PEO solutions for the construction industry: benefits, services, and how to choose the right partner

Robbin Schuchmann

Co-founder, Employ Borderless

A PEO (Professional Employer Organization) is a co-employment partner that provides HR support to businesses, such as payroll, compliance, benefits, and risk management. PEOs are a perfect fit for the construction industry because of the high safety risks, complex compliance requirements, fluctuating labor demands, and frequent staff turnover.

The challenges that the construction industry experiences are workforce retention, compliance, payroll and tax administration, workers’ compensation, and time and attendance management. PEO helps internal HR teams with these industry-specific difficulties, such as with administrative tasks, compliance, and risk management.

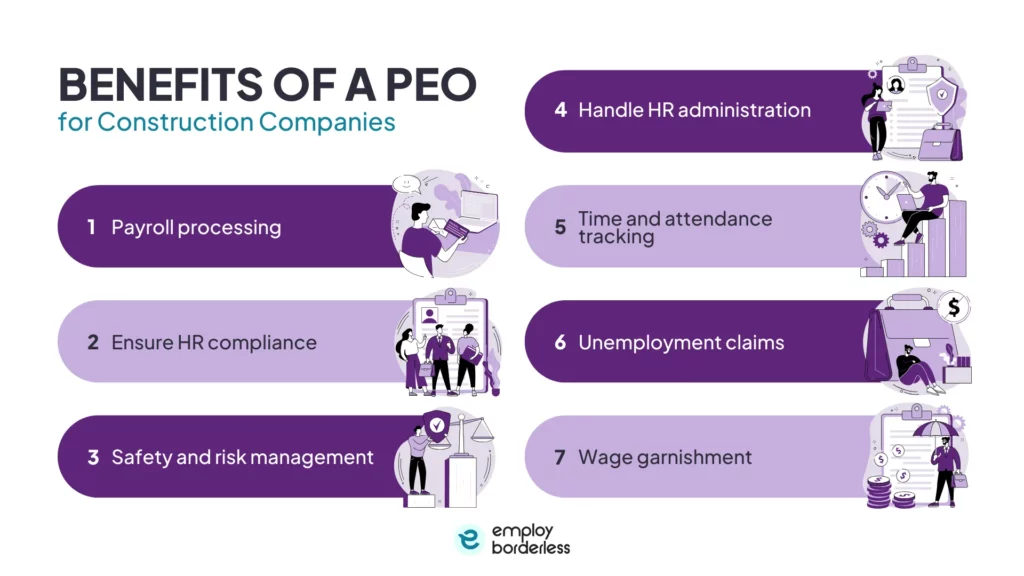

The benefits that a PEO offers to the construction industry are payroll processing, ensuring HR compliance, safety and risk management, handling HR administration, time and attendance tracking, unemployment claims, and wage garnishment.

What is a PEO?

A PEO (Professional Employer Organization) is a third-party organization that uses a co-employment model to offer HR and administrative services to businesses. This means that the company maintains control over routine operations, such as administrative functions (accounting and financing), sales and marketing, and customer service, while the PEO becomes the employer of record for tax and compliance purposes.

A PEO handles payroll processing, tax filing, workers’ compensation, employee benefits administration, and regulatory compliance. They provide premium benefits to small and medium-sized businesses at a low cost by combining workers from many client companies.

PEO helps businesses focus on core operations as it reduces compliance risk and administrative burden. Companies use PEOs to increase employee retention as they offer competitive benefits, such as health, dental, and vision insurance, and retirement plans like 401(k), and HR support, like recruiting, onboarding, and employee performance management.

Why is a PEO a perfect fit for the construction industry?

A PEO is a perfect fit for the construction industry because it supports the labor workforce and the industry’s compliance challenges. The construction industry faces unique demands, which include a fluctuating workforce, multiple job sites, a heavy compliance burden, and high injury risk.

The construction industry experiences fluctuating workforce demands because of seasonal contracts, project completions, and a high staff turnover rate. Small HR teams are unable to onboard and offboard under such changing conditions, so PEO simplifies these processes by helping with onboarding and recruiting, which is also cost-effective. This allows the construction industry to focus on the building process rather than the administrative complexities, like labor and workforce management.

The construction industry manages multiple job sites, which creates difficulties with labor classification, accurate timekeeping, and local law compliance. PEOs automatically handle standard-wage requirements and tax withholdings based on location, as they have relevant systems that comply with multi-state regulations. They also offer HR management specific to each job site, which reduces the risk of costly misclassification or payroll errors.

Employers in the construction industry face a particularly high compliance burden due to OSHA (Occupational Safety and Health Administration) regulations, safety audits, fringe benefit rules, and workers’ compensation laws. PEOs help with accident investigations, OSHA monitoring, safety training, and on-site consulting. They protect companies from penalties by ensuring compliance with fall protection, risk communication (conducting regular safety briefings), and equipment safety.

The construction industry also faces high injury risk, from falls, being struck by objects, to chemical exposure and dangerous equipment. PEOs are experts at managing workers’ compensation as they do risk assessments, secure group policies at a low cost, help with loss-control tactics, and manage claims accurately.

What challenges does the construction industry face?

The challenges that the construction industry faces are workforce retention, compliance, payroll and tax administration, workers’ compensation, and time and attendance management.

Workforce retention

Workforce retention means keeping employees in an organization and preventing them from leaving their jobs.

The construction industry’s project-based liability, demanding work environment, poor work-life integration, and limited professional growth make it challenging for construction companies to retain staff members.

The growing environment of construction sites causes a lack of hiring new workers. New hires feel burdened and unsupported because of poor training, mentorship, or team support, which causes them to leave.

Constructional jobs have irregular schedules, physical labor, and frequent site moves that make many workers tired and frustrated, so they look for more secure employment. It is challenging for construction businesses to promote stability and commitment because of frequent site switching.

Opportunities for career development are also limited as employees feel stuck in manual and repetitive jobs with no opportunity for advancement, recognition, or skill development, so workers leave to find more rewarding career paths.

Compliance

Compliance means ensuring businesses follow laws, guidelines, and policies that are relevant to a particular industry or business, such as financial compliance, environmental compliance, labor laws, and data and privacy protection.

Construction is a highly regulated industry, with different policies and guidelines, such as building codes and insurance requirements, OSHA standards (29 CFR 1926), union contracts, EPA (Environmental Protection Agency) regulations, and contractor licensing rules, which make it difficult for businesses to maintain complete compliance in all areas.

Construction-based projects involve suppliers, subcontractors, and general contractors, and each operates according to a different set of rules and regulations. It takes careful planning and supervision to ensure compliance throughout this system.

Construction compliance involves different paperwork and reports, such as certifications, training logs, safety inspections, and OSHA reports. These reports have to comply with a different set of policies, such as state labor laws and health and safety regulations. Poor document management of these construction-based projects causes audit failures and inaccurate filings.

Payroll and tax administration

Payroll and tax administration means managing employee compensation and making sure all relevant taxes and legal deductions are correctly computed, withheld, reported, and paid to the government authorities.

Workers in the construction industry change throughout a project, so payroll teams have to keep track of working hours, multiple wage rates (by trade, site, and state), and regularly hire and fire employees, which makes maintaining accurate payroll records difficult.

Federal (Davis-Bacon Act) and project-specific regulations require certified payroll with weekly tax filings, appropriate wage classification, and benefits documentation. Inaccurate reporting and documenting payroll causes financial and legal penalties.

Cross-jurisdictional projects are common, so payroll administrators also have to understand different federal, state, and local labor and tax laws. Misclassifying employees as independent contractors or vice versa also causes tax evasion, compensation fraud, and legal penalties.

Workers’ compensation

Workers’ compensation means insurance that covers medical expenses and wage replacement for workers who suffer injuries or are disabled.

The construction industry has the highest number of workers’ compensation claims because of the high risk of injury. Accidents occur due to the nature of construction work, which includes physically demanding tasks, outdoor conditions, constantly shifting job sites, and short project deadlines. These factors cause costly workers’ compensation claims, such as medical treatment, permanent disability, or time away from work because of suffering from an injury.

Workers’ compensation is costly for construction employers, and it also puts a burden on the administration. Employers require correct worker classification, accurate injury records, quick reporting, and coordination with insurance companies and medical providers from the administration, so filing errors and delays in reporting also cause penalties or denied claims.

Time and attendance management

Time and attendance management means keeping track of workers’ working hours and shifts, and also monitoring when they start or finish their shifts.

Construction workers operate on different job sites, sometimes in remote areas with poor internet connections. Manual timekeeping by using punch cards or paper timesheets causes errors, delays, and lost documentation.

Manual systems sometimes make errors, such as handwriting that is difficult to read, missing time stamps, and buddy punching, in which one worker clocks in or out on behalf of another, also known as ‘time theft’. These fake time records and attendance errors cause inaccurate payroll, reduce workers’ productivity, project expenses to rise, and affect actual labor hours.

How can a PEO help your construction company?

A PEO can help your construction company with payroll processing, ensure HR compliance, safety, and risk management, handle HR administration, time and attendance tracking solutions, unemployment claims, and wage garnishment.

Payroll processing

Payroll processing means distributing and calculating workers’ wages, which includes benefits and deductions, tax withholding, and making sure that workers are paid accurately and on time.

PEOs handle every aspect of payroll, from scheduling the timely issuance of pay cheques or direct deposits to calculating compensation, such as overtime, standard wages, and fringe benefits. They provide accurate labor-cost estimation, which helps construction companies with project planning and wage distribution.

Payroll automation makes sure workers receive their payments accurately and on time. It reduces the construction company’s administrative burden and increases workers’ morale.

A PEO helps in reducing payroll compliance risk by providing W-2s using its EIN (Employer Identification Number), by certified status (CPEO), filing returns, and withholding and paying federal, state, and local payroll taxes. They also ensure compliance with the government contract requirements as they create certified payroll reports, which include details of hours, classifications, and compensation rates.

Ensure HR compliance

Ensuring HR compliance means that a business complies with all applicable labor laws, rules, and internal policies, which involves hiring, pay, workplace safety, employee rights, benefits, and termination, to help avoid fines, legal action, and damage to the company’s reputation.

PEOs hire HR professionals who are aware of local, state, and industry-specific requirements, such as OSHA (Occupational Safety and Health Administration), FLSA (Fair Labor Standards Act), FMLA (Family and Medical Leave Act), ADA (Americans with Disabilities Act), COBRA (Consolidated Omnibus Budget Reconciliation Act), ACA (Affordable Care Act), and standard wages for government contracts. This helps construction companies stay audit-ready and avoid costly mistakes.

PEOs reduce legal liabilities and risk of wage claims, harassment, and discrimination by creating, updating, and maintaining HR policies, employee handbooks, I-9 forms, and recordkeeping procedures to fulfill compliance standards.

PEOs create safety procedures, plan training sessions, perform OSHA inspections, and help construction companies maintain on-site compliance measures, such as risk assessment, provide PPE (Personal Protective Equipment), and conduct on-site assessments regularly.

Safety and risk management

Safety and risk management means identifying, assessing, and managing any risks at work to avoid injuries and monetary losses. It involves putting safety rules into practice, educating workers, conducting assessments, and ensuring compliance with health and safety laws.

PEOs help identify potential dangers before accidents happen by conducting site audits, reviewing injuries (known as OSHA 300 logs), and monitoring risk exposure. They back programs like PtD (Prevention through Design) methods and perform OSHA inspections to actively remove dangers at building sites.

PEOs create industry-specific safety protocols, communicate rules, and conduct focused training sessions, such as PPE (Personal Protective Equipment) usage and emergency response, to promote safer work conditions.

PEOs regularly monitor the construction company’s projects and suggest changes as operations change through expert safety personnel and advanced technologies. They provide regular training and revision to make sure workers stay compliant and safety-focused.

Handle HR administration

Handling HR administration means managing workforce operations and legal compliance, such as employee recordkeeping, benefits enrollment, onboarding, offboarding, policy enforcement, performance monitoring, and compliance with employment regulations.

PEOs simplify the hiring process by handling recruit paperwork (I-9s, W-4s, contracts), conducting drug tests, and planning offboarding activities to ensure compliance and safe recordkeeping. PEOs manage the paperwork for HR compliance and maintain accurate employee files.

PEOs manage enrollment, qualifications, contract renewals, contributions, and filings for employee benefits such as health insurance, retirement plans (such as 401(k)s), COBRA (Consolidated Omnibus Budget Reconciliation Act), and ERISA (Employee Retirement Income Security Act) compliance.

PEOs create reports on payroll, benefits, and performance for management requirements or audits. It saves a construction company’s time by managing regular HR duties, which include pay calculation, federal, state, and local tax withholding, garnishment management, and pay cheque or direct deposit issuance, and helps them concentrate on core operations, while managing regulatory changes.

Time and attendance tracking

Time and attendance tracking means monitoring employees’ working hours, breaks, and vacation time, and when employees start and finish their work.

PEOs use digital tools such as web portals, mobile and GPS apps, and biometric time clocks. This replaces the lost timesheets, buddy punching, handwriting errors, and manual entry. The payroll system receives time data directly, which removes the need for manual data transfers and reduces errors in wage computations.

PEOs help workers on remote sites to accurately record their hours with GPS and mobile apps, which is important as they work in different construction sites. Automated systems help avoid wage and hour disputes or regulatory penalties by ensuring labour compliance, overtime limits, and break requirements.

Job-costing is integrated directly into a construction company’s HRIS (Human Resources Information System) by setting time tracking according to job, site, department, shift pattern, or pay rule. These methods help in labor cost control and also reduce time theft and unapproved overtime.

Unemployment claims

Unemployment claims mean workers who lose their jobs due to unexpected events (such as layoffs) file unemployment claims with the government for short-term financial support. The unemployment management in a state receives these claims, confirms eligibility, and decides on benefits.

The PEO handles unemployment insurance claims under its state accounts and EIN to protect the construction company from direct charges and make sure that claims are submitted accurately and on time when employees leave the company.

PEOs also help in preventing the unfair increase of unemployment insurance rates for construction companies by comparing authorized claims with workers’ claims. PEOs act as representatives of the construction company in court appeals and dealings on matters related to the state in the event of a claim dispute.

Wage garnishment

Wage garnishment is a legal process in which an employer withholds a portion of an employee’s income to pay off a debt, such as unpaid taxes, child support, student loans, or court orders.

The PEO is the legal employer of record of the construction company, so it receives the court order, accurately computes garnishments, and makes sure the right workers get paid.

Construction companies deal with irregular payroll demands due to shifting and seasonal labor workforce, so PEOs protect ongoing compliance by making sure the garnishment process stays the same throughout all pay periods, even when the workforce changes.

PEOs implement relevant state and federal restrictions, such as the 25% limit on disposable income specified in Title III of the CCPA (Consumer Credit Protection Act), and change garnishment computations as required to comply with legal changes, according to a fact sheet titled “Fact Sheet #30: Wage Garnishment Protections of the CCPA (Consumer Credit Protection Act)” published by the DOL (U.S. Department of Labor).

PEOs manage payment deadlines, timing, and reporting, which also reduces the possibility of fines for non-compliance. They carefully communicate with affected employees to maintain confidentiality and morale.

When should a construction business consider partnering with a PEO?

A construction business should consider partnering with a PEO before expanding into new markets and during periods of high turnover or seasonal hiring, increased burden on internal HR functions due to an increase in compliance with labor laws’ demands, and increased demand to implement benefits administration.

It is important to have a scalable HR and compliance structure in place when your construction business is preparing to expand into new markets, larger contracts, or different project types. For example, expanding its services, focusing on international markets, and going digital. PEO provides access to relevant systems, like multi-state payroll, tax filings, and workers’ compensation, to the construction business, which helps them grow while avoiding costly mistakes.

The construction business’s HR departments deal with issues like onboarding, offboarding, unemployment claims, and misclassification risks when construction staff increase or decrease. A Project Executive PEO helps internal teams with recruiting, onboarding, and offboarding so they concentrate on core construction operations while managing these workforce fluctuations, administrative duties, and maintaining compliance with staff regulations.

The construction business has to comply with complex labor laws in different jurisdictions, which increases HR burden for construction companies. Businesses operate in different regions with their own OSHA standard, labor laws, and unemployment regulations, so internal HR faces more pressure. A PEO helps reduce this burden by managing FMLA (Family and Medical Leave Act), ADA (Americans with Disabilities Act), wage laws, and job costing requirements by providing expert compliance support.

The demand to implement benefits administration increases because of the complexity in construction payroll and potential liabilities related to wage garnishment or unemployment claims. A PEO makes sure that these benefits, such as health, dental, vision, and retirement plans, are smoothly incorporated into payroll, garnishment procedures, and unemployment claims, which also reduces administrative risk.

How do you choose the right PEO partner for your construction business?

To choose the right PEO partner for your construction business, you should look for industry-specific expertise, customizable service packages, compliance, risk, and regulatory support, technology and integration capabilities, and transparent pricing and contract terms.

It is important to choose a PEO partner that already has construction experience. Request case studies or references from other companies to make sure they are aware of trade labor laws, insurances, safety compliance, and job-site regulations.

Decide in advance the type of services your construction company requires and make sure the PEO offers flexibility in choosing the required services, such as full-service HR or only payroll and compliance. This guarantees scalability as your company grows, while also adding or removing services like workers’ compensation, benefits administration, risk management, or recruitment.

There are many regulations relating to the construction industry, which include workers’ compensation, payroll taxes, OSHA standards, and local labor laws. Your company should consider ESAC (Employer Services Assurance Corporation) accreditation, CPEO (Certified PEO) status, and compensation guarantees when choosing the right PEO partner. The PEO protects you from penalties or audits while also staying updated with new regulations.

The software that your PEO partner uses should integrate with the systems you currently use, such as accounting, scheduling, and ERP (Enterprise Resource Planning). Look for self-service portals, mobile access, analytics dashboards, cloud-based HRIS (Human Resources Information System), and API (Application Programming Interface) connectors for a smooth workflow.

Understand the PEO’s fee structure, such as flat per-employee or payroll percentage. Carefully read and analyze contracts for exit clauses, renewal terms, hidden costs, and the number of employees related to cost adjustments. Pay close attention to unexpected fines that can risk your company.

What types of PEOs are available for construction?

The types of PEOs available for construction are full-service PEOs, CPEOs (Certified PEOs), industry-specific PEOs, and ASOs (Administrative Services Organizations). These PEO types provide co-employment and comprehensive HR solutions, manage HR duties without covering standard wage, OSHA compliance, and workers’ compensation, and depend on size, risk, and regulatory complexity.

What HR challenges can a PEO solve for construction owners?

The challenges that a PEO can solve for construction owners are payroll and tax administration, workers’ compensation, unemployment and claims handling, benefits administration, employee retention, regulatory compliance and safety, time and attendance tracking, PTO (Paid Time Off) management, and employee classification. PEO in HR helps construction owners accurately and productively solve these challenges.

What are the most important PEO services for construction?

The most important PEO services for construction are worksite safety programs, HR compliance and risk management, employee benefits administration, payroll processing, wage garnishment, compliance and legal expertise, and employee classification support. PEO services help construction companies increase worker productivity, maintain compliance, and simplify HR operations.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 9 articles

PEO fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations