Global payroll analytics tools: definition, working, benefits, and how to choose

Robbin Schuchmann

Co-founder, Employ Borderless

Global payroll analytics tools collect payroll information from different countries and analyze it to provide trends and insights that support informed business decisions. These tools work by connecting real-time data from cloud payroll, HCM (Human Capital Management), and financial platforms, which help organizations monitor how payroll activities match business objectives.

The benefits of global payroll analytics tools are increased operational performance, informed strategic decision-making, risk management and compliance monitoring, improved employee retention and experience, and a smooth connection with existing systems. The factors to consider when choosing a global payroll analytics tool include user experience, customer support and partnership, cost and total value, and analytics and reporting capabilities.

What are global payroll analytics tools?

Global payroll analytics tools analyze raw payroll data from multiple countries or regions to identify meaningful trends and generate actionable insights. They provide organizations with a consolidated view of global payroll metrics, which include labor costs, compliance status, workforce distribution, overtime, and employee benefits. Global payroll analytics tools help organizations better understand payroll expenses, compliance risks, and resource allocation at a global level by centralizing payroll data across regions.

How do global payroll analytics tools work?

Global payroll analytics tools work by managing more than just processing paychecks, as they turn payroll data into strategic insights that help businesses understand and improve their operations across countries and functions. These tools identify patterns in labor costs, compliance issues, employee compensation, and workforce trends, which help organizations understand cost distribution, assess possible risks, and evaluate compensation practices across regions.

These analytics tools work together with HR, finance, and compliance functions by gathering unified data from cloud payroll systems, HCM (Human Capital Management) platforms, and financial software in real time. This integration provides a consolidated analysis that supports cross‑departmental decision‑making and reduces errors from manual data entry.

Modern analytics tools also include predictive analytics, which help teams take action, such as identifying delayed contractor payments in a specific country or predicting future labor costs based on historical trends. Organizations improve operational effectiveness, resource allocation, and planning for growth by using payroll insights at a global scale. Global payroll analytics tools convert payroll from a back‑office administrative task into a strategic asset that supports business performance across borders.

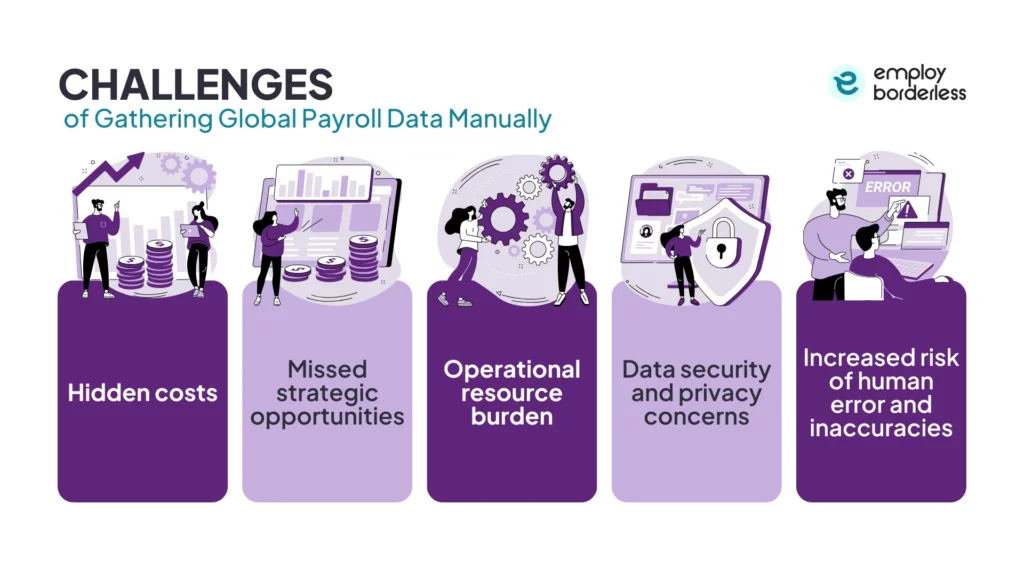

What are the challenges of gathering global payroll data manually?

The challenges of gathering global payroll data manually include hidden costs, missed strategic opportunities, operational resource burden, data security and privacy concerns, and increased risk of human error and inaccuracies.

The challenges of gathering global payroll data manually are listed below.

- Hidden costs: Manual global payroll processes sometimes hide expenses other than upfront wages, such as duplicate data entry, reconciliation efforts, training on multiple systems, and errors caused by outdated tools. These hidden costs slow growth and shift the budget from strategic needs because HR and payroll teams spend time correcting errors and managing disconnected systems.

- Missed strategic opportunities: Organizations lack timely and accurate insights into labor costs, trends, or workforce effectiveness when payroll data is collected manually and divided across different spreadsheets or local systems. This disorganized data makes it difficult to use payroll information for strategic planning, such as predicting workforce needs, improving compensation, or identifying cost‑saving opportunities.

- Operational resource burden: Reliance on manual processes means HR and payroll teams spend time on repetitive tasks like data entry, corrections, and cross‑checking figures rather than focusing on high‑value work. This operational burden consumes resources, increases workloads, and limits the team’s capacity to support strategic business initiatives.

- Data security and privacy concerns: Payroll data stores sensitive personal and financial information. Handling this information manually, mostly shared through email or stored in unprotected files, increases the risk of unauthorized access, data breaches, or regulatory non‑compliance. Different countries also implement strict privacy laws, like GDPR (General Data Protection Regulation), that require careful handling of personal data. Manual processes make it hard to implement consistent security controls and privacy standards.

- Increased risk of human error and inaccuracies: Manual payroll collection and processing are at risk for errors such as misentries, miscalculations, incorrect classifications, and outdated information. These errors result in incorrect pay, non‑compliance with tax and employment laws, penalties, and reputational damage, especially when managing different laws across multiple countries.

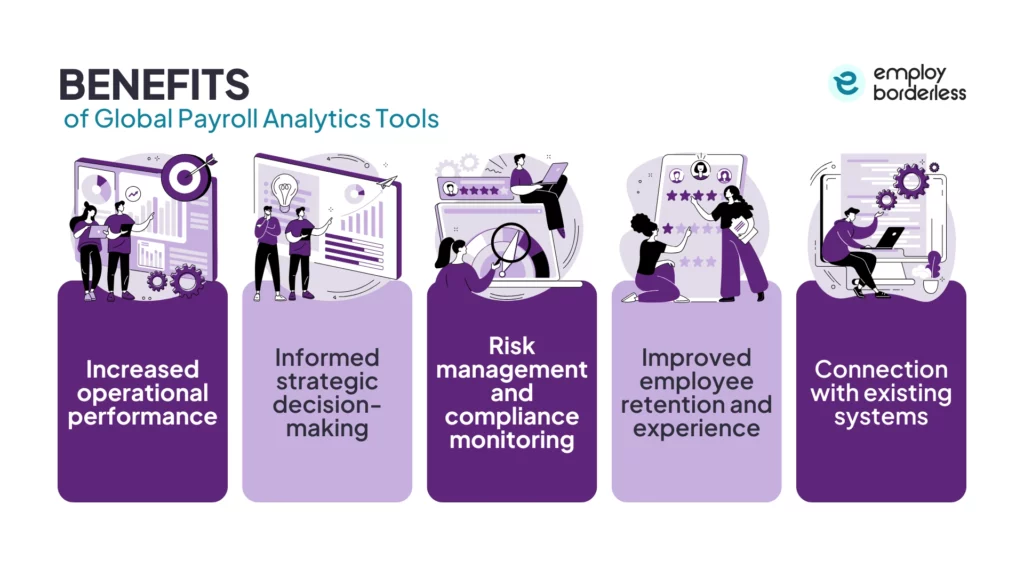

What are the benefits of global payroll analytics tools?

The benefits of global payroll analytics tools are increased operational performance, informed strategic decision-making, risk management and compliance monitoring, improved employee retention and experience, and a smooth connection with existing systems.

Increased operational performance

Global payroll analytics centralizes and automates payroll data, which reduces manual tasks and errors. This automation simplifies payroll operations and allows HR and finance teams to lower repetitive work and improve performance across regions. Organizations track payroll activity consistently and quickly identify process issues or ineffectiveness that slow operations down.

Informed strategic decision-making

Global payroll analytics provide data-driven insights into workforce costs, labor trends, overtime patterns, and compensation structures. These insights help executives make smart choices about budgeting, hiring, talent allocation, and workforce planning. They also help identify which regions have high labor costs or overtime increases and turn raw payroll data into information that supports business strategy.

Risk management and compliance monitoring

Global payroll analytics tools help monitor compliance by showing differences that lead to overtime violations or incorrect tax deductions. These systems mostly track changing labor laws and automate compliance checks to make sure payroll calculations follow regulations across countries. Automated updates reduce the risk of costly fines for non-compliance, while active monitoring helps with operational stability.

Improved employee retention and experience

Accurate payroll with reduced errors builds trust and satisfaction among employees. Global payroll analytics tools also support understanding workforce trends, like pay differences or benefit utilization, that influence employee experience.

Connection with existing systems

Global payroll analytics tools integrate smoothly with HRIS (Human Resource Information System), ERP (Enterprise Resource Planning), and financial systems. This integration removes duplicate data entry, makes sure all systems share the same accurate information, and increases the value of payroll data.

How to choose the right global payroll analytics tool?

To choose the right global payroll analytics tool, consider user experience, customer support and partnership, cost and total value, and analytics and reporting capabilities.

Choose a global payroll analytics tool that offers a simple user experience with clear dashboards and workflows. This transparency reduces training time, lowers errors, and makes it easy for HR teams and managers to use the system effectively daily. A user-friendly interface is a core requirement for evaluating payroll and HR software usability.

Select an analytics tool that provides strong customer support because payroll issues are time-sensitive and affect compliance and employee satisfaction. Look for vendors with responsive support teams and multiple support channels, like live chat, phone, documentation, or training resources.

Compare pricing structures and total cost of ownership, which involves subscription fees, implementation, training, and ongoing support. The goal is to make sure you get maximum value for the features and benefits the tool delivers, such as automation, compliance coverage, and analytics insights.

Invest in a global payroll analytics tool that gives the ability to generate customizable reports and thorough insights into workforce costs, payroll trends, compliance trends, and strategic metrics. Tools with strong analytics help executives make data-driven decisions rather than relying on spreadsheets or manual analysis.

Can global payroll analytics tools help with compliance?

Yes, global payroll analytics tools help with compliance by automating tax calculations, identifying regulatory differences, and generating audit-ready reports across jurisdictions. They monitor real-time updates to local laws, lower errors, and reduce fines through predictive analytics and centralized dashboards.

Are global payroll analytics tools secure?

Yes, global payroll analytics tools are secure, as they feature enterprise-grade encryption, MFA (Multi-Factor Authentication), RBAC (Role-Based Access Controls), and SOC 2/ISO 27001 certifications. These certifications ensure GDPR (General Data Protection Regulation) compliance, real-time monitoring, audit trails, and fraud detection to protect sensitive multinational data from breaches.

What types of insights can global payroll analytics provide?

The types of insights that global payroll analytics provide include cost trends, labor expenses, salary estimation, compliance differences, and employee demographics across countries. These insights help with real-time monitoring of payroll performance, turnover analysis, prediction, and ROI measurement to improve global operations and strategic decisions.

Are global payroll analytics tools suitable for small businesses?

Yes, global payroll analytics tools are suitable for small businesses because many providers offer scalable, affordable solutions that centralize payroll operations, automate repetitive tasks, and reduce compliance risk. Such tools help small firms manage payroll more effectively as they grow internationally.

What features should users expect in global payroll analytics reports?

The features that users should expect in global payroll analytics reports include real-time data and dashboards, compliance monitoring, customizable reporting, cost analysis, and predictive analytics.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations