How to switch PEOs

Robbin Schuchmann

Co-founder, Employ Borderless

A PEO (Professional Employer Organization) is a third-party organization that offers HR services to businesses under a co-employment model. The HR services that PEO handles include payroll, benefits administration, compliance, and risk management.

The PEO works by acting as a co-employer under the co-employment relationship and manages HR functions on behalf of the client, while the owner maintains authority over decision-making regarding employee management and performance.

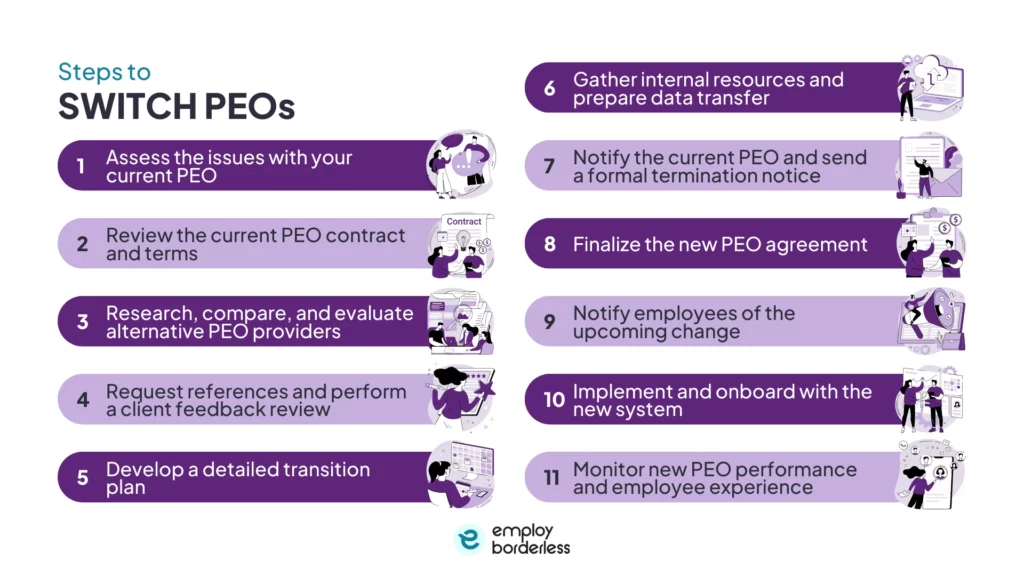

The steps to switch PEOs include assessing the issues with your current PEO, reviewing the current PEO contract and terms, researching, comparing, and evaluating alternative PEO providers, requesting references and performing a client feedback review, and developing a detailed transition plan. A business then gathers internal resources and prepares data transfer, notifies the current PEO, and sends a formal termination notice, finalizes the new PEO agreement, notifies employees of the upcoming change, implements onboarding with the new system, and monitors new PEO performance and employee experience.

The steps to switch PEOs are listed below.

- Assess the issues with your current PEO: Assess the current PEO’s service quality, cost, and compliance before switching to a new PEO provider. Businesses consider alternative HR solutions or alternative PEO arrangements if they face these issues with the current PEO.

- Review the current PEO contract and terms: Review PEO contract terms, termination clauses, notice periods, auto-renewal dates, early termination fees, data access rights, and offboarding responsibilities to exit agreements and engage legal or HR advisors for compliance.

- Research, compare, and evaluate alternative PEO providers: Research PEO partners by assessing their service offerings, cost structure, and user experience. Compare pricing models, technology platforms, and industry expertise. Request live demonstrations and verify the credentials of the shortlisted providers.

- Request references and perform a client feedback review: Request references, review platforms, and testimonials from similar businesses to verify PEO’s performance and credibility.

- Develop a detailed transition plan: Create a comprehensive transition plan that includes timelines, roles, data migration, and onboarding sequences, to assign responsibilities to internal stakeholders and clearly define tasks between teams.

- Gather internal resources and prepare data transfer: Gather important employee and company information, which includes payroll, benefits, and tax filings when switching to a PEO. Focus on data formatting, compliance, and handling sensitive information according to regulations by using secure methods.

- Notify the current PEO and send a formal termination notice: Notify the current PEO before formally terminating to make sure internal systems are ready. Submit a written termination notice with the termination date and contract reference.

- Finalize the new PEO agreement: The new PEO provider agreement should clearly define service levels, pricing, and responsibilities, and outline service scope, payment models, and technological platforms. Legal or HR counsel should review confidentiality, data security, and compliance responsibilities.

- Notify employees of the upcoming change: HR helps employees transition to new PEOs through Q&A sessions. Continuous communication about payroll, benefits, and login portals helps clarify the new PEO arrangement.

- Implement and onboard with the new system: Implementing a new PEO system involves setup tasks, payroll integration, employee enrollment, and onboarding, with PEOs providing guided instruction and HR staff providing training.

- Monitor new PEO performance and employee experience: Monitor new PEO system performance indicators, compare against SLAs (Service Level Agreements) and KPIs (Key Performance Indicators), and gather employee feedback to identify areas for improvement. Assess payroll accuracy, service response times, and benefits clarity.

Assess the issues with your current PEO

Assess the issues with your current PEO provider before switching to a new PEO by evaluating whether the PEO is still meeting their business needs and supporting their growth. Common problems with the current PEO include services that do not scale with your organization, poor service quality, such as slow response times or unresolved issues, outdated technology that lacks modern integrations, frequent personnel changes, and compliance gaps if the PEO is not maintaining industry-specific regulations.

Businesses also face issues related to the cost of the services when they consider switching their current PEO provider, such as hidden or fluctuating charges and unclear service fee details. A business explores alternative PEO arrangements or other HR solutions to get a better ROI (Return On Investment) when the pricing of current PEO increases and service value remains poor.

Review the current PEO contract and terms

Carefully review the current PEO contract and terms before switching to a new PEO to determine how and when you can exit the PEO agreement. This includes a detailed examination of the termination clauses, notice periods, auto-renewal dates, any early-termination fees, data access or transfer rights, and responsibilities during offboarding.

Some PEO agreements also involve early termination penalties, like paying the remaining contract value or daily service fees per employee, and businesses also face restrictions on accessing or transferring important HR and payroll data. These contracts include complex legal rules and requirements that impact your exit strategy, so businesses should engage legal or HR advisors to understand legal obligations and avoid unexpected costs or compliance issues.

Research, compare, and evaluate alternative PEO providers

Start researching by gathering information on PEO partners by assessing their service offerings, cost structure, and user experience. Service platforms, like PEO Spectrum, help businesses compare multiple providers side-by-side to evaluate differences in services and cost. Carefully analyze pricing models and service scopes, such as payroll, compliance, benefits, safety, and training. Review each provider’s technology platform and reporting tools, and then compare the support structure, which includes dedicated teams and call centers.

Shortlist providers based on industry-specific expertise or regulatory complexities by evaluating whether the PEO has presence and licensing in the states where you operate, to ensure local compliance and service quality. Request live software demonstrations to experience user interfaces, data dashboards, and reporting capabilities firsthand. Demonstrations help businesses confirm that the PEO’s technological platform matches their operational needs.

Check whether each provider holds credentials like IRS certification (Internal Revenue Service) and ESAC accreditation (Employer Services Assurance Corporation), which includes financial reliability, regulatory compliance, and tax responsibility.

Request references and perform client feedback review

Ask for references, particularly from businesses of similar size, industry, and location, to get real-life experiences, which help verify whether the PEO completes its responsibilities accurately and delivers on service expectations.

Review platforms like Gartner Peer Insights and Forbes Advisor, industry review sites, or testimonials, as they provide information on the PEO’s performance. Ratings and feedback from multiple sources confirm the provider’s credibility, strengths, or concerns. Consider how long clients stay with the PEO, as a low turnover rate shows strong client trust and the provider’s reliability. Verify providers’ transparency as reputable PEOs correctly provide past references without hesitation.

Develop a detailed transition plan

Develop a detailed transition plan by establishing a clear timeline, roles, data migration steps, and onboarding sequence. Define each phase, such as notification, data transfer, and system testing, with specific start and finish dates to keep the project on track. Assign responsibilities to internal stakeholders, which include HR, IT, Finance, and your new PEO transition team, to confirm accountability across all operational tasks.

Clarify roles and responsibilities between your internal team and the new PEO by specifying who leads tasks such as payroll setup, benefits enrollment, system configuration, compliance audits, and post-launch support. Clear task transfers and communication channels reduce confusion and possible workplace or operational disruptions.

Gather internal resources and prepare data transfer

Gather internal resources to compile important employee and company information to transfer when switching a PEO, which includes payroll history, employee records, benefits details, PTO (Paid Time Off) balances, W-2s, 1099s, and I-9s Forms. The transfer data also includes COBRA (Consolidated Omnibus Budget Reconciliation Act) and ACA (Affordable Care Act) documentation, tax filings, leave history, performance evaluations, and personal identifiers like Social Security Numbers.

Focus on data formatting and compliance to make sure data is clean, standardized, and aligned with the new HR system’s format after compiling the important data. Protect sensitive personal and wage information during this switching process to maintain employee privacy and integrity. The businesses also have to handle all PII (Personally Identifiable Information) and PHI (Protected Health Information) according to relevant regulations such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation) when switching a PEO.

The companies must use secure methods to transfer data and store it safely to avoid data breaches or legal violations. Businesses should utilize encrypted channels, secure cloud storage systems, and proper access controls throughout data migration when changing the current PEO provider.

Notify the current PEO and send a formal termination notice

Notify the current PEO after confirming your onboarding timeline with the new PEO provider, and make sure your internal systems and the new provider are fully ready before initiating formal termination. The business has to submit a written termination notice specifying the termination date and contract reference, by following the method required in your agreement. This notice is delivered through email, certified mail, or another contract-approved channel and includes relevant contractual citations, such as the termination clause and notice period.

Finalize the new PEO agreement

Confirm that all service levels, pricing, and responsibilities are clearly defined and finalized with the new PEO provider in the agreement. The businesses have to make sure that the agreement includes the scope of services, such as payroll, benefits, compliance, workers’ compensation, and clearly outlines service expectations, deliverables, and accountability for both parties.

Clarify the pricing model for payment, whether as flat per-employee fees or a percentage of payroll, and confirm any one-time setup fees. Identify the technological platforms specified in the agreement, how they integrate with your systems, and the type of support available after launch. The legal or HR counsel of the business should examine the agreement’s scope of services, confidentiality clauses, data security requirements, and compliance responsibilities to protect the business from liability.

Notify employees of the upcoming change

HR leads open Q&A sessions or webinars to notify and guide the employees through the transition. These forums clarify upcoming changes, reduce confusion, build confidence in the new PEO arrangement, and promote trust throughout the organization. The company has to inform employees about shifts in payroll timing, benefits enrollment processes, and access to new login portals or platforms.

Maintaining a continuous communication strategy during the transition is important as it clears employee confusion regarding the new provider. The company must provide ongoing updates, explain the reason behind the switch, and reassure employees about benefit continuity and system reliability, rather than just informing staff.

Implement and onboard with the new PEO system

Implementing your new PEO system begins by creating your account, integrating the payroll system with existing platforms, and enrolling employees in benefits. This phase also involves configuring payroll schedules, time-tracking, and aligning HR systems with the PEO’s platform to onboard accurately.

PEOs usually guide in onboarding by providing portal access, user introductions, and employee training on how to use the new system. HR staff receive detailed instruction on leading internal onboarding, while employees access self-service dashboards and benefits enrollment portals.

Monitor new PEO performance and employee experience

Regularly monitor performance indicators of the new PEO system, such as payroll accuracy, service response times, and system integration accuracy. These metrics confirm that the new PEO provider meets agreed-upon standards and operates productively. The company must assess the PEO’s performance by comparing it against the SLAs (Service Level Agreements) and KPIs (Key Performance Indicators) outlined in the contract to identify areas of strength and improvement.

Businesses should also gather feedback from employees regarding their experiences with the new system. They have to focus on aspects such as the usability of portals, the responsiveness of support services, and the clarity of benefits information. This feedback is important for identifying possible issues with the new PEO system and areas for improvement.

What are the reasons for a company to consider switching PEOs?

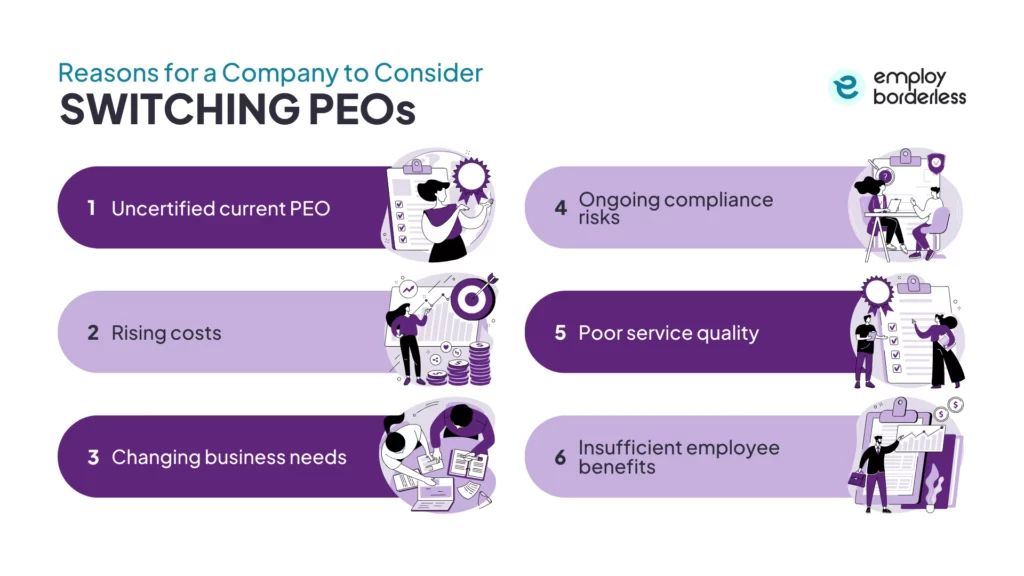

The reasons for a company to consider switching PEOs are an uncertified current PEO, rising costs, changing business needs, ongoing compliance risks, poor service quality, and insufficient employee benefits.

The reasons for a company to consider switching PEOs are listed below.

- Uncertified current PEO: Companies sometimes consider switching from an uncertified PEO to a CPEO (Certified PEO) to reduce tax liability risks, maintain federal tax credits, avoid duplicate payroll taxes, and access greater financial security and compliance assurance.

- Rising costs: PEOs raise their fee as businesses start to grow, particularly if pricing is based on a percentage of payroll or per-employee rates. This high pricing results in higher administrative costs for businesses, which exceed the expenses of maintaining an in-house HR team.

- Changing business needs: HR needs become more complex when a company expands, so the PEO that initially met its requirements is not sufficient. The business in this case requires more customized services, advanced technology platforms, and specialized compliance support to manage a larger workforce.

- Ongoing compliance risks: Ongoing compliance risks occur when a company experiences frequent non-compliance issues, such as the current PEO’s failure to stay informed with changing regulations or facing legal penalties for non-compliance. A company then considers switching to a new PEO with a strong compliance track record, which specializes in HR compliance and helps mitigate these legal risks.

- Poor service quality: Companies also consider switching to a new PEO if they face issues like delayed payroll, slow communication, poor benefits management, and unclear fees with the current PEO, which disrupts their operations and reduces employee satisfaction.

- Insufficient employee benefits: Insufficient employee benefits mean the current PEO provider offers limited health, retirement, or other benefits, which affects the client company’s employee satisfaction and retention.

When is the ideal time to switch a PEO?

The ideal time to switch a PEO is at the start of a calendar year, specifically January 1st or quarter, as it lowers operational disruptions and aligns with different HR and tax processes.

Switching to a PEO on January 1st confirms employees receive only one W-2 form for the entire year, which simplifies tax filing. Switching mid-year resets federal and state wage bases, which increases tax rates for the company. Health insurance plans also renew on January 1st, so changing PEO at this time guarantees a smooth coverage without compliance gaps. Many companies also plan their budgets and finances around the calendar year, so transitioning PEOs at the start of a calendar year aligns with these cycles.

The start of a new quarter, such as April 1st, July 1st, or October 1st, is the next best option to switch PEO if a January 1st transition is not practical. This timing allows for a clean break and lowers mid-year complications. Switching PEOs requires careful planning regardless of the chosen date, so it is advisable to begin the process at least 4 to 6 months in advance for a smooth transition.

How to find the right PEO for your company?

To find the right PEO for your company, consider service offerings and customization, industry expertise, cost structure, technology and integration, and scalability and growth support.

Evaluate the range of services a PEO provides, such as payroll processing, benefits administration, compliance support, and risk management. Determine if you are able to customize these services according to your company’s needs, and whether they allow flexibility as your business expands.

Select a PEO with experience in your industry because an industry-specific PEO has a better understanding of the unique challenges and regulatory requirements your business faces.

Understand the PEO’s pricing model, whether it is a flat fee per employee or a percentage of payroll. Make sure there are no hidden fees and that the costs align with the services provided. Transparent pricing helps the company in budgeting and prevents it from facing unexpected expenses.

Assess the PEO’s technology platform for user-friendliness, mobile access, and integration capabilities with your existing systems. A strong HRIS (Human Resource Information System) simplifies your HR process, which includes payroll processing, employee recruitment and onboarding, and compliance responsibilities, and improves operational productivity.

Choose a PEO that scales with your business and offers services that help your company grow, such as multistate compliance support, strategic HR consulting, and support with mergers or remote workforce expansion.

How to manage employee benefits during a PEO transition?

To manage employee benefits during a PEO transition, establish new benefit plans before ending your current PEO contract. Partner with a benefits broker to design a plan that aligns with your company’s needs and employee requirements. Communicate these changes clearly to your employees to maintain trust and satisfaction between employees and the company.

Who is the employer in a PEO agreement?

The employer in a PEO agreement is both the PEO and the client company, as they form a co-employment relationship. The PEO becomes the employer of record for tax and benefit purposes, while the client company’s employer manages daily employee management and performance.

Why switch to a new PEO or a payroll service?

Switch to a new PEO or a payroll service to receive improved service quality, accurate payroll administration, premium employee benefits, and better compliance support. Switching also provides access to advanced technological platforms, cost savings, and industry-specific expertise, which improves staff productivity and employee satisfaction.

How can you verify that the provider is a certified PEO?

You can verify that the provider is a certified PEO by checking IRS certification or if they are accredited by recognized organizations such as the ESAC (Employer Services Assurance Corporation). You can also review their credentials on official registries or request documentation directly from the provider to confirm compliance with industry standards.

Should you choose a PEO or an EOR for your business needs?

You should choose a PEO for your business needs as it co-employs your existing staff, and offers HR and benefits support while you maintain control over employees. You should choose an EOR because it employs the workers on your behalf, and it is ideal for managing remote or international teams. PEO and EOR both handle tasks like payroll, benefits administration, and tax withholding.

Does a PEO replace HR?

No, a PEO does not replace HR, but acts as a co-employer to provide outsourced HR services to a client company and handles complex and routine administrative tasks. PEO in HR handles employee hiring and onboarding, new hire documentation, payroll, benefits enrollment, and offers compliance support.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 9 articles

PEO fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations