PEO vs HRO: Definitions, Differences, Similarities, Benefits, and Drawbacks

Robbin Schuchmann

Co-founder, Employ Borderless

A PEO (Professional Employer Organization), also known as an outsourcing HR model, is a third-party organization that manages HR functions of businesses through a co-employment agreement, like payroll processing, benefits administration, and compliance management. HRO (Human Resource Outsourcing) is the practice of delegating HR functions and responsibilities to an external provider.

PEO and HRO differ in terms of employment model and setup, cost structure, scope of HR services, employee benefits access, legal responsibilities, flexibility and control, scalability, and effect on workplace culture. The PEO and HRO also share some similarities, like outsourced HR functions, payroll processing, compliance support, HR expertise and guidance, reduced administrative burden, and risk mitigation.

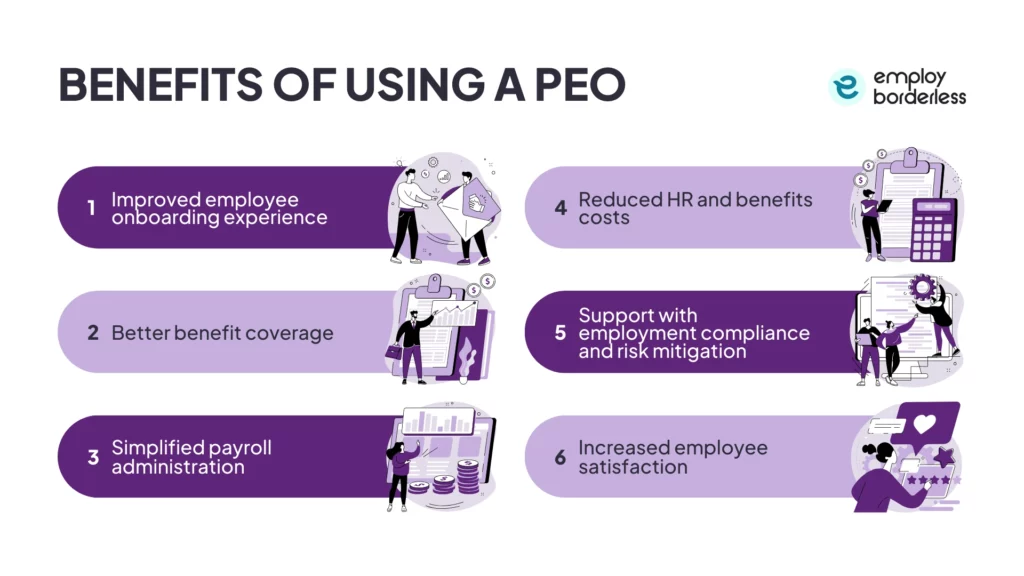

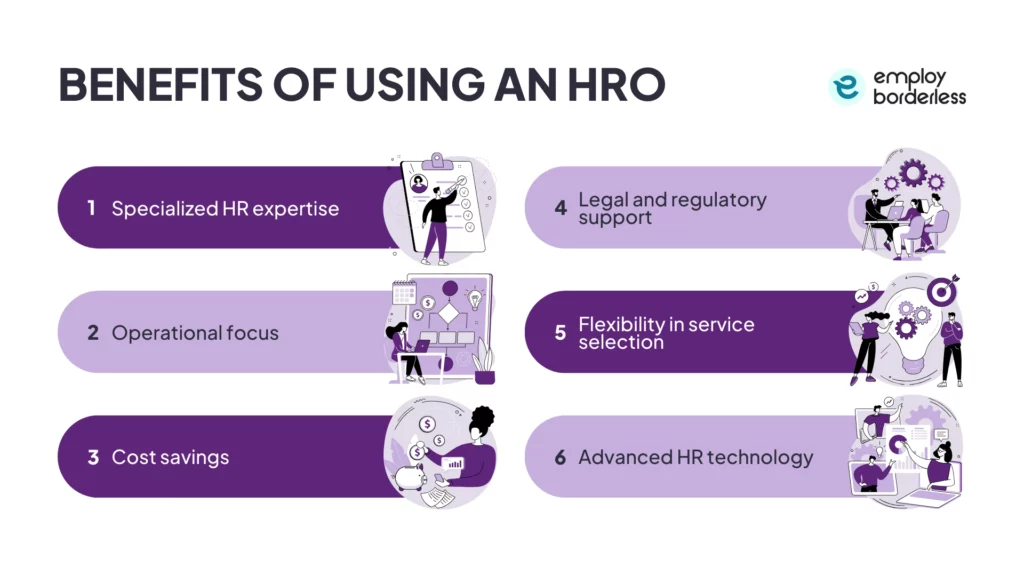

PEO provides some major benefits to client businesses, like improved employee onboarding experience, better benefit coverage, simplified payroll administration, and support with employment compliance and risk mitigation. HRO also provides benefits, such as specialized HR expertise, operational focus, cost savings, flexibility in service selection, and advanced HR technology.

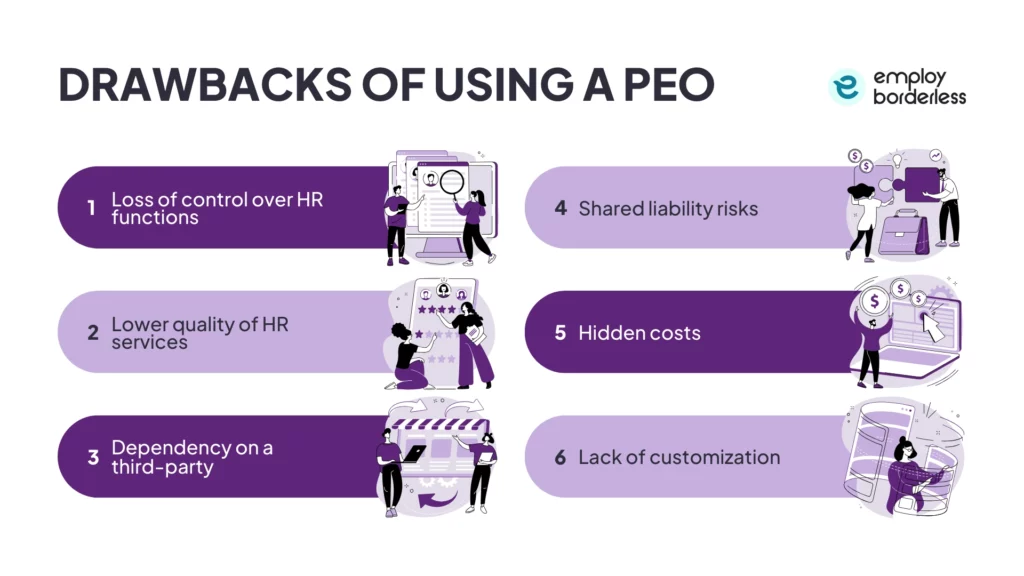

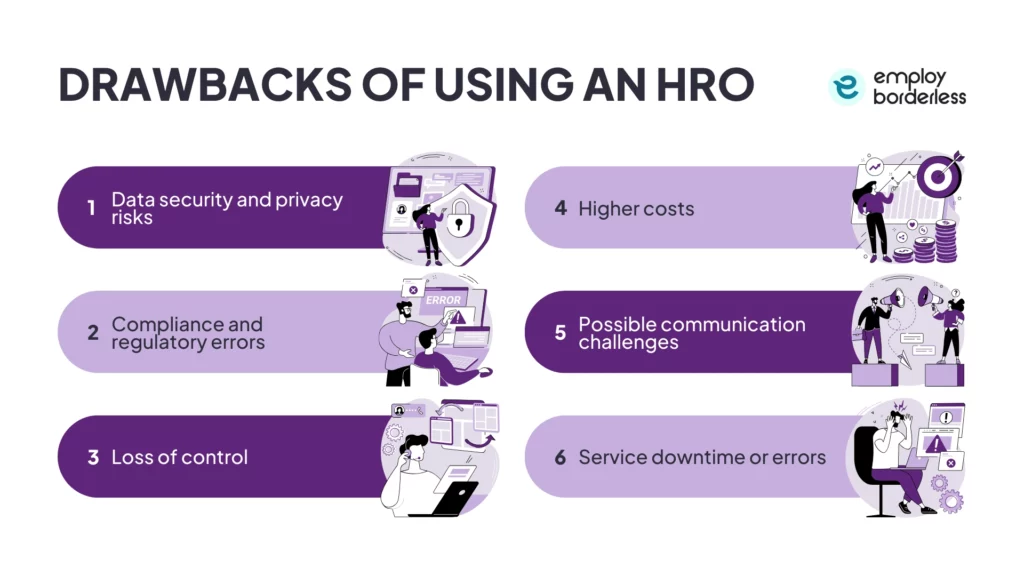

The drawbacks of using a PEO are loss of control over HR functions, lower quality of HR services, dependency on a third-party, hidden costs, and lack of customization, while the drawbacks of HRO include data security and privacy risks, compliance and regulatory errors, loss of control, higher costs, and service downtime or errors.

What is a PEO?

A PEO (Professional Employer Organization) is a third-party company that provides full-service human resources outsourcing to client businesses under a co-employment model. It handles the client’s payroll administration, employee benefits, compliance, and risk management.

How does a PEO work?

A PEO works by forming a co-employment partnership with the client company and shares employer responsibilities, such as payroll processing, workers’ compensation claims, health and retirement benefits, and tax compliance. The PEO acts as an employer of record and files taxes on behalf of the client using its own EIN (Employer Identification Number), while the client manages daily operations and employee management.

What is HRO?

HRO (Human Resource Outsourcing) is the practice of businesses hiring an external provider to handle some or all of their HR functions. The delegation of HR tasks ranges from specific services like payroll and benefits administration to comprehensive HR responsibilities such as recruitment, training, and employee development.

How does HRO work?

HRO works by delegating specific HR tasks or full HR functions from a company to an external service provider. The client company decides which HR functions to outsource, such as payroll, benefits administration, compliance, and recruiting. The HRO provider sets up systems, integrates technology, and matches HR processes with the client’s requirements. The provider manages daily operations like hiring, payroll processing, and employee support, while the client maintains control over strategic HR decisions.

What are the differences between PEO and HRO?

The differences between PEO and HRO are the employment model and setup, cost structure, scope of HR services, employee benefits access, legal responsibilities, flexibility and control, scalability, and effect on workplace culture.

| Features | PEO | HRO |

| Employment model and setup | Co-employment model | Independent third-party vendor |

| Cost structure | Percentage of payroll or a PEPM (Per Employee Per Month) | Charges based on the selective service |

| Scope of HR services | Comprehensive and packaged services | Offers selective or bundled services |

| Employee benefits access | Access to Fortune 500-level benefits | Support for managing benefits independently |

| Legal responsibilities | Shares liability with the employer | Clients are solely responsible for taxes, compliance, and liabilities |

| Flexibility and control | Less flexibility and control over benefits and HR policies | More control and customization |

| Scalability | Scales with the client company that needs full HR support | Suitable for companies with existing HR capabilities |

| Effect on workplace culture | Introduce external policies and HR practices that influence company culture | Smoothly integrates with the existing company culture |

Employment model and setup

PEOs work under a co-employment model, which means the PEO becomes the employer of record for tax and benefit purposes. The client company maintains authority over routine workplace operations, like inventory planning and task delegation, and also manages employee performance. An HRO functions as an independent vendor and does not enter into a co-employment partnership with the client company. The client remains the sole legal and worksite employer and outsources only selected HR tasks, such as benefits administration and payroll, to HRO.

Cost structure

A PEO charges either a percentage of payroll, which ranges from 2% to 12% or a flat fee per employee. The upfront cost of human resources services is high, but it leads to long-term savings because of bundled services and access to group benefits. An HRO uses a more flexible, pay-as-you-go model, which means companies only pay for the specific services they choose. This a la carte approach makes HRO more cost-effective for larger businesses that already have in-house HR teams.

Scope of HR services

The PEO provides a complete HR solution to businesses, which includes payroll, tax filing, benefits, compliance, hiring, onboarding, training, and risk management. HRO allows companies to select specific HR services according to their needs. For example, a company outsources payroll or compliance to an HRO while continuing to manage recruitment internally.

Employee benefits access

A PEO offers access to large-group health insurance and retirement plans at competitive rates by grouping employees from multiple companies. This group purchasing power allows smaller businesses to offer the employees benefits that are usually available only to larger organizations. This access to premium benefits helps small businesses attract and retain top talent for business growth.

An HRO does not directly sponsor employee benefits, but administers the plans that the client selects and helps manage them according to employee needs. These benefits sometimes cost more without the group purchasing power of a PEO.

Legal responsibilities

PEOs share legal and compliance responsibility with the client under the co-employment agreement. It files payroll taxes under its own EIN (Employer Identification Number) and handles workers’ compensation, unemployment insurance, and compliance on behalf of the client. An HRO does not share legal responsibility with the client company, so the employer remains fully responsible for compliance, taxes, and liabilities. The HRO only manages the outsourced tasks, not the legal risk.

Flexibility and control

A PEO offers less flexibility and control because companies have to use the PEO’s benefit plans and follow its standardized policies. It provides simplicity, compliance support, and access to well-managed benefits programs that many small businesses are unable to secure on their own, but this limits the employer’s ability to customize the policies according to their company objectives. HRO provides flexibility and control, as companies select vendors, plans, and processes according to their workplace policies and culture.

Scalability

A PEO offers integrated, bundled HR services that automatically scale with a company’s growth and changing needs, which allow businesses to adjust their HR solutions as their workforce and operations expand. HRO provides flexible, a la carte services, which help companies to scale selectively by outsourcing only the HR functions they need.

Effect on workplace culture

The PEO influences a company’s workplace culture by providing standardized HR policies and benefits across all client organizations. This standardization offers uniformity, compliance, and professional HR management, but it sometimes does not match a company’s unique culture, which results in employee confusion, lower morale, and reduced employee engagement.

An HRO does not influence a company’s unique culture as it only provides external vendor support without forming a co-employment agreement. The company maintains control over HR policies, practices, and workplace decisions.

What are the similarities between PEO and HRO?

The similarities between PEO and HRO are outsourced HR functions, payroll processing, compliance support, HR expertise and guidance, reduced administrative burden, and risk mitigation.

Outsourced HR functions

Outsourced HR functions mean companies outsource HR-related tasks and responsibilities, such as payroll administration, compliance support, and employee benefits, to an external provider. This HR outsourcing helps them focus on growth and core company activities, like customer support and product development.

A PEO offers a comprehensive HR solution for businesses to outsource, such as payroll processing, benefits administration, and compliance management. This outsourcing helps companies to focus on their core operations while making sure to handle HR tasks expertly and in compliance with employment regulations, like FLSA (Fair Labor Standards Act).

HRO provides businesses with the flexibility to outsource specific HR functions according to their needs. Companies choose to delegate tasks that range from administrative duties like payroll processing and benefits administration to more strategic HR operations like talent acquisition, employee onboarding, training, and compliance management.

Payroll processing

Payroll processing means businesses contract with a third-party service provider like PEO or HRO to handle employee compensation, which includes calculating total wages, earnings, withholding deductions, and filing payroll taxes.

PEOs manage payroll processing for businesses by providing accurate and timely payments to employees. They handle tax withholdings, deductions, and filings to reduce the administrative workload for companies and lower the risk of payroll errors.

An HRO also offers payroll processing services to help businesses manage employee compensation, tax withholdings, and compliance with payroll regulations. This support allows companies to simplify their payroll operations and ensure compliance with legal requirements.

Compliance support

Compliance support refers to involving a third-party service provider that makes sure that a company follows all relevant laws, regulations, and industry standards required for legally conducting its operations.

The PEO makes sure businesses follow complex employment laws and regulations, like OSHA (Occupational Safety and Health Administration) and FMLA (Family and Medical Leave Act). They provide guidance on compliance with federal, state, and local labor laws, which help companies mitigate risks and avoid costly fines.

HRO providers offer compliance support to companies by advising them on best practices and legal requirements related to HR functions and employment standards. Their expertise helps companies stay informed and compliant with relevant laws, but they do not take any responsibility in case of legal violations, as the client is the sole legal employer.

HR expertise and guidance

HR expertise and guidance mean businesses partner with third-party providers, such as PEOs and HROs, to access professional HR knowledge. These providers advise companies on workforce management, employee engagement, and strategic HR planning to match HR practices with their business goals.

PEOs offer HR expertise to businesses by providing strategic guidance on HR policies, employee relations, and organizational development. Their experience helps companies implement effective HR strategies according to their business goals, such as improving compliance management and creating a positive working environment by giving access to premium employee benefits, like health insurance and retirement plans, like 401 (k).

An HRO provider offers specialized HR expertise by helping businesses in areas such as talent acquisition, performance management, and employee development. Their guidance helps companies improve HR practices, employee retention, and overall workforce productivity.

Reduced administrative burden

Reduced administrative burden refers to companies outsourcing complex and time-consuming HR tasks, such as payroll, benefits administration, and compliance, to external providers. This allows internal teams to spend their time on core activities like product development, sales, and marketing, and also manage HR processes accurately.

Businesses outsource HR functions to PEOs, which saves them from administrative workload related to HR tasks, like payroll management, benefits enrollment, and compliance management. This allows internal teams to focus on strategic initiatives and core business activities, which leads to increased employee productivity.

An HRO provider also helps businesses reduce administrative workload by delegating specific HR functions. These delegated tasks help companies to simplify operations and use their company resources more accurately.

Risk mitigation

Risk mitigation means companies take active steps to prevent or reduce the impact of possible risks, such as legal issues, compliance violations, employee disputes, or workplace safety concerns on their business.

PEOs share employment-related liabilities with businesses, so it helps provide risk mitigation in areas such as workers’ compensation, unemployment insurance, and compliance with labor laws. This partnership helps companies manage and reduce HR-related risks that impact a business’s reputation and legal standing.

HRO providers also offer guidance on risk management practices as they help ensure compliance with labor laws, update workplace policies, manage employee relations, and reduce risk of lawsuits. Businesses are able to create a safer and legally compliant workplace, which increases employee productivity and loyalty.

What are the use cases of a PEO?

The use cases of a PEO include startups and small businesses, medium-sized businesses, companies expanding globally, and industries with high employee turnover.

The use cases of a PEO are listed below.

- Startups and small businesses: Startups and small businesses partner with PEOs to access expert HR support without building an in-house team. PEOs reduce compliance risks, manage payroll and benefits, and allow employers and the in-house team to focus on scaling the business. Small firms especially benefit from cost-effective benefits packages and simplified HR processes.

- Medium-sized businesses: Medium-sized businesses use PEOs as they grow from small teams, so expanding staff creates more complex HR, compliance, and benefits needs. PEOs provide expert support in payroll, risk management, employee relations, and regulatory compliance. This allows medium-sized companies to scale quickly, stay compliant, and reduce administrative burden without expanding their internal HR team.

- Companies expanding globally: Companies entering new global markets use PEOs to handle local hiring, payroll, benefits, and compliance with international labor and employment laws. It also helps with faster market expansion while reducing legal and operational challenges.

- Industries with high employee turnover: Industries with frequent staffing changes, such as retail, hospitality, or manufacturing, use PEOs to simplify hiring, onboarding, and administration. PEOs help stabilize operations by managing benefits, compliance, and workforce operations in high-turnover environments.

What are the use cases of HRO?

The use cases of HRO are growing and scaling companies, organizations with remote or distributed workforce, enterprises requiring expertise in recruiting, and companies that need temporary HR support.

The use cases of HRO are listed below.

- Growing and scaling companies: Companies that are expanding and scaling face increasingly complex HR challenges, from compliance and payroll to employee engagement. They access specialized HR expertise and advanced technology by partnering with an HRO without the high costs of maintaining a full in-house HR team. This support helps them to focus on growth while keeping HR operations accurate and compliant.

- Organizations with a remote or distributed workforce: Organizations with remote or distributed teams face difficulty in managing compliance, onboarding, and performance tracking. HRO providers resolve these challenges by offering scalable solutions such as digital onboarding systems, compliance support, and performance management tools. HRO helps businesses stay productive and keep employees engaged across multiple locations.

- Enterprises requiring expertise in recruiting: Enterprises requiring expertise in recruiting use HRO providers that specialize in recruitment processes and offer services such as candidate sourcing, screening, and placement. They use technology and industry knowledge to attract and retain qualified candidates expertly.

- Companies that need temporary HR support: Companies need temporary HR support during periods of high demand or organizational change. HRO providers offer flexible staffing solutions, like temporary HR professionals who are able to manage tasks like recruitment, onboarding, and compliance during transitional periods.

What are the benefits of using a PEO?

The benefits of using a PEO are improved employee onboarding experience, better benefit coverage, support with employment compliance and risk mitigation, and increased employee satisfaction.

Improved employee onboarding experience

An improved employee onboarding experience means PEOs simplify the hiring process by using digital platforms and standardized workflows, such as document processing, benefits enrollment, and training system setup, to create a smooth and organized process for new hires. The features of PEO’s standardized onboarding platforms also include pre-filled forms, self-onboarding portals, checklists, and digital signatures, which help employees adjust quickly and positively to the workplace. This simplified onboarding creates a stronger initial connection to the company culture and expectations.

Better benefit coverage

Better benefit coverage means a PEO helps businesses, especially small and medium-sized businesses, by offering employees high-quality benefits that are usually only available to larger companies, such as health and disability insurance.

PEOs negotiate competitive insurance rates by pooling employees from multiple client companies into one large group. This negotiating power gives businesses access to better health insurance, retirement plans such as 401(k), and dental and vision coverage, at lower rates than they get on their own. PEOs also provide extra benefits like mental health and wellness programs, flexible spending accounts, and life or disability insurance, which increases employee morale, helps businesses attract skilled talent, and improves staff retention.

Simplified payroll administration

Simplified payroll administration means businesses transfer payroll management tasks to a PEO, which reduces payroll complexity and saves time. PEOs manage wage calculations, tax withholdings and filings, direct deposits, pay slips, and compliance with wage and hour laws. This simplified payroll processing provides accuracy, reduces the risk of costly errors or fines, lowers the administrative burden, and allows companies to focus more on core activities such as customer service and business growth.

Reduced HR and benefits costs

Reduced HR and benefits costs mean that companies partner with PEOs to lower expenses on both HR operations and employee benefits.

Companies access complete HR support without maintaining a large in-house HR team by outsourcing HR functions to a PEO, such as payroll, benefits administration, tax filings, and compliance. Businesses lower expenses related to internal HR staff, office space, and technology, which also reduces HR overhead costs.

PEOs also pool employees from multiple companies to negotiate benefits at group rates, which include health insurance, retirement plans, and other benefits, like vision and dental insurance. This collective buying power reduces overall costs while giving employees access to benefits that small or medium-sized businesses are unable to afford independently.

Support with employment compliance and risk mitigation

Support with employment compliance and risk mitigation means PEOs help businesses follow labor laws, tax regulations, and workplace safety standards. This third-party service provider offers access to specialized knowledge on federal, state, and local employment regulations, like the ACA (Affordable Care Act), the EPA (Equal Pay Act), and the OSHA (Occupational Safety and Health Act), which help businesses stay compliant and avoid court disputes.

PEOs also offer EPLI (Employment Practices Liability Insurance), which protects businesses against claims related to employment practices, such as wrongful termination or discrimination. They also implement active risk management strategies, such as safety training programs and workplace audits, to reduce workplace accidents and related liabilities.

Increased employee satisfaction

Employee satisfaction increases when a PEO provides competitive benefits, provides accurate HR processes, and helps businesses create a positive work environment. PEOs implement HR technology platforms that provide employees with easy access to HR resources and support, which helps promote work-life balance and overall satisfaction. PEOs reduce the workload on internal HR teams and employees by handling administrative tasks like payroll, compliance, and benefits administration, which allows them to focus on employee development and engagement.

What are the benefits of using an HRO?

The benefits of using an HRO include specialized HR expertise, operational focus, cost savings, legal and regulatory support, flexibility in service selection, and advanced HR technology.

Specialized HR expertise

Specialized HR expertise means HRO providers offer access to HR professionals with expertise in different HR areas, like compliance, talent management, and employee relations. This access makes sure that businesses benefit from high-quality HR services without the need to develop in-house expertise. Businesses also simplify HR processes and improve operational accuracy by using the tools of HRO providers, such as ATS (Attendance Tracking System), HRIS (Human Resource Information System), and HCM platforms (Human Capital Management).

Operational focus

Operational focus means HRO allows businesses to concentrate on their core operations by delegating HR functions to specialized providers. This strategic shift helps companies spend more time and resources on growth initiatives and customer satisfaction, rather than being burdened by administrative HR tasks, like processing payroll and invoices, database maintenance, and preparing reports.

Cost savings

Cost savings occur when outsourcing HR functions to an HRO, as it lowers expenses related to hiring, training, and maintaining an in-house HR team. HRO services scale to meet changing HR needs, which allows companies to adjust quickly without investing in extra internal resources. They also provide simplified processes and advanced technology platforms, like HRIS and HCM, which make HR operations faster, more accurate, and reduce the risk of costly errors.

Legal and regulatory support

Legal and regulatory support means HRO providers offer specialized legal support to help businesses comply with labor laws and regulations. HRO provider services monitor and ensure compliance with multi-state regulations, educate on non-compliance risks, and implement best practices. They also help create and update employee handbooks and workplace policies according to current laws.

Flexibility in service selection

Flexibility in service selection means HRO allows businesses to customize their HR support by choosing specific services based on their needs, without being restricted to bundled packages. Companies select services such as payroll processing, benefits administration, or compliance support that match their current requirements. Companies manage costs effectively by avoiding expenses related to comprehensive HR departments by outsourcing only the necessary HR functions.

Advanced HR technology

Advanced HR technology means HRO providers implement systems that automate routine HR processes such as payroll processing, benefits administration, and time tracking. This automation not only saves time but also offers accuracy and compliance with regulatory requirements. Advanced HR technology by HRO offers analytics tools that help in workforce planning and performance management. Businesses are also able to make informed decisions regarding talent acquisition, retention strategies, and overall workforce development by analyzing employee data through analytics tools.

What are the drawbacks of using a PEO?

The drawbacks of using a PEO are loss of control over HR functions, lower quality of HR services, dependency on a third party, shared liability risks, hidden costs, and lack of customization.

The main disadvantages of using a PEO are listed below.

- Loss of control over HR functions: Loss of control over HR functions means PEOs use standardized systems and processes, which restrict the clients who require flexibility in areas such as benefits administration, vendor selection, and HR technology platforms. The co-employment relationship also means that the PEO shares responsibility for employment-related decisions, which reduces the company’s direct influence over HR policies and procedures.

- Lower quality of HR services: Lower quality of HR services means PEOs manage multiple clients and employees, which results in a less personalized customer service experience or challenges in communication and responsiveness. Employee concerns and inquiries are redirected, and a dedicated PEO representative is not always available to handle specific employee and HR needs.

- Dependency on a third-party: Dependency on a third party means relying on an external provider, such as a PEO, to manage important HR functions like payroll, compliance, and benefits. This reliance creates risks, which include administrative errors, data breaches, and compliance gaps by the PEO, which may damage employee trust and result in costly fines for the business.

- Shared liability risks: Shared liability risks mean a PEO takes on responsibilities for employment-related issues, such as wrongful termination or workplace discrimination claims. A PEO also manages compliance and payroll taxes, but errors in these areas can make the client legally responsible. These mistakes can cause financial penalties, lawsuits, and reputational harm for the client company.

- Hidden costs: Hidden costs mean a PEO agreement sometimes does not clearly explain the prices of each HR service, and uses pricing models such as a percentage of payroll or per-employee fees. Businesses often find extra expenses like onboarding fees, benefit markups, add-on charges, and exit penalties hidden in complex clauses, which puts a financial burden, especially on small and medium-sized businesses.

- Lack of customization: Lack of customization means the PEO usually offers standard, one-size-fits-all HR services that sometimes do not match the company’s unique needs or culture. This lack of customization makes it difficult to adjust policies, benefits, or workflows to suit the business’s specific requirements.

What are the drawbacks of using an HRO?

The drawbacks of using an HRO include data security and privacy risks, compliance and regulatory errors, loss of control, higher costs, possible communication challenges, and service downtime or errors.

The cons of using an HRO are listed below.

- Data security and privacy risks: Data security and privacy risks occur when companies outsource HR functions to an HRO and they share sensitive employee information, such as personal, financial, or medical data, with a third party. Businesses lose some control over data access as the HRO manages and stores this information, which increases the risk of breaches, misuse, and compliance violations, possibly leading companies to court penalties and reputational damage.

- Compliance and regulatory errors: Companies outsource HR functions to an HRO, but they remain fully responsible for compliance and regulatory requirements. For instance, if the provider fails to follow labor laws, misfiles payroll taxes, or makes reporting mistakes, the client still faces penalties, lawsuits, or audits. These errors damage the company’s reputation and increase costs rather than lowering them.

- Loss of control: Loss of control means that companies partnering with an HRO have less direct management of important HR processes. This reduced control results in slower issue resolution, misaligned policies, and lower employee engagement, as the provider sometimes does not fully understand the organization’s culture and requirements.

- Higher costs: Higher costs occur when businesses delegate HR tasks to an HRO, compared to basic HR solutions. HROs provide customized services according to the company’s needs, but these services often come at premium expenses. Businesses need to manage multiple providers or services, which also increases complexity and integration challenges, further raising overall costs.

- Possible communication challenges: Outsourcing HR functions to an HRO leads to communication challenges due to factors such as distance, differences in company culture, and confidentiality concerns. These issues cause difficulty in achieving company objectives, delays in issue resolution, and misunderstandings in policy implementation, which affects employee satisfaction and productivity.

- Service downtime or errors: Service downtime or errors means transferring HR tasks to an HRO involves technical issues for the employer, such as system outages or software malfunctions, which disrupt HR operations like payroll processing and benefits administration. These disruptions cause delays in employee payments, compliance issues, and decreased employee satisfaction.

What are the alternatives to PEO and HRO?

The alternatives to PEO and HRO are ASO (Administrative Services Organization) and EOR (Employer of Record). These alternative models offer flexibility and support depending on company size, geographic reach, and the level of control that companies require to maintain over HR functions.

An ASO (Administrative Services Organization) provides administrative HR services without establishing a co-employment relationship, which means the company maintains full control over employment decisions and liabilities. ASOs usually handle tasks like payroll processing, benefits administration, and compliance support. This model is ideal for businesses that require HR support while maintaining direct workplace management and responsibility.

EOR (Employer of Record) acts as the legal employer for employees of the client company, and takes responsibility for compliance, payroll, benefits, and tax filings. This arrangement allows companies to hire employees in regions where they do not have a legal entity and offer help with global expansion without the complexities of setting up local operations. EORs are particularly suitable for businesses that require expertise in international or remote workforce management.

What are the factors to consider when choosing between a PEO and an HRO?

The factors to consider when choosing between a PEO and an HRO include HR needs, cost structures, compliance requirements, provider credibility and experience, and security measures.

Choose a PEO because it provides comprehensive HR support, like payroll processing, benefits administration, and compliance management through a co-employment arrangement. Partner with an HRO as it is suitable for companies that require specific HR services, such as recruitment or compliance guidance, without the shared legal responsibilities of a PEO.

Select the PEO as its cost structure usually involves a percentage of payroll or a per-employee fee, which includes bundled HR services, like employee benefits and payroll management. Choose an HRO as the charges are usually based on the services selected, so it offers more cost flexibility but requires in-house HR management.

Partner with a PEO as it shares responsibility for compliance with employment laws and regulations, to reduce the client’s legal risk and compliance gaps. Select an HRO as it offers advisory support for compliance, but the client maintains full responsibility for employment-related requirements.

Choose an IRS-certified PEO to confirm its credibility or a PEO that has experience in the client company’s industry to better support HR and compliance requirements. Partner with an HRO as it offers specialized expertise in specific HR functions, which allows businesses to access targeted knowledge and resources.

Select a PEO for its strong security protocols, such as SSL encryption, to protect sensitive employee data, and for compliance with industry standards and regulations like GDPR (General Data Protection Regulation). Choosing an HRO for security measures differs by provider, so businesses need to assess each provider’s data protection policies to make sure they meet company standards.

What is the difference between PEO and PPO?

The difference between PEO and PPO is that a PEO partners with businesses to manage HR functions such as payroll, benefits, compliance, and risk management through a co-employment relationship. PPO is a type of health insurance plan that offers a network of healthcare providers and allows members to see specialists and out-of-network doctors without referrals.

What is the difference between HR and HRO?

The difference between HR and HRO is that HR is an internal department within a company responsible for managing employee-related functions, such as hiring, training, payroll, and compliance. HRO involves contracting external providers to handle some or all of these HR functions, which allows businesses to focus on core operations while using specialized expertise.

Should you choose a PEO or HRO?

You should choose a PEO if you require a full-service HR solution, which includes payroll administration, employee benefits, and compliance management. You should choose an HRO if your business has an established in-house HR team and requires specific, scalable HR services without a co-employment arrangement.

What does PEO stand for in HR?

A PEO stands for in HR as Professional Employer Organization, which is a third-party company that offers HR services to companies, such as payroll, benefits administration, and compliance, in a co-employment arrangement. PEO in HR also provides recruitment and onboarding, training, and employee development.

How can a PEO be compared to traditional HR?

A PEO can be compared to traditional HR in that a PEO handles HR functions like payroll, benefits, and compliance through a co-employment model, while traditional HR relies on an in-house team for workplace and administrative management, which requires more resources. The main difference between PEO and traditional HR is that a PEO shares HR responsibilities to reduce workload, while traditional HR keeps full control in-house.

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Ready to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations