2026 Payroll tax filing deadlines, forms, and deposit schedules

Robbin Schuchmann

Co-founder, Employ Borderless

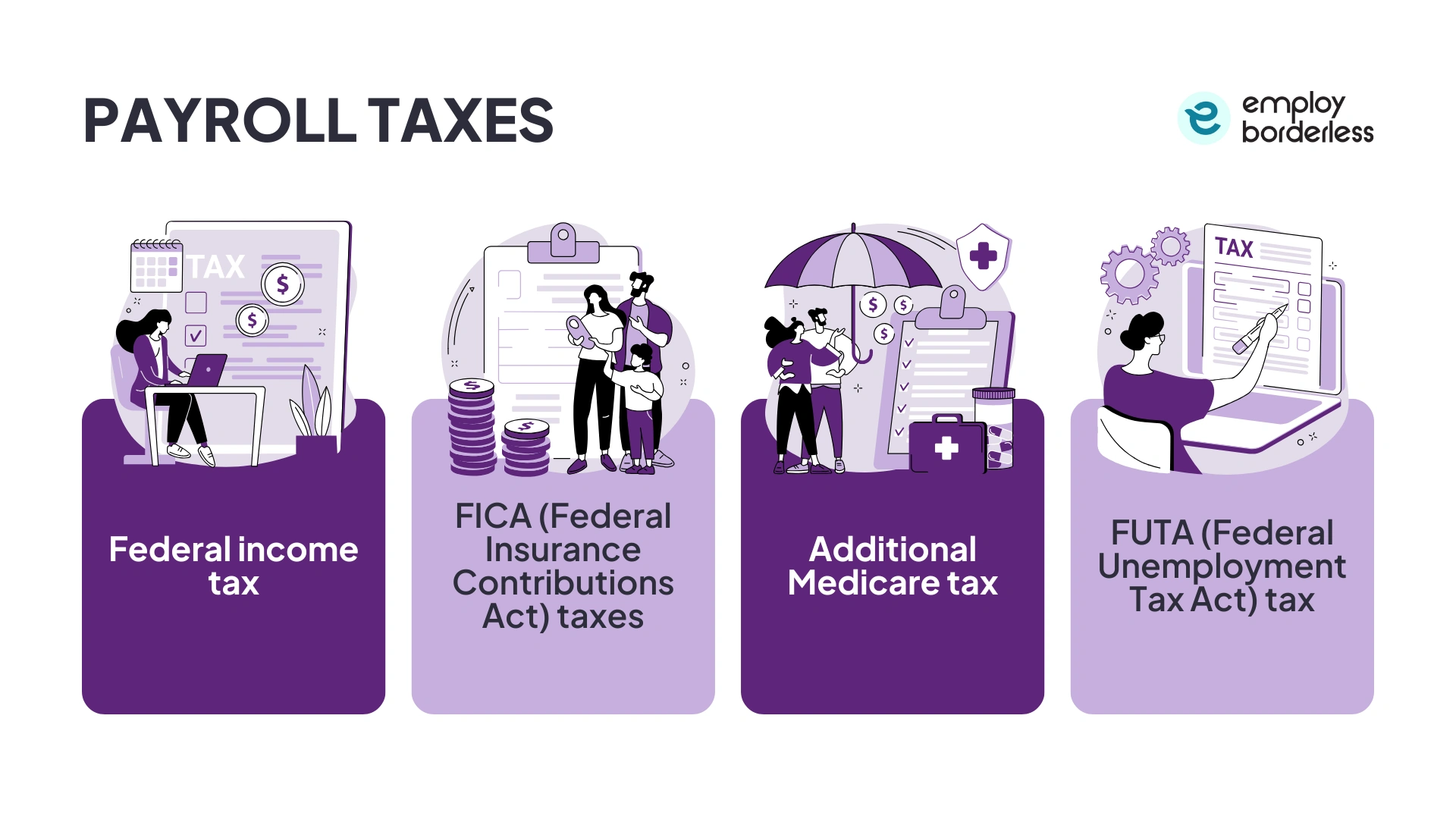

Payroll taxes are taxes that employers and employees pay on wages and salaries to fund government social insurance programs. These taxes are federal income tax, FICA (Federal Insurance Contributions Act) taxes, additional Medicare tax, and FUTA (Federal Unemployment Tax Act) tax.

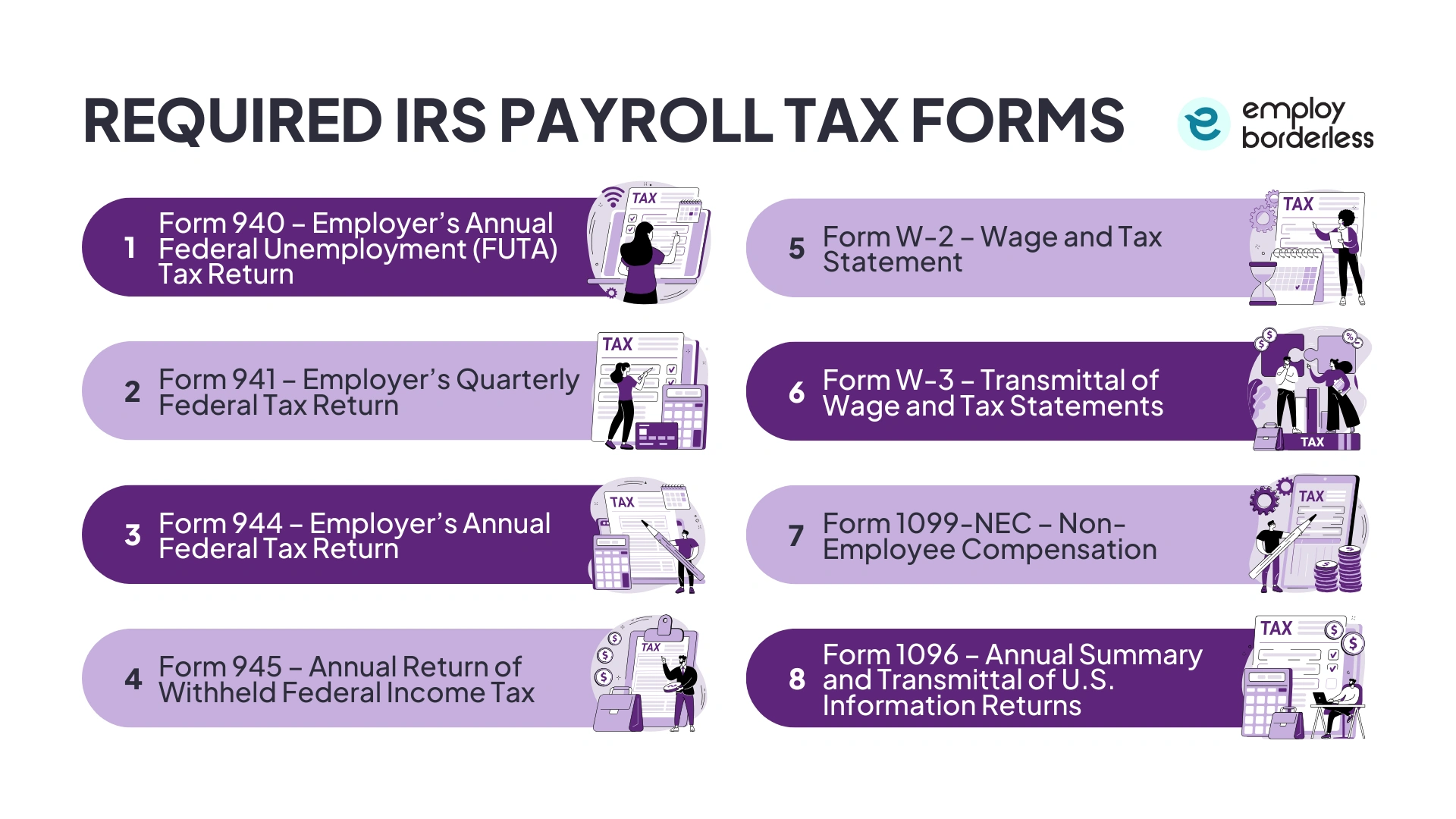

The required payroll tax forms are Form 940 (Employer’s Annual Federal Unemployment (FUTA) Tax Return), Form 941 (Employer’s Quarterly Federal Tax Return), Form 944 (Employer’s Annual Federal Tax Return), and Form 945 (Annual Return of Withheld Federal Income Tax). Other payroll tax forms include Form W-3 (Transmittal of Wage and Tax Statements), Form 1099-NEC (Non-Employee Compensation), and Form 1096 (Annual Summary and Transmittal of U.S. Information Returns).

The payroll tax deposit schedules are the income and FICA taxes, which include the monthly deposit schedule, the semiweekly payroll deposit schedule, next-day deposits, and the FUTA tax deposit schedule.

What are payroll taxes?

Payroll taxes are federal income tax, FICA (Federal Insurance Contributions Act) taxes, additional Medicare tax, and FUTA (Federal Unemployment Tax Act) tax, which are levied on wages and salaries.

Federal income tax

The federal government requires employers to withhold federal income tax from employees’ wages. The amount withheld is calculated based on each employee’s Form W-4 and the IRS withholding tables outlined in Publication 15-T.

FICA (Federal Insurance Contributions Act) taxes

FICA includes Social Security and Medicare taxes, each with its own rate. Social Security (6.2%) is subject to an annual wage base limit, while Medicare (1.45%) applies to all covered wages without a limit. Employers calculate FICA by applying the relevant Social Security and Medicare tax rates to an employee’s gross taxable wages. The total tax is shared equally between the employer and the employee. Employers should consult IRS Publication 15 (Circular E), Employer’s Tax Guide, for current rates and the Social Security wage base limit.

Additional Medicare tax

Employees who earn more than $200,000 in a calendar year are subject to the Additional Medicare Tax. Withholding begins in the pay period when wages exceed $200,000 and continues through the remainder of the year. Employers are responsible only for withholding this tax from employee wages and do not contribute a matching amount.

FUTA (Federal Unemployment Tax Act) tax

Employers may be required to pay FUTA tax on non-household and non-agricultural employees. FUTA tax applies if the business paid $1,500 or more in wages during any calendar quarter in the current or previous year. It also applies if the business employed one or more individuals for at least part of a day in 20 or more different weeks during the current or previous year. FUTA tax is paid entirely by employers, with additional details available in the IRS instructions for Form 940.

Why do timely tax payments matter for employers?

Timely tax payments matter for employers because they protect the financial stability of the organization and help avoid unnecessary costs. Late or inaccurate tax deposits result in IRS FTD (Failure-to-Deposit) penalties, which range from 2% to 15% depending on how late the payment is. The IRS automatically applies deposits to the most recent tax liability within a quarter before allocating them to unpaid balances, which increases an employer’s penalty exposure. Employers, however, may request that deposits be applied differently to reduce penalties. They must submit this request within 90 days of receiving the IRS penalty notice.

What are the required IRS payroll tax forms?

The required IRS payroll tax forms are Form 940 (Employer’s Annual Federal Unemployment (FUTA) Tax Return), Form 941 (Employer’s Quarterly Federal Tax Return), Form 944 (Employer’s Annual Federal Tax Return), and Form 945 (Annual Return of Withheld Federal Income Tax). Other payroll tax forms include Form W-3 (Transmittal of Wage and Tax Statements), Form 1099-NEC (Non-Employee Compensation), and Form 1096 (Annual Summary and Transmittal of U.S. Information Returns).

Form 940 – Employer’s Annual Federal Unemployment (FUTA) Tax Return

Form 940 is used to report federal unemployment (FUTA) taxes paid during the year. Employers must pay FUTA tax on a percentage of each employee’s wages, up to the first $7,000 in taxable wages per year, by law. This tax is the sole responsibility of the employer. FUTA taxes are generally deposited quarterly. Employers with a total FUTA tax liability of less than $500 for the year are allowed to deposit the full amount by January 31 following the end of the tax year. Refer to the instructions for Form 940 for additional details.

Filing deadline

The filing deadline is February 2nd. Employers who have made all required deposits on time are granted an additional 10 days to submit their return.

Requirements to file an extension

Employers get to request an extension of up to 90 days from the IRS. It is important to note that they must pay all taxes on time to avoid additional penalties, even when requesting an extension. The employer must write a formal letter stating the reason to request an extension, sign it or have an authorized agent sign it, and direct it properly to an IRS officer.

Penalties for noncompliance

Employers who submit Form 940 late face a failure-to-deposit penalty. The IRS is permitted to assess a penalty ranging from 2% to 15% of the unpaid tax if they make a late deposit or fail to deposit taxes.

Form 941 – Employer’s Quarterly Federal Tax Return

Form 941 is used to report payroll tax withholdings, like federal income, Social Security, and Medicare taxes, that are deducted from employees’ paychecks. It also reports your business’s quarterly contributions to Social Security and Medicare for all employees. Form 941 reconciles the taxes withheld from employee wages with the amounts owed by the employer, but it is separate from the regular semiweekly or monthly tax deposits.

Filing deadline

The filing deadlines for Form 941 are April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 of the following year for the fourth quarter. The due date moves to the next business day, which is Monday, February 1, 2027, if January 31 falls on a weekend or legal holiday (as it does on Sunday, January 31, 2027).

Requirements to file an extension

The IRS does not provide an extension request for Form 941.

Penalties for noncompliance

The penalty is normally 5 % of the unpaid tax shown on the return for each month (or part of a month) the return is late, up to a maximum of 25 % of the unpaid tax due, under IRS penalty provisions (as shown in Publication 15 and other IRS materials).

Form 944 – Employer’s Annual Federal Tax Return

Form 944 is intended for small businesses with an annual payroll tax liability, which includes Social Security, Medicare, and federal income taxes, of less than $1,000. This situation is uncommon and applies to relatively few businesses. Eligible employers have to file and pay these taxes just once a year, rather than quarterly.

Filing deadline

The filing deadline for Form 944 is February 2. Employers have an extra 10 days to submit the return when all tax deposits are current.

Requirements to file an extension

Form 944 has no formal extension process.

Penalties for noncompliance

Employers who file Form 944 late are subject to a failure-to-file penalty. They must pay the amount owed when submitting the form if the annual tax liability is less than $2,500. The IRS assesses penalties ranging from 2% to 15% of the unpaid tax if the payment is late.

Form 945 – Annual Return of Withheld Federal Income Tax

Form 945 is filed by businesses that withhold federal income tax from non-payroll payments during the year. Payments with Form 945 are required when the total tax due is $2,500 or less. Employers must make semiweekly or monthly deposits throughout the year if the tax owed exceeds this amount. Businesses that withhold federal income tax only from payroll payments, such as wages and salaries, and not from non-payroll payments, are not required to file Form 945 annually.

Filing deadline

The deadline to file Form 945 for 2025 is February 2, 2026. All required tax deposits made on time and in full extend the filing deadline to February 10, 2026.

Requirements to file an extension

The IRS does not provide an extension for filing Form 945.

Penalties for noncompliance

Failure-to-file penalties apply, and late or missed deposits have penalties ranging from 2% to 15% of the taxes owed.

Form W-2 – Wage and Tax Statement

A W-2 reports an employee’s wages and salaries, along with federal income tax, state and local income tax if applicable, and Social Security and Medicare taxes withheld. Employers must provide a W-2 to each employee annually and file it with the SSA (Social Security Administration).

Filing deadline

February 2, 2026, is the deadline to file Copy A of Form W-2 with the Social Security Administration and to provide employees with their W-2 copies. Postmark mailed forms by February 2.

Requirements to file an extension

Employers have to submit paper Form 8809 to request a non-automatic 30-day extension to file with the IRS/SSA if they are unable to prepare W-2s by January 31.

Penalties for noncompliance

Employers who fail to file correct Forms W-2 by the due date face IRS penalties under IRC 6721 if they are unable to show reasonable cause. Penalties start at $60 per form if filed within 30 days of the due date, increase to $130 if filed more than 30 days late but by August 1, and rise to $340 if filed after August 1 or not filed at all. The penalty is $680 per form if the failure is due to intentional disregard. These amounts apply to W-2s due after December 31, 2025, and are adjusted for inflation.

Form W-3 – Transmittal of Wage and Tax Statements

Form W-3 is a transmittal form sent to the Social Security Administration with Copy A of all employee W-2 forms. It summarizes total earnings, Social Security and Medicare wages, federal and state withholdings, and the total number of W-2s filed.

Filing deadline

The filing deadline for Form W-3 is February 2, 2026, whether filed through paper forms or electronically.

Requirements to file an extension

Employers get to request an automatic 30-day extension to file Forms W-3 and W-2 by submitting Form 8809 on or before January 31. Extensions are granted for reasonable cause, such as natural disasters or serious illness, and do not extend the deadline for providing employee copies.

Penalties for noncompliance

Employers that fail to file correct Forms W-3 on time face IRS penalties under IRC 6721 unless they show reasonable cause. Penalties range from $60 to $340 per form based on how late the filing is and rise to $680 per form for intentional disregard.

Form 1099-NEC – Non-Employee Compensation

Form 1099-NEC is used to report payments made to non-employees during the year. Employers must prepare and file a 1099-NEC if they pay a contractor $600 and report the income to the IRS at the start of the following year. Other non-employee payments may require Form 1099-MISC.

Filing deadline

The filing deadline for Form 1099-NEC is the 31st of January with the IRS when reporting non-employee compensation in Box 7 and providing copies to contractors. Employers must postmark the forms by January 31 if they mail them.

Requirements to file an extension

Employers request a 30-day extension by submitting Form 8809 (Application for Extension of Time to File Information Returns). The IRS does not automatically approve these requests, and if granted, the extension gives up to 30 additional days from the original due date.

Penalties for noncompliance

Penalties start at $60 per form if filed within 30 days of the due date, increase to $130 per form if filed more than 30 days late but by August 1, and rise to $340 per form if filed after August 1 or not filed at all. The penalty is $680 per form if the failure is due to intentional disregard.

Form 1096 – Annual Summary and Transmittal of U.S. Information Returns

Employers who submit 1099s must also file Form 1096, which summarizes the total number of 1099s and the amounts reported on them. They only need Form 1096 for paper filing, and it is not required for electronic submissions. Form 1096 is also used with Forms 1097, 1098, 3921, 5498, and W-2G.

Filing deadline

The filing deadline for 2025 tax year filings (due in 2026) is extended to February 2 due to a weekend.

Requirements to file an extension

Form 1096 applies to paper-filed information returns, such as most 1099s, 1098s, and W-2Gs. Employers can receive an automatic 30-day extension if they request it on time, and a second 30-day extension is granted for some forms with proper justification.

Penalties for noncompliance

The penalty is $60 per form if filed within 30 days of the due date, $130 per form if filed more than 30 days late but by August 1, and $340 per form if filed after August 1 or not filed at all. The penalty rises to $680 per form if the IRS finds the failure was due to intentional disregard.

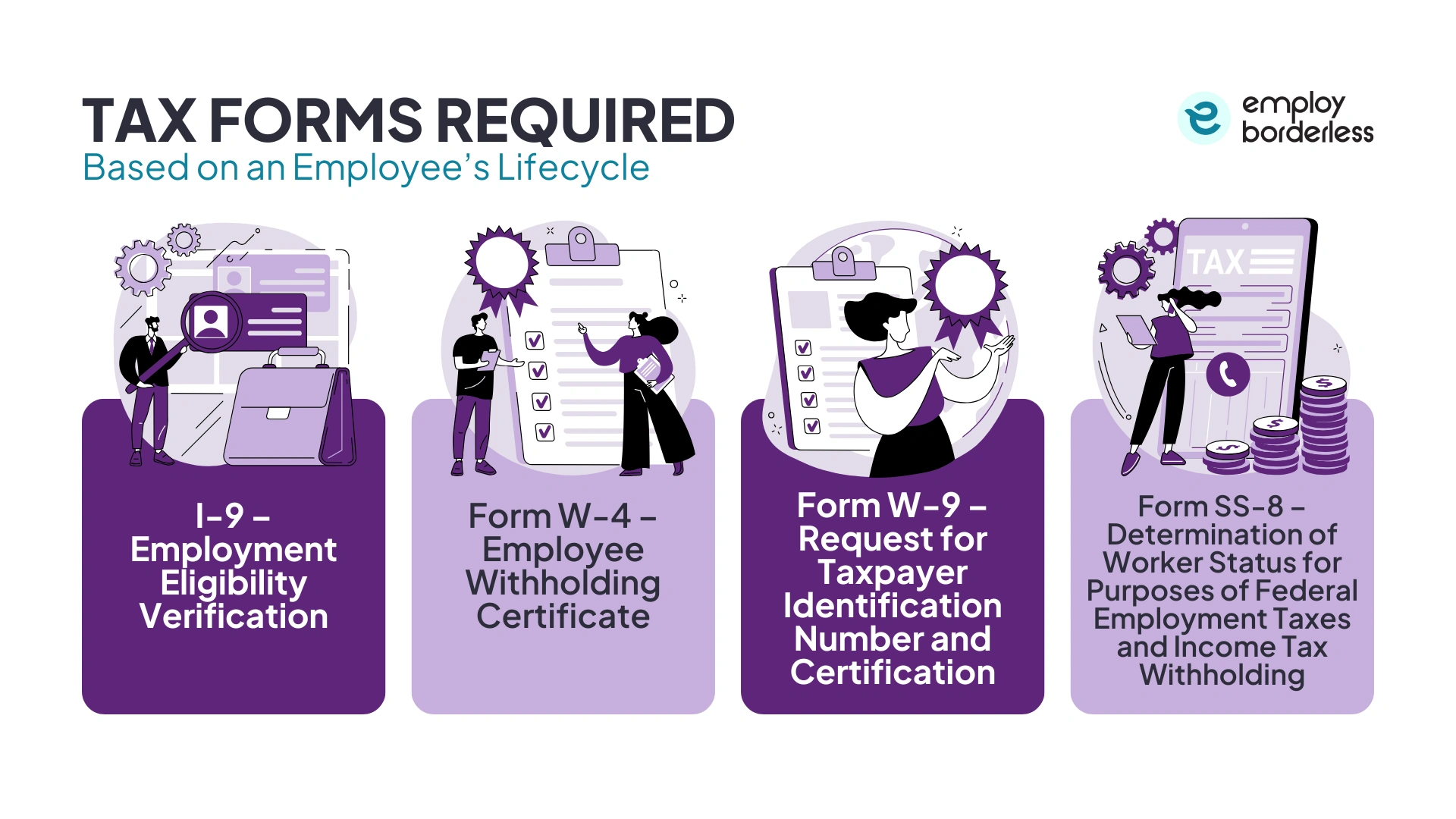

What tax forms are required based on an employee’s lifecycle?

The tax forms required based on an employee’s lifecycle include I-9 (Employment Eligibility Verification), Form W-4 (Employee Withholding Certificate), Form W-9 (Request for Taxpayer Identification Number and Certification), and Form SS-8 (Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding).

I-9 – Employment Eligibility Verification

Form I-9 verifies the identity and employment authorization of anyone hired to work in the United States. All U.S. employers must have every new employee complete this form, irrespective of their citizenship status.

Filing deadline

Employees must complete Section 1 of Form I-9 no later than their first day of work. Employers must complete Section 2 within three business days of the hire date. Complete Form I-9 by the date the employee’s work authorization expires, if reverification is required.

Penalties for noncompliance

ICE (Immigration and Customs Enforcement), through HSI (Homeland Security Investigations), routinely audits I-9 forms either randomly or after a complaint. Employers must provide I-9s and supporting documents, such as payroll records, within three business days to verify accuracy and prevent falsification if an NOI (Notice of Inspection) is issued. Paperwork violation fines range from $288 to $2,861 per form (2026 inflation-adjusted rates) for a first offense and increase for repeat violations.

Form W-4 – Employee Withholding Certificate

Form W-4 determines how much federal income tax to withhold from an employee’s paycheck. All employees must complete a W-4 when hired and update it whenever their personal or financial situation changes.

Filing deadline

Employees must complete Form W-4 before the first payroll period (before their first paycheck), ideally on or before the first day of work.

Penalties for noncompliance

Employers face no direct penalty for false W-4 info, as they rely on employee certification in good faith. Employees face a $500 penalty under IRC Section 6721 for substantially false statements with intent to defraud, not just invalid information.

Form W-9 – Request for Taxpayer Identification Number and Certification

Any business that pays an independent contractor $600 or more in a year must report the payments to the IRS using Form 1099-NEC. Business owners use the contractor’s information from Form W-9, which includes name and Taxpayer Identification Number or Social Security number, to complete the form accurately.

Filing deadline

The IRS recommends receiving a completed Form W-9 before making the first payment to a contractor, as it is needed for accurate 1099 reporting and to avoid backup withholding.

Penalties for noncompliance

Contractors who fail to provide a completed Form W-9 with correct information face a $50 IRS penalty. The payer must begin 24% backup withholding on reportable payments and remit the withheld funds to the IRS, stopping only once a valid TIN (Taxpayer Identification Number) is received if they still do not respond. The payer should make reasonable annual efforts to get the W-9, including first-year notices and any required “B” notices per IRS CP2100A, documenting all attempts to avoid penalties. Enter “refused to provide TIN” in the TIN field instead of leaving it blank when filing Form 1099-NEC by the deadline.

Form SS-8 – Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding

Form SS-8 is used to request a determination of a worker’s status, which helps decide whether federal employment taxes and income tax withholding apply.

Filing deadline

There is no filing deadline for Form SS-8.

Penalties for noncompliance

Form SS-8 is voluntary, with no filing deadline or penalties.

What are the payroll tax deposit schedules?

The payroll tax deposit schedules are the income and FICA taxes and the FUTA tax deposit schedule.

Income and FICA (Federal Insurance Contributions Act) taxes

The payroll tax deposit schedule an employer must follow for the current year depends on the total employment taxes reported during the lookback period. This schedule determines whether the employer is a monthly or semiweekly depositor and sets the deadlines for depositing federal income and FICA taxes.

Monthly deposit schedule

Monthly schedule depositors report $50,000 or less in employment taxes during the lookback period and must generally deposit employment taxes for a given month by the 15th day of the following month. For example, the total federal income tax and FICA tax liability accumulated in June is due by July 15.

Semiweekly payroll deposit schedule

The employer is a semiweekly schedule depositor and must deposit employment taxes based on the pay date if the employer reported more than $50,000 in taxes during the lookback period. Wages paid on Wednesday, Thursday, or Friday require a deposit by the following Wednesday. Wages paid on Saturday, Sunday, Monday, or Tuesday require a deposit by the following Friday. The deposit is considered timely when made by the close of the next business day if a deposit due date falls on a non-business day.

Next-day deposits

Accumulating $100,000 or more in taxes on any day during a deposit period triggers the next-day deposit rule, regardless of whether an employer follows a monthly or semiweekly deposit schedule. The employer must deposit the taxes by the next business day and becomes a semiweekly depositor for the remainder of the calendar year and the following year.

New employer

A new employer has a lookback period tax liability of zero for any quarter before the business started or was acquired. The employer follows the monthly deposit schedule during the first year of business unless the $100,000 next-day deposit rule applies.

FUTA tax deposit schedule

FUTA tax deposit schedules depend on a business’s quarterly tax liability. A FUTA liability of $500 or less for a quarter is allowed to move forward to the next quarter. The business must deposit the tax by the last day of the month following the end of the quarter, such as April 30 for first-quarter liabilities, when the liability exceeds $500, including any carryover.

What are the penalties for late tax deposits?

The penalties for late tax deposits are under IRC §6656, based on the number of days the deposit is late. The penalty is 2% of the unpaid tax if a deposit is 1 to 5 days late. Deposits 6 to 15 days late must pay a 5% penalty, and those more than 15 days late but before the IRS issues its first notice face 10%.

The penalty rises to 15% if the tax remains unpaid for more than 10 days after the IRS sends a notice and demand. A 10% penalty applies if the tax is paid directly to the IRS or with the tax return rather than through timely deposits. Interest is charged on the penalty amount, and penalties are dismissed if the employer shows a reasonable cause for the late deposit rather than willful neglect.

How to deposit payroll taxes?

To deposit payroll taxes, confirm or apply for an FEIN (Federal Employer Identification Number), submit payroll taxes electronically, and use the EFTPS (Electronic Federal Tax Payment System).

The methods to deposit payroll taxes are listed below.

Confirm or apply for an FEIN: An employer must confirm or receive an FEIN (Federal Employer Identification Number) from the IRS before depositing payroll taxes. FEIN is used to identify the business for federal tax purposes and is required on all tax deposits and filings. Businesses apply for this FEIN through the IRS (online, by mail, fax, or phone) so their payroll tax deposits are properly assigned if the employer does not yet have an FEIN.

Submit payroll taxes electronically: Employers must submit payroll taxes electronically, as the IRS generally requires federal tax deposits to go through an electronic funds transfer system instead of by paper. This method confirms the timely and accurate transmission of withheld income and FICA taxes.

Use the EFTPS (Electronic Federal Tax Payment System): The IRS provides an electronic payroll tax deposit method, known as the EFTPS (Electronic Federal Tax Payment System). This system is a free, secure online and phone system offered by the U.S. Department of the Treasury. Employers are able to schedule, make, and track federal tax deposits 24/7, receive immediate confirmation, and review payment history once enrolled in EFTPS using their FEIN and a PIN.

How to deposit employment taxes?

To deposit employment taxes, make payments directly from your bank account, use your business’s IRS tax account, and submit payments electronically.

The methods to deposit employment taxes are listed below.

Make payments directly from your bank account: Employers use IRS Direct Pay for Businesses to make federal tax payments directly from their checking or savings account at no cost. This service allows them to schedule, change, or cancel payments and receive a confirmation number once the payment is made.

Use your business’s IRS tax account: Employers log in and make tax deposits electronically using their bank account through the IRS Business Tax Account. It allows multiple payments and allows them to view recent payments and history.

Submit payments electronically: EFTPS (Electronic Federal Tax Payment System) is a free, secure system offered by the U.S. Treasury that helps employers to schedule and send federal tax deposits. These deposits include employment taxes directly from their bank account. Employers must enroll with their EIN (Employer Identification Number) and make payments online or by phone, schedule payments in advance, and track payment history.

How to file payroll tax returns?

To file payroll tax returns for income tax and FICA taxes, employers use the IRS forms that apply to their business and type of employment tax. These include Form 941 (Employer’s Quarterly Federal Tax Return) to report wages paid, federal income tax withheld, and both the employer and employee share of Social Security and Medicare taxes each quarter. Small employers notified by the IRS may file Form 944 (Employer’s Annual Federal Tax Return) once a year instead of quarterly returns if their employment tax liability is low.

Employers with agricultural employees use Form 943 (Employer’s Annual Federal Tax Return for Agricultural Employees) to report farm wages and related taxes. Employers file Form 945 (Annual Return of Withheld Federal Income Tax) to report withheld federal income tax on non‑payroll payments, such as backup withholding.

Employers file Form 940 (Employer’s Annual Federal Unemployment (FUTA) Tax Return) to report and pay federal unemployment taxes under FUTA. These forms are also filed electronically through the IRS’s e‑file system for employment tax forms or, where allowed, by paper, and each has its own due date and filing requirements that the IRS sets.

What are common mistakes to avoid when filing payroll taxes?

Common mistakes to avoid when filing payroll taxes are missing payroll tax deposit deadlines, incorrectly classifying employees, not staying updated with tax law changes or deadlines, and using manual systems.

Common mistakes to avoid when filing payroll taxes are discussed below.

Missing payroll tax deposit deadlines: Failing to deposit or file payroll taxes on time leads to IRS penalties and interest. Employers must track due dates for deposits and returns carefully and use reliable systems, like EFTPS (Electronic Federal Tax Payment System) or reminders, to provide timely payments.

Incorrectly classifying employees: Misclassifying workers as independent contractors rather than employees leads to tax liabilities, back taxes, penalties, and interest because payroll taxes are not withheld and reported correctly.

Not staying updated with tax law changes or deadlines: Payroll and tax laws change frequently. Employers that do not update payroll systems or practices to show new tax rates, rules, or reporting requirements risk miscalculations and non‑compliance penalties.

Using manual systems: Relying on manual processes or outdated systems increases the risk of errors in calculations, data entry, deadlines, and recordkeeping. Automated payroll software reduces mistakes and helps ensure compliance with current tax rules.

How to simplify paying and filing payroll taxes?

To simplify paying and filing payroll taxes, use smart technology, automate tax deposits and filings, access filings, reports, deposits, amendments, and notices securely 24/7, utilize year-end print services, and use registration services.

Modern payroll tax solutions integrate intelligent tools that automatically calculate wages, withholdings, and tax obligations, which reduces manual errors and ensures compliance with current tax rules. These systems connect payroll data with tax filing requirements, so employers can prepare and submit accurate returns easily.

Employers are able to set up automated processes that calculate, schedule, and transmit payroll tax deposits and return filings on time without manual intervention. This automation lowers the risk of missing deadlines and helps avoid costly penalties.

Payroll tax platforms mostly provide secure online dashboards that give employers instant access to filing histories, payment records, deposited amounts, amended tax returns, and IRS or agency notices. These dashboards make it easy to monitor compliance and respond quickly to any issues.

Many payroll service providers offer printing and distribution of year‑end tax forms such as W‑2s and 1099s. These services make sure that employees and contractors receive required documents accurately and on time, which lowers the administrative burden at year‑end.

Some payroll service vendors help employers with registering for required tax accounts and identifiers, such as state tax IDs or payroll tax accounts. This outsourced support simplifies the onboarding process and confirms all required registrations are completed correctly before filing and paying taxes.

What is the IRS lookback period used for?

The IRS lookback period is used to determine deposit frequency, monthly or semiweekly, for payroll taxes. These periods differ by form, like Form 941 (standard quarterly), which uses a July 1 to June 30 lookback, and Form 944 (annual filers), which uses the prior calendar year. Form 943 (agricultural) and Form 945 (nonpayroll) have their own rules.

How many days after payroll are payroll taxes due?

Payroll taxes are due based on your IRS deposit schedule. Monthly depositors pay by the 15th of the following month. Semiweekly depositors pay by the next Wednesday for Wednesday to Friday paydays and the next Friday for Saturday to Tuesday paydays. Deposits are due the next business day if taxes reach $100,000 or more in one day.

What is the 3-day payroll tax deposit rule?

The 3-day payroll tax deposit rule is that semiweekly schedule depositors have at least three business days after the close of the semiweekly period to make a payroll tax deposit. The depositor receives an additional business day for each holiday to submit the payment if any of those three days falls on a legal holiday.

How to keep up with payroll tax deposit schedules?

To keep up with payroll tax deposit schedules, regularly review your IRS deposit schedule each year. This review helps you know whether you are on a monthly or semiweekly timetable and to mark all due dates on a tax calendar with reminders. Use reliable payroll software or EFTPS (Electronic Federal Tax Payment System) to automate deposits and track deadlines. Consult IRS publications or updates to stay current with any rule changes and avoid the payroll taxation penalty.

How late can you pay payroll taxes?

Payroll taxes paid after the set deadlines result in FTD (Failure-to-Deposit) penalties and interest. The IRS calculates late payroll tax penalties based on the number of days the payment is overdue. Payroll tax penalties start at 2% if the payment is 1 to 5 days late and increase up to 15% if the payment remains unpaid more than 10 days after the IRS issues a notice.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations