PEO for restaurants: benefits, considerations, and how to choose

Robbin Schuchmann

Co-founder, Employ Borderless

Restaurant management is complex as it involves processing payroll, hiring new employees regularly, and complying with labor laws. These complexities occur because of high turnover, tip reporting regulations, and seasonal staffing shifts.

A PEO (Professional Employer Organisation) provides a strategic solution by handling HR, payroll, benefits, and compliance through a co-employment agreement to help restaurant owners concentrate on food quality and service.

Benefits of using PEOs for restaurants include cost savings and scalability to enable growth, compliance assistance, payroll and tax administration to prevent costly errors, and employee engagement and retention through easier onboarding and higher job satisfaction.

What is a PEO?

A PEO (Professional Employer Organization) is an outsourced HR provider that enters into a co-employment agreement with businesses and performs legal and administrative employment requirements. The PEO manages benefits, workers’ compensation, compliance, withholding, and payment for taxes by using its own EIN (Employer Identification Number) and becomes the employer of record for payroll and tax purposes.

PEOs manage all payroll processing and employment tax filings on behalf of the client company. The client company maintains authority over routine HR choices, which include hiring, firing, promotions, and workplace management. PEOs group workers from many clients to offer affordable health insurance and retirement plans. PEOs reduce legal and financial risk because they are aware of workers’ compensation, labor laws, safety regulations, and unemployment insurance.

PEOs also provide safety management services such as OSHA (Occupational Safety and Health Administration) safety inspections, labor and employment law compliance, and liability protection. They provide HR technology systems, such as benefits enrollment, time attendance, training, filing of documents, and access to expert HR consulting services about policies, employee onboarding, performance management, and development of the workforce.

Why should restaurants work with a PEO?

Restaurants should work with a PEO to manage high employee turnover, difficult labor law compliance, seasonal workforce changes, and routine HR administrative tasks, all of which are regular and costly challenges in the restaurant industry. PEOs provide customized services that improve operational performance, employee productivity, and reduce risks, like IRS (Internal Revenue Service) penalties, wage and hours violations, and high recruiting costs.

The restaurant business has one of the highest staff turnover rates, with hiring, onboarding, and training new hires, which is a time-consuming and costly process. PEOs simplify the onboarding process and maintain employee records. It also offers competitive benefit packages, like PTO (Paid Time Off) and sick leave, health insurance, and EAPs (Employee Assistance Programs) that encourage employees to stay.

Restaurants also have to comply with the wage policies, tip reporting requirements, overtime policies, meal and break laws, and OSHA safety requirements. These policies change frequently depending on different locations, for example, when a restaurant in state A opens a new branch in state B, it then has to follow the wage policies and rest-break laws of state B. PEOs provide compliance experts who help restaurants make sure they are not violating any applicable local, state, or federal labor regulations.

The number of employees in restaurants changes according to tourist seasons, weather, and holidays. PEOs offer reasonable, on-demand payroll, benefits, and HR solutions that change with a restaurant’s staffing needs. Restaurants recruit and hire many employees, but PEO still helps in ensuring compliance and maintaining stability.

Restaurant owners and managers have limited time to improve the quality of their cuisine or customer service as they regularly manage payroll, schedules, insurance information, hiring, and staff conflicts. PEOs take over hiring, firing, and other HR tasks, such as managing payroll, employee tax filings, benefits, and employee assistance, which saves time and avoids errors.

What are the benefits of PEOs for restaurants?

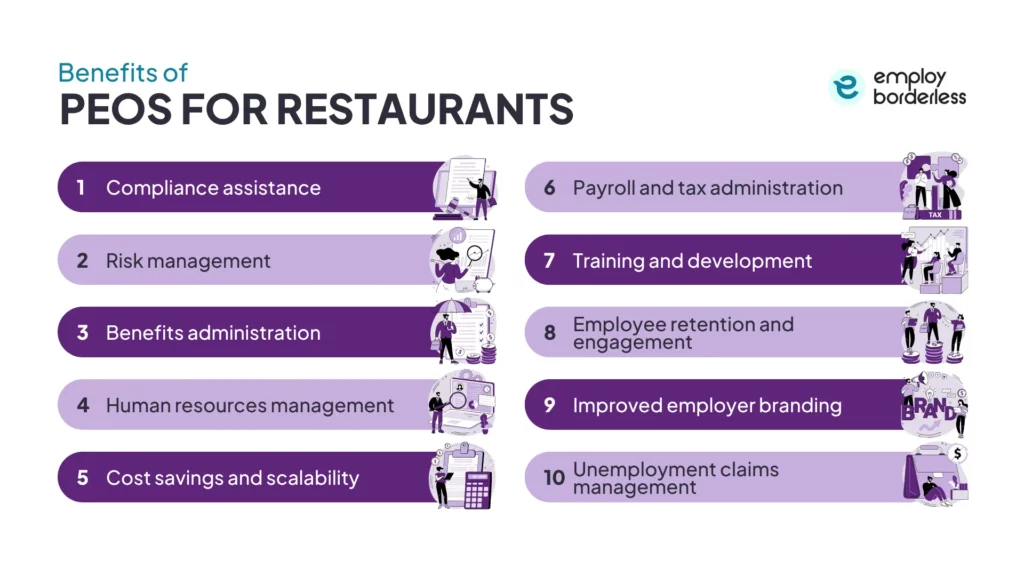

The benefits of PEOs for restaurants are compliance assistance, risk management, benefits administration, human resources management, cost savings and scalability, payroll and tax administration, training and development, employee retention and engagement, improved employer branding, and unemployment claims management.

Compliance assistance

Compliance assistance means helping businesses understand, comply with, and maintain legal, local, and federal requirements. This includes labor laws, tax laws, workplace safety regulations, employee classifications, and industry-specific requirements.

PEOs are aware of changing labor laws and make sure that the restaurant is not at risk of legal action or penalties for failing to comply with wage laws, overtime regulations, and workplace safety standards.

PEOs file taxes and help with OSHA-specific safety standards, workers’ compensation claim administration, employee handbooks, employee safety, workplace policies, and liability avoidance.

Many PEOs, like Fourth and DineHR, specialize in hospitality and restaurant-specific services, like payroll and HR administration, and create them to comply with regulations like tip collecting, OSHA kitchens, and staff members’ shifting schedules.

Risk management

Risk management means identifying, evaluating, and reducing the possible risks that have a negative effect on a business, such as legal liability, accidents in the workplace, and financial losses.

PEOs handle claims, workers’ compensation coverage, and return-to-work programs. It helps with premium and legal exposure management, which reduces administrative burden.

PEOs also provide security measures, such as food safety training, rotating tasks, and safe lifting training, and identify risks, like hot surfaces, poor equipment, and faulty electrical appliances, through audits and safety assessments.

PEOs offer effective risk management operations, such as incident reporting, emergency preparation, preventive maintenance, and employee training, to facilitate workflow, cut down on waiting times and incidents, and expand the workforce in the service and restaurant industries.

Benefits administration

Benefits administration means planning, organizing, and regulating benefits such as health insurance, retirement plans, paid time off, FSA (Flexible Spending Account), and disability insurance.

PEOs combine the health plans of different client companies, so small restaurants can offer their employees benefits like medical, dental, vision, 401(k), life, and disability insurance at group rates that are unavailable to them.

The PEOs increase employee satisfaction by giving the restaurant’s internal HR team all benefits-related inquiries, claims, and help, which reduces the administrative burden on them.

PEOs help restaurants attract and keep employees by negotiating better rates, which improves the benefits procedures, and offers comprehensive packages, such as retirement savings plans, commuter benefits, and long-term or short-term disability coverage.

Human resources management

Human resources management means managing people within an organization to improve their performance while building a positive and compliant work environment.

PEOs save restaurant owners’ money and administrative effort by providing HR services, which include hiring, training, performance management, and employee relations. They make sure that HR policies, such as handbooks, scheduling rules, and workplace regulations, meet the local, state, and federal requirements to reduce legal risk and internal HR issues.

PEOs offer complete and accurate expert HR advice, so restaurant owners and managers do not have to invest in an HR group. PEOs offer strategic staffing, performance management, and conflict resolution services. They also offer training development programs that help restaurants create more stable and productive staff and reduce turnover rates.

Cost savings and scalability

Cost savings means saving money by cutting down expenses and keeping a larger portion of profits. This involves productivity, reducing errors, and negotiating better prices. Scalability means the ability of a business to expand, for example, by employing more employees or opening new sites without facing major issues or requiring more resources.

PEOs can negotiate lower health insurance, workers’ compensation, and unemployment insurance rates by grouping many small businesses. This allows restaurants to grow as they benefit from group rates that are only available to larger businesses.

PEOs save labor costs by handling payroll, HR, and compliance tasks for the restaurants, so restaurants do not need a full-time HR staff or overworked managers.

PEOs easily handle growing HR requirements like onboarding, multi-state payroll, and benefits as a restaurant grows by adding new sites or hiring more employees. PEO’s flexible service approach allows restaurants to scale the level of support easily when using or discontinuing PEO HR services, without building or removing systems internally.

Payroll and tax administration

Payroll and tax administration means handling employee compensation and making sure payroll taxes are accurately calculated, withheld, reported, and paid to the government.

PEOs make sure that employees’ working hours, overtime, and tip calculations are handled accurately and that mistakes about payroll issues or employee job dissatisfaction are fixed. PEOs also manage all aspects of payroll tax compliance, such as calculating federal, state, and local tax withholdings, filing payroll tax returns, and paying taxes to avoid errors or costly fines for restaurants.

PEOs are good at handling payrolls for different states as they have relevant systems to comply with different jurisdictional regulations. PEOs simplify calculating the federal and state taxes that apply to restaurants. It also handles payroll and tax functions for restaurants that have opened a new site in a different state with different tax regulations.

Outsourcing payroll and tax administration allows restaurant owners and managers to focus on the core responsibilities, like managing food and customers.

Training and development

Training and development are programs and activities that help employees in an organization improve their skills, expertise, and performance on the job.

PEOs also offer customized training programs for the restaurant industry, such as machine training, food hygiene, food information, and customer handling. The training programs have well-structured modules, such as company culture policies, food safety and sanitation, and POS (Point of Sale), through which new hires learn fast.

PEOs provide a continuous growth for restaurants through leadership workshops, compliance refresher courses, and hygiene training courses that help employees to develop and stay up to date with industry requirements.

Employee retention and engagement

Employee retention means retaining employees by offering them rewards, a positive work environment, and good working conditions. Employee engagement means employee enthusiasm and dedication to their company and its goals.

PEOs help in simplifying HR with recruitment and onboarding, payroll, and benefits, and allow the restaurant teams to work productively. This increases employee satisfaction and engagement because PEO removes the administrative burden.

PEOs offer competitive benefits, like retirement plans 401(k), health insurance, and workers’ compensation that small restaurants are unable to receive. These benefits by PEO not only attract new employees, but the regular staff also remain loyal and work actively in these small restaurants.

Improved employer branding

Improved employer branding means promoting a company’s reputation as an ideal place of work to both current and potential employees with the company’s values, culture, and overall employee experience.

A PEO helps in building a strong employer brand image, based on employee benefits, recognition, and development opportunities, to attract candidates who fit their brand’s culture and values. PEO-supported restaurants have low turnover rates and increased employee satisfaction, which also increases their value to job seekers in a competitive labor market.

PEO offers compensation packages and improved workplace policies to restaurants, which is helpful for their branding and attracts qualified candidates who appreciate a stable and encouraging work environment.

Unemployment claims management

Unemployment claims management means managing and responding to claims made by former workers looking for unemployment benefits, such as health insurance assistance, and training and job placement services.

PEO serves as a co-employer, so it protects the restaurant from being held solely responsible for benefit payments, as both parties share responsibility for unemployment claims. PEOs handle every step of the claims process, from filing to hearing representation, reducing administrative effort and making timely and accurate submissions.

PEOs estimate claim costs and are aware of unemployment trends, so they take active measures, like assessing layoff procedures to reduce claims and maintain low state unemployment tax rates.

PEOs keep accurate employment records and help in correctly recording terminations, which helps in managing the disputes of false claims and avoids paying unnecessary benefits.

Does partnering with a PEO mean losing control of my employees?

No, partnering with a PEO does not mean losing control of your employees as the restaurant owner (employer) maintains control over hiring, firing, daily management, scheduling, performance reviews, and all other operational decisions, even in a co-employment agreement.

A PEO takes on the role of employer of record for tax, benefit, and compliance purposes, but still, employers make important employment decisions, which include salary raises, promotions, terminations, and disciplinary measures. The PEO has to ask for notifications on these actions, but it cannot take the place of the employer’s managerial authority to maintain compliance.

Employing a PEO to handle HR administration gives the employer more control over the company because it saves time and resources for employers to concentrate on core duties like team building, expansion, and customer service.

How to choose the right PEO for your restaurant?

To choose the right PEO for your restaurant, you should look for industry experience of the PEO, assess your business needs, check certifications, review technology and integration, understand pricing structure, and read contracts carefully.

Choose a PEO that already has restaurant or hospitality industry experience. It is informed about wage-hour laws specific to the foodservice industry, OSHA (Occupational Safety and Health Administration) kitchen compliance, seasonal staffing, tip reporting, and shift scheduling.

You should also assess your business needs when choosing a PEO, such as the rate of staff turnover, the complexity of payroll types, and compliance with tip and labor regulations. Then, decide which services are required (benefits, training, or HR support). This helps in choosing a PEO that fits your operational needs.

When choosing a PEO, make sure it is either ESAC-accredited (Employer Services Assurance Corporation) or IRS-certified (CPEO). These certifications help businesses in legal compliance, ethical business operations, and financial stability.

Choose a PEO that provides easy-to-use HR technology that can work with advanced tools, such as POS (Point of Sale) platforms or scheduling systems (HotSchedules), to simplify daily operations.

When choosing a PEO, verify if they charge as a percentage of payroll or as a fixed fee per employee. Review the services included and check for any additional costs, such as termination fees, year-end tax processing, and off-cycle payroll runs.

Check the fine print for information on SLAs (Service Level Agreements), cancellation policies, and whether the services will grow with your restaurant.

What services does the PEO offer?

The services that PEO offers are HR support, compliance management, employee benefits administration, payroll and tax administration, risk management, and workers’ compensation. PEO services also include training and development programs, recruitment and onboarding, insurance, and performance management.

Is the PEO experienced in the restaurant industry?

Yes, the PEO is experienced in the restaurant industry because it provides them with customized solutions such as tip reporting, wage law compliance, POS (Point of Sale) and scheduling tool integration, and industry-specific benefits. PEO helps restaurants with smooth HR operations, accurate payroll, and regulatory support for food service enterprises.

How does the PEO handle payroll and tax filings?

The PEO handles payroll and tax filings by serving as the employer of record. It processes payroll, files quarterly and annual tax returns, calculates and withholds federal, state, and local taxes, transfers payments, and ensures multi-state compliance, which helps in reducing errors and fines.

How does PEO compliance protect your restaurant?

The PEO compliance protects your restaurant by ensuring compliance with OSHA (Occupational Safety and Health Administration) standards, wage laws, labor laws, and the ACA (Affordable Care Act). PEO compliance protects your restaurant from legal problems and regulatory violations by managing risk, updating policies, helping with audits, and helping in avoiding costly penalties.

Can a PEO help reduce employee turnover in restaurants?

Yes, a PEO can help reduce employee turnover in restaurants by providing competitive benefits, like health-related benefits, retirement plans, onboarding, managing HR duties, and improving workplace compliance. These services improve employee retention and satisfaction, which is important in the restaurant industry because of its high turnover rate.

PEO vs. ASO: Which is right for your business?

Businesses select the best HR solution depending on their need for shared liability or control over administrative functions. It is important to understand the differences between PEO and ASO, as PEO (Professional Employer Organisation) offers full-service HR with access to large-group benefits and shared liability. An ASO (Administrative Services Organisation) also provides HR support, but the client company is still fully liable legally and files taxes using its own EIN (Employer Identification Number).

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 9 articles

PEO fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations