PEO Agreement: Definition, Components, Benefits, Drawbacks, and Exit Conditions

Robbin Schuchmann

Co-founder, Employ Borderless

A PEO agreement is a formal contract that establishes how a business and a professional employer organization share responsibilities for managing HR, payroll, benefits, and compliance. The purpose of the PEO agreement is to define the terms of the co-employment relationship, which include details of each party’s roles, responsibilities, service scope, liabilities, and the conditions under which services are provided or discontinued.

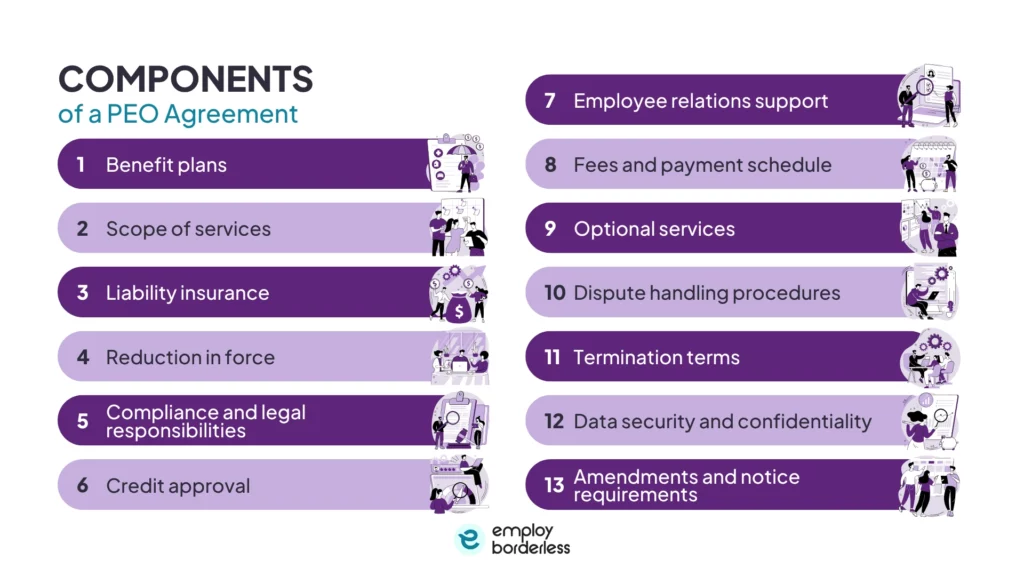

The main components of a PEO agreement are benefit plans, scope of services, liability insurance, reduction in force, compliance and legal responsibilities, credit approval, employee relations support, dispute handling procedures, termination terms, and amendments and notice requirements. The major benefits of signing a PEO agreement include clarity and transparency, focus on core business activities, employee benefits, compliance support, improved employee experience, and risk mitigation.

Despite these benefits, there are also some drawbacks of a PEO agreement, which are hidden fees, lack of clear exit terms, communication challenges, integration issues, and data ownership and accessibility issues. The conditions for ending the PEO agreement are notice periods, termination fees, transition of responsibilities, contractual violations, communication with legal teams, and final detail review.

What is a PEO agreement?

A PEO agreement, also known as a client service agreement, is a formal legal contract that has the complete details of the terms and conditions of PEO services, such as scope of services, employee benefits, fee structure, termination clauses, and compliance responsibilities.

What is the purpose of the PEO agreement?

The purpose of the PEO agreement is to formalize the co-employment relationship between PEOs and the client businesses, which allows the businesses to outsource important HR functions to a PEO. These outsourced functions include payroll and tax administration, benefits administration, workers’ compensation, recruitment, training and development, and compliance support.

What are the components of a PEO agreement?

The components of a PEO agreement are benefit plans, scope of services, liability insurance, reduction in force, compliance and legal responsibilities, credit approval, employee relations support, fees and payment schedule, optional services, dispute handling procedures, termination terms, data security and confidentiality, and amendments and notice requirements.

Benefit plans

Benefit plans refer to employer-sponsored programs that a PEO offers through its group plans, such as health, disability, and life insurance.

The benefit plans section in a PEO agreement specifies the types of employee benefits the PEO provides and manages, which include health, dental, vision, retirement plans, FSAs (Flexible Spending Accounts), wellness programs, and EAPs (Employee Assistance Programs). This section in the PEO agreement defines eligibility, administration processes, fee responsibilities, and compliance monitoring. This service agreement also mentions how benefits change over time and clarifies that if the client offers any separate benefit plans outside the PEO’s offerings, the client maintains full responsibility and liability for those plans.

Scope of services

The scope of services section of the PEO agreement defines exactly which HR, administrative, and compliance functions the PEO performs on behalf of the client.

The PEO agreement explains the division of labor and lists which HR-related functions the PEO handles, such as workers’ compensation, tax filing, payroll, and benefits administration, and the tasks that the client still manages, which involve daily management or internal company policies. This agreement makes sure that both parties understand their legal and operational responsibilities and helps avoid misunderstanding.

Liability insurance

Liability insurance in the PEO agreement section refers to the insurance coverages that protect both the client and the PEO against legal and financial risks that occur from employment-related activities, such as physical hazards, workplace harassment, and exposure to dangerous materials.

The insurance coverage provided by the PEO, according to the agreement, protects clients from claims such as workers’ compensation and EPLI (Employment Practices Liability Insurance), which protects employees from discrimination, wrongful termination, and harassment. This section identifies the risks the client company is responsible for and makes sure that both parties clearly understand their assigned financial responsibilities in the event of a claim. It also protects both the workforce and the business from possible legal exposure.

Reduction in force

Reduction in force refers to the termination of some workers from the company for operational reasons like budget cuts, reorganization, or downsizing.

The PEO agreement explains the role of PEOs in supporting the client during the RIF (Reduction in Force) event. The PEO manages notice requirements and advises the client on advance notice to employees, which is required under the WARN Act (Worker Adjustment and Retraining Notification) or relevant state laws. It also helps with final pay, COBRA (Consolidated Omnibus Budget Reconciliation Act) continuation, and unused PTO (Paid Time Off) payouts.

The PEO supports employee communication, prepares documentation for affected employees, and manages unemployment benefits claims. This helps prevent legal risks and claims related to improper layoff practices. The service makes sure that the PEO handles sensitive employment matters in an orderly manner, which reduces operational disruption and maintains regulatory compliance to protect both the client and the PEO.

Compliance and legal responsibilities

Compliance and legal responsibilities according to the PEO agreement clarify the respective duties of the client and the PEO related to risk management and compliance with employment-related laws and regulations.

This component of the PEO agreement explains which party is accountable for complying with federal, state, and local employment laws, and this includes tax filings, workplace safety standards, wage and hour regulations, and anti-discrimination laws. The responsibilities of a PEO are payroll tax reporting and remittance to the legal authorities, and making sure that client businesses comply with labor laws, such as the FMLA (Family and Medical Leave Act), FLSA (Fair Labor Standards Act), the ACA (Affordable Care Act), and the EEOC (Equal Employment Opportunity Commission).

The client company is responsible for following internal policies and procedures that are outside the PEO’s control. The PEO agreement clarifies that both the PEO and the client business share legal accountability under the co-employment model, so it advises on labor law changes and HR best practices to maintain employee records according to state-specific laws.

Credit approval

Credit approval is the process through which the PEO evaluates the client company’s financial stability, credibility, and payment reliability before entering into a co-employment agreement.

The PEO assesses the credit history, past tax liabilities, bank references, and payroll volume of the client business. A PEO agreement makes sure that the client is able to meet ongoing financial responsibilities, which involve payroll funding, tax remittances, and benefits payments. It protects the PEO from financial risk related to non-payment default by establishing the terms and conditions for payment schedules, deposits, or credit limits. The purpose of this section is to make sure that the client and the PEO are both clear about their financial expectations.

Employee relations support

Employee relations support refers to the guidance, services, and resources the PEO provides to help the client manage employee behavior, solve workplace issues, and make sure employees are treated fairly.

The PEO agreement defines the role of the PEO in supporting the client with employee performance management, conflict resolution, disciplinary actions, and terminations. The PEO helps ensure compliance with employment laws and internal policies, which reduces the risk of legal claims from employees, such as wrongful termination, discrimination, or misconduct.

The PEO provides guidance on performance reviews, disciplinary procedures, and documentation as part of this service. It also provides mentorship to HR staff and managers on effective employee communication and conflict resolution strategies, which include mediation support, incident investigation support, and training and education. This service agreement makes sure that a PEO promotes a positive workplace culture, which helps the client reduce legal disputes.

Fees and payment schedule

The PEO agreement outlines the cost structure for the services provided by the PEO and the terms under which the clients have to make payments.

This section explains how fees are calculated, commonly as a flat rate per employee, a percentage of total payroll, or a fixed monthly fee, and defines the schedule for payment, which is weekly, biweekly, or monthly. It also includes details such as payroll funding requirements, late payment penalties, and extra charges for optional services like brokerage services and employee training.

This service agreement section provides transparency, sets clear expectations, and reduces billing disputes between the PEO and the client. It helps the client and the PEO manage their financial duties within the co-employment relationship by coordinating service delivery with predictable and well-defined payment commitments.

Optional services

Optional services in the PEO agreement describe the extra services that the PEO provides beyond the main services of the standard agreement, which include talent acquisition, updating employee handbooks, background checks, drug screening, customized reporting, safety audits, supplemental insurance, and technology solutions. These optional services are not always included in the client service agreement and are provided at the client’s request at an extra cost.

This section allows the client to customize the co-employment relationship according to their business needs and gives them flexibility to access added services as their company grows or requirements change. The cost, availability, and specifics of the services are usually recorded separately or mentioned as exhibits to the main contract.

Dispute handling procedures

Dispute handling procedures are a component of the PEO agreement, which defines the process for resolving disputes between the client business and the PEO in a legal manner. The common disputes are related to the service delivery, fees, responsibility, employee matters, or contract interpretation.

This section describes the conflict resolution procedures, which include written notice, a specified response time, and escalation procedures such as administrative discussions or internal reviews. The ADR (Alternative Dispute Resolution) method is implemented in case of unresolved disputes, which involve mediation, arbitration, and litigation. These procedures provide a fair, timely, and structured approach to resolving issues, which reduces business disruptions and legal risk. The agreement makes sure both parties understand how to manage disputes under the co-employment relationship to support a professional and cooperative partnership.

Termination terms

Termination terms define the specified conditions in the PEO agreement that either the client or the PEO uses to terminate the co-employment relationship.

This section in the PEO agreement includes details like mandatory notice periods of 30 days, proper written or electronic notice methods, and legitimate reasons for termination, such as non-payment, contract violations, financial difficulties, or mutual agreement. It also sometimes outlines early termination costs, final payment requirements, and protocols for returning payroll, benefits, and personnel information to the client or a different supplier. These terms are important for a legally compliant separation, which involves reducing service disruption and protecting both parties from unexpected liabilities.

Data security and confidentiality

Data security and confidentiality refer to the rules and legal commitments established by both parties in the PEO agreement to make sure that all sensitive personal and company information is protected from unwanted access, disclosure, or misuse.

This component of the PEO agreement makes sure that both parties agree not to disclose or misuse confidential information exchanged during the partnership. This includes payroll records, tax and benefits information, employee personal data, and other sensitive business details. The agreement also outlines required security measures, such as encryption, secure portals, access controls, and compliance with privacy laws like HIPAA (Health Insurance Portability and Accountability Act) and state-specific regulations. It defines protocols for data transmission, access, and maintenance.

Mutual confidentiality duties prohibit either party from using or sharing private information without proper authorization. This component is important for data protection and data breach prevention to develop trust within the co-employment relationship and to make sure all parties follow strict data protection standards.

Amendments and notice requirements

Amendments and notice requirements are an important component of the PEO agreement as they define the process for making changes to the agreement and the formal requirements for communicating those changes or other important actions.

This section explains that any amendments to the agreement have to be made in writing and signed by authorized representatives of both the client and the PEO to be valid. It also outlines the delivery process for formal notices, such as termination, fee changes, or service updates, by specifying the required notice periods and acceptable delivery methods, which include email, certified mail, or secure electronic systems. This section is important as it brings clarity and prevents misunderstandings to support the legal implementation of the agreement. This transparency is achieved by establishing a mutually-agreed-upon process for making changes and sharing necessary information.

What are the benefits of signing a PEO agreement?

The benefits of signing a PEO agreement are clarity and transparency, focus on core business activities, employee benefits, compliance support, improved employee experience, and risk mitigation.

The benefits of signing a PEO agreement are listed below.

- Clarity and transparency: Clarity and transparency in a PEO agreement mean both the client and the PEO fully understand their roles, responsibilities, and services within the co-employment relationship. The agreement reduces misunderstandings, builds trust, supports smooth daily operations, helps prevent disputes, ensures compliance, and promotes a strong partnership.

- Focus on core business activities: Focus on core business activities refers to the client company using its internal resources toward strategic priorities, such as growth, operations, and customer service, by outsourcing HR, payroll, and benefits administration to the PEO. The PEO manages these time-consuming tasks as outlined in the client service agreement, which allows the business to operate more productively.

- Employee benefits: Employee benefits in a PEO agreement refer to the complete benefits programs that the PEO offers and manages on behalf of the client’s workforce by grouping workers from different client businesses. The PEO gives small and medium-sized enterprises access to premium, reasonably priced benefits that they are unable to afford on their own. These benefits include medical, dental, vision, life insurance, 401(k) retirement plans, disability coverage, and COBRA administration.

- Compliance support: Compliance support means PEO makes sure the client company maintains compliance with federal, state, and local employment laws and regulations as part of the client service agreement. This includes guidance on labor laws, such as the FLSA (Fair Labor Standards Act), ACA (Affordable Care Act), and EEO (Equal Employment Opportunity) regulations. The PEO also helps with proper employee classification, wage and hour compliance, and required documentation.

- Improved employee experience: Improved employee experience means PEO provides employees access to premium benefits, reliable payroll processing, clear workplace policies, and HR support. This third-party model increases employee trust, reduces employee turnover, and promotes a positive working environment as part of their co-employment agreement.

- Risk mitigation: Risk mitigation means a PEO agreement helps reduce the client’s exposure to employment-related risks such as labor law non-compliance, payroll tax errors, workers’ compensation claims, and wrongful termination lawsuits. The PEO guarantees proper wage practices, employee classification, and documentation, which protects the client from costly legal and regulatory penalties and allows the business to operate more securely under the co-employment model.

What are the drawbacks of signing a PEO agreement?

The drawbacks of signing a PEO agreement are hidden fees, lack of clear exit terms, communication challenges, integration issues, and data ownership and accessibility issues.

The drawbacks of signing a PEO agreement are listed below.

- Hidden fees: Hidden fees refer to non-transparent pricing models in PEO agreement contracts, where charges are based on a percentage of payroll or a flat fee per employee without clearly explaining the cost of each service. Administrative fees are bundled within insurance and benefits expenses, which makes it hard for clients to understand exactly what they are paying for. Services not included in the main contract also result in extra fees.

- Lack of clear exit terms: Some contracts have set notice periods before termination, such as a 30-day notice, while some require multi-year commitments, so early termination results in unreported fines. Unexpected financial fines and legal issues occur from unclear withdrawal requirements, such as inaccurate deadlines, penalty calculations, and restrictions. The client company is sometimes also unable to terminate the agreement without a termination-for-cause clause, even if the PEO fails to provide agreed-upon services.

- Communication challenges: Unclear or limited contract terms related to support and responsiveness cause communication issues in PEO agreements. Many contracts also lack defined SLAs (Service Level Agreements) for how quickly the PEO has to handle payroll issues, employee complaints, or compliance matters. The PEO, as a co-employer, adds extra steps in the communication process, from client to PEO and then to employee, which causes misunderstandings and delays.

- Integration issues: Integration issues mean PEO contracts do not clarify exactly how the systems of PEOs work with the existing payroll, HR, or compliance software of the client, which results in technical errors. Data migration interruptions or delays in system setup also result from unclear onboarding procedures. The agreement restricts customization by requiring the use of standardized tools from PEO that are sometimes not compatible with the company’s unique operations.

- Data ownership and accessibility issues: PEO contracts sometimes include unclear terms about the ownership of payroll and employee data, which creates challenges for the client business. Operational visibility is limited since the PEO usually stores and manages this data on its own systems. The agreement also does not guarantee access to customized reports or the ability to export data. These unclear terms cause data ownership disputes, particularly during contract termination.

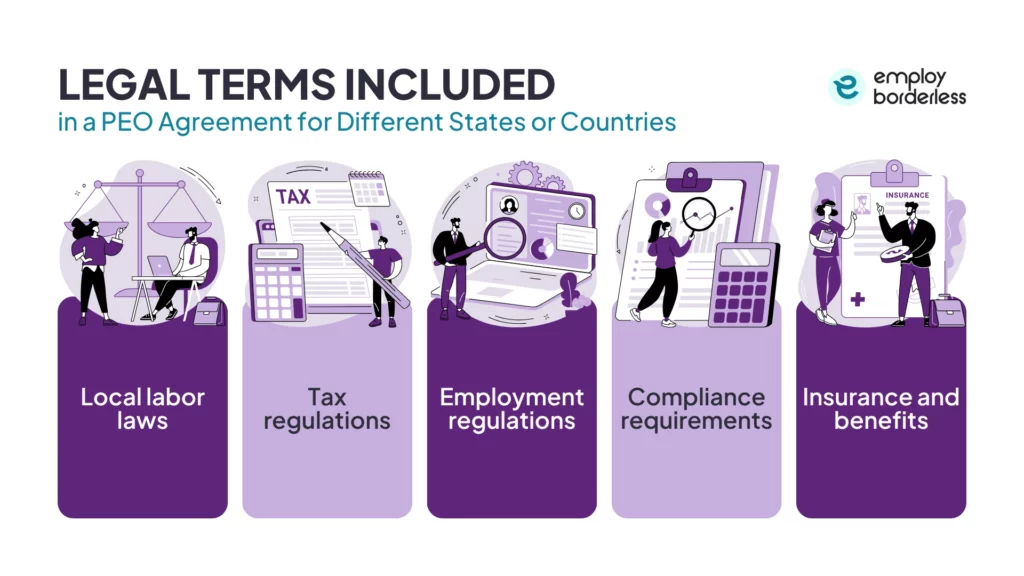

What legal terms are included in a PEO agreement for different states or countries?

The legal terms that are included in a PEO agreement for different states or countries involve local labor laws, tax regulations, employment regulations, compliance requirements, and insurance and benefits.

The legal terms that are included in a PEO agreement for different states or countries are listed below.

- Local labor laws: The PEO agreement includes local labor law clauses that outline laws related to minimum wages, overtime, leave benefits, termination policies, and social security contributions that are unique to a given jurisdiction. This reduces legal and financial risk by making sure the PEO and the client comply with the regulations that are relevant in each area.

- Tax regulations: Tax regulations in the PEO agreement contracts outline which party (PEO or the client) is responsible for workers’ compensation, unemployment insurance, and payroll tax filings that depend on state or local regulations. These responsibilities must comply with local law and differ greatly depending on the region. PEO agreements also clarify that any legal problems have to be decided according to the laws of a specific jurisdiction, such as the state or local jurisdiction in which services are provided.

- Employment regulations: PEO agreements include specific terms to ensure compliance with employment regulations at the local, state, national, or international level. These regulations determine how employees must be hired, managed, paid, and terminated. The employment regulations in areas include wage and hours laws, like minimum wage, overtime, rest breaks, and maximum working hours, anti-discrimination and equal opportunity laws, termination and severance rules, and leave and benefit entitlements.

- Compliance requirements: Compliance requirements mean PEO agreements divide the compliance duties between clients and PEOs. Compliance gaps that are not properly specified result in penalties, legal action, or damage to a party’s reputation. The contract has to clearly define who is in charge of what, particularly in international or multi-state activities. These compliance requirements differ by location and include payroll tax compliance, benefits, ACA (Affordable Care Act) compliance, HR and employment practices, and compliance with data privacy and recordkeeping.

- Insurance and benefits: PEO agreements include legal terms to ensure compliance with local and state laws on health insurance, workers’ compensation, retirement plans, and other employee benefits, like vision and dental insurance. These terms differ by jurisdiction and define coverage requirements, contribution responsibilities, eligibility rules, and compliance with regulations like the ACA (U.S.) or country-specific mandates.

What are the conditions for ending the PEO agreement?

The conditions for ending the PEO agreement are notice periods, termination fees, transition of responsibilities, contractual violations, communication with legal teams, and final detail review.

Notice periods

Notice period in a PEO agreement refers to the required advance written notification that either the client or the PEO has to give before terminating the agreement. PEO agreements commonly include notice period clauses requiring a warning before terminating the contract. The typical duration is 30 days, which allows both parties enough time to manage transitions and lower operational disruptions.

Termination fees

Termination fees are charges outlined in a PEO agreement that either the client or the PEO has to pay if the contract is ended before the agreed term, particularly without proper notice or valid reason. These clauses define the conditions under which either party is able to terminate the co-employment relationship and detail any related costs or responsibilities.

These termination fees are costly because they depend on the number of employees and the number of days left on the contract. The purpose of this condition is to protect both the PEO and the client from lost revenue. These fees may not apply if both parties consent to the termination or if the PEO does not fulfil its service responsibilities.

Transition of responsibilities

Transition of responsibilities in a PEO agreement refers to the process of transferring HR, payroll, benefits, and compliance duties either to the PEO at the start of the contract or back to the client (or a new provider) when the agreement ends.

The client transfers important employment-related responsibilities to the PEO at the start of the PEO arrangement, such as handling payroll, employee benefits, taxes, and legal compliance, and in the case of contract termination, these HR responsibilities are transferred back to the client or another provider. Incorrect contract conditions for this transition sometimes result in data loss, service interruptions, noncompliance, or delayed payroll and benefits. Clear transition terms in the PEO agreement guarantee a successful transfer with little operational risk.

Contractual violations

Contractual violations in a PEO agreement refer to any failure by either the client or the PEO to meet the conditions and terms stated in the contract.

A contractual violation occurs when one party fails to fulfill their responsibilities, such as by missing payments, failing to deliver services, like payroll or benefits, or violating confidentiality, so penalties, legal action, or early agreement termination result from these violations. Most PEO contracts include clauses defining what is considered a violation and how disputes or consequences are handled. These terms help avoid misunderstandings, financial penalties, or damage to either party if the agreement is breached.

Communication with legal teams

Communication with legal teams means the cooperation between the legal advisors or compliance teams of the client and the PEO to make sure the PEO agreement follows all relevant laws and protects the client’s rights and interests.

Proper communication with legal teams helps identify risks, clarify contract terms, such as liability, data ownership, or termination clauses, and ensure compliance with employment laws. Businesses sometimes do not notice unclear or unfavorable terms that result in disputes, hidden costs, or legal exposure without legal review. Clear legal communication makes sure the agreement is clearly understood by the client and is according to the company’s needs.

Final detail review

The final detailed review of the PEO agreement refers to the thorough examination of the contract before signing to make sure all terms, conditions, and legal responsibilities are clearly defined and fully understood by both parties.

This condition involves reviewing service scope, pricing, data management, termination clauses, compliance requirements, and potential risks. It helps identify unclear legal wording, hidden fees, or missing protections. A careful final review, particularly with legal involvement, makes sure that the agreement meets the company’s expectations and avoids future misunderstandings or costly errors.

What factors should businesses consider before signing a PEO agreement?

The factors that businesses should consider before signing a PEO agreement are experience and industry expertise, licenses and accreditations, service quality and support model, insurance and benefits offering, reputation and client references, and dispute resolution and contractual protections.

Choose a PEO that understands your industry and company size before signing a PEO agreement. Specialized experience helps businesses make sure the selected PEO understands their unique workforce, compliance challenges, and operational needs.

Verify that the PEO is properly licensed and holds recognized certifications such as IRS CPEO (Certified PEO) and ESAC (Employer Services Assurance Corporation) accreditation, or relevant state or country licensure. These credentials show financial integrity, ethical business standards, and compliance reliability, which are important to consider before entering into a PEO agreement.

Make sure the PEO offers high-quality customer service by assigning a specific representative who understands your business needs, has fast response times, and reliable support channels, such as email support, a client portal, or a help centre. SLAs (Service Level Agreements), or defined service commitments, are important for accurate performance standards.

Review the quality and flexibility of benefits such as health insurance, workers’ compensation, retirement plans, and wellness programs. Consider how taxable structures, networks, and contribution rules match with your needs before signing a PEO agreement.

Check client testimonials, case studies, and independent reviews, particularly from businesses similar to yours, before signing a PEO agreement. Positive feedback shows reliability and accurate service delivery.

Carefully examine the agreement’s termination terms, notice periods, termination penalties, and dispute resolution processes. Make sure you have clearly understood early exit clauses, liabilities, and protections in case of poor performance or legal issues before signing a PEO agreement contract.

Is the PEO certified or accredited?

Yes, the PEO is certified by the IRS (Internal Revenue Service) under a voluntary program. Certified PEO requires audited financials, bonding, tax compliance, and handling federal employment tax liability on behalf of clients. The PEO is also accredited by ESAC (Employer Service Assurance Corporation) to show compliance with industry standards for financial stability, ethical business conduct, and regulatory compliance.

How is a PEO defined?

A PEO (Professional Employer Organization) is defined as a third-party organization that provides HR services to businesses under a co-employment agreement. The PEO becomes the employer of record for payroll, taxes, benefits, and HR compliance, while the client maintains control over daily employee and performance management.

What services do PEOs typically offer?

The services that PEOs typically offer are compliance, HR consulting, recruitment, benefits administration, and compensation. PEO services also include risk management, employee training and development, technology solutions, and payroll management.

How often should a PEO contract be reviewed?

A PEO contract should often be reviewed annually, particularly before renewal or when business needs or regulations change. Regular yearly reviews help make sure the agreement stays according to company goals, protects against hidden costs, and verifies that the PEO continues to meet compliance and service expectations.

Who is the employer in a PEO arrangement?

The employers in a PEO arrangement are both the client company and the PEO, as they share employer responsibilities through a co-employment relationship. The PEO is the employer of record for tax and compliance purposes and handles payroll, benefits, and tax filings, while the client remains the primary employer and manages performance and workplace operations.

What are the types of PEO?

The types of PEO are CPEO (Certified PEO), PEO alliances, industry-specific PEOs, full-service PEOs, and ASOs (Administrative Service Organizations). These PEO types differ according to business size and needs and offer different levels of support in areas such as payroll, compliance, benefits administration, and HR services.

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Ready to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations