How to leave a PEO?

Robbin Schuchmann

Co-founder, Employ Borderless

A PEO (Professional Employer Organization), also known as an outsourced HR solution, is a third-party organization that provides HR services to businesses under a co-employment model. These HR services include payroll management, benefits administration, and compliance support.

The PEO works by acting as a co-employer, under the co-employment agreement, and becomes the employer of record for tax and benefit purposes on behalf of the client. The client maintains control over daily operations, like employee and performance management.

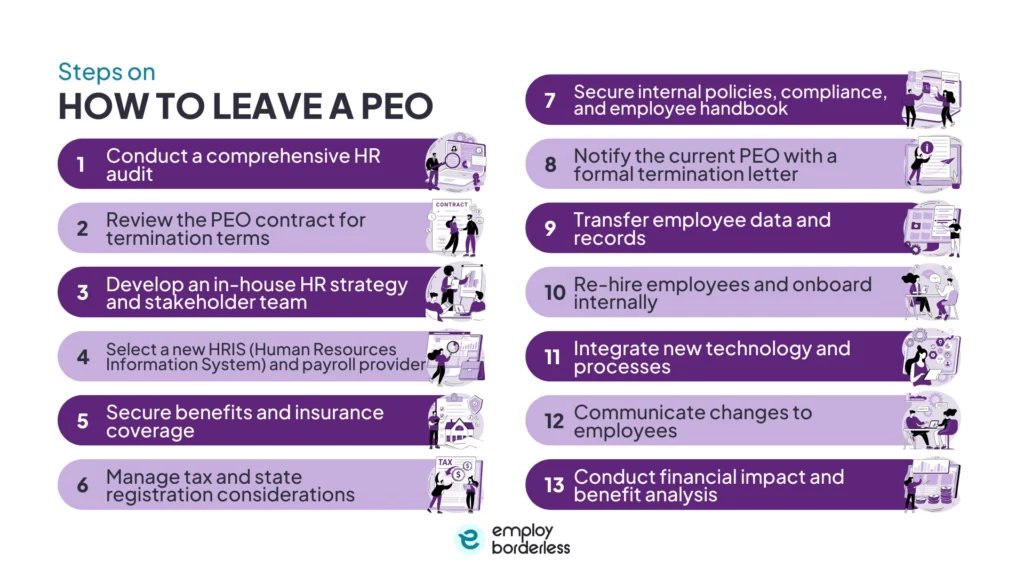

Businesses leave PEO by conducting a comprehensive HR audit, reviewing the PEO contract for termination terms, developing an in-house HR strategy and stakeholder team, selecting a new HRIS (Human Resources Information System) and payroll provider, notifying the current PEO with a formal termination letter, integrating new technology and processes, communicating changes to employees, and conducting financial impact and benefit analysis.

The steps to leave a PEO are listed below.

- Conduct a comprehensive HR audit: Conduct a comprehensive HR audit, gap analysis, and review of service levels for identifying areas for in-house transition, accurate payroll processing, and to maintain compliance.

- Review the PEO contract for termination terms: Examine the PEO contract for termination clauses, liability-related terms, and data transfer obligations to manage legal risks.

- Develop an in-house HR strategy and stakeholder team: Businesses need to redefine internal HR roles, assign team leads, establish accountability, and create a structured plan for the in-house services transition.

- Select a new HRIS (Human Resources Information System) and payroll provider: Choose HRIS and payroll providers based on scalability, cost-effectiveness, compliance support, and system integrations. Implement a correct timeline to match the transition with payroll cycles, and conduct parallel payrolls.

- Secure benefits and insurance coverage: Select a qualified benefits broker to evaluate existing plans, negotiate new options, and provide a smooth transition from PEO to new insurance. Coordinate onboarding, integrate benefits, and secure external vendors for other benefits, such as retirement plans, 401(k).

- Manage tax and state registration considerations: Register or re-activate SUTA (State Unemployment Tax Act) and withholding accounts in states where PEO filed taxes. Make sure successor employer status prevents wage-base restarts if exiting a non-certified PEO mid-year. Match filing dates and consult state unemployment agencies for guidance.

- Secure internal policies, compliance, and employee handbooks: Establish internal HR policies and compliance standards for leaving a PEO, distribute a well-structured handbook, and provide uniform guidance to employees to reduce legal errors.

- Notify the current PEO with a formal termination letter: The company needs to send a formal termination letter that outlines contract terms, effective date, data management responsibilities, and a request for transfer of payroll, benefits, and employee records to ensure contractual compliance.

- Transfer employee data and records: Request a formal data transfer protocol from PEO, make proper formatting, ensure compliance with HIPAA (Health Insurance Portability and Accountability Act) and PII (Personally Identifiable Information) standards, and test data transfers into the new platform to reduce operational disruptions.

- Re-hire employees and onboard internally: The company rehires employees under its EIN (Employer Identification Number), provides compliance training, and re-enrolls them in benefit programs to ensure compliance and employee engagement after exiting a PEO.

- Integrate new technology and processes: Employers need to implement HRIS (Human Resources Information System) and payroll platforms, conduct training, customize configuration, perform integration testing, and pilot testing to confirm system stability and accurate use.

- Communicate changes to employees: Make sure employees are informed about upcoming changes through clear communication, which includes live Q&A sessions and an HR representative who helps reduce employee confusion and maintain productivity.

- Conduct financial impact and benefit analysis: Compare PEO fees against in-house expenses to understand the cost difference. Maintain control over HR systems for long-term ROI and immediate savings, to achieve 27% ROI.

- Conduct a comprehensive HR audit

Conduct a comprehensive HR audit by documenting every service the PEO manages, such as payroll processing, benefits administration, compliance, risk management, and employee relations, to view your existing HR operations and determine what services have to be transitioned back in-house.

Perform a gap analysis to identify any missed areas like tax filings, safety reporting, or policy liabilities. Evaluate PEO dependencies, such as who owns the data, which systems are used, and clarify the full scope of HR responsibilities that require reassignment.

Review how the PEO has performed against expected service levels, which include accuracy of payroll, timeliness of compliance filing, and benefits administration. Determine who holds ownership over important data like employee records, payroll history, and tax filings.

- Review the PEO contract for termination terms

Carefully examine your PEO contract for clauses to terminate the agreement, such as the mandatory notice period, automatic renewal deadlines, and any fees or penalties for terminating the contract early. For instance, some agreements apply fees equal to many remaining months of service or restrict data access following termination.

Analyze liability-related terms and data transfer obligations in the agreement and make sure you clearly understand the clauses about compensation, liability limits, and responsibilities for transferring HR and payroll data. This helps manage possible risk and guarantee a smooth transition of data when leaving a PEO.

- Develop an in-house HR strategy and stakeholder team

Businesses need to redefine internal HR roles by assigning team leads for payroll, benefits, compliance, and employee relations when preparing to leave a PEO. Clearly define ownership of each area to manage HR functions. Create a structured plan that outlines the implementation of HR systems, tools, and policies, and the management of the services when transitioning them in-house. This plan needs to include relevant HR software selection, compliance protocols set up, and making sure that staff receive proper training to handle ongoing responsibilities accurately.

- Select a new HRIS (Human Resources Information System) and payroll provider

Choose HRIS and payroll providers based on scalability, cost-effectiveness, compliance support, and system integrations. Make sure the solution grows with the company, matches the budget, helps the company stay compliant across jurisdictions, and integrates smoothly with tools like time-tracking systems or accounting software. Set a correct implementation timeline, commonly ranging from 2 to 8 weeks, and match the transition with payroll cycles or the start of a quarter to lower operational disruption. Conduct parallel payrolls during the transition to find issues before fully switching over to a new provider.

- Secure benefits and insurance coverage

Identify benefits goals, cost control, sufficient coverage, and employee support, and use these to select a qualified benefits broker. An expert broker evaluates existing benefit plans, negotiates new health, dental, and vision options, and provides a smooth transition when replacing the coverage previously managed by the PEO.

Set up new insurance plans quickly to avoid coverage gaps, protect employee well-being, and guarantee ongoing access to medical, dental, and vision care as you leave the PEO. Coordinate the start of medical, dental, and vision benefits, as well as workers’ compensation, with your onboarding timeline. Confirm these are integrated into your HRIS (Human Resources Information System) to make benefits enrollment smooth and compliant.

Secure external vendors for other benefits like retirement plans, 401(k), COBRA (Consolidated Omnibus Budget Reconciliation Act) administration, HSAs (Health Savings Accounts), and FSAs (Flexible Spending Accounts). This confirms continuity in retirement, health savings, and compliance-related benefits as the company exits the PEO.

- Manage tax and state registration considerations

Register (or re-activate) your own SUTA (State Unemployment Tax Act) and state or local withholding accounts in every state where the PEO filed taxes on your behalf. Your HRIS vendor or an implementation partner helps with setting up IDs (Identification Numbers) and remittance schedules.

Exiting a non-certified PEO mid-year causes FICA (Federal Insurance Contributions Act), FUTA (Federal Unemployment Tax Act), and SUTA wage bases to restart under your EIN (Employer Identification Number), which results in overlap or duplicate tax payments. IRS-certified PEOs receive successor employer status, which usually prevents federal wage-base restarts, so it is important to verify state-specific rules, as they sometimes differ.

Confirm whether the PEO is responsible for filing the final and quarterly tax returns under its accounts, and establish who handles filing responsibilities under your accounts later. Match all filing dates carefully to avoid errors or duplicate submissions. Employers maintain the PEO’s unemployment insurance merit rate for the remainder of the year after termination in some states, so it is advisable to consult the state unemployment agency for guidance.

- Secure internal policies, compliance, and employee handbook

Re-establish internal HR policies and make sure to correctly document compliance standards when leaving a PEO. Recreate or update policies that define company rules and employee expectations, followed by a legal review to ensure compliance with federal, state, and local regulations.

Include important compliance areas in the employee handbook, such as wage and hour laws, workplace harassment prevention, PTO (Paid Time Off), family and medical leave, and codes of conduct. The handbook is distributed digitally through HRIS systems or the company intranet, or in printed format, to confirm accessibility and acknowledgment by all employees after it is finalized. Clear and legal policies and a well-structured handbook ensure compliance, reduce risk and liabilities, and establish uniform guidance for employees during and after leaving PEO.

- Notify the current PEO with a formal termination letter

The termination process requires creating a clear, formal letter that references the relevant contract terms, specifies the effective termination date, and outlines responsibilities for data management during the transition. The letter also includes a request for written confirmation of receipt and cooperation in transferring all important payroll, benefits, and employee records. This formal communication with the PEO ensures compliance with contractual obligations while establishing a documented record of the termination process for leaving the PEO.

- Transfer employee data and records

Request a formal data transfer protocol from your PEO, which includes employee files, payroll history, tax documents, and benefits information. Make sure the PEO provides all important HR and financial records in a structured manner for system migration.

Secure proper data formatting in line with your new HRIS (Human Resources Information System) or payroll platform requirements, to verify that records are complete and accurate before transfer. Ensure compliance with HIPAA (Health Insurance Portability and Accountability Act) and PII (Personally Identifiable Information) standards by using encrypted transfer methods, restricted access, and audit trails.

Confirm system readiness by testing data transfers into the new platform to lower operational disruptions during payroll cycles and benefits administration. Establish a checklist to track the retrieval of all important records, which reduces the risk of gaps or compliance issues during and after leaving the PEO.

- Re-hire employees and onboard internally

The company has to formally re-hire employees under its own EIN (Employer Identification Number) after employees are transitioned out of the PEO. This process usually involves new Form I-9s completion, updated offer letters issuance, and structured onboarding workflows set up within the HRIS. Provide required compliance training, such as harassment prevention and workplace safety, to ensure compliance with legal and company standards as part of onboarding again.

Employees also need to be re-enrolled in benefit programs such as health, dental, and retirement plans, with system onboarding support provided to confirm smooth access to payroll, timekeeping, and HR portals. These steps help maintain compliance, improve employee engagement, and build strong connections with organizational systems after leaving the PEO.

- Integrate new technology and processes

Employers need to implement their selected HRIS (Human Resources Information System) and payroll platforms accurately after leaving the PEO. This includes conducting structured training sessions for HR staff and managers to make sure they understand system use, payroll functions, reporting, and compliance features. Customize the role-based system access according to responsibilities, such as payroll administrators, benefits managers, and supervisors. Integration testing verifies payroll accuracy, benefits enrollment, and timekeeping workflows, which reduces the risk of workflow disruptions before launching the HRIS system. Pilot testing in phases helps businesses make sure the HRIS is stable and easy to use.

- Communicate changes to employees

Keep employees informed with clear memos or emails detailing the upcoming changes by hosting live Q&A sessions or webinars to help clarify expectations. Assign a specific HR representative or team for any employee questions to explain how benefits plans, payroll processing, and access to HR systems are changing and outline important dates clearly. Regular updates help employees reduce confusion and keep the workforce aligned and productive.

- Conduct financial impact and benefit analysis

Develop a projected cost difference by comparing current PEO fees, which include administrative charges and bundled service costs, against anticipated in-house expenses for payroll, benefits, compliance, and HR staffing to understand the financial impact of leaving the PEO. Consider the benefits of maintaining control over your HR systems, which lowers legal risks and achieves long-term ROI (Return On Investment). Industry data shows businesses using PEOs average 27% ROI, while leaving a PEO delivers significant immediate savings.

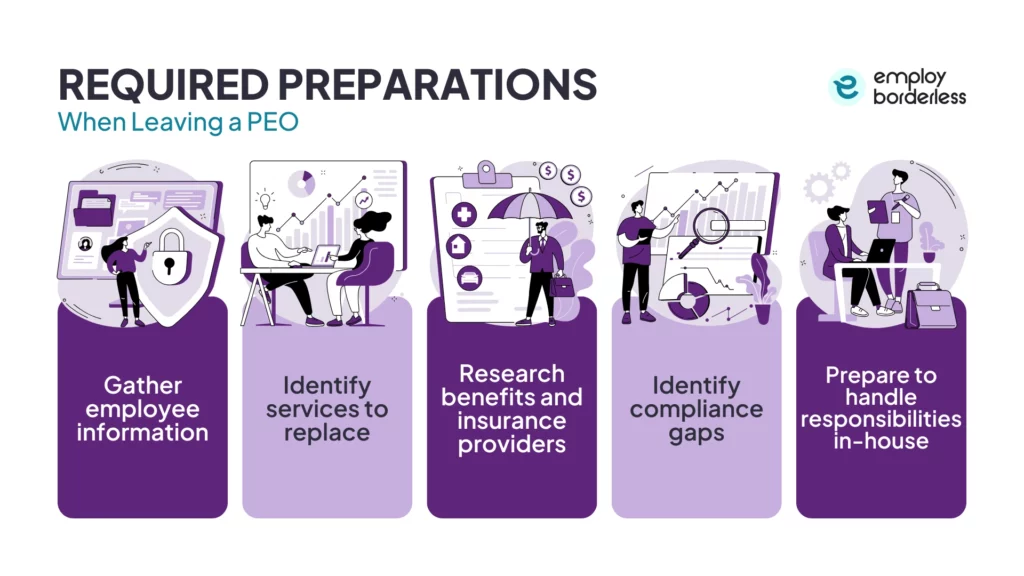

What preparations are required when leaving a PEO arrangement?

The preparations that are required when leaving a PEO arrangement include gathering employee information, identifying services to replace, researching benefits and insurance providers, identifying compliance gaps, and preparing to handle responsibilities in-house.

- Gather employee information

Gathering employee information includes personal details, job titles, salaries, benefits enrollments, tax withholdings, and any employment agreements. Accurate and up-to-date information is important for a smooth exit of payroll, benefits, and HR responsibilities from the PEO to in-house management or a new service provider. Organizations prevent administrative errors, maintain compliance with labor regulations, such as FLSA (Fair Labor Standards Act) and FMLA (Family and Medical Leave Act), and provide employees with uninterrupted access to benefits and payroll services when leaving the PEO by collecting this data early.

- Identify services to replace

Evaluate the HR functions previously managed by the PEO that your organization needs to handle or outsource when leaving a PEO. This third-party service provider usually handles a complete set of HR services, which include payroll administration, employee benefits management, tax withholding, compliance training, and HR support. Businesses need to assess each of these services to determine whether to manage them internally, engage specialized service providers, or implement alternative solutions to confirm a smooth transition.

- Research benefits and insurance providers

Researching benefits and insurance providers involves assessing employee needs for health, dental, vision, life insurance, and retirement plans. Conduct surveys or focus groups to make sure new offerings match employee expectations and support overall satisfaction. Evaluate possible insurance carriers and providers based on coverage options, cost competitiveness, and reputation. Engage a licensed benefits broker as they help businesses select suitable providers and plans, negotiate suitable terms, and also customize the offerings according to the company’s size and industry.

- Identify compliance gaps

Identify compliance gaps when leaving a PEO, as the company is responsible for HR functions and legal obligations, which include reviewing state registrations, tax accounts, employee classification, like exempt or non-exempt, and workplace safety regulations, such as OSHA (Occupational Safety and Health Insurance). Assess the benefits plan compliance and employee data privacy to meet ERISA (Employee Retirement Income Security Act) and HIPAA (Health Insurance Portability and Accountability Act) requirements. Active management of these areas reduces legal risks, ensures regulatory compliance, and helps businesses exit smoothly from the PEO.

- Prepare to handle responsibilities in-house

Preparing to handle responsibilities in-house means companies need to establish roles and assign team leads for payroll, benefits administration, compliance, and employee relations when leaving a PEO. They also need to develop structured workflows for recruiting, onboarding, performance management, and payroll processing. Businesses need to implement HRIS and payroll systems that integrate with operations, train internal teams, and secure access to updated policies. A clear division of responsibilities in-house not only guarantees smooth HR operations and legal compliance but also improves accountability, decision-making, and employee satisfaction.

What are the benefits of leaving a PEO?

The benefits of leaving a PEO are cost savings and control, customization and flexibility, compliance and risk management control, scalability and growth alignment, improved data privacy and security, and better employee experience.

The advantages of leaving a PEO are listed below.

- Cost savings: Leaving a PEO results in cost savings as PEOs charge administrative fees based on a percentage of payroll, which grows as the workforce expands. Companies that do not pay these overhead fees get greater transparency in HR expenses and distribute resources more accurately to functions that directly support business growth.

- Customization and flexibility: Customization and flexibility mean companies develop employee benefits packages, implement HR policies that match their unique culture, and adopt technology solutions according to their operations rather than PEO’s standardized solutions. This flexibility not only improves employee satisfaction but also supports the company’s strategic objectives by creating a more personalized and responsive workplace when leaving a PEO.

- Compliance and risk management control: PEOs help businesses with compliance tasks such as payroll tax filings, benefits plan administration, and workplace safety reporting, but they do not mitigate all compliance risks. For example, if a PEO inaccurately handles payroll tax filings, the company remains liable due to the co-employment arrangement. Leaving a PEO gives the company direct control over compliance and risk management, as it follows employment regulations, such as the FLSA (Fair Labor Standards Act), and reduces legal or financial issues.

- Scalability and growth alignment: Exiting a PEO improves business scalability by avoiding rising per-employee fees and allows custom HR solutions rather than one-size-fits-all processes. Companies align HR with growth strategies, which include market development and strategic partnerships, and culture more directly. This flexibility also makes sure HR advances with business expansion.

- Improved data privacy and security: Leaving this outsourced HR model improves data privacy and security as companies have direct control over sensitive employee information, rather than relying on a third party’s systems and policies. Organizations then also implement stronger, customized security measures, like SSL encryption and password protocols, that match their standards. This reduces risks related to how a PEO stores or shares data and builds greater accountability and trust by handling and keeping information in-house.

- Better employee experience: Better employee experience means companies that exit a PEO provide employees with a more personalized, employee-centered HR approach without the restrictions of one-size-fits-all policies. They also have the flexibility to design benefits, policies, and engagement initiatives that directly show the company’s values and employees’ needs. This shift helps create stronger connections, clearer communication, and a feeling that employees are valued, rather than working under the PEO’s group of clients.

What are the disadvantages of leaving a PEO?

The disadvantages of leaving a PEO are loss of administrative convenience, facing exit challenges, higher benefits and insurance costs, reduced transparency and more complexity, continued compliance liability, and challenges in restoring internal HR capabilities.

The disadvantages of leaving a PEO are listed below.

- Loss of administrative convenience: Loss of administrative convenience means companies that leave the PEO have to handle all HR functions, from payroll and employee benefits to compliance and workers’ compensation. They also have to engage multiple vendors and systems, which creates complexity and increases internal workload for the staff. These administrative challenges, particularly on smaller teams, reduce productivity and make the employees lose focus on main business activities such as sales and marketing.

- Facing exit challenges: Exiting a PEO includes complex contract terms such as required notice periods and early termination fees. The company needs to develop a detailed transition plan and rebuild in-house HR capabilities from payroll and benefits to compliance, which involves new vendors or systems. Businesses also need to plan their PEO exit around tax year periods to avoid complexities such as tax restarts or duplicate filings.

- Higher benefits and insurance costs: Leaving this third-party service provider results in higher benefits and insurance costs, as the grouped purchasing power of a PEO usually secures more competitive rates. Companies lose access to these group discounts and experience premiums and administrative expenses, particularly for health coverage, workers’ compensation, and other benefits, when they manage these benefits independently.

- Reduced transparency and greater complexity: Reduced transparency and greater complexity occur because PEOs previously managed employee benefits and provided access to vendors, so businesses lose detailed insight into costs, such as spending on benefits and fees after exiting. They also have to coordinate multiple vendors and systems on their own, which adds operational complexity and limits transparency in internal processes, such as payroll management, benefits administration, and compliance reporting.

- Continued compliance liability: Companies have to manage full compliance responsibility in areas such as payroll tax filings, employee classification, workplace safety reporting, and compliance with labor laws, without the PEO’s support after exiting. This also includes compliance with benefits regulations, which include the ACA (Affordable Care Act) and ERISA (Employee Retirement Income Security Act). Small errors or negligence in any regulation result in penalties, audits, and damage to both the company’s reputation and employee trust.

- Challenges in restoring internal HR capabilities: Exiting a PEO creates challenges in restoring internal HR capabilities, as companies have to hire HR staff, set up payroll and benefits systems, and build policies again. This transition is costly, time-consuming, and increases HR burden, particularly for smaller businesses.

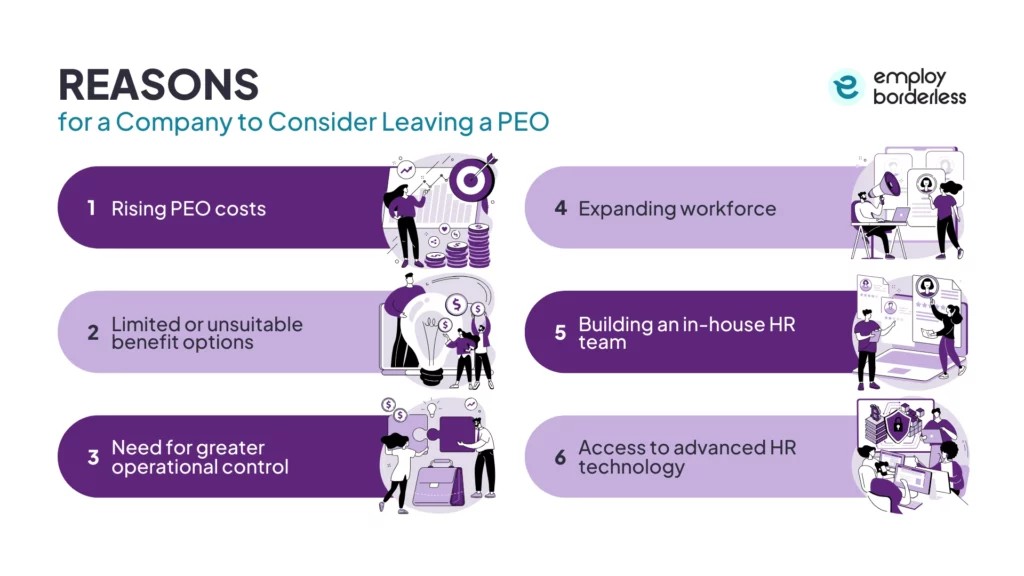

What are the reasons for a company to consider leaving a PEO?

The reasons for a company to consider leaving a PEO include rising PEO costs, limited or unsuitable benefit options, need for greater operational control, expanding workforce, building an in-house HR team, and access to advanced HR technology.

Rising PEO costs

Rising PEO costs occur because PEO fees are based on payroll or the number of employees, so expenses grow as the company expands. These fees exceed the cost of building an in-house HR function for fast-growing businesses, which makes a PEO less cost-effective over time. PEO pricing also lacks transparency, and clients sometimes face unexpected costs, such as added service fees or inflated administrative charges, that are unclear at the start of the partnership. These unexpected costs cause businesses to reconsider their PEO arrangements because the fees exceed the value provided and impact the budget as the business grows.

Limited or unsuitable benefit options

Limited or unsuitable benefit options mean businesses are restricted to pre-selected benefit plans and providers, which limits their ability to customize offerings to employee needs or company culture when working with a PEO. This one-size-fits-all structure results in gaps in coverage or unsuitable benefits, particularly as the organization grows or develops unique requirements. Exiting a PEO brings the flexibility to select benefits independently and design more relevant, competitive benefit packages according to the company culture.

Need for greater operational control

Need for greater operational control means that as businesses grow, their HR and leadership teams require more control than a PEO’s standardized system allows. Exiting a PEO allows companies to customize HR procedures and systems according to their unique culture, strategic goals, and operational needs, rather than conforming to strict, one-size-fits-all structures. It also helps organizations maintain full authority over decisions around benefits, vendors, and HR workflows, which improves flexibility and autonomy in managing workforce operations, such as employee and performance management.

Expanding workforce

An expanding workforce means that as companies grow and hire more employees, their HR needs become more complex, which a PEO’s standardized model does not fully meet. The PEOs’ established systems lack the flexibility required by larger teams to meet unique policies, compliance requirements, and cultural differences. Exiting a PEO also allows businesses to rebuild HR processes according to the company’s values to support a growing and expanded workforce.

Building an in-house HR team

Building an in-house HR team means businesses can manage HR independently as they grow while working with a PEO. Organizations start hiring experienced HR professionals and implement systems like HRIS (Human Resources Information System) to support strategic initiatives, such as leadership development, performance management, and employee engagement. Transitioning to an in-house HR team allows companies to adjust HR strategies to their values and goals, rather than relying on the standardized solutions offered by PEOs.

Access to advanced HR technology

Access to advanced HR technology means PEOs offer cloud-based platforms for payroll, benefits, and compliance, but these systems are standardized and sometimes do not integrate smoothly with a company’s existing tools or scale with its growth. Exiting a PEO and switching to an HRIS (Human Resources Information System) allows businesses to select and implement technology according to their needs, which offers greater flexibility, customization, and control over HR processes, such as performance management and workplace engagement.

What changes occur after exiting a PEO?

The changes that occur after exiting a PEO are data management and compliance responsibilities, implementation of independent HR systems, tax implications, transition of employee benefits, and improved control over HR functions.

Businesses have to securely transfer and manage employee data after exiting the PEO, which includes payroll records and benefits information, and take full responsibility for compliance with federal and state employment laws, such as the ADA (Americans with Disabilities Act) and the FLSA (Fair Labor Standards Act).

Companies are responsible for selecting and managing their own HR technology platforms after leaving the PEO, such as payroll systems and HRIS (Human Resources Information System), which involve extra costs and administrative efforts.

Exiting a PEO, particularly mid-year, results in tax complications for the business, such as the need to get new EINs (Employer Identification Numbers) and the resetting of wage bases for unemployment taxes, which involve FUTA (Federal Unemployment Tax Act) and SUTA (State Unemployment Tax Act).

Companies have to manage the transition of employee benefits plans after leaving a PEO, which includes selecting new providers and confirming ongoing insurance coverage for a better employee experience. The businesses also maintain full autonomy over HR policies, benefits, and employee relations when they leave a PEO, which helps them customize these packages according to their organizational culture and company goals.

How to manage employee benefits when leaving a PEO?

To manage employee benefits when leaving a PEO, establish new employee benefit plans, compare market options, select plans according to employee needs, and ensure compliance with COBRA (Consolidated Omnibus Budget Reconciliation Act) requirements to offer ongoing health coverage options.

How long does it take to exit a PEO?

It takes four to six months to exit a PEO, and it depends on company size and complexity. Exiting a PEO requires careful planning, employee data transfer, benefits transition, and compliance management.

Why switch to a new PEO or a payroll service?

Switch to a new PEO or a payroll service as businesses receive support for growth, improved cost-effectiveness, and service quality from a new PEO or payroll service provider. A new provider handles complex payroll, automates HR processes, and offers HR expertise, which helps companies match HR management with their operational needs and strategic goals.

How can you verify that the provider is a certified PEO?

You can verify that the provider is a certified PEO by checking its IRS certification or accreditation by ESAC (Employer Services Assurance Corporation). Certified PEOs meet financial, operational, and ethical standards, which confirms reliability and compliance with industry regulations.

What compliance tasks does a company handle after leaving a PEO?

The compliance tasks that a company handles after leaving a PEO are federal and payroll taxes, employee benefits compliance, labor laws compliance, which include wage and overtime, and PTO (Paid Time Off), workers’ compensation, unemployment insurance filings, and OSHA (Occupational Safety and Health Act) regulation.

Does a PEO replace HR?

No, a PEO does not replace HR, but provides outsourced HR services and helps the HR department by handling administrative tasks. PEO in HR handles payroll, benefits enrollment, and compliance support, which allows the internal team to focus on business strategy, employee engagement, and promoting a productive workplace culture.

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Ready to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations