How to evaluate global payroll

Robbin Schuchmann

Co-founder, Employ Borderless

Global payroll means managing employee pay across multiple countries through a uniform process that follows local tax laws, labor rules, and payment requirements. It works by collecting payroll data from each location, applying country-specific regulations, processing salaries in local currencies, and providing compliant payments and reports through a centralized system.

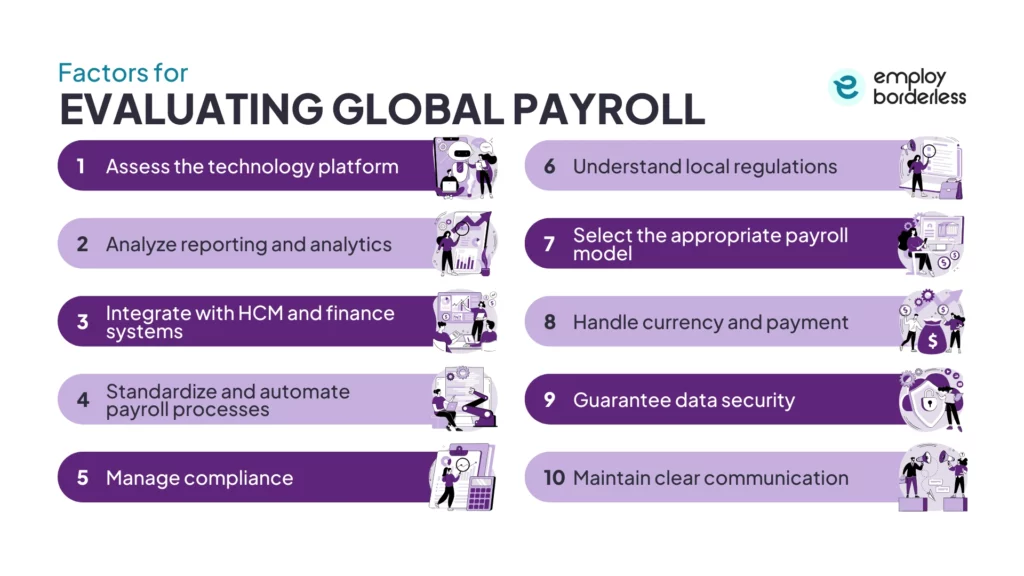

To evaluate global payroll, assess the technology platform, analyze reporting and analytics, integrate with HCM and finance systems, standardize and automate payroll processes, manage compliance, select the appropriate payroll model, handle currency and payment, and maintain clear communication.

The factors to consider when evaluating the global payroll are mentioned below.

- Assess the technology platform: Evaluate each provider’s system to make sure it supports global and local payroll processes, self-service, and secure document management.

- Analyze reporting and analytics: Use unified reporting and dashboards to monitor payroll performance, identify delays, and support strategic business decisions.

- Integrate with HCM and finance systems: Connect payroll with HR and finance systems to maintain accurate data across all platforms and processes.

- Standardize and automate payroll processes: Implement consistent best-practice workflows and automation to simplify payroll tasks and improve productivity across multiple countries.

- Manage compliance: Make sure statutory filings, payments, and regulatory obligations are accurate, timely, and regularly monitored to avoid fines and penalties.

- Understand local regulations: Monitor labor laws, tax codes, and payroll requirements in each country to ensure compliance and reduce legal risks.

- Select the appropriate payroll model: Choose in-house, outsourced, or hybrid payroll approaches depending on company size, local complexity, and operational needs.

- Handle currency and payment: Pay employees accurately in local currencies, manage exchange rates, reduce transfer fees, and comply with local banking regulations.

- Guarantee data security: Protect sensitive payroll information with encryption, access controls, secure systems, and compliance with global security standards.

- Maintain clear communication: Provide employees with clear payslips, deductions, and benefits information, which includes multilingual support where necessary.

Assess the technology platform

Assess the technology platform by examining each provider’s system in detail, rather than considering that all unified platforms offer the same value. Carefully review how the platform works across countries, as some solutions still depend on separate or disconnected processes. Make sure the system supports both global and local data collection and analysis for accurate reporting and compliance. The platform must include check printing or ePayslip generation, easy-to-use employee self-service tools, secure document management for payroll records, and reliable customer support to manage issues across regions.

Analyze reporting and analytics

Analyze reporting and analytics means a unified payroll solution has to offer clear insight into payroll performance and support compliance with overall business objectives. A single global payroll database centralizes data across countries, which allows automated reporting and real-time dashboard analytics without manual consolidation.

Automation reduces manual effort, limits data extraction from separate systems, and improves the quality and speed of decision-making. Vendor evaluation also requires reviewing whether analytics involve the entire payroll process, which helps identify delays, common errors, and operational gaps across payroll cycles.

Integrate with HCM and finance systems

Integrating global payroll with HCM (Human Capital Management) and finance systems allows payroll to work together with core HR and financial systems for accurate, consistent data across the business. Integration brings consistent payroll, HR, and financial data into one shared setting to avoid differences that occur when multiple systems hold separate information. A suitable integration provides a single, user-friendly interface for back-office payroll processes, which makes automation easy and reduces manual tasks.

Check for certified connectors or APIs with leading HCM platforms such as Workday, SAP SuccessFactors, and Oracle. These pre-built tools make integration faster and more cost-effective while improving reliability. Review their certifications, experience, in-house expertise, and customer references to confirm they are able to support your specific integration needs. Make sure that these tools also offer smooth, accessible connections across systems when evaluating vendors.

Standardize and automate payroll processes

Standardize and automate payroll processes by choosing a global payroll provider that automates and simplifies both global and local payroll tasks across multiple countries. This automation reduces errors and improves operational performance. Examine clearly defined best-practice processes, proven implementation methodologies, and strategies to support user adoption to make sure payroll teams follow uniform workflows across regions.

Standardized processes also simplify training and education for payroll professionals worldwide. Include vendor-provided training as part of your implementation project to help teams use the new system effectively and accurately.

Manage compliance

Managing compliance means making accurate statutory filings and payments for global payroll because missed or incorrect submissions lead to costly fines, legal penalties, and damage to your company’s reputation. Evaluate payroll vendors for in-country expertise and compliance tools that help understand each jurisdiction’s filing status, tax rules, and reporting requirements, so your operations comply with changing laws.

The ideal solution allows stakeholders to track legal and regulatory responsibilities regularly, with system alerts for upcoming deadlines and verification that filings and payments are completed accurately. A clear, holistic compliance calendar that shows due dates and major events across all countries improves compliance intelligence. Verify that vendors follow strict security standards, such as ISO 27001 certification, to protect sensitive payroll and employee data while maintaining regulatory compliance and trust.

Understand local regulations

Understand local regulations while evaluating global payroll because each country has its own labor laws, tax codes, payroll rules, and statutory requirements that directly affect how companies pay employees and run payroll. Companies that track and adjust to regulatory changes reduce compliance risks, avoid fines and audits, and protect their reputation. Staying informed on local updates allows global payroll teams to apply correct calculations, meet filing obligations, and maintain compliant payroll operations in every country.

Select the appropriate payroll model

Selecting the appropriate payroll model means deciding the method for running payroll operations across different countries. In-house payroll places all payroll functions within the organization and suits companies with strong local HR teams and established systems. Outsourced payroll involves contracting a global payroll provider that manages compliance, processing, and payments across multiple countries, which reduces internal workload and reliance on local expertise.

Hybrid payroll combines in-house and outsourced approaches, with the model adjusting by country based on complexity, risk, or scale. Each model affects control, cost, compliance, and scalability, so organizations must assess internal capabilities and business goals before choosing the most suitable model.

Handle currency and payment

Paying employees across borders requires defined procedures to manage local currencies, monitor exchange rate movements, and reduce transfer fees to protect your payroll budget. Global payroll has to compensate international employees accurately and in compliance with local pay requirements while making sure salaries arrive in the correct currency and meet local tax and regulatory rules.

Many global payroll providers offer in-built payment systems with multi-currency support and automated currency conversion, which simplify payments in local currencies. Such providers also help control costs related to exchange rates and international transfers. These integrated payment features simplify global payroll operations and improve payment reliability for employees in different countries.

Guarantee data security

Guarantee data security for global payroll because payroll systems store highly sensitive employee information that organizations have to protect from breaches and misuse actively. Companies need to select providers that comply with global security standards such as ISO 27001 and SOC certifications, which confirm strong security management and regular audits.

Effective global payroll platforms use SSL (Secure Sockets Layer) encryption for data stored and in transit, apply strict access controls, and rely on secure systems to prevent unauthorized access. These actions help organizations meet data protection regulations, reduce risk, and maintain employee trust.

Maintain clear communication

Maintaining clear communication in global payroll means making sure employees in every country understand their payslips, deductions, and benefits so they feel confident that their compensation is accurate and transparent. Provide clear explanations of pay components and offer support in local languages when needed to reduce confusion and questions, especially in regions with multiple languages or payroll practices.

Effective communication also includes timely responses to employee inquiries and accessible resources, which improve employee satisfaction and trust in payroll processes across your global workforce.

What is global payroll?

Global payroll is the process of paying employees working in different countries while ensuring compliance with the tax and legal requirements of each country. This multi-country payroll process includes calculating wages and withholding taxes through a unified system. It also involves managing multiple taxation laws, employee benefits, and social security contributions, which differ from country to country.

How does global payroll work?

Global payroll works similarly to local payroll, as it makes sure employees receive accurate and timely payments, even when they are based in different countries. The process involves collecting and consolidating employee data from multiple locations, applying local tax laws and labor regulations to calculate pay correctly, and handling payments in multiple currencies. Payroll teams also perform reviews, approvals, and compliance checks while generating reports for internal and regulatory purposes.

What are the common challenges in global payroll?

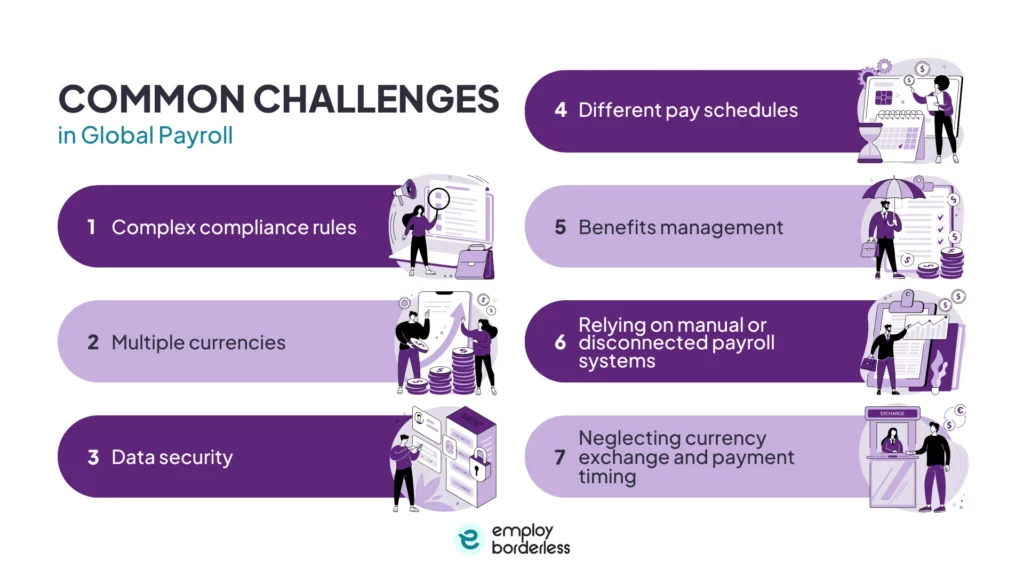

The common challenges in global payroll are complex compliance rules, multiple currencies, data security, different pay schedules, benefits management, relying on manual or disconnected payroll systems, and neglecting currency exchange and payment timing.

The common challenges in global payroll are listed below.

- Complex compliance rules: Complex compliance rules mean companies have to manage different labor, tax, and payroll regulations in every country. Compliance issues occur as multinational companies fail to actively track frequent legal changes, which results in fines and penalties.

- Multiple currencies: Handling payroll in different local currencies, dealing with fluctuating exchange rates, and controlling transaction costs make budgeting and accurate payments more difficult for businesses working globally.

- Data security: Protecting sensitive employee payroll data across borders requires strict compliance with global and local data protection laws, or companies risk breaches and regulatory penalties.

- Different pay schedules: Companies mostly use different payroll cycles and calendars, which require careful coordination to meet all local pay dates without errors.

- Benefits management: Each market has its own rules for employee benefits, statutory contributions, and deductions, which makes consistent payroll calculations difficult.

- Relying on manual or disconnected payroll systems: Relying on spreadsheets or separate systems per country creates disconnected data, leads to inconsistent reporting, increases errors, and requires extra administrative effort.

- Neglecting currency exchange and payment timing: Failing to plan for currency conversion timing, processing delays, and local banking rules slows payments and causes errors in employees’ compensation.

How to avoid issues in managing global payroll?

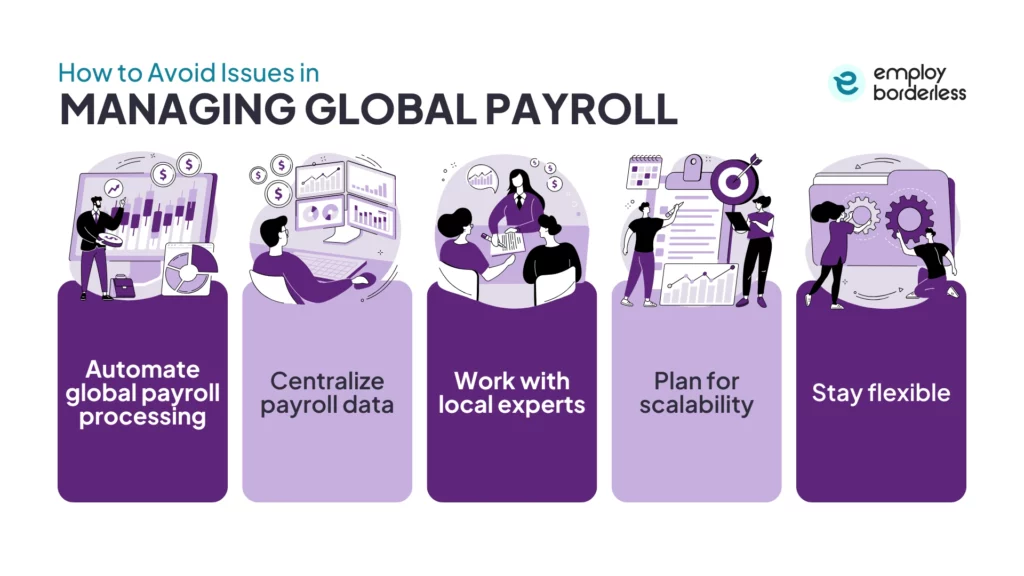

To avoid issues in managing global payroll, automate global payroll processing, centralize payroll data, work with local experts, plan for scalability, and stay flexible.

Automate global payroll processing

Automating global payroll reduces manual errors by performing calculations, tax withholdings, payslip generation, and compliance checks automatically, rather than relying on staff to enter data manually, which increases accuracy and reliability. Automation completes payroll processing faster, which allows payroll teams to spend less time on repetitive tasks and more time on strategic work. Automated systems apply local tax and labor rules reliably and update these rules as they change, which helps companies stay compliant with multiple jurisdictions without ongoing manual adjustments.

Centralize payroll data

Centralizing payroll data gives a single, consistent dataset for all countries instead of separate records in different systems, which improves accuracy and reduces global payroll issues. Centralized data also makes reporting and analysis faster and provides a clear view of total payroll costs, trends, and performance across the organization. A central system reduces administrative burden and manual reconciliation, which allows teams to focus on core business operations rather than fixing errors from inaccurate payroll data.

Work with local experts

Local payroll and tax experts understand each country’s specific labor, tax, and compliance requirements, which helps interpret and apply them correctly to avoid legal mistakes. Partnering with local advisors or a provider with regional experts makes it easy to keep up with changing laws and to make sure business operations apply current regulations in every market. Combining global systems with local insight gives more reliable payroll processing across countries and simplifies reporting and compliance tracking.

Plan for scalability

Invest in payroll software that grows with your business, supports additional countries, and standardizes processes across regions. Scalable systems help avoid difficulties and unproductive manual work as the workforce size increases. Build a centralized or unified payroll system that handles multiple countries rather than using separate tools for each region. Centralization improves accuracy, reduces errors, and makes it easy to expand payroll operations. Select solutions and partners that match current needs and also predict future expansion to avoid costly system replacements and disruption as global operations expand.

Stay flexible

Stay flexible by using responsive payroll technology that supports multiple countries, currencies, and local rules, which allows teams to update workflows without major system changes. Automate processes where possible to reduce manual work, lower errors, and adjust quickly to new compliance requirements. Monitor regulatory changes continuously and maintain connections with in-country experts to implement updates immediately. Work with flexible providers or partners who are able to scale services, add new countries, or adjust payment methods as your global workforce expands.

How to choose the right global payroll solution?

To choose the right global payroll solution, consider country coverage, security certifications, and transparency in pricing. Choose a payroll provider with up-to-date knowledge of global and local compliance and customer support.

Select the right global payroll solution that covers all countries where your business operates. Comprehensive coverage avoids managing multiple vendors, maintains uniform payroll processes, and simplifies compliance across your global workforce.

Consider using global payroll solutions that comply with global standards like ISO 27001 or SOC to protect sensitive employee payroll data and meet data protection regulations, such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act).

Confirm that the global payroll solution provides clear, upfront pricing without hidden fees, which helps with accurate budgeting for payroll operations across multiple countries.

Choose a global payroll solution that has up-to-date expertise in local and global payroll laws, which include tax codes, labor regulations, and reporting requirements, to reduce compliance risks.

Prioritize the global payroll solution that provides responsive, knowledgeable support to resolve complex payroll issues quickly and offer continuous operations across different markets.

Are there global payroll systems?

Yes, there are global payroll systems designed to help companies pay employees in multiple countries from one central platform. These payroll systems consolidate payroll data, handle local compliance, and process salaries in different currencies, which allows businesses to manage international payroll from a unified solution rather than separate local tools.

What are global payroll services?

Global payroll services are comprehensive solutions that help companies handle payroll for employees in different countries. These global payroll services manage all aspects of payroll processing, which includes calculating wages, complying with local labor laws, withholding federal income taxes, and handling currency conversions.

What is the difference between global and international payroll management?

The difference between global and international payroll management is that global payroll management runs payroll centrally across multiple countries using standardized systems to manage compliance, currencies, and reporting. International payroll management focuses on managing payroll country by country and relies more on local processes while maintaining overall coordination.

How much does a global payroll solution typically cost?

Global payroll solutions typically cost between about $20 and $50 per employee per month, with lower rates near $5 to $15 and higher rates above $50 depending on features, support level, and number of countries involved. Some EORs, or enterprise services, are much more expensive.

What certifications should a global payroll provider have?

The certifications that a global payroll provider should have include ISO 27001 for information security, SOC 1 and SOC 2 reports for controls over financial data and system security, and GDPR (General Data Protection Regulation) compliance for data privacy.

How to measure the ROI of your global payroll solution?

To measure the ROI of your global payroll solution, compare total payroll costs before and after implementation, which include labor, compliance, and error-correction costs. Track results such as reduced processing time, fewer payroll errors, improved compliance, and lower administrative effort. Calculate ROI as benefits minus costs divided by costs, shown as a percentage.

How long does it take to set up a global payroll system?

Global payroll setup time depends on the level of complexity and scope. Basic implementations for a few countries take about 10 days to 3 months, while more extensive global implementations across many countries usually take 3 to 6 months or more, which depends on data quality, the number of countries, and integration needs. Larger enterprises sometimes take more than six months.

Co-founder, Employ Borderless

Robbin Schuchmann is the co-founder of Employ Borderless, an independent advisory platform for global employment. With years of experience analyzing EOR, PEO, and global payroll providers, he helps companies make informed decisions about international hiring.

Learning path · 10 articles

Payroll fundamentals

Master the fundamentals with our step-by-step guide.

Start the pathReady to hire globally?

Get a free, personalized recommendation for the best EOR provider based on your needs.

Get free recommendations