Payroll reconciliation: definition, how it works, steps, benefits, challenges, and best practices

Robbin Schuchmann

Co-founder, Employ Borderless

Payroll reconciliation is the process businesses use to make sure payroll records and financial accounts agree with each other. It involves checking employee hours, pay rates, taxes, deductions, and benefits against what is recorded in the company’s systems and what was actually paid out through banks.

The important steps of payroll reconciliation involve establishing a regular reconciliation schedule, collecting source records, calculating total gross earnings for each employee, checking payroll system entries for accuracy of gross earnings, and reviewing deductions and withholdings. Businesses then compare net pay with bank transactions, record payroll in the general ledger, make sure employer tax liabilities match reports, match payroll tax deposits to the actual IRS, identify and resolve payroll errors, and document and approve the reconciliation process.

The benefits of payroll reconciliation include providing accuracy and compliance with tax regulations, identifying and preventing fraudulent activities, simplifying financial reporting, improving employee trust and satisfaction, avoiding costly errors like overpayments, and

matching your ledger to payroll.

The common payroll reconciliation challenges include high volume and complexity of data, managing multi-jurisdiction payrolls, lack of smooth system integration, timing mismatches in records, and handling changes and corrections.

The best practices of payroll reconciliation include setting a consistent reconciliation schedule, communicating clearly with the finance team, using a dual verification process, educating staff on accurate time tracking, and keeping detailed records for audit readiness.

What is payroll reconciliation?

Payroll reconciliation is the process of comparing payroll records against financial statements, timesheets, tax reports, and other related documents to maintain accuracy and consistency. This reconciliation process involves checking that salaries, wages, deductions, and employer contributions are calculated and recorded correctly before paying employees. It helps businesses find and fix errors such as overpayments, underpayments, and wrong tax withholdings.

How does payroll reconciliation work?

Payroll reconciliation works by comparing the company’s payroll records (such as hours worked, wages, and deductions) with its accounting or financial records to make sure everything matches. There is no single standard method of payroll reconciliation since every business has different systems and payroll complexity, so each company adapts the process to meet its needs. The process of payroll reconciliation involves verifying amounts paid to employees with what’s posted in the company’s general ledger or bank statements and then investigating the discrepancies.

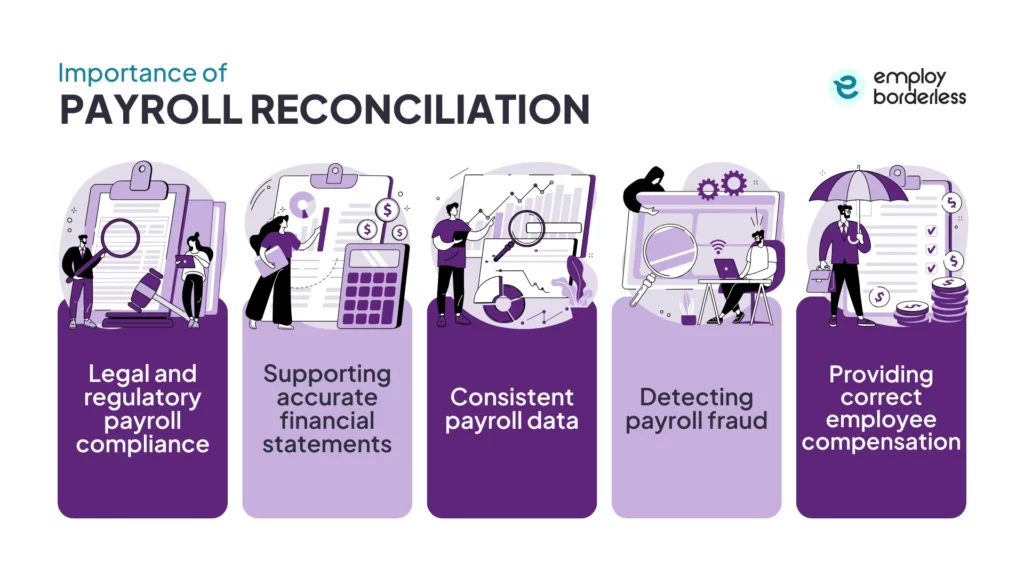

Why is payroll reconciliation important?

Payroll reconciliation is important for businesses because of legal and regulatory payroll compliance, supporting accurate financial statements, consistent payroll data, detecting payroll fraud, and providing correct employee compensation.

Legal and regulatory payroll compliance

Payroll reconciliation makes sure that all tax withholdings, social contributions, and other deductions match current laws and regulations. Companies check all the details regularly to reduce the risk of errors that could trigger fines, penalties, or audits from tax authorities.

Supporting accurate financial statements

Payroll is one of the largest expenses for most businesses, and even small errors can cause financial errors. Reconciling payroll with accounting records, wages, benefits, and tax liabilities correctly. This accuracy supports reliable financial statements and helps management make better business decisions.

Consistent payroll data

When businesses reconcile payroll, they make sure the same information flows through HR, accounting, and finance systems. This consistency reduces confusion and avoids mismatched data entries. It also increases reporting accuracy for both internal teams and external auditors.

Detecting payroll fraud

Payroll reconciliation helps detect irregularities such as ghost employees, duplicate payments, or unauthorized salary adjustments. Companies compare records and find mismatches early, which helps businesses prevent losses and protect themselves from fraud. This process also improves transparency and accountability in payroll operations.

Providing correct employee compensation

Employees want their accurate compensation on time, and reconciliation helps with that by checking pay amounts against hours worked, benefits, and deductions. This also helps businesses to prevent underpayments and overpayments, restores employee trust, and maintains a positive environment at the workplace.

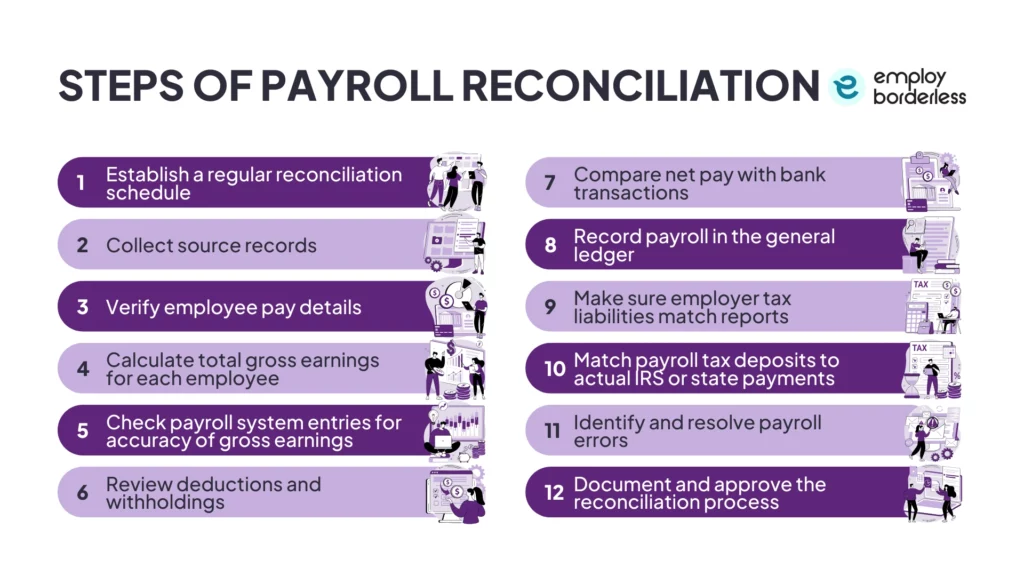

What are the steps of payroll reconciliation?

The steps of payroll reconciliation are to establish a regular reconciliation schedule, collect source records, verify employee pay details, calculate total gross earnings for each employee, and check payroll system entries for accuracy of gross earnings.

1. Establish a regular reconciliation schedule

Set a consistent schedule for payroll reconciliation to keep records accurate. Perform checks before each payroll run to confirm calculations, monthly to match tax filings, and quarterly or annually for audits and year-end tax forms. A regular schedule helps businesses find mistakes easily to make the payroll tax compliant.

2. Collect source records

Collect all the important documents before starting reconciliation, such as employee time cards, payroll registers, and bank statements. These records will provide your payroll company with details of hours worked, pay amounts, and payments made, and make the reconciliation process smooth and reliable.

3. Verify employee pay details

Check that the employee details are up-to-date, job classifications are correct, and personal information (like tax withholdings and benefits) is accurate. Verifying employee details makes sure that every employee receives the correct pay. It also keeps the payroll in line with labor laws and company policies.

4. Calculate total gross earnings for each employee

Companies need to multiply the hourly rate by the hours worked for hourly employees and the fixed salary for salaried employees. Add overtime, bonuses, or commissions if applicable, and remember that accurate gross earnings help in calculating the correct deductions and net pay.

5. Check payroll system entries for accuracy of gross earnings

Review payroll system entries to confirm gross earnings match your manual calculations, check for discrepancies, and document to make any adjustments or corrections. This step helps to identify errors before finalizing payroll.

6. Review deductions and withholdings

Examine all deductions such as taxes, benefits, and garnishments. Payroll companies must make sure tax withholdings match current rates and apply the benefit and retirement contributions correctly. Accurate deductions keep employees’ pay correct and maintain compliance with tax rules.

7. Compare net pay with bank transactions

Match net pay amounts from payroll records with bank deposits or payment files. Investigate reasons like bank fees or transaction delays if there are differences. Comparing net pay with bank transactions means that the employees receive the right amount on time.

8. Record payroll in the general ledger

Enter payroll transactions into the general ledger accurately. Payroll companies can keep debit expense accounts for gross pay, credit liability accounts for deductions, and credit cash or bank accounts for net pay. This step keeps financial records accurate and ready for reporting.

9. Make sure employer tax liabilities match reports

Compare payroll tax reports with general ledger entries to confirm that contributions, such as Social Security and Medicare, are recorded accurately. Fix any mismatches to avoid penalties and stay compliant with tax obligations.

10. Match payroll tax deposits to actual IRS or state payments

Reconcile tax deposits by comparing IRS or state payment records with your internal records. Make sure that all deposits are accurate and made on time, and if any issue arises, resolve them quickly to keep your business compliant.

11. Identify and resolve payroll errors

Review reconciliation reports for unusual entries or inconsistencies and find the cause of errors, such as data entry mistakes or software glitches. Correct issues promptly to maintain accuracy and build employee trust.

12. Document and approve the reconciliation process

Write down all steps and results from the reconciliation process and get approvals from managers or relevant authorities as required. Keep these records for audits, compliance checks, and future reference as documentation maintains transparency and accountability.

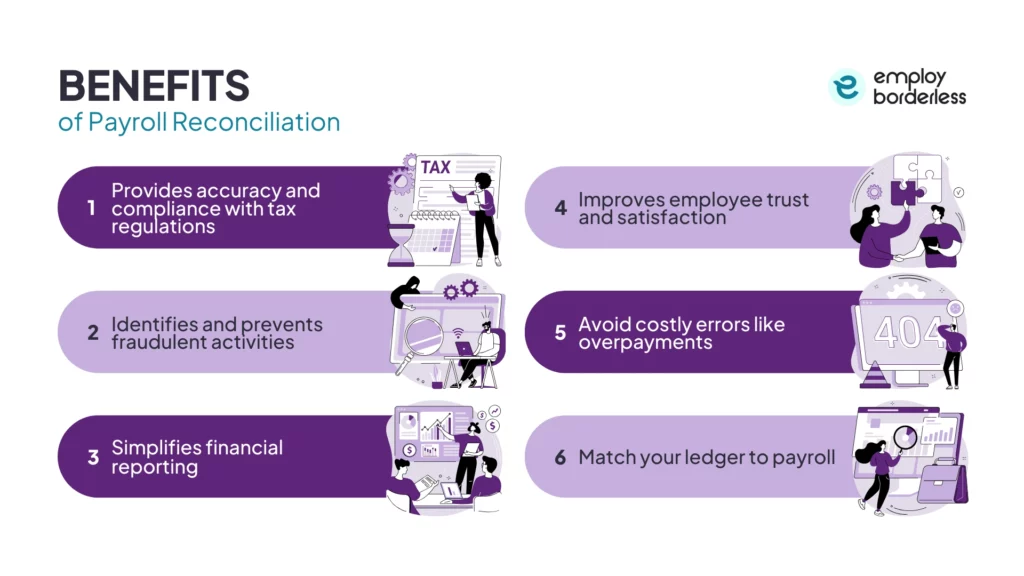

What are the benefits of payroll reconciliation?

The benefits of payroll reconciliation include providing accuracy and compliance with tax regulations, identifying and preventing fraudulent activities, simplifying financial reporting, improving employee trust and satisfaction, avoiding costly errors like overpayments, and matching your ledger to payroll.

Provides accuracy and compliance with tax regulations

Payroll reconciliation makes sure to calculate and report wages, taxes, and deductions correctly. It helps the business follow tax laws and avoid mistakes that could cause trouble. The company avoids penalties and tax audits by maintaining accuracy while keeping the payroll fully compliant with regulations.

Identifies and prevents fraudulent activities

Reconciliation helps businesses find fraudulent activities such as ghost employees, duplicate checks, and fake changes. It compares payroll records with actual payments to find anything unusual. The company protects its money by catching fraud early and also builds trust in payroll operations.

Simplifies financial reporting

Payroll reconciliation makes sure to record payroll costs and liabilities properly in the company’s books. It makes audits and tax filing easier because the numbers match and provides managers with reliable payroll data for planning and decisions, which reduces stress for both HR and finance teams.

Improves employee trust and satisfaction

Employees feel valued and respected when they receive correct paychecks. Reconciliation prevents delays or underpayments and builds trust between staff and management. This trust also keeps employees engaged and loyal to the company.

Avoid costly errors like overpayments

Reconciliation catches mistakes such as wrong overtime, duplicate entries, or miscalculations. Overpaying employees wastes money and is often hard to recover, so when businesses fix these issues early, they save money, protect cash flow, and avoid disputes with employees.

Match your ledger to payroll

Payroll reconciliation matches payroll records with the general ledger in accounting to make sure that both systems show the same numbers for wages and deductions. This keeps financial reports consistent and error-free and makes audits and reviews much smoother.

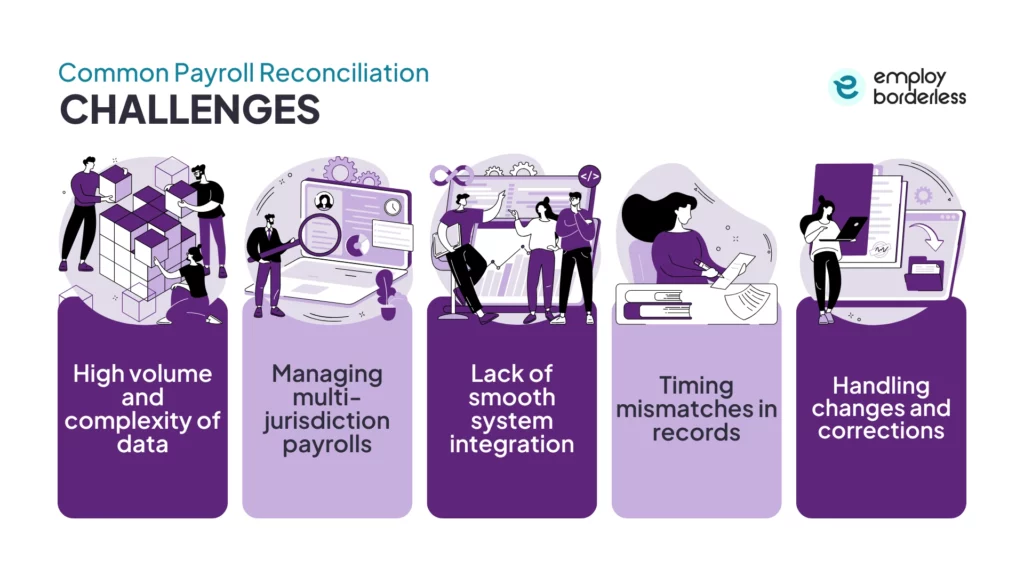

What are some common payroll reconciliation challenges?

Some common payroll reconciliation challenges are high volume and complexity of data, managing multi-jurisdiction payrolls, lack of smooth system integration, timing mismatches in records, and handling changes and corrections.

The common payroll reconciliation challenges are mentioned below.

- High volume and complexity of data: Large businesses process thousands of payroll entries every pay cycle. Managing this huge volume makes it easy for small errors to slip in, and the complexity of calculations and records increases the risk of mistakes.

- Managing multi-jurisdiction payrolls: Companies with employees in different states or countries must follow many tax rules. Each jurisdiction has its own rates, deadlines, and compliance requirements, and this makes reconciliation more complicated and time-consuming.

- Lack of smooth system integration: When payroll, HR, and accounting systems do not connect well, data mismatches happen. Manual data entry increases the chance of errors, slows down reconciliation, and makes payroll less accurate.

- Timing mismatches in records: Payroll and bank records often do not update at the same time, and these timing differences create temporary mismatches during reconciliation. It requires extra checks to make the numbers the same in different records.

- Handling changes and corrections: Employee data often changes, such as tax status, benefits, or pay rates. Correcting these updates across all systems can be difficult, and if your payroll company misses them, it leads to errors in payroll records.

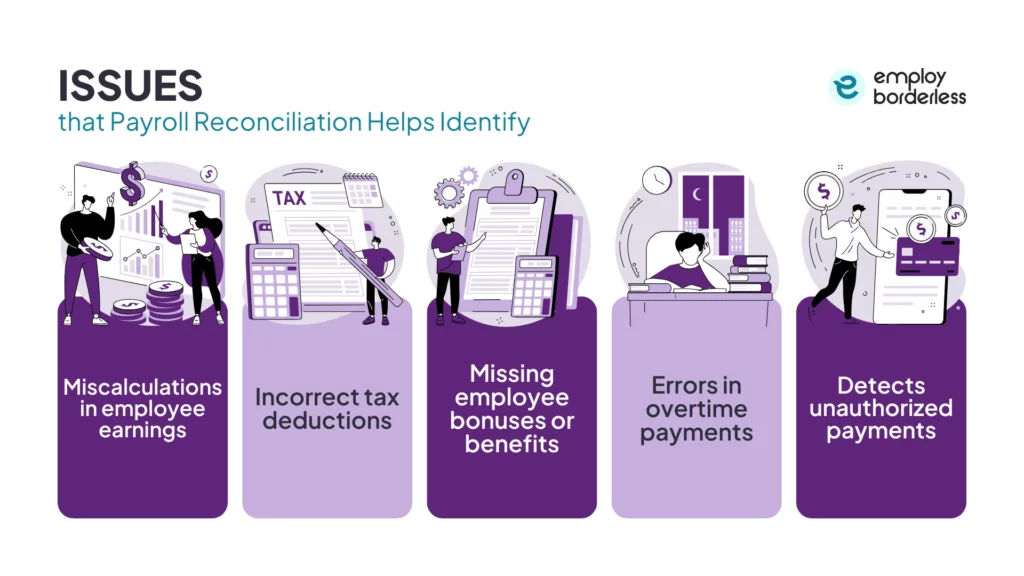

What issues does payroll reconciliation help identify?

The issues that payroll reconciliation helps identify are miscalculations in employee earnings, incorrect tax deductions, missing employee bonuses or benefits, errors in overtime payments, and unauthorized payments.

The issues that payroll reconciliation helps identify are mentioned below.

- Miscalculations in employee earnings: Payroll reconciliation helps find mistakes in wages caused by wrong hours or salary rates. Even small errors in earnings can upset employees and create trust issues, so by checking calculations carefully, the company provides accurate pay to everyone.

- Incorrect tax deductions: Sometimes payroll systems apply wrong tax rates or fail to update deductions on time. Reconciliation helps to find these issues before the company makes filings to tax authorities. This protects the business from penalties and keeps employees’ tax records accurate.

- Missing employee bonuses or benefits: Employees sometimes do not receive their entitled bonuses or benefits. Payroll reconciliation highlights these missing payments and allows the team to correct them quickly. This keeps employees satisfied and reduces workplace complaints.

- Errors in overtime payments: Overtime is miscalculated due to incorrect hourly rates or missed entries. Payroll reconciliation checks to correctly pay all extra hours worked. This step protects the business from wage disputes and maintains fairness.

- Detects unauthorized payments: Reconciliation can reveal ghost employees, duplicate salary entries, or payments to the wrong accounts. These unauthorized payments can cause big financial losses if left unchecked. Detecting them early prevents fraud and maximizes payroll security.

What are the best practices of payroll reconciliation?

The best practices of payroll reconciliation are to set a consistent reconciliation schedule, communicate clearly with the finance team, use a dual verification process, educate staff on accurate time tracking, and keep detailed records for audit readiness.

Set a consistent reconciliation schedule

Create a regular schedule for payroll reconciliation, such as before each payroll run and at month-end. A consistent routine helps catch errors early instead of waiting until year-end. This practice keeps payroll accurate and ensures that it is in compliance with tax rules.

Communicate clearly with the finance team

Businesses need to work closely with the finance team to share payroll details and updates. Clear communication avoids mismatches between payroll records and financial reports. It also helps both teams solve issues quickly and maintain accurate books.

Use a dual verification process

Businesses must have at least two people check payroll calculations before finalizing them. A dual review reduces the risk of errors and prevents fraudulent activities. This adds an extra layer of accountability and builds employee trust in payroll accuracy.

Educate staff on accurate time tracking

Train employees and managers on how to record hours, overtime, and leave correctly. Accurate time tracking minimizes payroll disputes and prevents costly mistakes. It also makes reconciliation easier by making the data reliable from the start.

Keep detailed records for audit readiness

Maintain organized records of all payroll transactions, corrections, and approvals. Detailed documentation supports compliance with tax authorities and labor laws. It also makes audits smoother and protects the business from penalties or disputes.

How to handle payroll mistakes found in reconciliation?

To handle payroll mistakes found in reconciliation, identify the mistake quickly, correct the error in payroll records, communicate with the affected employee, adjust payments and withholdings, and strengthen controls to prevent future errors.

Review the payroll reports carefully to identify the mistake quickly and determine where the error occurred, such as wrong hours, rates, or deductions. Pinpointing the source helps resolve issues quickly and prevent further problems.

Correct the error in payroll records by updating the payroll system with accurate data, whether related to employee earnings, overtime, or tax deductions. Make sure the correction is reflected in both payroll and accounting records.

Communicating with the affected employee is important, whether they were underpaid or overpaid, to build trust. Clear communication reassures the employee while the issue is being resolved.

Adjust payments with withholdings if the employee was underpaid, and if overpaid, agree on a recovery method that is fair and compliant with labor laws.

Strengthen controls to prevent future errors by reviewing what caused the mistake in payroll, such as manual entry or system issues, and improving the process. Improving the process includes providing extra training, dual verification, or better software checks.

Who is responsible for payroll liabilities?

An employer is responsible for payroll liabilities, which include withheld employee taxes and the employer’s own contributions. The legal responsibility for paying taxes correctly and on time remains with the employer even if the business outsources payroll. Tax authorities hold the employer, not the provider, accountable if the errors occur.

How can I reconcile Form 941 with payroll records?

You can reconcile Form 941 with payroll records by comparing wages, tips, and compensation reported on the form with your payroll registers. Match federal income tax, Social Security, and Medicare withholdings to payroll system totals. Then confirm that deposits made to the IRS match reported liabilities, and investigate any differences.

What are the basic steps in processing payroll?

The basic steps in processing payroll include collecting employee data and timekeeping records, calculating gross pay, determining taxes and deductions, calculating net pay, processing payments, and maintaining detailed payroll records for compliance. This payroll process involves gathering information, performing calculations, issuing payments, and keeping accurate records for tax and compliance purposes.

How often should you reconcile payroll?

You should reconcile payroll after every pay period, before each monthly tax deposit, before quarterly Form 941 filings, and annually before W-2 filings. Performing payroll reconciliation on a more frequent, even continuous, basis is best practice since it helps identify errors early and ensures accurate employee payments.

Should payroll report to HR or accounting?

Payroll should report to either HR or accounting, depending on the company’s size, needs, and resources. Payroll management involves both financial accounting and human resources functions. Reporting to HR offers benefits like real-time data integration, while reporting payroll to accounting provides greater financial expertise for tax compliance.

What do payroll regulations and compliance mean?

Payroll regulations and compliance mean that employers must adhere to all federal, state, and local laws governing how employees are paid, taxed, and compensated. Payroll compliance involves employers following laws regarding minimum wage, overtime pay, and proper payment for all hours worked.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations