employment tax returns using its own EIN (Employer Identification Number) and is responsible for submitting Forms W-2, W-3, 941, and state unemployment filings. The PEO also makes sure all filings comply with tax and labor regulations, such as the FICA (Federal Insurance Contributions Act) and FUTA (Federal Unemployment Tax Act).

The PEO maintains detailed wage records, performs accurate payroll calculations, and submits payroll taxes on time for wage accuracy and regulatory compliance. It also monitors multi-state laws and federal mandates, such as the FLSA (Fair Labor Standards Act) and the ACA (Affordable Care Act). Some PEOs are IRS-certified (CPEO) or ESAC-accredited, which provides extra support for financial compliance.

Classify employees accurately

PEOs record employee wages by accurately classifying employees for legal, tax, and benefits purposes. They also help differentiate between categories of workers, such as independent contractors and employees, exempt and non-exempt, and full-time and part-time employees. Proper classification is important for correct tax withholding, eligibility for benefits, compliance with overtime pay, and securing suitable workers’ compensation coverage.

Misclassifying, particularly exempt vs non-exempt employment, results in major classification violations, so enterprises face penalties for unpaid overtime or minimum wage, and back wages, under the FLSA (Fair Labor Standards Act).

Use PEO-provided payroll systems for wage processing and tracking

Businesses use cloud-based payroll platforms provided by PEOs to integrate them with their internal HR and payroll systems to process wages, ensure compliance, and simplify payroll reporting. These platforms include Gusto, Deel, and Onpa, which centralize time and attendance tracking, tax withholding and filing, benefits deductions, direct deposit issuance, year-end form generation like W‑2s and 1099s, and process payroll on schedule.

These cloud-based payroll platforms are regularly updated with changing tax rates, filing deadlines, and regulatory requirements, which reduces the risk of compliance errors. Integrated systems also reduce manual data entry and duplication, improve data accuracy, and reduce routine administrative tasks like coordinating payroll entries or correcting errors.

Many platforms also include self-service portals, which allow employees to independently manage benefits enrollment, view pay stubs, request time off, and access tax documents, which helps improve employee engagement.

Record PEO payroll invoices and costs in the accounting system

Businesses usually record different payroll-related transactions in their accounting systems to ensure accuracy and compliance when working with a PEO. These include the gross wages paid to employees, which show total compensation such as salaries, bonuses, and commissions. PEO administrative fees are recorded separately as service expenses related to payroll and HR support.

Payroll tax liabilities, which include FICA, FUTA, and SUTA, are recorded as liabilities and tracked until they are paid, which guarantees accurate records and cash flow management. Benefits premiums, such as health insurance and retirement contributions, are documented, supported through the PEO’s payroll system. Workers’ compensation costs, usually bundled into the PEO service agreement, have to be recorded to show the full cost of labor and maintain compliance with state regulations.

Maintain compliance with tax and labor laws

Companies maintain ongoing compliance with federal, state, and local tax and labor regulations while recording wages accurately by partnering with a PEO. The PEO calculates and withholds important payroll taxes, such as federal and state income tax, Social Security, and Medicare. It also handles timely filings of Forms 941 (quarterly), 940 (annual FUTA), W‑2s, and relevant state-specific forms.

PEOs also monitor the latest changes to labor regulations, such as minimum wage rates, overtime eligibility, and exempt vs. non‑exempt classifications, and integrate these into automated payroll processing to protect legal compliance. They also provide compliance alerts and legal updates, and manage ACA (Affordable Care Act) reporting and benefits-eligibility audits to help businesses stay compliant with changing regulatory requirements.

Generate and maintain internal payroll reports for budgeting and audits

Businesses partnering with a PEO benefit from detailed internal payroll reports that are important for internal audits, budgeting, forecasting, cash flow tracking, and administrative decision-making. It is best to create these reports on a monthly, quarterly, and yearly basis, as each payroll cycle report provides detailed insight into labor costs, which include salaries, taxes, and deductions for accurate records and informed financial planning.

Quarterly and annual reports are important for strategic planning and forecasting, which allow management to compare actual expenses against budgets and adjust projections using past trends. Regular payroll reporting also supports strong internal controls as it helps identify errors early and improves audit readiness.

What are the benefits of PEO for recording wages?

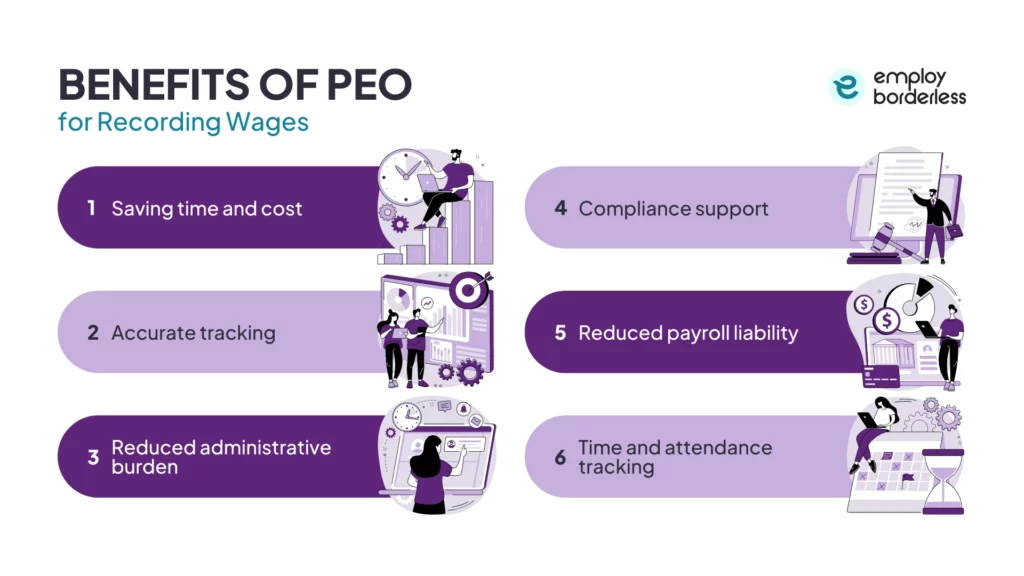

The benefits of PEO for recording wages are saving time and cost, accurate tracking, reduced administrative burden, compliance support, reduced payroll liability, and time and attendance tracking.

The benefits of PEO for recording wages are listed below.

- Saving time and cost: Businesses use PEO to record wages, which saves time as it automates payroll tasks like wage calculations, tax filings, and direct deposits. The PEO also reduces costs by reducing the need for in-house payroll staff, software, and correcting compliance errors. This allows businesses to focus on core operations like sales, marketing, and product development.

- Accurate tracking: PEOs provide accurate tracking of wages, hours worked, taxes, and deductions through automated systems. This reduces errors, supports compliance, and provides reliable payroll data for financial planning.

- Reduced administrative burden: Reduced administrative burden means PEO handles payroll processing, tax filings, benefits deductions, and compliance tasks on behalf of the client. This helps internal teams to focus on core business activities, such as operational management strategy and financial accounting.

- Compliance support: A PEO provides compliance support by staying informed with tax laws and labor regulations, such as the FLSA and FMLA, to provide accurate filings, proper employee classification, and compliance with wage and hour laws. This reduces the company’s exposure to legal risks and penalties.

- Reduced payroll liability: The PEO takes on responsibility for accurate tax withholdings, filings, and compliance, and helps businesses reduce payroll liability. This also lowers the business’s risk of IRS penalties, audits, or legal issues related to payroll errors.

- Time and attendance tracking: PEOs provide integrated time and attendance tracking systems that automatically record employee hours, reduce manual entry errors, and guarantee accurate payroll processing. This helps with compliance, overtime calculations, and productive workforce management.

What payroll duties does a PEO handle other than recording wages?

The payroll duties that a PEO handles, other than recording wages, include creating payroll policies, managing taxes, integrating benefit deductions, and handling required payroll documents.

PEO establishes when and how employees are paid, such as weekly or monthly cycles, and the methods used, like direct deposit or checks, while making sure schedules comply with labor laws. This accuracy improves employee trust in payroll and avoids legal disputes between employers and employees.

This third-party provider manages all payroll tax responsibilities, which include calculating and withholding income, Social Security, and Medicare taxes, then filing and submitting these taxes accurately to the legal authorities.

PEOs administer a range of employee benefits, from health, dental, vision, life, and disability insurance, to HSAs (Health Savings Accounts), FSAs (Flexible Spending Accounts), COBRA (Consolidated Omnibus Budget Reconciliation Act) coverage, and retirement plans such as 401(k). They handle enrollments, process life-event changes, support employees with claims, and guarantee accurate reporting of all related tax and benefits filings.

This outsourced model prepares and distributes all payroll document forms, such as W-2s, W-3s, 1099s, quarterly tax forms, like 941, unemployment filings, new-hire documentation, and year-end reports. It maintains records for audit or regulatory needs and ensures compliance with IRS and state documentation requirements, while reducing administrative burden.

What is the difference between PEO and payroll service?

The difference between PEO and payroll service is that a PEO takes on responsibility for payroll taxes and handles both filing and legal liability, while payroll service only prepares and files the forms, and the client is legally responsible for any tax issues.

Who is considered the employer for payroll tax purposes in a PEO agreement?

The PEO is considered the employer for payroll tax purposes in a PEO agreement, as it acts as the employer of record and files taxes using its own EIN (Employer Identification Number). The client remains legally liable for tax obligations and penalties, unless the PEO is IRS-certified.

What is the average cost of a PEO?

The average cost of a PEO is either a percentage of total payroll that ranges between 2% to 12%, or PEPM (Per-Employee-Per-Month), approximately $100 to $200. The PEO cost depends on the services required by the client and the business size.

What payroll forms does a PEO take care of?

The payroll forms that a PEO takes care of include IRS Form 941 (quarterly federal tax return), Form 940 (annual federal unemployment tax return), provides W-2s for employees, and often issues 1099-NEC forms for contractors.

What is the difference between EOR (Employer of Record) and PEO?

The difference between EOR and PEO is that EOR serves as the sole legal employer and handles all employment tasks, compliance, and payroll. PEO works as a co-employer and shares HR responsibilities like payroll, benefits, and compliance, while the client remains the legal employer.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 9 articles

PEO fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations