Managing global payroll: definition, importance, challenges, methods, and benefits

Robbin Schuchmann

Co-founder, Employ Borderless

Global payroll is the process of paying and managing employee compensation across multiple countries. Managing global payroll is important for compliance and risk mitigation, cost savings, employee trust, accurate payments for the global workforce, and employer brand improvement.

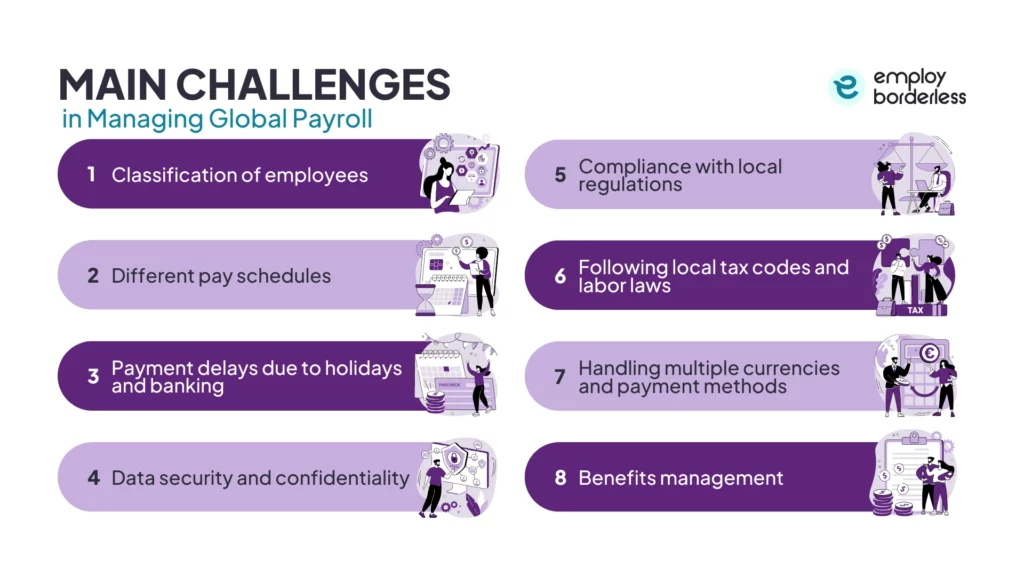

The challenges in managing global payroll include classification of employees, different pay schedules, payment delays due to holidays and banking, data security and confidentiality, compliance with local regulations, handling multiple currencies and payment methods, and benefits management.

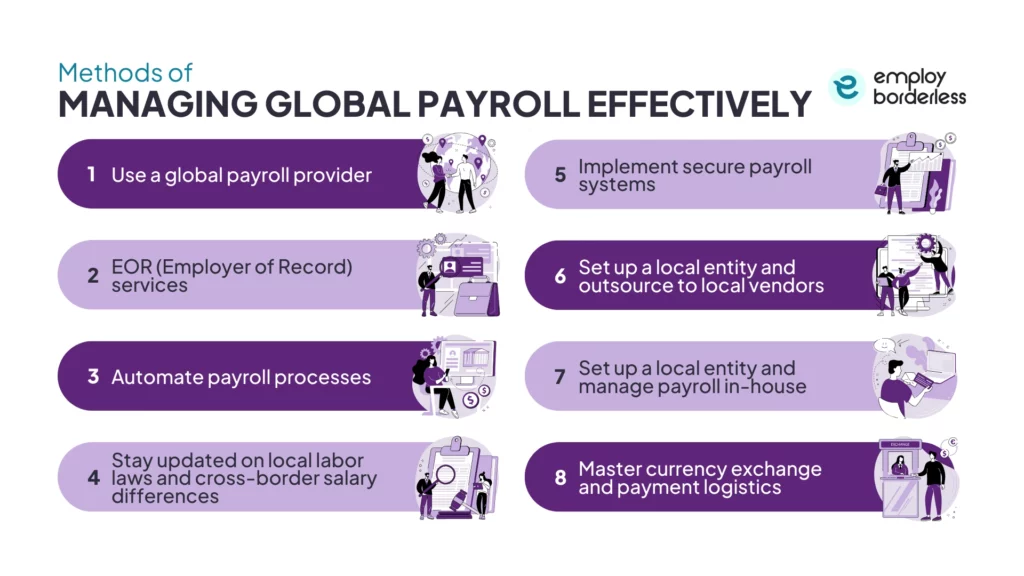

There are methods to manage global payroll that involve using a global payroll provider, EOR (Employer of Record) services, automating payroll processes, staying updated on local labor laws and cross-border salary differences, implementing secure payroll systems, setting up a local entity and outsourcing to local vendors, and mastering currency exchange and payment logistics.

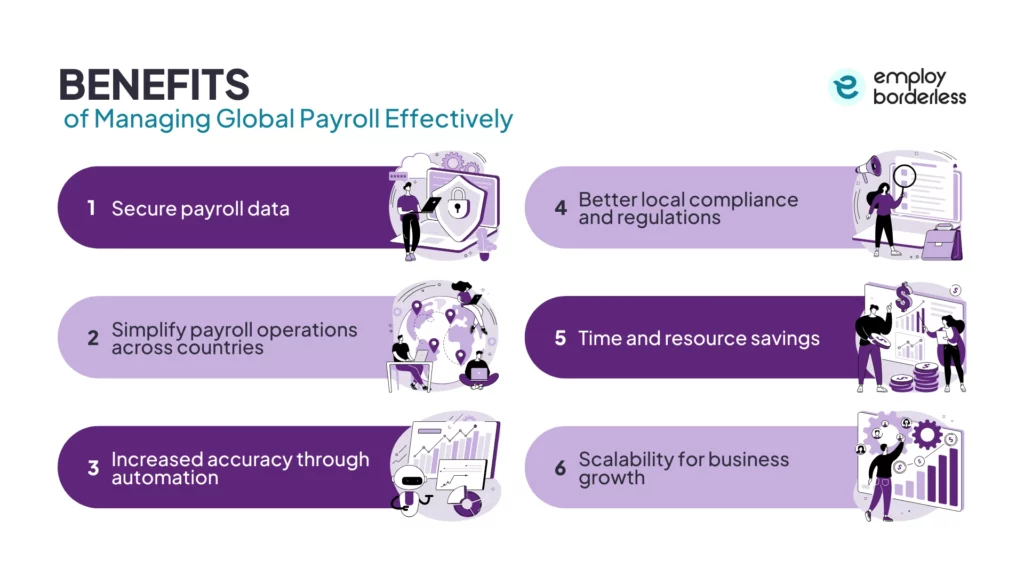

The benefits of managing global payroll include secure payroll data, simplified payroll operations across countries, increased accuracy through automation, better local compliance and regulations, time and resource savings, and scalability for business growth.

What is global payroll?

Global payroll is the process of managing and distributing workers’ compensation across multiple regions while ensuring compliance with international laws and regulations. It involves a range of processes, from managing payroll operations, such as withholding taxes, calculating wages, and distributing payslips, to handling different currencies, employment laws, and tax systems across borders. Managing global payroll is complex because it requires gathering and consolidating payroll data from multiple locations, applying local tax laws, and processing payments in foreign currencies.

Why is global payroll management important?

Global payroll management is important for compliance and risk mitigation, cost savings, employee trust, accurate payments for the global workforce, and employer brand improvement.

The reasons for the importance of global payroll management are discussed below.

- Compliance and risk mitigation: Managing global payroll means making sure that the company follows each country’s unique tax, labor, and reporting laws. Non-compliance results in costly fines, operational disruption, and reputational damage if companies do not follow these obligations. Centralizing global payroll processes and expertise mitigates these risks. Staying compliant protects the business from penalties and legal liabilities while making sure that payroll regulations are followed correctly across borders.

- Cost savings: Global payroll systems reduce manual administrative work, consolidate data, and prevent costly errors or penalties due to non-compliance. Companies reduce overhead and simplify operations by automating and centralizing payroll functions, which leads to long-term cost savings. Reducing manual work and avoiding expensive mistakes or fines saves money and resources for strategic business priorities.

- Employee trust: Accurate, transparent, and on-time payroll builds confidence among employees. Mistakes such as late payments or unclear payslips discourage workers and damage trust. A reliable global payroll system that delivers correct pay each time helps create positive employer-employee relationships. Employee trust in the company increases when they receive compensation on time, which improves engagement and retention.

- Accurate payments for the global workforce: Global payroll handles local tax deductions, social contributions, different pay cycles, and currency differences. Centralized systems and expertise reduce human calculation errors and confirm that employees receive correct compensation in their local currency. Correct payments prevent financial difficulties for employees, maintain compliance with local laws, and reduce legal disputes or corrections.

- Employer brand improvement: Consistent compliance and reliable global payroll maintain a company’s reputation with staff, partners, and customers internationally. Companies known for paying accurately and conforming to local laws are usually more attractive to top talent and respected in the global market. A strong employer brand helps attract and retain the best employees globally, which shows that the organization values equity and responsibility.

What are the main challenges in managing global payroll?

The main challenges in managing global payroll are classification of employees, different pay schedules, payment delays due to holidays and banking, data security and confidentiality, compliance with local regulations, handling multiple currencies and payment methods, and benefits management.

Classification of employees

Correctly classifying workers, such as full-time, part-time, and contractors, is complex because different countries have different legal definitions and requirements. Misclassification results in legal penalties, back pay liabilities, and tax issues, especially when contractors are treated like employees or if employees are classified as contractors.

Different pay schedules

Countries follow different pay periods and payroll cycles, like monthly or biweekly, which makes it difficult to coordinate payroll runs across regions. Irregular schedules lead to planning issues, missed deadlines, and employee dissatisfaction if they are not managed correctly.

Payment delays due to holidays and banking

Local bank holidays, weekends, and differing banking processing times delay payroll disbursements. International transfers mostly pass through multiple banks, which increases the chances of delays, particularly if holidays in one region interrupt the flow of funds.

Data security and confidentiality

Global payroll involves handling sensitive personal and financial data, such as salary and bank details. Different jurisdictions implement differing data protection laws like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act). Multinational companies that fail to secure or properly handle this data face compliance issues, breaches, fines, and reputational risk.

Compliance with local regulations

Compliance with local tax and labor regulations is complex because each country has its own unique and changing rules. Companies operating in multiple jurisdictions have to understand and apply different tax withholding requirements, social security contributions, filing deadlines, reporting formats, and labor standards, all of which differ from one jurisdiction to another.

Following local tax codes and labor laws

Following local tax codes and labor laws means that each country establishes unique tax codes. These codes determine the amount of income tax to withhold, how to calculate employer contributions, such as social security, and the timing and method for submitting filings. International companies that misunderstand these local tax codes face penalties, fines, back taxes, and payroll delays.

Handling multiple currencies and payment methods

Global payroll mostly requires paying employees in local currencies, which creates challenges such as exchange rate fluctuations, conversion fees, and budgeting unpredictability. Companies also have to support different payment methods based on local availability, such as direct bank transfer, mobile wallets, or other platforms.

Benefits management

Employee benefits, such as healthcare, pensions, and statutory contributions, differ widely by country. Global payroll teams have to understand and correctly calculate deductions and contributions for each jurisdiction. Mismanaging benefits leads to compliance issues, financial penalties, and dissatisfied employees.

How to manage global payroll effectively?

To manage global payroll effectively, use a global payroll provider, EOR (Employer of Record) services, automate payroll processes, stay updated on local labor laws and cross-border salary differences, implement secure payroll systems, set up a local entity and outsource to local vendors, and master currency exchange and payment logistics.

Use a global payroll provider

Use a global payroll provider, as it offers a centralized platform to process payroll across multiple countries. These providers handle local tax rules, labor laws, statutory deductions, and payroll reporting in one unified system, which reduces errors and operational complexity. They mostly provide real-time visibility and consolidated reporting of payroll data across regions. A global payroll provider simplifies global payroll operations, improves accuracy, and supports compliance without having separate systems in every country.

EOR (Employer of Record) services

An EOR (Employer of Record) acts as the legal employer of your international staff and takes responsibility for payroll processing, tax and social contributions, benefits, and compliance with local labor laws. The hiring company retains control of daily operations while the EOR handles all administrative and regulatory obligations. An EOR allows companies to hire internationally without establishing a local legal entity and ensures compliance with complex local employment regulations.

Automate payroll processes

Automation uses software to handle repetitive payroll tasks, such as calculations, data entry, tax withholdings, compliance checks, and reporting, without manual involvement. Automated global payroll solutions reduce errors, save time, and provide uniformity across markets. Companies improve performance, reduce mistakes, and allow HR teams to focus on strategy over administration.

Stay updated on local labor laws and cross-border salary differences

Each country has unique employment laws, tax rules, national holidays, benefits requirements, and wage standards. Businesses need to subscribe to regulatory updates, work with local experts, and use systems that automatically update payroll rules so that salary calculations and compliance are accurate. Staying current prevents compliance errors and confirms that payroll processing shows each location’s legal and financial requirements.

Implement secure payroll systems

Global payroll handles highly sensitive employee data, such as salary figures, national identification numbers, and bank account details. Secure global payroll systems include data encryption, strict access controls, authentication, and compliance with data protection laws, such as GDPR (General Data Protection Regulation), to protect confidentiality and authenticity. These systems protect employee privacy, avoid data breaches, and ensure compliance with global and local data security regulations.

Set up a local entity and outsource to local vendors

Companies that operate through a local legal entity outsource global payroll to local providers with expertise in domestic tax codes, labor laws, and compliance requirements. Local vendors are able to manage payroll processing, filings, and reporting on the company’s behalf. The company receives in-country expertise and reduces the burden of compliance with local specifics while keeping organizational control of operations.

Set up a local entity and manage payroll in-house

Establishing your own local legal entity allows you to run payroll in-house for larger operations. This establishment means hiring local payroll staff and systems to ensure compliance, manage employee compensation, and file taxes directly with authorities. It gives full control over payroll operations but requires thorough local expertise and system investment.

Master currency exchange and payment logistics

Managing payroll globally involves multiple currencies and international bank transfers. Best practices include monitoring exchange rates, choosing payment partners with global reach, and adding extra days to payroll schedules for processing. International firms should secure competitive exchange rates when possible to avoid unexpected cost fluctuations.

What are the benefits of managing global payroll effectively?

The benefits of managing global payroll effectively include secure payroll data, simplified payroll operations across countries, increased accuracy through automation, better local compliance and regulations, time and resource savings, and scalability for business growth.

The benefits of managing global payroll effectively are discussed below.

- Secure payroll data: Reliable global payroll systems use advanced security practices such as encryption, access controls, and protected networks to secure sensitive employee and financial information. These protections help prevent unauthorized access, data breaches, and legal penalties under privacy laws like the CCPA (California Consumer Privacy Act).

- Simplify payroll operations across countries: A centralized global payroll solution consolidates data from all locations into one platform. The platform allows HR and finance teams to monitor, report, and manage payroll across multiple countries from a single dashboard. This centralization reduces administrative complexity and removes separate systems that are difficult to coordinate.

- Increased accuracy through automation: Automated payroll processes reduce manual errors by handling complex calculations, such as taxes, deductions, and local rules, with the right software. Automation also integrates with other systems like HRIS (Human Resource Information System) and ERP (Enterprise Resource Planning), which provides accurate payroll results across the globe.

- Better local compliance and regulations: Companies automatically apply updated tax codes, labor regulations, and reporting standards for every country they operate in by using global payroll tools or services. These tools or services reduce legal risks and help avoid fines or penalties related to non-compliance.

- Time and resource savings: Managing global payroll manually across multiple jurisdictions is time-consuming. A global payroll system helps HR and finance teams with repetitive tasks by automating workflows, generating reports, and handling compliance checks. This system gives teams more time to focus on strategic projects rather than administrative work.

- Scalability for business growth: A suitable global payroll solution grows with the business without requiring major system upgrades as it expands into new markets. Scalable platforms support new countries, workforce sizes, and payroll complexities, which help companies enter new regions smoothly.

What is the future of managing global payroll?

The future of managing global payroll is combining advanced AI technology with expert help to make payroll simple, accurate, and easy to handle across countries. Automating complex calculations and compliance updates simplifies routine tasks. Providing predictive insights supports decision-making for planning budgets related to salaries, bonuses, and benefits in multiple countries.

Expert guidance is also important to understand local regulations, labor laws, and cultural standards. An expert global payroll service provider manages unique payroll cases that automated systems are unable to resolve while maintaining compliance and reducing legal risk in different global locations. Combining intelligent automation with personalized support from payroll specialists helps businesses scale payroll operations across borders with accuracy and strategic value. This support changes payroll from a back-office function into a core component of global workforce growth.

How to choose the right provider for managing global payroll effectively?

To choose the right provider for managing global payroll effectively, consider security certifications, country coverage, transparent pricing, compliance updates, payment speed and reliability, and HR and finance integration.

Choose a global payroll provider that holds recognized security standards, such as ISO/IEC 27001, GDPR (General Data Protection Regulation) compliance, or SOC 2 (System and Organization Controls 2). These standards show that the system protects sensitive payroll and personal data and lowers the risk of breaches or unauthorized access.

Select the provider that supports payroll operations in all the countries where your workforce is located. Comprehensive country coverage makes sure local tax, labor, and payroll regulations are managed correctly and avoids gaps in service or compliance. Prioritize a provider that offers transparent pricing, which means the provider clearly explains fees and costs, like any currency or conversion expenses, with no hidden fees. This transparency helps with budgeting and prevents unexpected expenses.

Partner with a global payroll provider that stays updated with local and international regulatory changes. The provider has to automatically update payroll processes to show new tax laws or reporting requirements, which reduces legal risk. Hire a reliable provider to guarantee timely and accurate payroll disbursements across different time zones and banking systems. These timely disbursements of salaries build trust with employees and reduce delays or errors.

Choose a global payroll solution that offers smooth integration with existing HR and finance systems. This integration has to make sure that payroll data flows smoothly between departments, reduces manual work, and improves accuracy and reporting.

What certifications does a global payroll provider need?

The certifications that a global payroll provider needs include ISO 27001 for information security, SOC 2 for data protection and system controls, and GDPR (General Data Protection Regulation) compliance for data handling. Professional credentials such as GPMC (Global Payroll Management Certificate), CIPP (Certified International Payroll Professional), and CCP (Certified Payroll Professional) show expertise in multi-country compliance and operations.

How can you measure the ROI of your global payroll solution?

You can measure the ROI of your global payroll solution by tracking total cost of ownership, payroll accuracy, payment timeliness, compliance issues, processing time, employee satisfaction, and cost per employee. These insights help you see cost savings, increased productivity, and improved workforce experience over time.

Should you use manual or automated payroll for managing global payroll?

You should use automated payroll for managing global payroll operations, which involves AI in payroll, due to complex multi-country regulations, tax differences, and currency needs. Using manual methods risks high errors, compliance fines, and time loss, while automation provides accuracy and scalability.

Should I centralize global payroll operations?

Yes, you should centralize global payroll operations to improve accuracy, compliance, and cost control by consolidating processes into a single platform. It reduces reliance on local systems, provides data visibility, simplifies regulatory compliance across countries, and supports scalable growth. Centralization also lowers errors and administrative burden compared to decentralized payroll systems.

How do payroll integrations help manage global payroll?

Payroll integrations help manage global payroll by automatically organizing employee, time‑tracking, HR, and finance data across systems, which reduces manual entry and errors. Payroll integrations also improve real‑time compliance with international tax and labor rules, simplify reporting and scheduling, and allow HR or finance teams to focus on strategic work instead of repetitive tasks.

Which model is better for managing global payroll, EOR or PEO?

An EOR (Employer of Record) is better for managing global payroll than a PEO, as it becomes the legal employer and handles payroll, compliance, and taxes across countries without requiring local entities. A PEO works under co‑employment and provides HR support where you already have a legal entity and share compliance responsibility.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations