Payroll tax penalty: Causes, consequences, relief options, and how to avoid them

Robbin Schuchmann

Co-founder, Employ Borderless

Unpaid payroll tax penalties are charges the IRS or state tax agencies impose on employers who fail to deposit or report payroll taxes on time, miscalculate amounts, or neglect their payroll tax obligations. Common causes of payroll tax penalties include failing to deposit taxes on time, calculating payroll taxes incorrectly, keeping inaccurate records, using payroll tax funds to pay other creditors, and not staying up to date on changes to payroll tax deposit schedules.

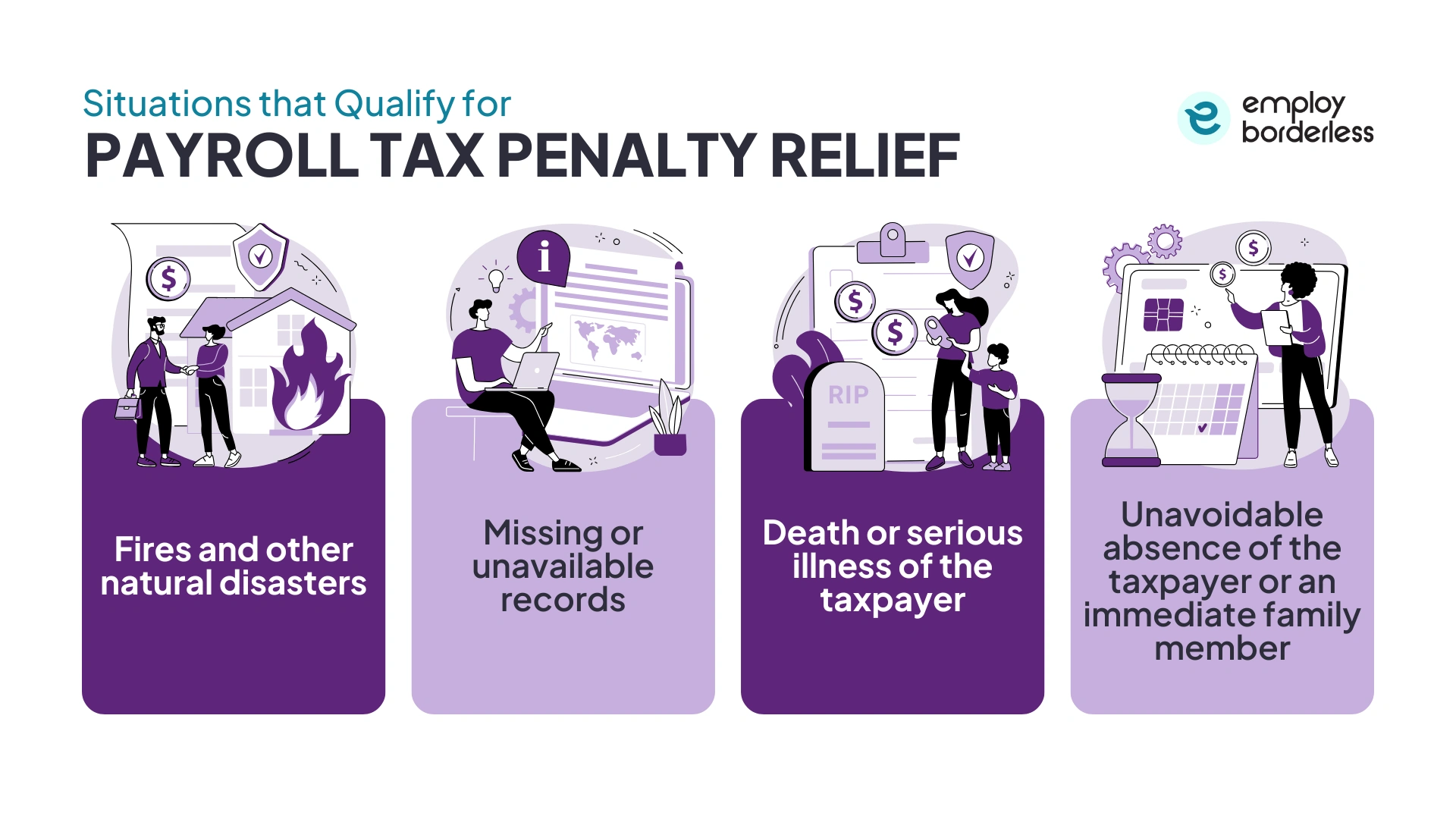

The penalties for failing to deposit or report payroll taxes are monetary penalties, interest charged on overdue payroll taxes, IRS liens on property or assets, civil penalties for noncompliance, and criminal prosecution for intentional violations. The situations that qualify for payroll tax penalty relief include fires and other natural disasters, missing or unavailable records, death or serious illness of the taxpayer, and unavoidable absence of the taxpayer or an immediate family member.

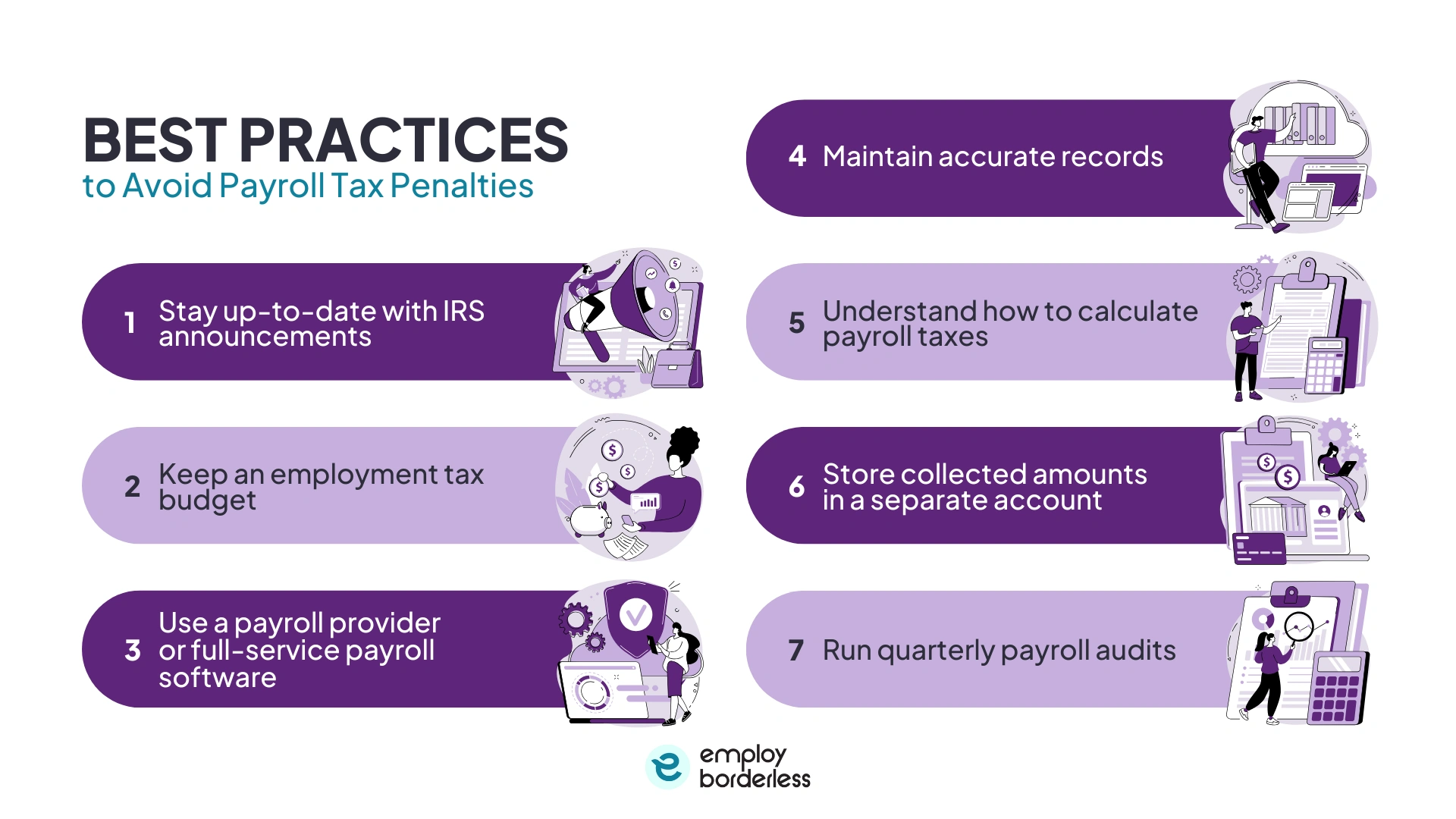

The best practices to avoid payroll tax penalties are staying up-to-date with IRS announcements, keeping an employment tax budget, using a payroll provider or full-service payroll software, maintaining accurate records, understanding how to calculate payroll taxes, and running quarterly payroll audits.

What are unpaid payroll tax penalties?

Unpaid payroll tax penalties are financial fines for employers, businesses, or organizations. These fines result from late deposits, incorrect withholdings, or missed filings. The penalties increase, particularly if the IRS or relevant state agency determines the noncompliance is intentional. Financial consequences involve more than fines or penalties and subject the employer to personal liability, while, in extreme situations, even criminal charges for unpaid payroll taxes.

What happens when payroll taxes are not paid on time?

When payroll taxes are not paid on time, the IRS, in most cases, issues a notice to the taxpayer’s address of record stating the penalty amount, due date, and a deadline for resolution. Unpaid tax interest becomes due, which increases the total amount owed over time. The TFRP (Trust Fund Recovery Penalty) is applied when the IRS determines there is a willful failure to pay.

Employers face this penalty when they know or should have known about their payroll tax regulations and intentionally ignore them or show indifference to the law. For example, if a business owner redirects withheld employee taxes for personal use instead of remitting them to the IRS, they are personally liable under the TFRP.

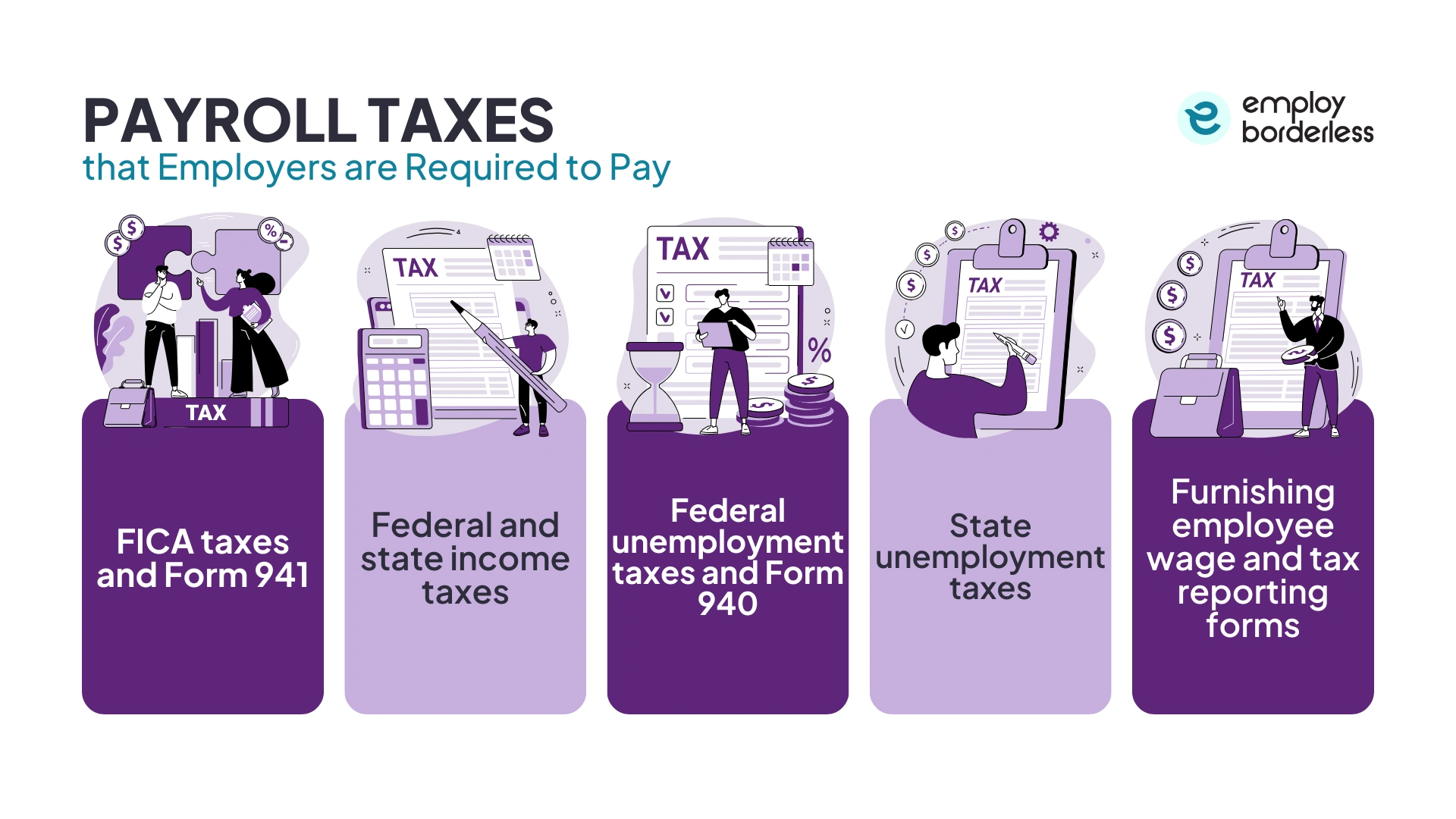

What payroll taxes are employers required to pay?

Payroll taxes that employers are required to pay include FICA taxes and Form 941, federal and state income taxes, federal unemployment taxes and Form 940, state unemployment taxes, and furnishing employee wage and tax reporting forms.

FICA taxes and Form 941

Employers are required to withhold FICA taxes, which include Social Security and Medicare, from employee wages and also contribute an employer portion up to the Social Security wage limit. Payment frequency depends on the size of the payroll, but FICA taxes are generally deposited monthly or semiweekly. These taxes are reported quarterly on IRS Form 941, the Employer’s Quarterly Federal Tax Return.

Federal and state income taxes

Business owners are required to withhold federal income tax from employees’ wages based on their Form W-4 and remit it to the IRS according to the specified schedule. Employers also withhold state income tax in states that impose income tax and send the amounts to the relevant state revenue agency following its rules and deposit deadlines.

Federal unemployment taxes and Form 940

Employers must pay federal unemployment tax under the FUTA (Federal Unemployment Tax Act), which funds federal unemployment insurance programs that help pay benefits to workers who lose their jobs. Only employers pay this tax, and it is not withheld from employee wages. The tax generally applies to the first $7,000 of wages paid to each employee in a calendar year and is reported annually on IRS Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return.

State unemployment taxes

State unemployment taxes, mostly called SUTA or SUI, are payroll taxes that employers pay to fund state unemployment insurance benefits for eligible workers who lose their jobs. Each state sets its own tax rates and taxable wage base, so the amount an employer owes depends on where the business operates and how much it pays its employees.

Most employers pay these taxes quarterly, and rates differ widely based on the employer’s history of layoffs and benefit claims. A few states also require or allow limited employee contributions, but in most states, SUTA is paid entirely by the employer. Employers who pay SUTA on time also benefit from a credit against their federal unemployment tax.

Furnishing employee wage and tax reporting forms

Furnishing employee wage and tax reporting forms means that employers must prepare and provide annual statements showing each employee’s wages and the taxes withheld, and submit these to the relevant government agency. For example, employers must give each employee a completed Form W‑2, Wage and Tax Statement, by January 31 of the year following the tax year, and they must also file copies of those W‑2s (along with Form W‑3, the transmittal summary) with the SSA (Social Security Administration) by the same deadline. These forms report wages, federal income tax withheld, and Social Security and Medicare withholdings to confirm accurate tax records and benefit credits.

What are the common types of federal payroll tax penalties?

The common types of federal payroll tax penalties are the failure-to-file penalty and the failure-to-deposit penalty.

Failure-to-file penalty

A failure-to-file penalty applies when a required tax return, such as an employment tax return, is not filed by the due date, including extensions. The penalty is 5% of the unpaid tax due for each month or part of a month the return is late, up to a 25% maximum. The failure-to-file portion is reduced accordingly if both failure-to-file and failure-to-pay penalties apply in a month.

The IRS waives or reduces the penalty for reasonable cause, like fires, natural disasters or civil disturbances, and inability to get records. Other valid reasons for penalty relief include death, serious illness, or unavoidable absence of the taxpayer or immediate family, and system issues that delayed a timely electronic filing or payment.

Failure-to-deposit penalty

Failure-to-deposit penalty is a penalty for employers who do not deposit employment taxes, like federal income tax withheld, Social Security, Medicare, and FUTA, on time, in the right amount, or in the correct way. Employers are required to make monthly or semiweekly employment tax deposits.

The failure-to-deposit penalty is calculated as a percentage of the unpaid or late payroll tax deposit, which depends on how late the payment is. The IRS charges 2% if the deposit is 1 to 5 days late, 5% if it is 6 to 15 days late, 10% if it is more than 15 days late, and 15% if it remains unpaid more than 10 days after the IRS issues a notice. Interest is charged on the penalty until it is paid. The IRS sends a notice or letter if the penalty is owed.

How to calculate payroll taxes?

To calculate payroll taxes, employers apply IRS-set fixed rates and withholding rules to each employee’s gross wages. Employers withhold 6.2% for Social Security (up to the annual wage limit) and 1.45% for Medicare from employee wages, then match these amounts with an equal employer contribution. This contribution makes the combined Social Security and Medicare 15.3% of salary (7.65% from the employee, 7.65% from the employer). Employees earning above specific income thresholds also owe an Additional Medicare Tax of 0.9%, which employers withhold but do not match.

Employers must also withhold federal, state, and local income taxes each pay period based on the employee’s withholding certificates and the applicable tax brackets. They pay unemployment taxes at both the federal and state levels. The FUTA rate is a flat 6% on the first $7,000 of wages per employee, while SUTA rates differ by jurisdiction. Eligible employers, however, get to claim a credit of up to 5.4% for paying state unemployment taxes, which reduces the effective FUTA rate.

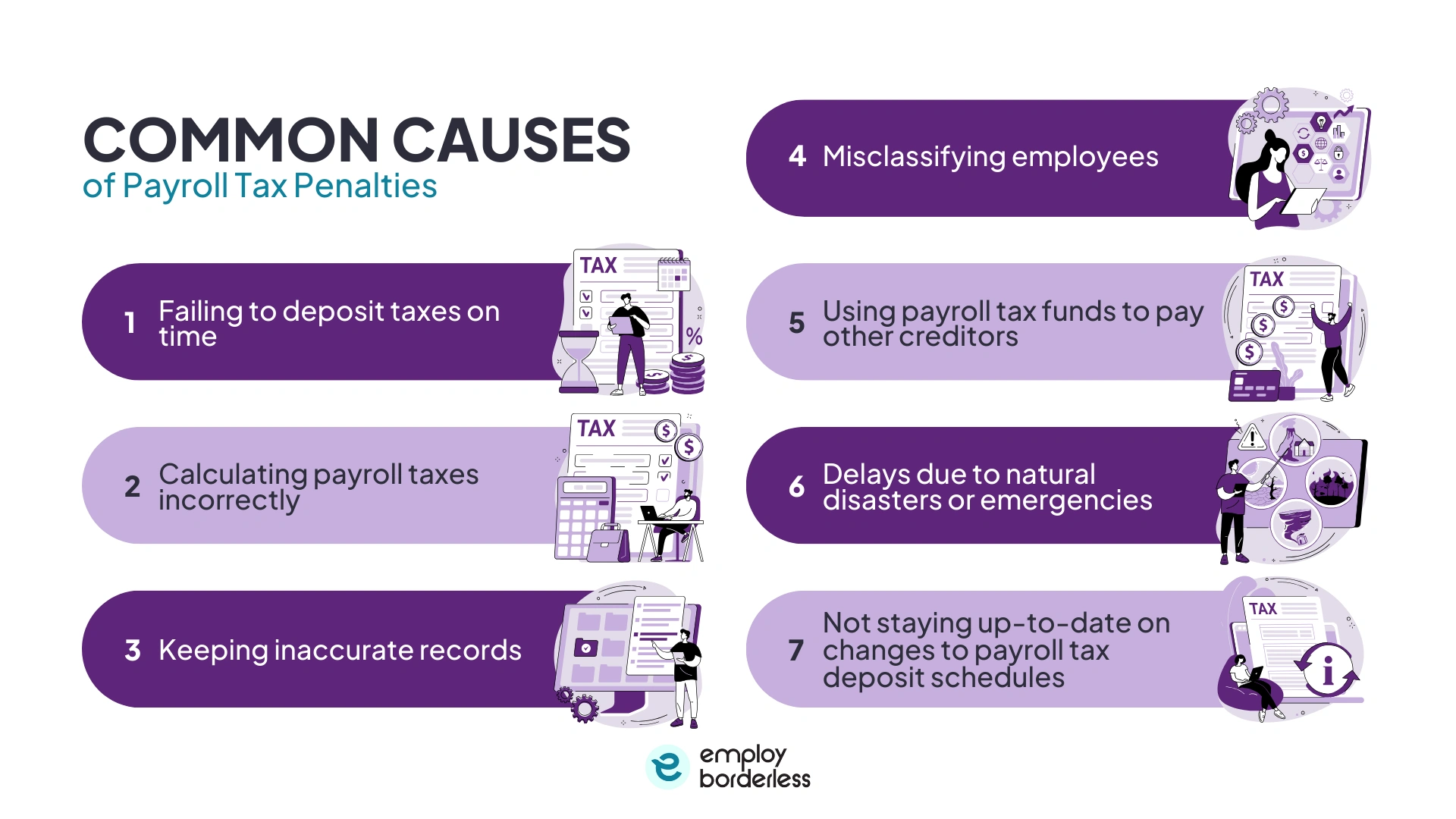

What are the common causes of payroll tax penalties?

The common causes of payroll tax penalties are failing to deposit taxes on time, calculating payroll taxes incorrectly, keeping inaccurate records, using payroll tax funds to pay other creditors, and not staying up-to-date on changes to payroll tax deposit schedules.

Failing to deposit taxes on time

Failing to deposit payroll taxes on time leads to penalties because the IRS requires employers to make employment tax deposits. These tax deposits include federal income tax, Social Security, and Medicare on a strict schedule, either monthly or semiweekly, which depends on the amount of tax owed. This penalty exists to ensure timely compliance with payroll tax obligations and applies even if the deposit is only a few days late.

Calculating payroll taxes incorrectly

Calculating payroll taxes incorrectly happens when employers or payroll systems wrongly calculate the amounts to withhold or pay. This miscalculation occurs if outdated tax tables or wage base limits are used, which leads to withholding too little or too much tax or mishandling special situations like year‑end rate changes. Failing to keep payroll systems updated or relying on manual calculations increases the risk of underwithholding or misreporting taxes, as federal and state tax rates, thresholds, and wage bases change regularly. This failure results in IRS or state tax penalties.

Keeping inaccurate records

Poor or disorganized recordkeeping makes it easy to misreport wages, withholdings, or deposits, which increases the risk of filing errors and penalties during IRS audits. Maintaining complete and accurate payroll records is important for payroll compliance.

Misclassifying employees

Employers who misclassify a worker as a contractor instead of an employee fail to withhold and remit federal income tax, Social Security (FICA), Medicare, and unemployment taxes required for employees. The IRS holds these employers liable for unpaid payroll taxes, plus interest and penalties based on the amounts they should have withheld and paid. Penalties include a percentage of wages, repayment of both employee and employer FICA contributions, failure-to-pay fines, and, in serious cases, criminal penalties, whether the misclassification is intentional or unintentional.

Using payroll tax funds to pay other creditors

Employers who use payroll tax funds (withheld from employees’ wages for income, Social Security, and Medicare taxes) to pay other business expenses or creditors instead of remitting them to the IRS violate trust fund rules. The IRS considers these withheld amounts trust funds held for the government, not the employer, and makes the employer responsible for collecting, accounting for, and paying them over.

Shifting these funds leads to the TFRP (Trust Fund Recovery Penalty), which makes one or more responsible entities liable for the full amount of unpaid trust fund taxes, plus interest and additional penalties. This penalty applies even if the business continues operating or lacks remaining assets.

Delays due to natural disasters or emergencies

Natural disasters and other major emergencies disrupt payroll operations and make it difficult or impossible for employers to deposit or file payroll taxes on time. The IRS provides penalty relief if the employer shows reasonable cause, which means they exercise ordinary business care but are still unable to meet their tax obligations due to circumstances beyond their control.

Examples of events include fires, hurricanes, floods, earthquakes, civil disturbances, or other disasters that made it unreasonable to comply with the deadline. Employers generally must explain the situation in detail and provide documentation showing how the disaster prevented timely payment or filing to request relief. The IRS reviews each case individually based on the facts and circumstances.

Not staying up-to-date on changes to payroll tax deposit schedules

Employers must follow the IRS‑determined deposit schedule (monthly or semiweekly) based on their reported payroll tax in a prior lookback period. Failing to stay aware of changes to this schedule leads to making deposits on the wrong dates and facing a failure-to-deposit penalty. The IRS requires deposits according to the correct schedule immediately, even without notice. Employers are responsible for monitoring their payroll tax liability and adjusting their deposit frequency as necessary to meet all deadlines.

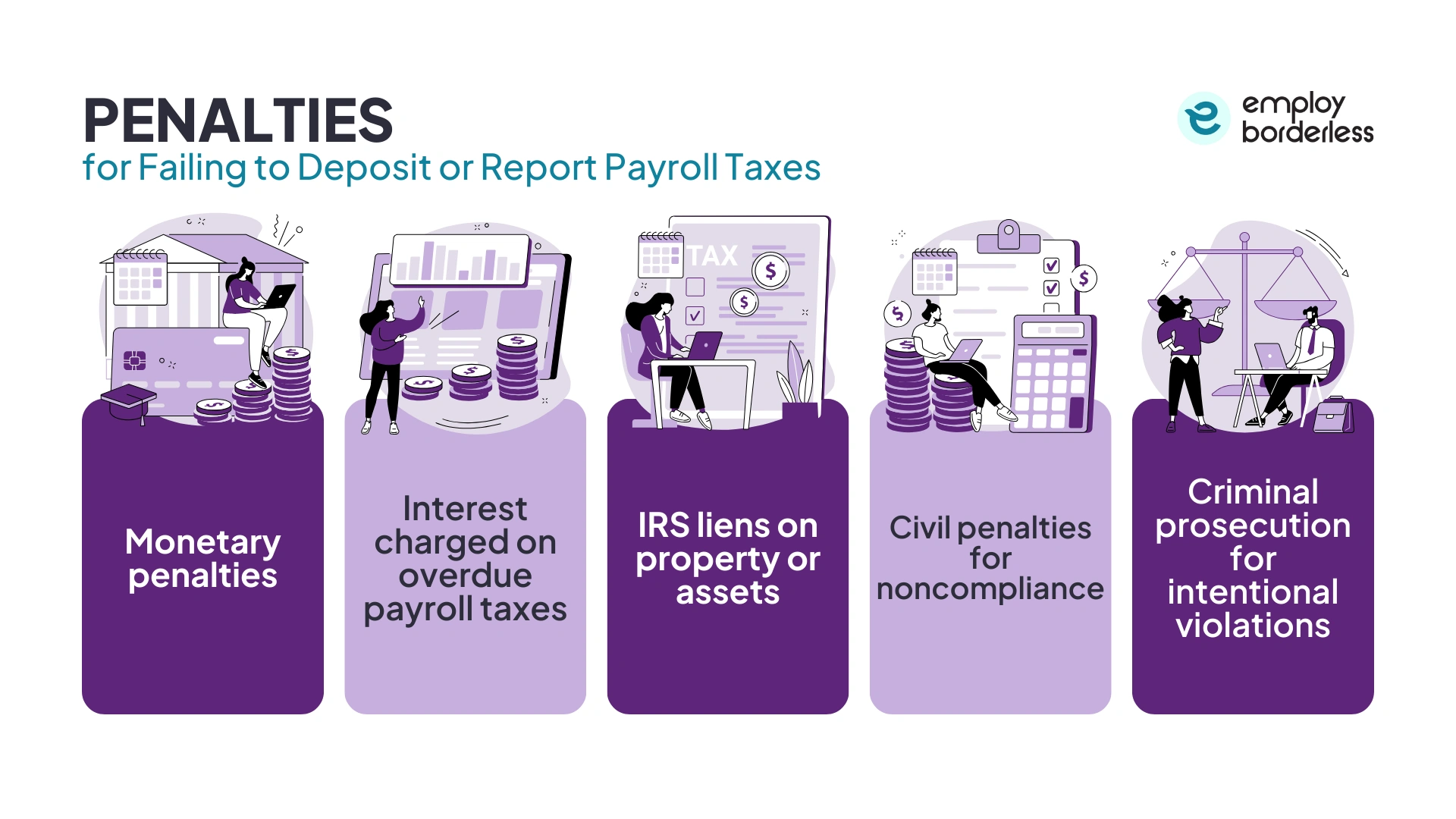

What are the penalties for failing to deposit or report payroll taxes?

The penalties for failing to deposit or report payroll taxes are monetary penalties, interest charged on overdue payroll taxes, IRS liens on property or assets, civil penalties for noncompliance, and criminal prosecution for intentional violations.

Monetary penalties

The IRS applies financial penalties when employers do not deposit or report payroll taxes properly. For example, the failure-to-deposit penalty is calculated as a percentage of the unpaid tax and increases as the deposit is late, starting at about 2% for 1 to 5 days late and going up to 15% for extended delays. Other civil penalties include amounts for underreporting, negligence, or failure to file required information returns. These penalties are assessed in addition to the original tax owed and increase the employer’s liability.

Interest charged on overdue payroll taxes

The IRS charges interest on any unpaid payroll taxes and on the penalties themselves. This interest increases daily from the original tax due date until the balance is fully paid. It increases the total amount owed over time, even if the underlying tax liability stays the same.

IRS liens on property or assets

The IRS places a federal tax lien on the employer’s business or personal property if payroll tax debts remain unpaid. A tax lien protects the government’s interest in assets such as real estate, equipment, or bank accounts. It also affects credit ratings, which makes it difficult to sell or refinance assets and causes problems with future borrowing.

Civil penalties for noncompliance

The IRS assesses additional civil penalties for more serious compliance failures other than simple late deposit charges. For example, if an employer willfully fails to collect or pay over taxes withheld from employees, the IRS imposes a TFRP (Trust Fund Recovery Penalty) equal to 100% of the unpaid trust fund taxes. This penalty makes responsible individuals personally liable for the tax amounts that they should have paid earlier.

Criminal prosecution for intentional violations

The IRS takes criminal charges against employers who intentionally avoid payroll tax obligations in the most serious cases. Willful failure to collect, account for, or pay over payroll taxes is prosecuted as a felony (criminal offense in the U.S.) under federal tax law. Convictions result in fines of up to $10,000 or more and prison sentences of up to five years for each offense, along with repayment and interest on unpaid taxes.

What situations qualify for payroll tax penalty relief?

The situations that qualify for payroll tax penalty relief include fires and other natural disasters, missing or unavailable records, death or serious illness of the taxpayer, and unavoidable absence of the taxpayer or an immediate family member.

The situations that qualify for payroll tax penalty relief are discussed below.

Fires and other natural disasters: The IRS offers penalty relief if a fire, natural disaster, or similar disturbance directly prevents employers from filing, paying, or depositing payroll taxes on time. This penalty relief includes situations where disasters destroy records, damage business premises, or block access to necessary information, and employers show that the event made compliance impossible despite reasonable efforts. Documentation such as official disaster declarations, insurance claims, or other evidence of the event and its impact supports the case.

Missing or unavailable records: Employers qualify for penalty relief if they cannot receive or access important documents required to calculate or report payroll taxes, even after reasonable efforts. This applies to situations where records are lost, destroyed, or never received, where the inability to get the documents directly caused the late filing or payment.

Death or serious illness of the taxpayer: The IRS allows penalty relief when the taxpayer or an immediate family member experiences death or a serious medical condition that prevents timely payroll tax compliance. Presenting evidence such as hospital records or a death certificate helps verify the claim.

Unavoidable absence of the taxpayer or an immediate family member: The IRS considers penalty relief appropriate when an extended or unavoidable absence of the taxpayer or a family member directly prevents meeting payroll tax deadlines. Circumstances like mandatory emergency travel or other critical absences qualify if no reasonable alternative exists.

What are the best practices to avoid payroll tax penalties?

The best practices to avoid payroll tax penalties are to stay up-to-date with IRS announcements, keep an employment tax budget, use a payroll provider or full-service payroll software, maintain accurate records, understand how to calculate payroll taxes, and run quarterly payroll audits.

Stay up-to-date with IRS announcements

Employers should monitor IRS news, tax law updates, and deadline alerts so they know about changes that affect payroll tax rules and filing requirements. Regularly checking IRS releases or subscribing to updates helps prevent mistakes due to outdated rules.

Keep an employment tax budget

Planning and allocating funds specifically for employment tax obligations helps businesses avoid cash shortages that lead to late deposits or payments. Budgeting for payroll taxes makes sure funds are available when tax deposits are due.

Use a payroll provider or full-service payroll software

Employers need to automate tax calculations, deposits, and reporting by using a reputable payroll service or software. These tools help confirm accuracy, send reminders for deadlines, update tax tables automatically, and reduce manual errors that result in penalties.

Maintain accurate records

Businesses must keep complete, organized payroll records for wages, tax withholdings, and employee information. Well‑maintained records help provide correct reporting and make it easy to respond to audits or inquiries. The IRS requires employers to retain employment tax records for at least four years after the tax becomes due or is paid, whichever is later.

Understand how to calculate payroll taxes

Employers need to know the correct way to compute tax withholdings and liability for federal, state, and local taxes. Using current tax rates and reliable tools or software prevents miscalculations that lead to underpayment penalties.

Store collected amounts in a separate account

Setting up a dedicated bank account for payroll tax funds helps confirm that money withheld from employees’ wages stays available and is not accidentally used for other business expenses. This separate account reduces the risk of failing to remit taxes on time.

Run quarterly payroll audits

Employers should review payroll processes regularly, for instance, quarterly, to check for errors in withholdings, deposits, filings, and records. Regular audits help identify errors early, which gives businesses time to resolve issues before the IRS assesses penalties.

How to choose a payroll provider to avoid tax penalties?

To choose a payroll provider to avoid tax penalties, consider provider reliability and reputation, compliance expertise, use of IRS-approved systems, and up-to-date legal knowledge.

Choose a trusted, qualified payroll service with a proven track record so they file returns and make deposits correctly rather than leaving employers responsible for unpaid taxes.

Select a payroll provider that stays up to date on federal and state tax laws and regulations and helps confirm accurate tax calculations, filings, and deposits on time.

Prioritize a provider that uses systems like the EFTPS (Electronic Federal Tax Payment System) for deposits so employers are able to monitor payment history and make sure taxes are paid under their EIN (Employer Identification Number).

Choose a payroll partner that actively updates its processes and software when tax laws or regulations change to ensure ongoing compliance.

Who is liable for unpaid payroll taxes?

The business itself is liable for unpaid payroll taxes, but it also extends to any responsible person with the authority to collect, account for, and pay those taxes. This liable person includes corporate officers, owners, partners, directors, or others with financial control, and they face the TFRP (Trust Fund Recovery Penalty) for willfully failing to pay withheld taxes.

Can the IRS negotiate payroll taxes?

Yes, the IRS can negotiate payroll taxes through formal programs like an OIC (Offer in Compromise), which allows eligible taxpayers to settle for less than owed based on income, expenses, and ability to pay. Trust fund payroll taxes (withheld income taxes, Social Security, and Medicare portions) are usually not affected through OIC. Rare non-trust fund portions, such as employer FICA matches, sometimes qualify if strict eligibility requirements, such as current tax compliance and timely deposits, are met.

How to avoid an underpayment tax penalty?

To avoid an underpayment tax penalty, pay enough tax during the year through withholding or quarterly estimated payments to meet IRS safe harbor rules. Pay at least 90% of your current year's total tax liability or 100% of the prior year's tax (110% if the prior year's adjusted gross income exceeded $150,000), whichever is less. No penalty applies if you owe less than $1,000 after payroll tax withholdings and credits.

Are payroll tax penalties deductible?

No, payroll tax penalties are not deductible as a business expense. The IRS does not allow businesses to deduct penalties related to late tax filings or payments.

How do interest and penalties increase payroll tax costs?

Interest and penalties increase payroll tax costs as the IRS adds penalties for late deposits or filings and then charges interest on both the unpaid taxes and the penalties until the balance is paid in full. Interest is charged daily, so delays cause the total amount owed to grow quickly, even when the original tax liability stays the same.

What qualifies as willful tax evasion?

Willful tax evasion qualifies as intentional actions taken to deliberately avoid paying taxes that are owed. The IRS generally looks for willfulness, which means the taxpayer knows their legal tax duty and voluntarily chooses to violate it. Common qualifying actions include intentionally underreporting income, keeping double books, falsifying records, hiding assets or income, claiming false deductions, or deliberately failing to file returns or pay taxes.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations